DNY59

We beforehand coated ASML Holding N.V. (NASDAQ:ASML) (OTCPK:ASMLF) in October 2023, discussing how the October 2023 backside was extremely engaging for buyers trying to greenback price common, considerably aided by Taiwan Semiconductor’s (TSM) commentary on the close to bottoming of the semiconductor market.

Mixed with its 20Y moat, we had maintained our optimism on its long-term prospects whereas reiterating our Purchase ranking on the inventory.

On this article, we will talk about why we imagine that ASML’s 2024 commentary has been on the cautious aspect, with a number of Large Tech firms and information middle REITs reporting rising urge for food for cloud computing/ generative AI companies and infrastructure associated spending.

Nevertheless, with the inventory already recording large recoveries for the reason that latest October 2023 backside, we advocate buyers to attend for a extra engaging entry level for an improved upside potential.

The Semiconductor Funding Thesis Stays Insatiable

For now, ASML has reported a backside line beat in its FQ3’23 earnings name, with revenues of €6.67 billion (-3.3% QoQ/ +15.5% YoY) and GAAP EPS of €4.81 (-2.4% QoQ/ +12.1% YoY).

Whereas its bookings have notably decelerated to €2.6B (-42.2% QoQ/ -70.7% YoY), the general backlog stays greater than strong at over €35B, implying that its capability are nonetheless absolutely booked by way of the subsequent 5 – 6 quarters.

A lot of ASML’s reserving deceleration is attributed to the delayed capex from a number of foundries, comparable to TSM and Samsung (OTCPK:SSNLF), with Intel (INTC) and Micron (MU) being the few exceptions so far.

Nevertheless, we imagine that the headwinds might not final lengthy, with the Semiconductor Trade Affiliation already reporting glorious progress within the international chip gross sales to $48B for November 2023 (+2.9% MoM/ +5.3% YoY), with it marking the primary progress in over a 12 months.

There’s nonetheless nice demand for cloud computing put up pandemic and generative AI companies, with a number of Large Tech firms already projecting increased infrastructure information middle capex forward. The checklist consists of Amazon.com, Inc. (AMZN), Microsoft Company (MSFT), Alphabet Inc. (GOOG) (GOOGL), and Meta Platforms, Inc. (META).

A number of information middle REITs have additionally reported rising leases with increased charges, with demand being gated by capability and building/ energy necessities, together with Iron Mountain (IRM) and Digital Realty Belief (DLR).

Mixed with the projected enlargement within the international semiconductor capability to 30M wafers monthly in 2024 (+6.4% YoY), up from the 29.6M wafers monthly reported in 2023 (+5.5% YoY), we imagine that the ASML’s flat 2024 web gross sales steerage might have been extra on the cautious aspect.

For now, the administration’s prudence is an efficient factor certainly, as a result of any prime/ backside line beats might set off the inventory’s upward motion forward.

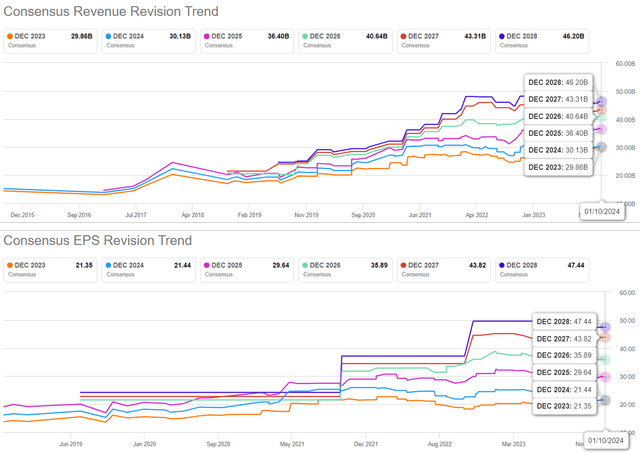

The Consensus Ahead Estimates

Looking for Alpha

The consensus has additionally maintained their ahead estimates, with ASML anticipated to generate a prime and backside line enlargement at a CAGR of +16.2% and +24.1% by way of FY2025.

That is in comparison with the earlier estimates of +15.9%/ +26.1% and its historic progress at +20.9%/ +26.6% between FY2016 and FY2022, respectively.

On account of its worthwhile progress pattern, we imagine that ASML stays properly poised as one of the vital vital firms globally, with one other being TSM, regardless of the continuing geopolitical issues surrounding the commerce curb, with it solely “impacting a small variety of prospects in China.”

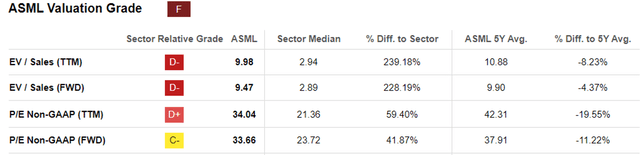

ASML Valuations

Looking for Alpha

And it’s for these causes, we imagine that ASML deserves its premium FWD EV/ Gross sales valuation of 9.47x and FWD P/E valuation of 33.66x, in comparison with its 1Y imply of 9.03x/ 32.60x, 3Y pre-pandemic imply of 6.34x/ 26.80x, and the sector median of two.89x/ 23.72x, respectively.

Its moat within the superior semiconductor lithography gear is undisputed as properly, with Canon’s (OTCPK:CAJPY) (OTCPK:CAJFF) various lithography choices unlikely “to interchange EUV machines,” with the latter’s value being one digit lesser.

That is the case of when one will get the standard that they pay for, with TSM and INTC prone to be loyal ASML prospects as the forefront international foundries.

So, Is ASML Inventory A Purchase, Promote, or Maintain?

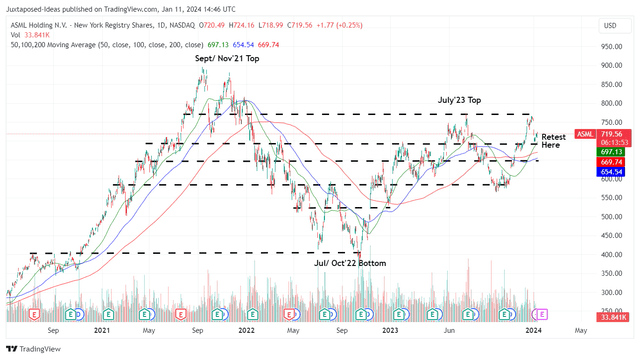

ASML 4Y Inventory Value

Buying and selling View

Now that the Chinese language commerce ban has been introduced, ASML’s inventory has reversed its upward momentum, rapidly plunging after the information, but in addition bouncing off its earlier help ranges of $690s.

Primarily based on the administration’s FY2023 steerage, with revenues of €27.52B (+30% YoY), gross margins of 51% (+0.5 factors YoY), secure quarterly working bills of ~€1.31B, and ~15% in earnings tax (inline YoY), it seems that we may even see an approximate web earnings of €7.47B (+32.9% YoY).

Mixed with its lowering FQ3’23 share rely of 393.7M (-0.2M QoQ/ -2.9M YoY), we may even see ASML file exemplary FY2023 adj EPS of €19.00 (+34.4% YoY) certainly, or the equal of $20.90 primarily based on the overseas alternate on the time of writing.

Because of the latest correction and its premium P/E valuation of 33.66x, the inventory seems to be buying and selling close to its truthful worth of $703.50 as properly. Primarily based on the consensus FY2025 adj EPS estimates of $29.64, there seems to be a superb upside potential of +38.9% to our long-term value goal of $997.60.

On the identical time, ASML affords a token dividend yield of 0.85%, permitting buyers to recurrently DRIP on a quarterly foundation regardless of the volatility within the inventory market, as now we have equally achieved.

On account of the superb twin pronged (potential) returns, we proceed to fee the ASML inventory as a Purchase, although with no particular entry level because it depends upon particular person buyers’ greenback price common.

Primarily based on the lifting market sentiments attributed to the cooling inflation and the Fed’s speculative pivot from Q1’24 onwards, it seems that we might not see one other low entry level of $580s, with the inventory already rallying by +24.1% for the reason that latest October 2023 backside.

With the inventory market already getting into excessive greed territory, buyers might need to observe ASML’s inventory motion for slightly longer and add upon a average pullback, ideally at its earlier help ranges of $650s for an improved margin of security.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.