Fokusiert

Funding Thesis

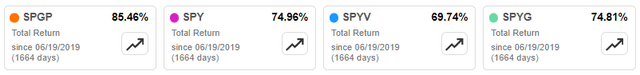

I final lined the Invesco S&P 500 GARP ETF (NYSEARCA:SPGP) in June 2023, cautioning readers towards an funding on account of its excessive publicity to risky Power and Materials shares. Regardless of these dangers, SPGP proved stable, gaining 9.49% and matching the features of the SPDR S&P 500 ETF (SPY). Because it started monitoring its present Index, SPGP has outperformed the SPDR Portfolio S&P 500 Worth ETF (SPYV) and the SPDR Portfolio S&P 500 Development ETF (SPYG) by 11% every on whole returns.

Looking for Alpha

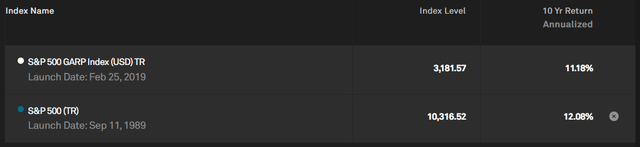

The result’s spectacular, however I fear about traders chasing efficiency. Since I downgraded SPGP from “purchase” to “maintain” on April 28, 2022, SPGP has lagged SPY by 1.47% and SPYV by 6.47%. If you choose ETFs based mostly on historic returns, you would possibly take into account that every one of SPGP’s alpha was generated between October 2020 and March 2021, when it beat SPY by 18.18%. I do not suppose it is prudent to emphasise such a novel interval, so I’ve but to determine whether or not SPGP was simply “fortunate” or its technique is superior. Ten-year returns supplied by S&P Dow Jones Indices do not recommend the strategy is something particular, and though that features the outcomes of a backtest, I am not comfy leaping on the SPGP bandwagon simply but.

S&P Dow Jones Indices

That mentioned, there are advantages to evaluating SPGP’s semi-annual reconstitutions, because it highlights market segments which might be priced properly. The newest one occurred a couple of weeks in the past, and the primary a part of this text will handle these adjustments. The second half will evaluate SPGP’s fundamentals alongside different ETFs with enticing mixtures of development and worth. I sit up for taking you thru these choices and answering your questions within the feedback part afterward.

SPGP Overview

Technique Dialogue

SPGP tracks the S&P 500 GARP Index, choosing 75 S&P 500 Index shares every June and December based mostly on 5 screens:

- Three-year earnings per share development

- Three-year gross sales per share development

- Monetary leverage

- Return on fairness

- Earnings-To-Worth

Development scores are calculated for all S&P 500 firms, with the highest 150 qualifying. The listing is minimize to 75 based mostly on high quality and worth scores, with elements weighted by their development scores. This order of operations is vital as a result of it is evident the choice course of favors development shares. In consequence, it is notable when worth shares are chosen as an alternative, implying that development shares are so overvalued that it would not matter what development potential they provide – it is not price it. That occurred in December 2021, and the Index has lacked stable gross sales and earnings development charges since.

December Reconstitution Abstract

December’s reconstitution was comparatively uneventful, with solely 9 substitutions. The additions had been as follows:

- Enphase Power (ENPH): 1.83%

- Deere & Co. (DE): 1.56%

- Tapestry (TPR): 1.35%

- ON Semiconductor (ON): 1.31%

- Lamb Weston (LW): 1.01%

- Visa (V): 1.01%

- Microchip Expertise (MCHP): 0.99%

- Raymond James Monetary (RJF): 0.98%

- W. R. Berkley (WRB): 0.96%

Most additions are from the Expertise and Financials sector, however the whole influence by weight is simply 11.00%. As offsets, the Index deleted 9 shares:

- Moderna (MRNA): 2.13%

- Weyerhaeuser (WY): 1.64%

- Generac Holdings (GNRC): 1.53%

- C.H. Robinson Worldwide (CHRW): 1.19%

- Dow (DOW): 1.05%

- Cigna (CI): 0.90%

- Procter & Gamble (PG): 0.89%

- Arch Capital Group (ACGL): 0.88%

- Accenture (ACN): 0.82%

The mixed weight of those 9 shares was 11.03%, with Accenture as the one Expertise firm. The online result’s a 21.29% allocation to that sector. Power publicity stays excessive at 25.45%, and I reiterate the cautionary level from my final evaluation that that is extreme. Since vitality costs are unimaginable to forecast, so are the expansion charges assigned to this sector.

The Sunday Investor

SPGP Fundamentals

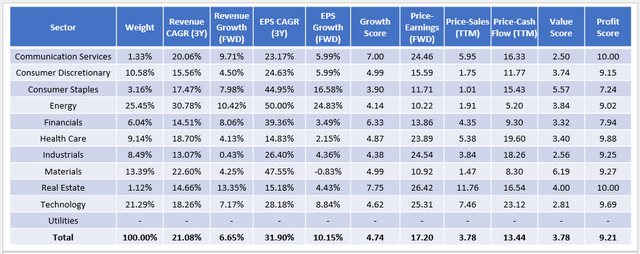

Excessive-Degree Abstract

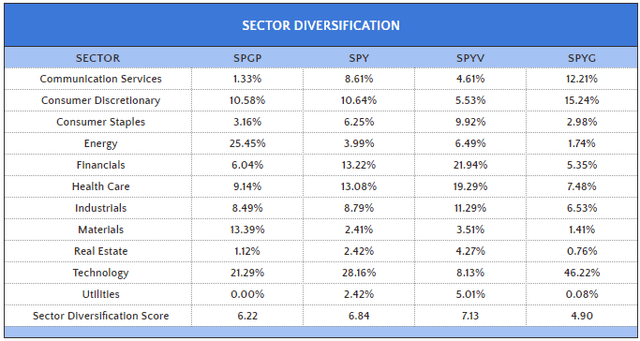

The next desk offers a abstract of SPGP’s high-level fundamentals. We will use this as a place to begin to establish its strengths and weaknesses by evaluating it with SPY, SPYV, and SPYG.

The Sunday Investor

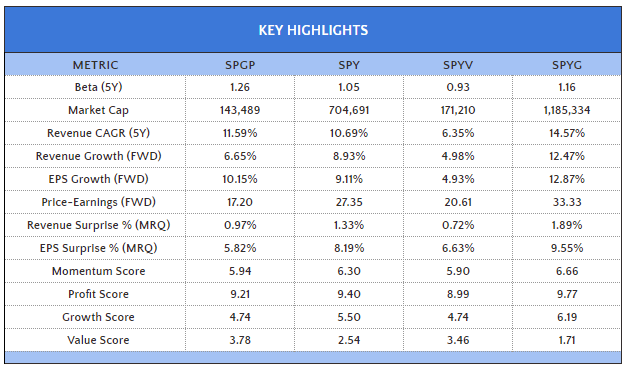

SPGP’s estimated gross sales and earnings development charges are 6.65% and 10.15% and are closest to SPY. Nonetheless, it trades at simply 17.20x ahead earnings, the most cost effective among the many 4. SPGP’s weighted common market capitalization of $143 billion displays the presence of no less than some mega-cap shares, and its 1.26 five-year beta displays excessive publicity to Power and Supplies.

GARP traders usually calculate a inventory’s PEG ratio, quick for price-earnings to development. If we divide SPGP’s 10.15% estimated earnings per share development charge into its 17.20x ahead P/E ratio, we get 1.69x in comparison with 3.00x, 4.18x, and a couple of.59x for SPY, SPYV, and SPYG. Since traders choose this quantity to be as little as doable, SPGP stands out for the higher.

Nonetheless, this desk comprises a clue that extra evaluation is required. Within the backside three rows, I calculated a revenue, development, and worth rating based mostly on particular person Looking for Alpha Issue Grades. SPGP’s 4.74/10 development rating considerably lags behind SPY and SPYG and matches SPYV’s rating. The reason being that this rating evaluates every inventory with its sector friends, so it is a greater apples-to-apples comparability. Due to this fact, SPGP just isn’t an important development ETF for the time being, and by trying on the fund from the sector stage, we see why.

Sector Abstract

Power is the primary cause for SPGP’s seemingly robust fundamentals. SPGP’s Power shares commerce at 10.22x ahead earnings with 24.83% estimated earnings per share development, or a 0.41 PEG ratio. With 25.45% publicity, the sector has appreciable affect.

The Sunday Investor

Nonetheless, these estimates are unreliable. One piece of proof comes from the EIA, with the one-year confidence interval for WTI crude oil spot costs ranging between $40 and $130 per barrel. Different specialists additionally report a spread of estimates, with a notable instance being PIRA Power Group’s $100-105 common estimate for Brent crude between 2012 and 2025. The common value was $75, or roughly $55 in inflation-adjusted {dollars}, and is decrease than the agency’s $60 “Low Worth” state of affairs, as described in this exhibit. My strategy is to view Power sector earnings development estimates with the identical diploma of skepticism as specialists for oil costs.

Moreover, the sector’s 4.14/10 development rating may very well be higher. SPGP’s picks in Actual Property, Communication Providers, and Financials provide the very best development scores, however their weights are minimal. As an alternative, the truth that the ETF’s 3.78/10 worth rating is healthier than SPYV’s proves that SPGP stays firmly a price play.

Constructive Takeaways / Three Alternate options

The perfect half about SPGP’s present composition is its excessive revenue rating (9.21/10), which does not require a lot mega-cap publicity. Apple (AAPL) and Microsoft (MSFT) are members however with minimal weightings under 1.00%. Alphabet (GOOGL), Visa (V), Broadcom (AVGO), Exxon Mobil (XOM), and Chevron (CVX) are additionally current, however their common weight is just one.30%. This 75-stock fund within reason well-diversified on the firm stage, and I’ve attributed this to the Index’s monetary leverage and return on fairness screens.

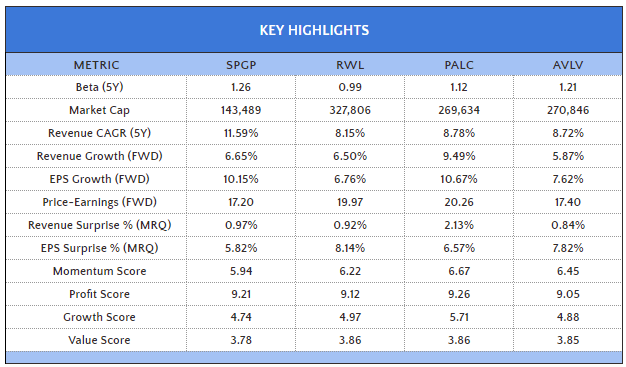

I am unable to overstate the significance of those screens and the way troublesome it’s to search out high-quality ETFs with good development and worth scores. Amongst large-cap ETFs, I solely recognized 30 in my database, and most had poor revenue scores. Nonetheless, three caught my eye that I might such as you to think about:

- Invesco S&P 500 Income ETF (RWL)

- Pacer Lunt Massive Cap Multi-Issue Alternator ETF (PALC)

- Avantis U.S. Massive Cap Worth ETF (AVLV)

As proven under, every various has revenue scores above 9.00 and targets large-cap shares, as indicated by their weighted common market cap figures. They’re additionally much less risky than SPGP and have extra momentum than SPGP.

The Sunday Investor

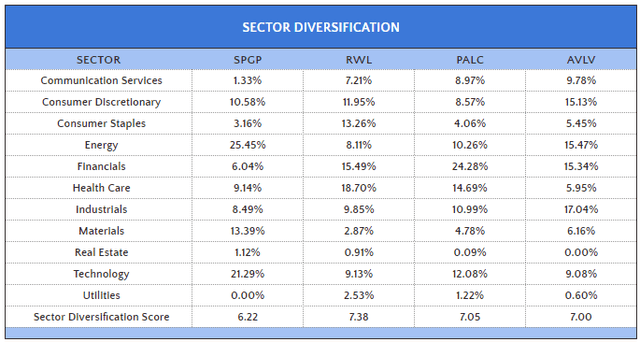

One other profit is that they are higher diversified. RWL has 10%+ allocations to 4 sectors. PALC’s second-largest sector (Expertise) is simply at 12%. Lastly, AVLV has exposures for all sectors under 20%.

The Sunday Investor

Funding Suggestion

SPGP’s newest reconstitution resulted in 9 substitutions and was largely uneventful. The principle takeaway is that it nonetheless has a price lean, evidenced by its 17.20x ahead earnings valuation and three.78/10 worth rating that matches SPYV’s. The portfolio’s excessive beta stays, as does its appreciable publicity to Power shares. Given the unpredictability of oil costs, I ask readers to take that sector’s enticing fundamentals with a grain of salt.

Though SPGP just isn’t a superb development fund right this moment, there are few various ETFs with superior development and worth scores. I discovered three that didn’t sacrifice high quality or diversification, however they’re all value-oriented and won’t routinely modify ought to development shares change into favored once more. That makes SPGP distinctive and acceptable for style-neutral traders who need extra exercise than the usual passive fund gives. Whereas it is not for me, as I am not satisfied the technique is healthier than SPY’s, I hope I supplied sufficient info so that you can make an knowledgeable choice. If I missed something otherwise you’d like additional particulars, please be happy to remark under.