miodrag ignjatovic/E+ by way of Getty Pictures

Funding Thesis

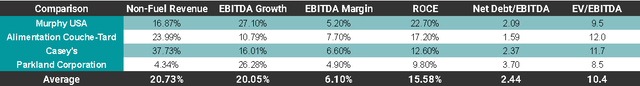

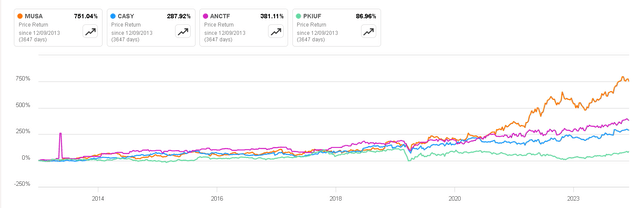

Murphy USA (NYSE:MUSA) has undeniably delivered excellent returns over the previous decade, outshining even its high-quality rivals within the business. Nonetheless, as you rightly identified, there are looming considerations on the horizon that recommend the corporate could also be suspending an important job important for preserving its terminal worth. That is particularly noteworthy given the proactive measures taken by rivals comparable to Alimentation Couche-Tard and Casey’s in recent times.

On this article, we’ll delve into the first danger confronted by corporations of this nature and discover the particular methods every firm is using to mitigate this danger. With a specific concentrate on Murphy USA, the intention is to justify the notion that, regardless of the present attractiveness of its valuation, there could also be an underlying higher danger related to investing within the firm. This danger, if not adequately addressed, might doubtlessly affect the corporate’s long-term sustainability and aggressive place inside the evolving market panorama.

Murphy USA Efficiency (Searching for Alpha)

Enterprise Overview

Murphy USA is a series of retail gasoline stations primarily situated in america. It was spun off from Murphy Oil Company in 2013 to function as a separate firm. Murphy USA is understood for its comfort shops and fueling stations, typically situated close to or inside Walmart retailer parking tons.

These gasoline stations sometimes provide a variety of comfort retailer gadgets comparable to snacks, drinks, tobacco merchandise, and different necessities. Murphy USA additionally offers gasoline at aggressive costs, making it a preferred selection for drivers in search of gasoline or diesel gasoline whereas purchasing at Walmart or in areas the place Murphy USA stations are situated.

Transition to Electrical Automobiles

As extensively acknowledged, society is at present present process a transition in direction of electrical automobiles (EVs) and cleaner vitality sources like renewable energy. This transformation poses a notable problem for corporations working conventional gasoline stations. Nonetheless, it is essential to acknowledge that the shift to EVs is anticipated to happen progressively, and there’ll probably be a prolonged interval throughout which each EVs and inside combustion automobiles coexist on the roads. A Morgan Stanley Analysis means that even by 2030, typical inside combustion automobiles will nonetheless make up 50% of annual gross sales. Subsequently, the purpose at which EVs comprise 100% of annual automobile gross sales stays distant. This emphasizes the continued want for gasoline stations to serve the hundreds of thousands of inside combustion automobiles over the subsequent decade or probably even longer.

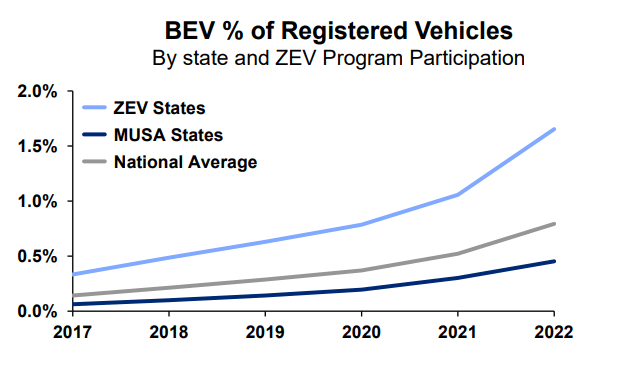

One other noteworthy side is that the corporate estimates that in states with the next density of Murphy USA institutions, the penetration of electrical automobiles is decrease than the nationwide common. Subsequently, theoretically, the transition to pure electrical automobiles ought to be much more gradual in areas the place there’s a higher presence of MUSA.

Nonetheless, this is able to solely mitigate the chance, not eradicate it. For that reason, you will need to additionally analyze the share of gross sales which might be associated to gasoline.

Murphy USA Investor Presentation

Non-Associated Gasoline Income

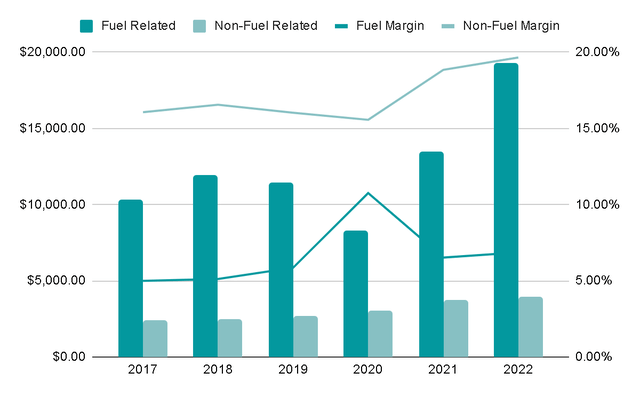

In corporations inside this sector, it’s normal to watch that, along with income generated from gasoline gross sales, a considerable portion of gross sales is derived from the merchandise bought in comfort shops. These merchandise sometimes boast higher revenue margins, rendering their earnings extra sustainable in comparison with that from gasoline gross sales. A compelling illustration of this dynamic unfolded in 2020, whereby gasoline income skilled a 28% lower, and EBIT margins hovered between 5 and 6% in recent times. Conversely, gross sales of merchandise in comfort shops witnessed a 12% development throughout 2020, with margins constantly resting at roughly 16-17%. This underscores the importance of an organization having higher publicity to the comfort retailer section somewhat than relying closely on gasoline gross sales.

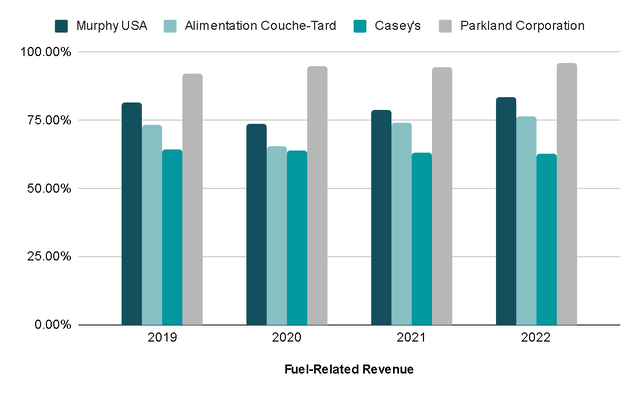

Writer’s Illustration

If we look at the share of income associated to gasoline, Murphy USA has constantly represented an common of 80%. Nonetheless, corporations like Alimentation Couche-Tard or Casey’s, which I beforehand analyzed, have strategically centered on lowering their reliance on gasoline gross sales to boost their terminal worth. Alimentation Couche-Tard achieved this by means of its Circle Okay comfort shops and a plan to introduce electrical stations, whereas Casey’s diversified into meals gross sales, comparable to pizzas. This shift is obvious of their percentages of earnings not depending on gasoline, with Alimentation Couche-Tard averaging 72% and Casey’s at 63%.

Whereas we’ll delve into Murphy USA’s methods to decrease its publicity shortly, it is value noting that some corporations are at present positioned extra favorably. They’ve demonstrated foresight in anticipating this shift and the agility to implement crucial initiatives earlier than the business undergoes important adjustments.

Writer’s Illustration

Capital Allocation

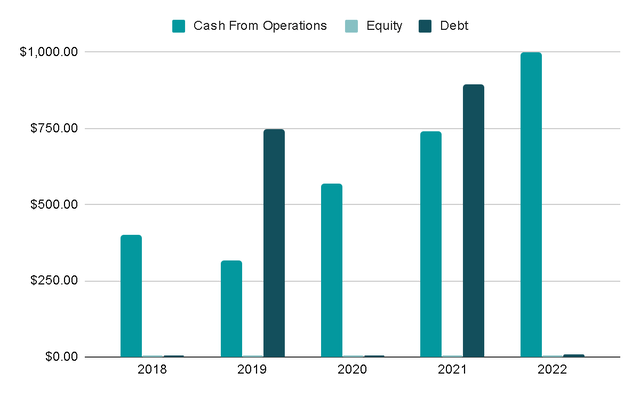

Up to now 5 years, the corporate primarily funded its operations with $3 billion generated from money flows, issuing a modest $1.6 billion in debt. Notably, there was no dilution of shares throughout this era, suggesting sound capital allocation practices.

Writer’s Illustration

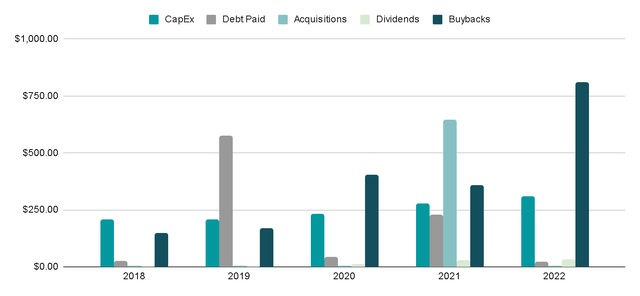

This capital has been deployed for numerous functions, guided by administration’s strategic issues. As an example, in 2019, almost $600 million was allotted to debt reimbursement, whereas in 2021, $650 million (together with $900 million in debt) was invested within the acquisition of the comfort retailer QuickChek. Initially mini-supermarkets, QuickChek shops developed into comfort shops with gasoline stations for the reason that Nineteen Nineties. Regardless of the shift in direction of gasoline choices, the first focus stays on retail shops, aligning with Murphy USA’s aim to boost income from comfort shops.

One notable absence from administration commentary is the potential for developing electrical stations, akin to the initiatives by Alimentation Couche-Tard. This might pose a important problem, doubtlessly leaving the corporate trailing within the race to determine a outstanding place within the burgeoning electrical automobile business. Furthermore, the set up of electrical stations might current a chance to spice up non-fuel income, because the charging length offers prospects with an interval to have interaction in comfort retailer purchases.

Writer’s Illustration

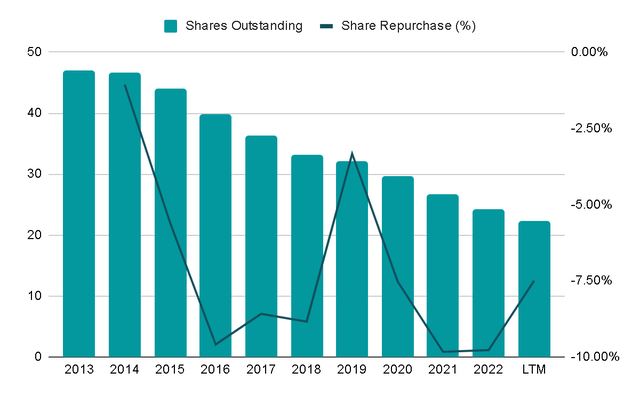

Conversely, it seems that the corporate has predominantly favored returning money to shareholders by means of buybacks. Since 2013, they’ve executed share repurchases at an annual charge of seven%, deploying $2 billion for this goal within the final 5 years. Whereas this positively impacts earnings per share, it prompts consideration of different makes use of for this capital. Redirecting these funds in direction of initiatives comparable to:

- Increasing non-fuel-related earnings by means of the development or acquisition of extra comfort shops.

- Initiating an assertive implementation of charging stations inside present gasoline stations.

These alternate options, in my view, could be extra strategic in navigating the transition in direction of electrical automobiles, emphasizing long-term worth creation over short-term monetary metrics.

Writer’s Illustration

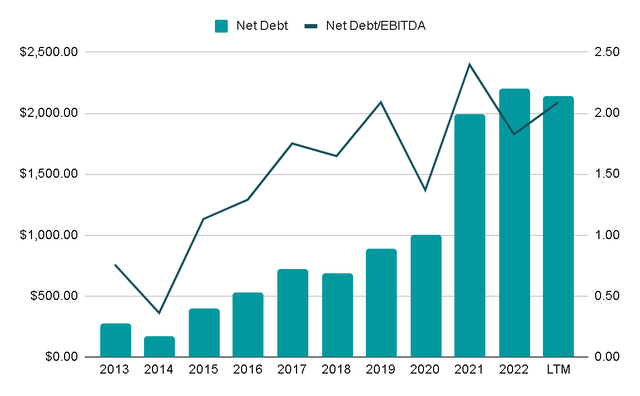

As inferred earlier, the corporate’s present monetary place seems considerably strained because of substantial debt incurred for particular acquisitions. The present internet debt stands at $2.1 billion, leading to a Web Debt/EBITDA ratio of 2x, which, whereas not at present alarming, displays an growing stage of leverage over the previous decade.

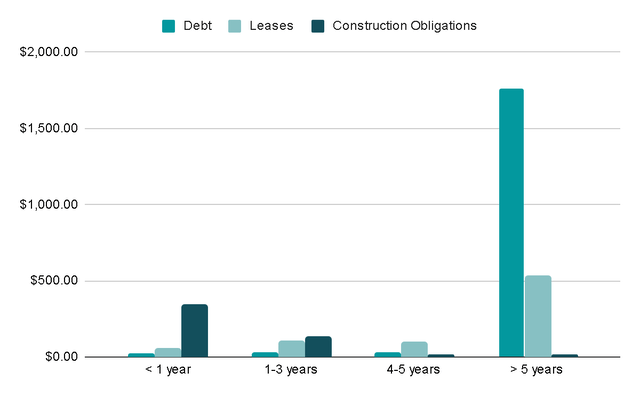

Writer’s Illustration

A constructive side is that 75% of the debt has maturity dates extending past 5 years. Notably, virtually a 3rd of the entire debt, amounting to barely over $1 billion, is tied to 2 Senior Notes. These notes mature in 2029 and 2031, carrying fastened rates of interest of 4.75% and three.75%, respectively. It is a favorable state of affairs because it means that the corporate will not have to renegotiate debt at doubtlessly excessive rates of interest within the close to time period. Furthermore, the affordable rates of interest are fastened for an prolonged interval, offering a measure of stability and mitigating the chance related to fluctuating rates of interest.

Writer’s Illustration

Valuation

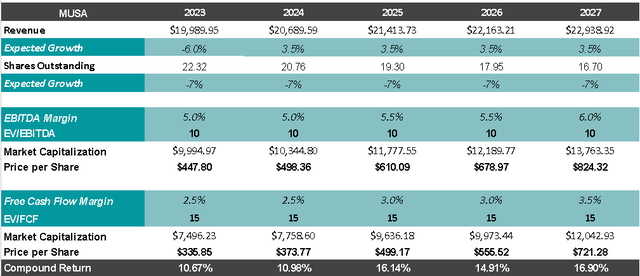

To undertaking the potential efficiency of buying Murphy USA at its present worth, I will conduct a valuation evaluation by estimating gross sales and margin development over the subsequent 5 years.

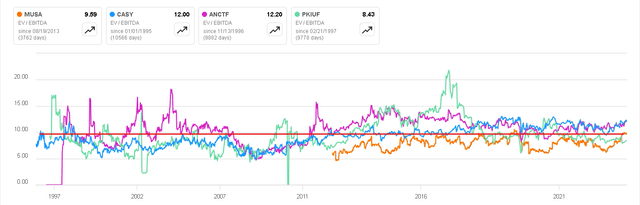

It is a complicated job to undertaking the enterprise’s trajectory, given the potential for adjustments comparable to acquisitions or shifts within the strategic plan. Notably, the businesses with greater EV/EBITDA multiples additionally are likely to have higher non-fuel-related revenues, suggesting a market desire for corporations with higher predictability.

Searching for Alpha

For the present 12 months, I will contemplate analysts’ estimates, anticipating a 6% lower in income because of the normalization of gasoline costs after the 2022 highs that favored a 39% development. Subsequently, I will undertaking an annual development of three.5%, aligning with the historic common development charge over the previous decade.

Assuming the corporate maintains its share buyback technique at a charge of seven% yearly, alongside a slight margin enlargement from the QuickChek shops acquisition, and making use of an exit a number of of 10x EBITDA and 15x FCF, we might anticipate a compounded annual return of 17%, along with the 0.5% dividend yield. This appears to be a horny return, contingent on the administration’s continued dedication to aggressive share repurchases.

Writer’s Illustration

It is essential to acknowledge the quite a few variables at play on this valuation, and any adjustments in elements like administration technique or unexpected market situations might considerably affect the outcomes. Acquisitions, adjustments within the buyback coverage, margins based on the gross sales combine, and many others.

Ultimate Ideas

After a complete evaluation of the corporate’s strengths and weaknesses, my conclusion is that, whereas Murphy USA has demonstrated profitable capital allocation, evident within the spectacular returns on capital employed (22% final 12 months and 21% on common over the past 5 years), it seems to be considerably behind in initiatives associated to the transition in direction of electrical automobiles, which is more and more perceived as the way forward for human transportation.

This remark leads me to consider that the corporate will not be low-cost, however somewhat that it has the next stage of uncertainty in comparison with corporations like Alimentation Couche-Tard or Casey’s. Consequently, the valuation ought to account for this danger/reward dynamic.

For a clearer perspective, I’ve ready a comparative desk outlining key features of the 4 corporations within the sector below evaluation. Given its low dependence on gasoline, greater margins, and decrease debt, Alimentation Couche-Tard seems to be probably the most promising choice. Casey’s follows intently, and Murphy USA ranks because the third choice. Regardless of this, I contemplate Murphy USA as a ‘maintain‘—a place which will provide engaging returns if the corporate efficiently navigates the challenges forward.

Writer’s Illustration