Paul Morigi

Co-authored with “Hidden Alternatives.”

Worth investing includes shopping for underappreciated companies when others are promoting them at a reduction after which holding them for the long run. This strategy led to a few of Warren Buffett’s most important and worthwhile investments, acquired when others panicked.

In the course of the 2008 monetary disaster, when everybody was working away from the inventory market, the legendary investor purchased Financial institution of America (BAC) and Goldman Sachs (GS) shares, which turned glorious passive earnings sources for years.

“Within the 58 years we have been working Berkshire, I might say there’s been an amazing improve within the variety of folks doing dumb issues, they usually do huge dumb issues,” he mentioned. The rationale they do it’s as a result of, to some extent, they’ll get cash from folks a lot simpler than once we began.” – Warren Buffett.

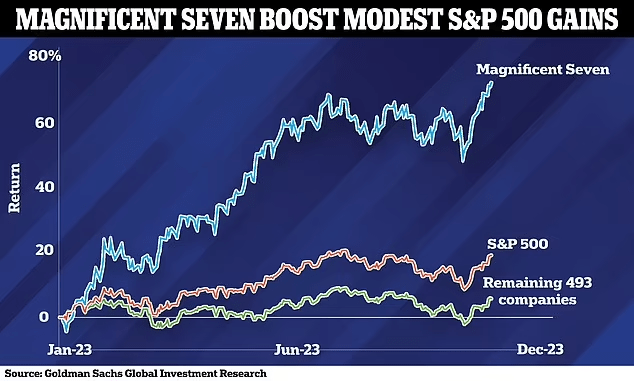

The markets might have recovered, however it’s the story of two markets with a handful of firms swelling up in valuation. The remainder of the index with out The Magnificent Seven continues to current undervalued bargains to scoop up. Supply.

DailyMail

We focus on two such beaten-down and ignored picks that we purchase because the Magnificent Seven distract the markets. Let’s dive in!

Choose #1: BTI – Yield 9.7%

In 2011, Google (GOOG)(GOOGL) paid $12.5 billion to amass Motorola Mobility. Three years later, the corporate offered a lot of it to Lenovo for $2.9 billion, realizing a $9.5 billion loss. It’s probably that Google overpaid for the belongings, however the firm retained a plethora of cellular patents that it licensed to Lenovo and continued producing money flows. Furthermore, a number of of these acquired patents had been instrumental for the corporate in launching its Pixel model of smartphones.

In the identical vein of dialogue, in 2005, Google acquired the quite unknown Android for $50 million. At the moment, this platform has 72% of the market share and generates tons of of billions in income from licensing and gross sales on the Google Play Retailer. However all that success is not going to be mirrored on the conglomerate’s e book worth, since accounting ideas typically require the buying firm to account for the acquisition utilizing the acquisition technique, the place the belongings and liabilities are recorded at their honest values on the acquisition date.

Within the above examples, Google’s write-down of the Motorola asset acquisition or the dearth of adjustment of the e book worth of its Android acquisition did not impair the monetization potential of those companies.

Allow us to now discuss British American Tobacco p.l.c. (BTI, BTAFF), popularly often called BAT, which is presently within the information for the announcement of a £25 billion impairment cost regarding its U.S. manufacturers, which it acquired through RJ Reynolds in 2017.

Manufacturers do not carry indefinite worth, and the write-down of the e book worth of the acquisition is a sensible alignment of worth that BAT would get if it had been to promote these belongings (not that they’re planning presently). In truth, the Oracle of Omaha has repeatedly talked about that e book worth is not a significant measure of an organization’s worth.

The actually fantastic companies require no e book worth. It is a issue we ignore. We do have a look at what an organization is ready to earn on invested belongings and what it may earn on incremental invested belongings. However the e book worth, we don’t give a thought to. – Warren Buffett in 2000.

The financial worth of an income-generating asset like a model can generally be extra intently tied to its capability to generate money move quite than its market worth, and e book worth changes might not all the time align completely with the continued operational efficiency of the asset.

Flamable tobacco is a enterprise that requires no new funding. The worldwide buyer base is huge, and the demand stays robust, though on a gentle declining pattern on account of well being considerations and social stigma. BAT subsidiary Reynolds American is the second-biggest U.S. cigarette maker by gross sales and has continued to reveal cussed demand regardless of huge worth hikes and taxation. We anticipate this profitability and money move potential to proceed for the foreseeable future till BAT has a dominant non-combustible enterprise.

There’s a important profit from this impairment

As mentioned earlier than, the impairment is basically on paper and doesn’t imply BAT is disposing of those belongings at pennies on the greenback. These manufacturers will proceed churning FCF (Free Money Circulation) for the foreseeable future.

There’s one notable profit from the impairment in that it’s typically tax deductible. In its monetary studies from FY 2022, BAT reported a 29% stake in ITC, which had a e book worth of £1.9 billion however was price greater than £12 billion from a good worth perspective. Via 2023, this stake has appreciated to over £16 billion. If BAT had been to understand the capital positive factors from this funding, it might offset all these positive factors by way of the impairment.

And if BAT pursues the disposition of its ITC stake, the proceeds will likely be substantial sufficient to extinguish ~50% of the corporate’s internet debt. Supply.

FY 2023 steering stays intact

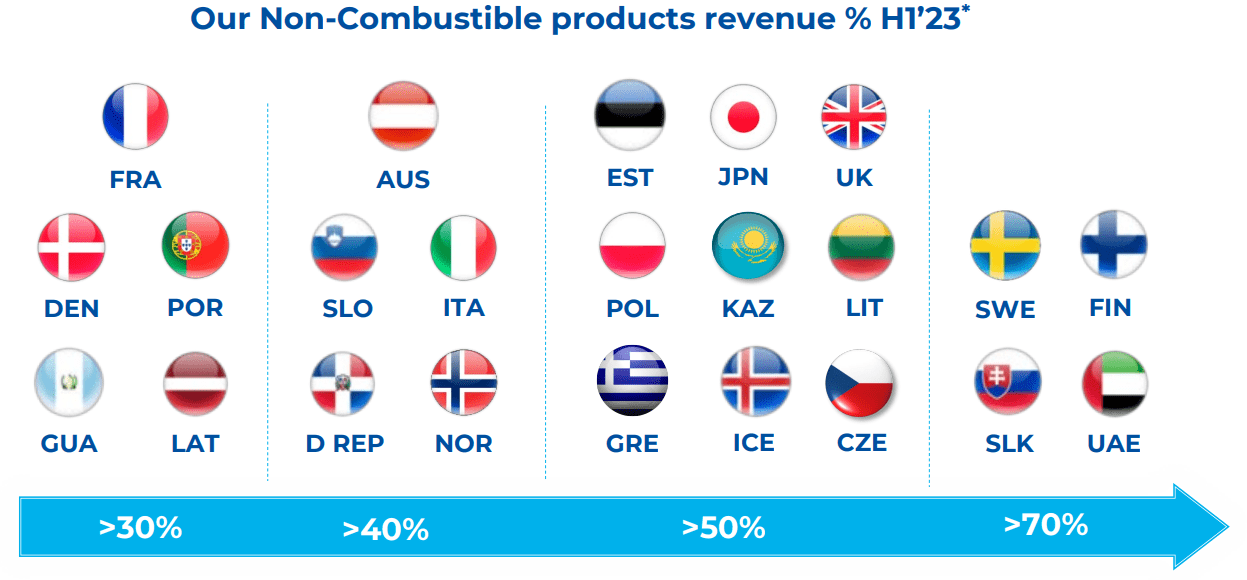

1H 2023 Investor Presentation

Non-combustibles symbolize a quickly rising portion of BAT’s enterprise globally, and the corporate’s publicity to rising economies like Bangladesh, Pakistan, and Indonesia, will guarantee modest development even in its flamable phase. Mr. Market is being irrational, BAT solely by way of the U.S. market. In truth, the U.S. authorities lately introduced its choice to delay the menthol ban in worry of the political penalties of the choice forward of the federal elections.

On this current press launch, administration reaffirmed their FY 2023 steering, anticipating revenues to be on the low finish of the 3-5% development projection, a mid-single-digit adjusted EPS development, and powerful new class top-line development, and expects this to contribute to 50% of the highest line by 2035.

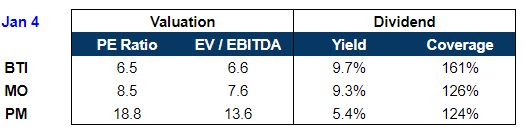

BAT presently trades at an especially low valuation on ahead earnings whereas sporting a big 9.7% yield. Amongst tobacco friends, BAT maintains the bottom 62% dividend payout ratio, indicating enough security to the earnings stream and powerful prospects for continued dividend development within the coming years.

Creator’s Calculations

Accounting laws require firms to hold out common impairment exams, and BAT’s present announcement presents important tax offsets with none change to the money move technology from its legacy manufacturers or affecting the dividend security. We all know the flamable enterprise will slowly fade away in developed nations, however that is still a number of a long time away and enough to fund the expansion and enlargement of non-combustibles. The steep irrational sell-off presents a sexy alternative to load up on this 9.7% yield.

Choose #2: RVT – Yield 7.5%*

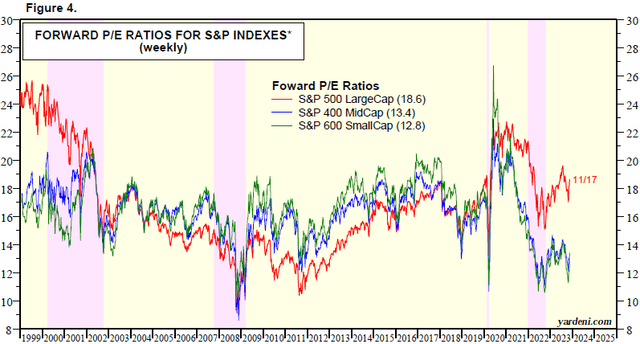

Because of the document tempo of price hikes by the Federal Reserve, and chronic recession forecasts by Wall Avenue, we see the widest disconnect between the valuations of Small Cap vs. Giant Cap. Supply.

Yardeni Analysis

Small caps are presently buying and selling at valuations nicely beneath their historic ranges, showing to be priced as if the recession had been already right here.

Cut price consumers see numerous worth within the SmallCap sector, however as earnings traders, we need to accumulate ready charges for that valuation enchancment, whether or not it’s from price cuts or higher earnings bulletins from SmallCap companies.

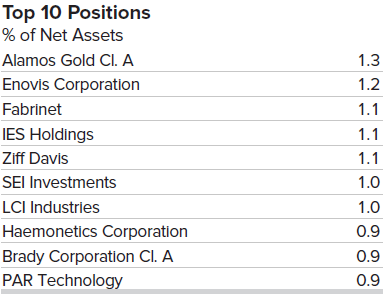

Royce Worth Belief (RVT) is a time-tested closed-end fund, or CEF, run by managers who pay scrupulous consideration to small-company stability sheets. As such, there may be higher safety towards particular person firm blowups. 60% of the fund’s belongings are invested throughout industrials, financials, and knowledge expertise, with an actively managed portfolio of 488 holdings from the small-cap phase of the market. Notably, the CEF’s weighted common P/E ratio sits at 14.4x, beneath that of its benchmark, the Russell 2000 index. Supply.

RVT Reality Sheet

RVT was born in 1986, an period with excessive inflation, unemployment, and a weak financial outlook, making it one of many few funds which have demonstrated long-term portfolio reliance and shareholder returns by way of a variety of financial challenges.

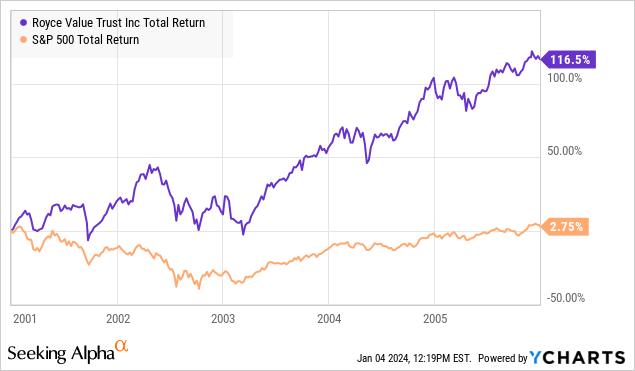

The parameters surrounding the financial system right this moment, specifically unemployment, inflation, and rates of interest, are extremely corresponding to these of the Dot-com bubble period. Evaluating the efficiency of RVT and the S&P 500 since January 2001, we are able to clearly see what the CEF is product of, and the fund is well-positioned to repeat this within the coming years.

*RVT has a variable distribution coverage whereby its quarterly fee is adjusted primarily based on the NAV on the finish of the trailing 4 quarters. Variable dividends scare numerous traders, however the variability is a protection mechanism to guard the fund from having to liquidate priceless belongings at unfavorable market costs. RVT doesn’t make the most of leverage in its funding technique, which additional protects the fund from additional draw back from a weakening financial system.

Within the 9 months of FY 2023, RVT’s distributions had been composed of 0.5% earnings, 15.3% short-term positive factors, 84.2% long-term positive factors, and 0% ROC.

Not solely is RVT composed of undervalued firms from an undervalued sector, however the fund itself trades at a big 12% low cost to NAV. This makes each invested greenback robotically work more durable to safe returns.

RVT’s time-tested technique makes it a wonderful addition to your earnings portfolio, and the generational disconnect in SmallCap valuations makes it very interesting to lock within the 7.5% yield.

Conclusion

All of us love a discount in virtually each buy, be it items or companies. However on the subject of investing, folks discover it surprisingly snug to purchase at 52-week excessive worth factors. It’s like going to a bar throughout comfortable hour and ready for it to finish earlier than you order your drink at common costs. It would not make any sense, however that is how the markets function, and people who perceive it repeatedly profit.

“Some folks shouldn’t personal shares in any respect as a result of they simply get too upset with worth fluctuations. When you’re gonna do dumb issues as a result of your inventory goes down, you should not personal a inventory in any respect.” – Warren Buffett.

The markets clearly present a disconnected restoration the place the majority of it stays undervalued with respect to its underlying earnings. BTI and RVT current two such deeply discounted picks that we’re shopping for to gather regular dividends by way of the market’s irrational part.

At Excessive Dividend Alternatives, we now have been regular consumers of passive earnings, and our “mannequin portfolio” of +45 picks presently yields ~9.7%. They supply a dependable earnings stream as we patiently await market normalization throughout this unbalanced restoration. Our technique includes seizing alternatives when others are fearfully promoting, and with the upcoming shift within the price cycle, the inventory market’s “comfortable hour” is drawing to a detailed. Take swift motion and capitalize on these bargains earlier than they vanish!

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.