Sundry Images

With markets hovering to YTD highs, many value-conscious traders are asking the identical query: is it too late for me to maneuver money off the sidelines and throw cash into the market rebound? My reply, after all, is not any: nevertheless it requires considerate inventory choosing. Specifically, we have to focus in corporations that also have room to run from a valuation perspective, and have catalysts for development in 2024.

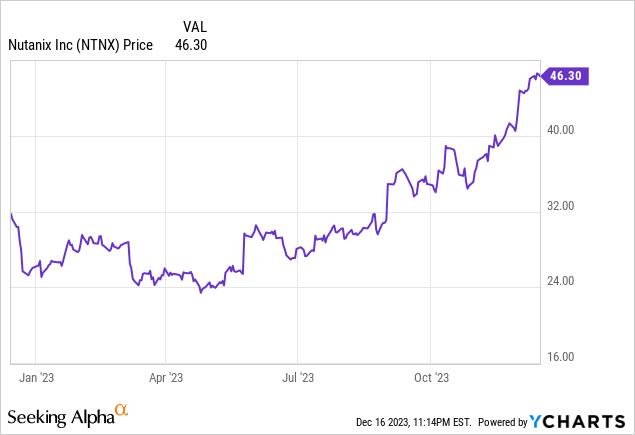

Nutanix (NASDAQ:NTNX) is a improbable alternative on this regard. The hyperconverged infrastructure software program firm has been on a tear this 12 months because it executed very robust high line tendencies amid a difficult 12 months for IT. Up greater than 75% 12 months so far, I nonetheless consider there may be extra upside for subsequent 12 months.

I final wrote a bullish observe on Nutanix, when the inventory was buying and selling nearer to $36 per share. Even with the robust rally since then (which has been in live performance with different mid-cap tech shares rallying on the again of decrease rate of interest expectations), I feel Nutanix’s inventory outperformance has been accompanied by each encouraging and new development drivers in addition to significant revenue growth.

AI is by now a little bit of a drained dialog within the markets, and the highest “apparent” performs like C3.ai (AI) and Palantir (PLTR) have already seen a considerable increase and bust cycle this 12 months. However I additionally assume corporations like Nutanix that take pleasure in tangential advantages to AI adoption have a lot to learn from elevated curiosity in automation as nicely.

Nutanix administration believes that AI will probably be deployed near the place the information is saved. And that’s what Nutanix is all about: constructing a quick infrastructure round information that may be quickly used for analytics. In Q1, Nutanix began promoting its “GPT in a Field” answer; and to a federal company leveraging it for against the law detection use case, no much less (which harkens very strongly to Palantir’s features). Going ahead, I see many extra of those use circumstances driving continued demand for next-gen information platforms like Nutanix – particularly for these organizations that need to run AI apps outdoors of the cloud and in their very own information warehouses.

For all these causes, I stay fairly bullish on Nutanix. As a reminder to traders who’re newer to this title, right here is my full up to date long-term bull case on Nutanix:

-

Class chief within the hybrid cloud- Although the buzzword “cloud” grabs all of the media consideration within the software program trade as of late, the fact is that many corporations, particularly these in complicated or extremely regulated industries, won’t ever completely transfer their programs into the cloud. Nutanix is a champion of the “hybrid cloud” technique, by which a few of a enterprise’s property are within the cloud and others are in on-prem environments. For the on-prem property, Nutanix’s hyper-converged expertise ensures that clients get the identical efficiency and agility advantages that customers obtain within the cloud. Most corporations at present make use of some kind of hybrid cloud technique – that means Nutanix merchandise are broadly relevant to all IT departments.

-

AI potential- Nutanix administration believes AI purposes will run the place the information is housed. Already, the corporate has signed on main offers involving AI and GPT-related use circumstances.

-

Software program-first- Earlier on in Nutanix’s lifespan, the corporate offered server units as its main enterprise, with its proprietary software program overlaid as a “bundle answer.” Now, Nutanix sells solely software program. This has dramatically raised its margin profile whereas additionally making it extra palatable for corporations who solely need to devour software program to run on their very own {hardware}.

-

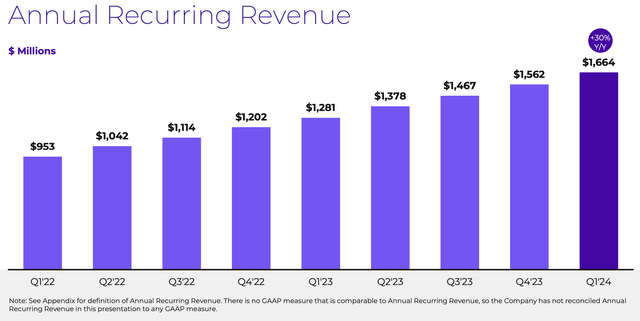

Annual recurring income on the forefront of Nutanix’s gross sales focus- Firstly of Nutanix’s fiscal 2021, the corporate made the earth-shaking choice to incentivize its gross sales employees based mostly on ACV and never TCV. Previously, Nutanix’s account executives offered longer-term contracts and incentivized clients with larger reductions as a result of they had been paid based mostly on the worth of the whole deal. What’s necessary for Nutanix and for traders, nevertheless, is how a lot Nutanix can rake in yearly and for every buyer’s lifetime. So Nutanix shifted its gross sales compensation in step with this precedence and started paying its gross sales groups based mostly on ACV – and this has yielded very robust leads to rising each ACV and ARR.

-

Prioritizing profitability- The corporate hit professional forma profitability for the primary time in FY23 and is eyeing additional positive factors forward in FY24 on the again of a ramping gross margin profile.

Despite these strengths, I proceed to assume that Nutanix trades cheaply. At present share costs close to $46, the corporate trades at a market cap of $11.24 billion. After netting off the $1.44 billion of money and $1.22 billion of convertible debt on Nutanix’s most up-to-date stability sheet, the corporate’s ensuing enterprise worth is $11.02 billion.

In the meantime, for the present fiscal 12 months FY24 (the 12 months for Nutanix ending in September 2024), Wall Road analysts predict the corporate to generate $2.48 billion in income, representing 17% y/y development. This places Nutanix’s valuation at 4.4x EV/FY24 income.

For my part, Nutanix’s mixture of top-line development catalysts (together with and particularly AI-driven use case growth) plus excessive gross margins which are yielding robust revenue positive factors benefit a minimum of a 5.5x income a number of for the corporate, implying a $57 worth goal for the inventory and ~23% upside from present ranges.

Keep lengthy right here and preserve using the current upside tendencies.

Q3 obtain

Let’s now cowl Nutanix’s newest quarterly leads to better element. The Q3 earnings abstract is proven under:

Nutanix Q3 earnings abstract (Nutanix Q3 earnings launch)

Nutanix’s income grew 18% y/y to $511.1 million, nicely forward of Wall Road’s $500.8 million (+15% y/y) by a three-point margin. The corporate additionally noticed power in ARR provides, rising 30% y/y to $1.66 billion – a $102 million sequential enhance to the recurring income base, up from $95 million within the earlier quarter.

Nutanix ARR (Nutanix Q3 earnings launch)

The corporate famous particular power within the federal authorities sector in Q1, together with the aforementioned GPT-in-a-Field deal: which was Nutanix’s first such win for the product with an current massive buyer. It’s additionally comforting to notice that public sector shoppers – which have a popularity for longer approval processes – have been fast to undertake new AI-related merchandise, which is a harbinger for elevated adoption to learn calendar 2024 tendencies.

Nutanix has additionally been in a position to drive go-to market growth by means of reseller companions. Specifically, it has deepened its relationship with Cisco, whose gross sales group is now pushing a joint Cisco-Nutanix answer.

Nonetheless, the corporate is noting some overhang of macro impacts, and can also be anticipating a few of these results to linger into subsequent 12 months. Per CFO Rukmini Sivaraman’s remarks on the Q1 earnings name:

Much like final quarter, we noticed a modest elongation of common gross sales cycles, relative to the 12 months in the past quarter […]

We’re seeing continued new and growth alternatives for our options, regardless of the unsure macro surroundings. Nevertheless, as we talked about beforehand, we’ve got continued to see a modest elongation of common gross sales cycles. Our fiscal 12 months ’24 new and growth ACV efficiency outlook assumes some influence from these macro dynamics. Second, the steering assumes that our renewals enterprise will proceed to carry out nicely.

And a reminder that whereas our out there to resume, or ATR pool, continues to develop year-over-year, it’s rising at a slower tempo in fiscal 12 months ’24, however is predicted to reaccelerate in fiscal 12 months ’25, based mostly on our present view.”

Word that the touch upon larger renewal base beginning in FY25 is a superb main indicator for continued robust development trajectory.

From a profitability standpoint, professional forma gross margins hit a sky excessive stage of 85.9%, up 250bps y/y. Word that one of many widespread misconceptions of Nutanix – based mostly on its earlier post-IPO enterprise mannequin – was that it offered commoditized {hardware}. Now with margins approaching 90% and towering over many of the software program sector, it’s tough to argue that Nutanix is something however a software program firm.

Professional forma working earnings of $79.5 million additionally notched a 15.5% margin, up from simply 2.3% within the 12 months in the past quarter. For sure, Nutanix is really exhibiting the profitability potential of a extra mature software program firm that has slowed down opex development and is capitalizing on robust expansions/renewals.

Key takeaways

Selecting corporations with each an affordable valuation and clear catalysts for outperformance in 2024 is a vital technique for outperforming the markets subsequent 12 months. Although Nutanix has already recorded loads of positive factors this 12 months, there’s nonetheless room to go even additional.