Darren415

Welcome to a different installment of our Preferreds Market Weekly Evaluation, the place we focus on most popular inventory and child bond market exercise from each the bottom-up, highlighting particular person information and occasions, in addition to the top-down, offering an outline of the broader market. We additionally attempt to add some historic context in addition to related themes that look to be driving markets or that traders should be aware of. This replace covers the interval by way of the third week of December.

You’ll want to try our different weekly updates masking the enterprise growth firm (“BDC”) in addition to the closed-end fund (“CEF”) markets for views throughout the broader revenue house.

Market Motion

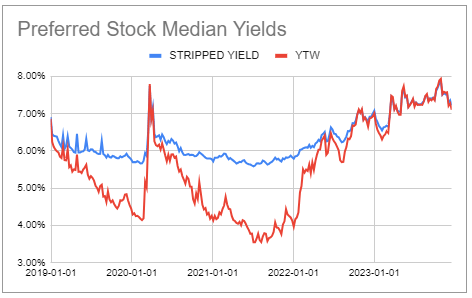

Preferreds continued to rally final week on the again of additional falls in Treasury yields, bringing the year-to-date complete return of the sector to round 9%. Alternate-traded preferreds yields continued to float in the direction of 7% from their current 8% peak.

Systematic Earnings Preferreds Device

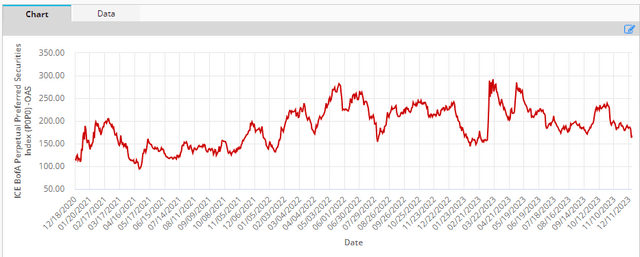

Credit score spreads are buying and selling close to the underside of their post-2022 vary.

ICE

Market Themes

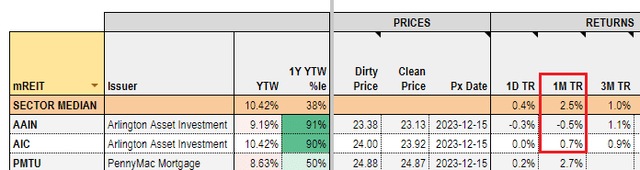

A day after AAIC shareholders voted to approve the proposed merger with Ellington Monetary (EFC) on December twelfth, AAIC introduced its plans to delist and deregister its two child bonds (AIC) and (AAIN) with the final day of buying and selling on the NYSE being January fifth.

The explanation given for the delisting is that “the prices of compliance, the calls for on administration’s time and the assets required to keep up the itemizing of the Senior Notes on the NYSE will exceed the advantages”.

There are three odd issues right here. One is that the AAIC preferreds are transformed into EFC preferreds and can proceed to commerce on the NYSE. In different phrases, the bigger entity is blissful to tackle extra regulatory necessities of the preferreds however not the debt. Maybe the compliance and regulatory necessities of exchange-traded debt are extra onerous than for exchange-traded preferreds however on the face of it this can be a unusual final result.

Two, the prices and advantages within the remark above accrue to totally different gamers. EFC do not accrue many advantages from conserving the bonds listed on the change however they do profit from their existence (because of their comparatively low coupons).

The advantages of listed bonds, nevertheless, would accrue largely to bondholders who can reap the benefits of their every day liquidity. By delisting the bonds, EFC do not lose many advantages (arguably they lose the flexibility to purchase them again within the secondary however this can be a minor profit) however do away with burdensome compliance and regulatory prices. Bondholders however do not acquire something from the delisting and lose the flexibility to simply commerce the bonds. Briefly, when AAIC speak about prices of listed bonds exceeding their advantages they’re clearly speaking solely concerning the firm’s price/profit calculation which is the polar reverse of the bondholder one.

Third, it is odd for Arlington to problem a press release saying it is too burdensome for them to handle the bonds if a day later they do not have that duty anyway as Arlington administration just isn’t chargeable for the bigger merged entity which now backstops the bonds. Maybe what occurred right here is that EFC wished to depart the unpopular soiled work to Arlington as its final public dealing with job.

In any case, usually, securities going by way of delisting / deregistration undergo available in the market as traders rush to promote their holdings. It’s because traders do not like sitting on illiquid holdings whereas others promote to get in entrance of the doubtless promoting wave.

To this point the bonds have been pretty resilient although they’ve underperformed different mortgage REIT bonds by round 2-3% over the past month.

Systematic Earnings Preferreds Device

The yields of those bonds are already very engaging even within the higher-risk portfolio of EFC. Any additional drops could be engaging entry factors in our view for traders who can put up with an illiquid holding.

Stance And Takeaways

Though the delisting of the 2 AAIC child bonds is unlucky, traders who prize liquidity have many different choices out there to them. Within the comparatively small mortgage REIT child bond sector, traders ought to take a look on the Prepared Capital 2026 bond (RCC) in addition to the PennyMac 2028 bond (PMTU) which commerce at yields of 8.05% and eight.6% respectively.

Take a look at Systematic Earnings and discover our Earnings Portfolios, engineered with each yield and threat administration issues.

Use our highly effective Interactive Investor Instruments to navigate the BDC, CEF, OEF, most popular and child bond markets.

Learn our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Examine us out on a no-risk foundation – join a 2-week free trial!