mixetto/E+ through Getty Photographs

Foremost Thesis / Background

The aim of this text is to supply three classes realized from early on in my investing profession. For individuals who are seasoned buyers, this can be a refresher and/or not have a necessity for it. For these beginning out, this might supply a method to keep away from making among the rookie errors that I made after I first received underway with taking cost of my portfolio out of my undergraduate research. My hope on this overview is to present readers some easy recommendation that they will use in a sensible approach when managing their portfolio.

Give The Herd Time To Run Earlier than You Go In opposition to It

The primary matter could come throughout market timing however that basically is not the purpose. It has extra to do with how I might method bull and bear market runs in phrases of including or lessening my positions.

As my followers know, I like to be a contrarian. When the market sells off, or will get overly optimistic, I like to take the opposite course. That is true in micro-terms, resembling with shares and funds. However it is usually related for thematic investing, resembling when to spend money on unloved sectors or nations. We do not have to look a lot additional than 2022 and 2023 for this to play out. In 2022, the market hated Tech. In 2023, the market beloved it. After I see 20%+ strikes in brief time-frames like that, I are inclined to take the alternative commerce.

However the mistake I made early on was taking this contrarian play too quickly. What I’m referring to is, for instance, a 5% or 10% drop in a couple of days or a couple of weeks. I might purchase a inventory, see it drop a bit, and say “I would like to purchase extra” and dive on in. Or, against this, purchase a inventory/fund/sector and see it pop 5 or 10% in a couple of months and suppose “I’ve to seize that revenue!”.

The web result’s that I usually didn’t wait lengthy sufficient for a place to say no sufficient to essentially benefit including to it, nor did I wait lengthy sufficient to gather as massive a achieve as I ought to have. I merely monitored my positions with a set off finger, taking untimely positive factors and chasing small losses after I ought to have been extra affected person.

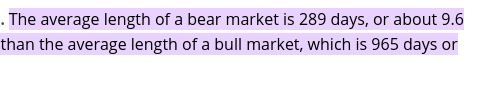

To assist right this (except for merely making errors at a youthful age), I needed to step again and notice that momentum out there usually lasts a very long time. A 5-10% transfer can typically be loads, however oftentimes it is not. The main indices, a lot much less particular person tickers, could make huge strikes for months at a time because the final decade has proven us fairly clearly. And after we have a look at each bull and bear markets, we see that they usually stick round for some time. Fortuitously, bull markets do are inclined to last more, however neither are fleeting:

Size of Bull and Bear Markets (Common) (The Hartford Funds)

What I takeaway from that is that there is no motive to hurry out and in of a place. Sure, I nonetheless wish to have a contrarian mindset and search for alternatives when the market is performing irrationally. However it may possibly act irrationally, or not less than one-sided, for fairly a protracted stretch at instances. So whereas I’ll proceed to have the urge to wager towards the herd, I wish to let the herd run for some time earlier than I get in the best way. In any other case, buyers have the chance of getting run over.

“A Loss Is A Loss Is A Loss”

I’ll begin this by saying that simply because a place is at present within the pink, does not imply you need to dump it. I’m not suggesting that in any respect. However we, as human beings, generally tend to not wish to admit an error. I’m as responsible as any of this, particularly after I first began out. A inventory or fund goes within the pink, and I wished to trip it out for so long as I wanted to with a purpose to finally flip a revenue (or not less than not a loss). With properly run firms or funds, a dropping place can usually be a sign so as to add to a place or “double down”. However, in lots of instances, a small loss can flip in to both an even bigger loss or a chronic loss, and people are those we wish to keep away from.

Whereas this sounds apparent, buyers always discover themselves with positions within the pink for weeks, months, and even years. And the aim of this overview is to determine why this occurs and how one can keep away from it. Personally, as soon as I received over the hurdle of not desirous to admit a mistake, I’ve been capable of extra simply lower small losses earlier than they flip into huge ones. This has made me a extra profitable investor than I used to be in my early years.

However this results in the query – why are dropping positions so laborious to eliminate? Apart from the emotional connection we will must some holdings, buyers have a approach of rationalizing losses in order that they do not appear “actual”. Readers will doubtless acknowledge lots of the following phrases – both from their very own private expertise, from mates / co-workers, and even right here on In search of Alpha! They’re as follows (and this isn’t an all-inclusive listing):

- It is solely a “paper loss”

- It should “come again quickly”

- I’ll promote as soon as I “get again to even”

- It is solely a loss “when you promote”

The final one is the one I actually wish to harp on. A loss is at all times a loss. Whether or not or not it’s “realized” is only for tax accounting. Whereas understanding capital positive factors and losses is essential, being an unrealized loss does not make it any much less of a loss. This may increasingly sound apparent to some, whereas others could contest it – and that’s sort of the purpose. There are these on the market who disagree with the premise that unrealized losses are precise losses. However the actuality is they’re, and ready to promote does not make it any much less so.

There are essential issues to make when holding on to positions just because we do not wish to acknowledge a loss. One is {that a} loss can get larger – so holding as a result of it’s “down” may very well find yourself being extra pricey as time goes on. A second is alternative value. Whereas a place could not decline extra, it could not go up both. Whereas one is ready for a dropping place to rebound, they might be lacking out on options that would offer a stronger return. That is a chance value.

And to recover from it I’ve a easy technique. I ask myself: “Would I purchase this place at present?”. If the reply is “no”, then I dump it, whether or not or not I’ve a achieve or a loss on the place. That side turns into irrelevant. If I would not purchase it and maintain it based mostly on at present’s value and future prospects, the truth that I purchased it prior to now and am now sitting at a loss shouldn’t be factored in.

The underside-line to me is {that a} dropping place is one thing to method with the willingness to carry or promote based mostly on its personal deserves. Simply because a place is within the pink should not make somebody extra hooked up to it. Go away the emotion out and method it critically simply as you’d some other place.

To wrap this up, let’s tie this again to an instance that can make it simple to recollect. Within the Italian mafia there’s a crucial code: “the boss is the boss is the boss”. Right here in my world, I’ve the same code: “a loss is a loss is a loss”. Do not attempt to re-characterize it or rationalize it. Whether or not it’s in a tax deferred account, an “unrealized” loss, or an enormous or a small one, it’s nonetheless a loss. Understanding that’s vital earlier than making any resolution to purchase or maintain.

Low-cost Can Keep Low-cost For A Lengthy Time

My closing level considerations worth investing. That is an space I’m usually keen on. In any case, who does not like a sector or inventory that appears closely discounted? That may usually result in “alpha”, proper?

The reply is, after all, “it relies upon”. Sure, unloved corners of the market are sometimes corners of worth that may produce outsized positive factors. I’m at all times on the hunt for disconnects between what I consider and what Mr. Market thinks. Whether or not it’s a thematic concept, a specific firm or fund, or a geographical area, I wish to discover investments that the market is discounting as a result of they may rebound in an enormous approach. That is one thing I’ve at all times carried out and can proceed to do.

However the level right here is that this is not a fool-proof technique. The alternative can usually occur: that unloved concepts keep unloved for a very long time. Just like loss harvesting, there’s alternative value to think about. Whereas one is “ready” for an unloved funding concept to pan out, they might be lacking out on momentum performs that proceed to ship.

The takeaway right here is that simply because one thing is (or appears to be like) “low cost” does not imply it truly is. If one thing is comparatively low cost it could be for motive, and that motive could also be round for a very long time. Generally years.

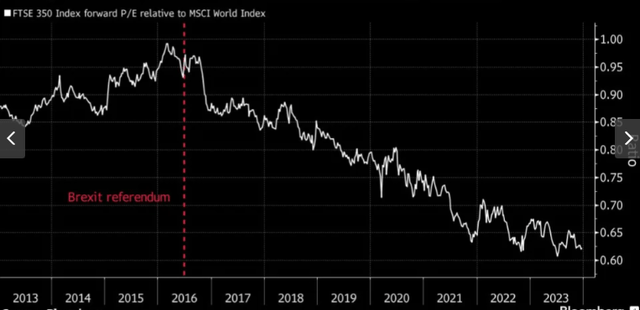

Take the UK (Britain) fairness market for instance. Put up-Brexit, British shares regarded low cost. Within the years that adopted, they regarded even cheaper. And, at present, they’re close to a file when it comes to a reduction between their value and the remainder of the world:

Britain’s Low cost Has Continued (Bloomberg)

This actually illustrates how “low cost” wasn’t actually low cost for years. The British index continued to get cheaper and cheaper, relative to the remainder of the world and that has not modified within the latter levels of 2023.

This is only one instance I pulled, however there are many others. My followers know I cowl numerous municipal bond CEFs, and there are loads that commerce at persistent reductions to their underlying worth. So, once more, on the floor some funds with 10% reductions (and better) look low cost, one has to understand that usually these reductions persist, and even widen, through the years. What this implies is that buyers want to actually be vital of any funding that appears under-valued. It might be a real “worth”, or it could simply be part of a protracted listing of under-valued investments that keep under-valued for years to come back.

Backside-line

I began my funding profession with a finance schooling and a small bankroll. What I realized within the classroom turned out leaving me comparatively unprepared for the funding world, and I realized some classes the laborious approach. However, luckily, these errors got here low cost in comparison with the place I’m at present. Whereas I nonetheless err in judgment typically, I’ve chosen a couple of hurdles I confronted early on that now not penalize me at present. My hope is that takeaways from this overview depart readers a bit of wiser and, ideally, permits them to keep away from a few of these pitfalls in their very own funding journey.