[ad_1]

As employment wants have gotten increasingly more advanced, companies are searching for cost-effective HR help. PEOs or Skilled Employer Organizations supply HR options to companies of all sizes, dealing with payroll, advantages, and compliance duties.

The Skilled Employer Group (PEO) market, valued at USD 59.62 billion in 2022, is anticipated to succeed in USD 152.14 billion by 2031, rising at a fee of 11.10% yearly (Straits Analysis).

PEOs are extra adaptive to altering workforce landscapes, present versatile options, and permit corporations to regulate to new employment tendencies.

This weblog discusses the that means of PEO together with its enterprise significance within the fashionable workforce. It talks about how PEO advantages corporations, how to decide on the suitable one, and what its shortcomings are.

Ultimately, we’ll take inspiration from a few of the success tales of PEO as we be taught extra concerning the subject.

What’s a PEO: Which means, Definition, & Historical past

A Skilled Employer Group (PEO) is an organization that gives outsourcing companies to small and medium-sized companies. The outsourcing companies listed here are largely HR and people-centric starting from payroll to administration.

Partnering with a PEO offers enterprise leaders a number of benefits, supporting workers and serving to the group obtain its mission.

Definition of PEO

In response to the Nationwide Affiliation of Skilled Employer Organizations (NAPEO), a PEO is an organization that gives full outsourced HR options for small and midsize companies. They sometimes deal with companies like payroll, worker advantages, HR administration, tax administration, and regulatory compliance.

Historical past of PEO

Skilled Employer Organizations (PEOs) have an interesting historical past rooted within the want for companies to handle their workers extra effectively. Allow us to take a look at it via the years:

Nineteen Eighties:

Within the Nineteen Eighties, Skilled Employer Organizations (PEOs) started by dealing with easy payroll actions for consumer companies like distributing paychecks and managing payroll information. Nonetheless, this brought on confusion about employer standing, resulting in regulatory interventions.

Nineteen Eighties and 2000s:

Between 1980 and 2000, employment legal guidelines grew by 60%, rising prices for companies. PEOs tailored by increasing companies, together with HR administration, advantages administration, and regulatory compliance. Additionally they took on advanced duties like retirement plan administration and Worker Help Applications (EAPs).

In contractual relationships, PEOs and consumer companies outline duties. PEOs deal with HR duties and administrative duties, turning into joint employers with shoppers. PEOs don’t present each day supervision or intervene in recruitment processes.

Current time:

PEOs developed to satisfy altering laws and consumer wants, providing complete HR options whereas assuaging administrative burdens for companies.

This gives companies with professional HR help, permitting them to focus on extra core actions whereas guaranteeing that their workers obtain correct HR companies. Over time, the idea of PEOs has gained reputation, particularly amongst smaller companies. It simplifies HR complexities and helps corporations thrive in in the present day’s aggressive market.

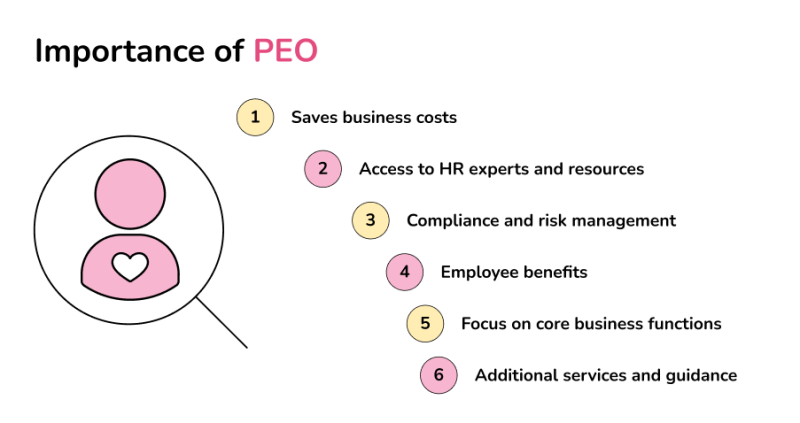

Significance of PEOs within the fashionable workforce

PEOs present important HR companies like payroll processing, tax dealing with, and advantages administration. They work underneath a co-employment mannequin, performing as the executive employer.

This distinctive relationship permits companies to entry massive group profit choices, decreasing prices and creating predictability round potential will increase sooner or later.

Listed below are 6 major vital factors why companies think about using PEOs:

1. Saves enterprise prices

Skilled Employer Organizations (PEOs) cut back prices for companies by streamlining HR capabilities, managing compliance, and offering entry to massive group advantages.

In response to Onward Advisors, 58% of corporations achieved a median financial savings of 24% or no improve in prices by utilizing a PEO.

2. Gives entry to HR experience and sources

Skilled Employer Organizations (PEOs) present complete HR information and sources. Additionally they grant entry to cutting-edge HR applied sciences, enhancing effectivity and the general worker expertise.

Moreover, these organizations streamline the tedious duties of sourcing, choosing, and managing worker profit applications, conserving inside sources within the course of.

3. Improves compliance and danger administration

55% of companies gained management over authorized dangers and compliance administration, decreasing potential authorized points.

If a partnered firm faces any violations, the accountability extends to the collaborating PEO. Subsequently, PEOs play an important position in guiding corporations via authorized challenges and guaranteeing efficient compliance administration.

4. Enhances worker advantages

PEOs analysis, negotiate, and administer complete advantages packages, guaranteeing workers obtain beneficial perks reminiscent of medical insurance, retirement plans, and wellness applications.

They leverage their experience and buying energy to supply aggressive advantages, enhancing the general worker expertise and satisfaction.

5. Permits extra concentrate on core enterprise capabilities

PEOs present companies with the pliability to regulate to adjustments simply. Whether or not it’s hiring extra workers, coming into new markets, or updating HR guidelines, PEOs have the information and sources to make these transitions clean.

This lets companies consider their major targets with out getting slowed down by administrative points.

6. Gives extra companies and steerage

Since PEOs are so invested in your organization, they provide extra coaching and steerage to your organization. Some examples are:

- Coaching for sexual harassment.

- Creating an worker handbook and sustaining it.

- Coaching on Indian legal guidelines just like the Minimal Wages Act, Code on Social Safety, Code on Wages, and so on.

- Guiding the perfect hiring and shedding practices.

How do PEOs work: Key capabilities and companies provided

The precise companies supplied by skilled employer organizations differ relying on the entity. Nonetheless, PEOs sometimes present three major companies:

- HR help

- Worker advantages

- Danger and compliance administration

The options are tailor-made to shoppers’ wants. Let’s take a better take a look at the above class of companies and the choices accessible.

1. HR Help

PEOs information companies in human sources methods from dealing with administrative duties to making sure environment friendly workforce operations. Listed below are a few of the companies provided underneath this class.

- HR Administration

- Payroll and Tax Options

- Efficiency Administration

- Recruiting Providers

- Coaching and Improvement

- Scheduling

- Time and Attendance

- Garnishment processing

- Tax & tax return remittance

- W-2 & W-3 reconciliation

- Licensed payroll

2. Worker Advantages

PEOs handle complete worker profit applications by leveraging their collective buying energy. They safe aggressive advantages for workers. Among the companies underneath worker advantages are:

- Healthcare advantages

- Life, Incapacity, Dental, and Imaginative and prescient Plans

- 401(ok) and Different Financial savings Plans

- Voluntary Advantages

- Complimentary Advantages

- On-line open enrollment

- Bill reconciliation

- Accountability for remittance to carriers

- Liable for worker terminations

- COBRA and HIPAA administration

3. Danger and Compliance Administration

By guaranteeing companies adhere to laws, PEOs reduce authorized problems, permitting corporations to function easily with out worrying about compliance challenges. The companies and capabilities on this class are:

- Worker Lawsuits

- Staff’ Compensation Administration

- Office Security Enhancements

- Inexpensive Care Act (ACA) Compliance

- Depart of Absence Administration

- I-9 Verification

- Occupational Security and Well being Administration (OSHA) Help

- Worker Insurance policies and Notifications

- Investigations of fraudulent claims

- Return-to-work applications

What varieties of companies profit from PEOs?

Companies aiming to create excellent workplaces can vastly profit from partnering with a PEO. By collaborating with a PEO, corporations can obtain steerage in HR methods and delegate administrative HR duties.

A incredible firm tradition, attracting high expertise, and fostering worker development are key traits of the perfect workplaces. An appropriate PEO can help companies in reaching these targets.

PEOs are appropriate for a variety of industries, together with:

- Actual property and property administration

- Pc companies and know-how

- Securities brokers and sellers

- Engineering companies

- Well being companies

- Authorized companies

- Administration consulting companies

- Enterprise companies

- Accounting, auditing, and bookkeeping

- Manufacturing

- Plumbing, HVAC, electrical, and different trades

- Insurance coverage

- Wholesale

- Nonprofits

How do the above companies profit from a PEO?

A collaboration with a PEO affords entry to professional HR professionals at decrease prices, guaranteeing compliance with advanced employment legal guidelines and laws. Shared legal responsibility with the PEO gives peace of thoughts, and group buying energy allows higher worker advantages.

PEOs deal with advantages administration, saving time and decreasing prices associated to insurance coverage. Environment friendly HR know-how options streamline processes, and companies can entry a wide range of HR companies and distributors via one platform, contributing to their general success and development.

How do PEOs differ from conventional HR and payroll companies?

Listed below are the important thing variations between Skilled Employer Organizations (PEOs) and Conventional HR

| S.No | Key Variations | PEOs | Conventional HR |

| 1. | Employer of Report Standing | Acts because the official employer for tax and insurance coverage functions. | The corporate immediately serves because the employer of file. |

| 2. | Co-Employment Relationship | Establishes a co-employment relationship, sharing sure employer duties. | Includes a direct employer-employee relationship with no third social gathering. |

| 3. | Complete HR Providers | Present a variety of HR companies, together with payroll, advantages, and compliance administration. | Corporations deal with HR duties internally, which can differ in scope and specialization. |

| 4. | Danger Administration and Compliance | Specialise in guaranteeing authorized compliance, and decreasing the corporate’s danger of authorized points. | Corporations should handle compliance independently, which will be difficult on account of evolving legal guidelines. |

| 5. | Integration and Expertise | Provide built-in HR know-how platforms for streamlined processes. | Depends on in-house or outsourced know-how, which can lack seamless integration. |

| 6. | Scalability and Flexibility | Simply scale HR companies in accordance with enterprise development, adapting to altering wants. | Requires inside changes, which will be time-consuming in periods of growth or downsizing. |

| 7. | Management of HR capabilities | Companies utilizing PEOs share management over HR capabilities. | Corporations retain full management over all HR capabilities, permitting them to tailor insurance policies and practices to their particular wants. |

Elements to think about whereas choosing the proper PEO for your online business

There are many choices to select from whereas choosing the suitable PEO for your online business. Nonetheless, there are specific components that must be stored in thoughts whereas doing so.

Listed below are they:

1. CPEO licensed

The Inside Income Service (IRS) designated a choose few PEOs as Licensed Skilled Employer Organizations (CPEO) in 2017, setting a excessive normal for excellence. By working with a CPEO, which solely 6% of PEOs within the U.S. obtain, you make sure you’re collaborating with a top-tier group.

2. ESAC accredited

In 1995, the Employer Providers Assurance Company (ESAC) was established because the official accrediting company for skilled employer organizations (PEOs). Once you associate with ESAC-accredited PEOs, you’re selecting business finest practices and monetary reliability – solely 5% of all PEOs have earned this prestigious accreditation.

3. Location: Nationwide or Regional

When contemplating PEOs, you’ll discover they fall into two major classes: nationwide and regional. Nationwide PEOs function nationwide, serving shoppers in a number of states, whereas regional PEOs might concentrate on particular states or areas.

4. Expertise used

Because the rise of HR tech, have in mind how up to date the PEO is on the know-how entrance. As an HR skilled, you’ll admire that PEOs typically present know-how options to simplify HR duties.

Listed below are some must-have applied sciences in your PEO:

- Payroll processing software program

- HR administration software program

- Time and attendance monitoring software program

- Worker self-service portals

From managing payroll and advantages to monitoring paid time without work (PTO), these instruments are accessible to each managers and workers, making HR administration extra environment friendly.

5. Kind of service mannequin

When selecting a PEO, attempt to perceive the service mannequin they provide. Some PEOs present a normal, one-size-fits-all method, whereas others supply extremely customized options.

Contemplating these variations can considerably influence your resolution on which PEO to associate with, guaranteeing you discover the suitable match on your group’s distinctive wants.

What are some inquiries to ask whereas choosing a PEO?

Listed below are 14 questions you may think about asking when you’re looking on your PEO choices.

- Are you formally licensed by the IRS as a PEO?

- How is your pricing structured for the companies you present?

- Do you supply a service assure to make sure buyer satisfaction?

- Will my firm have devoted help staff members assigned to us?

- What measures do you’re taking to safeguard my firm from potential worker lawsuits?

- Is your medical insurance and staff’ compensation insurance coverage totally coated?

- Are the profit premiums you current the ultimate charges, or are there extra prices?

- What number of completely different advantages carriers do you collaborate with?

- On common, how lengthy do your shoppers sometimes keep together with your companies?

- What’s the scope of your compliance companies, and are there further charges related?

- How steadily do you replace and enhance your know-how platform?

- Do you present cellular entry for worksite workers to handle their payroll, HR, and advantages info?

- What protocols do you’ve got in place to make sure information safety?

- Might you join me with a few of your present shoppers for references?

Challenges of a PEO: Potential Drawbacks

Though there appear to be a number of advantages of partnering with a PEO, because the group grows, its drawbacks turn out to be extra outstanding. PEOs should not excellent for large-sized organizations with out sufficient customizations.

Allow us to take a look on the disadvantages of PEO intimately:

1. Imposing One-Measurement-Matches-All Method

PEOs supply generic advantages and companies that aren’t personalized to satisfy the particular wants of your online business and its workers. This implies paying for companies you don’t want and being unable to supply tailor-made advantages for a extra impactful worker expertise.

2. Paying Extra for Much less

Regardless of the comfort, the one-stop-shop resolution supplied by PEOs typically ends in companies paying extra for fewer advantages. The dearth of customization means you would possibly find yourself with a package deal that doesn’t totally tackle your workers’ wants or preferences.

3. Inefficient Charge Construction

Many PEOs cost charges primarily based on a straight proportion of your payroll bills. Whereas this would possibly lower your expenses for smaller organizations initially, as your online business grows, it may possibly surpass the charges charged by non-PEO suppliers. Consequently, the cost-effectiveness diminishes over time and impacts your funds considerably.

4. Lack of Management Over Advantages Technique

By counting on a PEO, you give up management over your advantages technique. PEOs typically don’t prioritize the nuances that differentiate your organization as an employer. This lack of customization can have an effect on your capacity to supply distinctive and engaging advantages to your workers. It additionally hinders your capacity to face out within the aggressive job market.

5. Monetary Affect with Worker Raises

When your group gives raises to workers, the PEO charges improve proportionally since they’re structured as a proportion of payroll. Which means as you reward your workers’ efficiency and loyalty, the PEO’s share additionally rises, impacting your general funds negatively

Value Construction of PEO: High Corporations

Skilled Employer Organizations (PEOs) sometimes cost companies primarily based on a flat month-to-month price or a proportion of the payroll. The price construction can differ broadly relying on components reminiscent of

- Measurement of the enterprise

- Variety of workers

- Providers required

- Particular wants of the enterprise

The pricing ranges from INR 3000 to INR 5000 per 30 days relying upon the above-mentioned components and the quoting course of.

Quoting Course of

The quoting course of when choosing a PEO entails speaking to the PEO representatives about your organization’s wants. You share particulars just like the variety of workers and particular companies you require.

The PEO makes use of this info to create a personalized quote, detailing the companies and prices. You overview the quote, negotiate if wanted, and when you agree, you signal a contract, formalizing the partnership with the PEO.

The knowledge that it’s essential share in the course of the course of has been talked about in short beneath:

1. Firm Data

- Basic particulars like FEIN quantity and workplace areas.

- Present gross payroll by class code.

- Particulars of the present Staff’ Comp coverage, together with expertise modification fee and loss runs from previous years.

- Plan descriptions and newest invoices from present insurance coverage carriers.

- Present yr SUTA charges sheet from every state the place your organization operates.

- Prior quarter’s payroll tax returns.

- Disclosure of any ongoing claims in opposition to your organization filed with organizations like DOL, EEOC, IDHR, or different human rights companies.

2. Worker Data

- Worker census

- Staff’ comp class code

- Annual wage

- Employment standing, and so on.

3. Your HR Wants

- Frequency of onsite HR help required.

- The popular frequency for payroll processing.

- Curiosity in particular worker advantages choices.

| Class | Data |

| Firm Data | |

| FEIN Quantity | [Your FEIN Number] |

| Workplace Places | [List of office locations] |

| Present Gross Payroll by Class Code | [Provide details by class code] |

| Staff’ Comp Coverage | Expertise Modification Charge: [Your EMR]

Loss Runs: [Provide details from past years] |

| Plan Descriptions and Invoices | [Details of existing insurance carriers, including plan descriptions and latest invoices] |

| Present 12 months SUTA Charges Sheet | [Provide rates for each state where your company operates] |

| Prior Quarter’s Payroll Tax Returns | [Attach or provide details from prior quarter returns] |

| Ongoing Claims Disclosure | [Disclose any ongoing claims filed with DOL, EEOC, IDHR, or other human rights agencies] |

| Worker Data | |

| Worker Census | [Provide census data including number of employees] |

| Staff’ Comp Class Code | [Specify Workers’ Comp class codes for employees] |

| Annual Wage | [Provide annual salary information for each employee] |

| Employment Standing | [Indicate employment status for each employee] |

| HR Wants | |

| Frequency of Onsite HR Help | [Specify preferred frequency for onsite HR assistance] |

| Most popular Payroll Processing Frequency | [Indicate preferred frequency for payroll processing] |

| Curiosity in Worker Advantages Choices | [List specific employee benefits offerings of interest] |

High PEO Corporations

Listed below are the highest 10 Corporations within the PEO Indian Market in accordance with Strait Analysis:

- NewHorizons International Companions

- International PEO Providers LLC

- Sky Government

- ADP TotalSource

- Papaya International

- Velocity International

- Paychex

- Synergy HR

- Insperity

- INS International

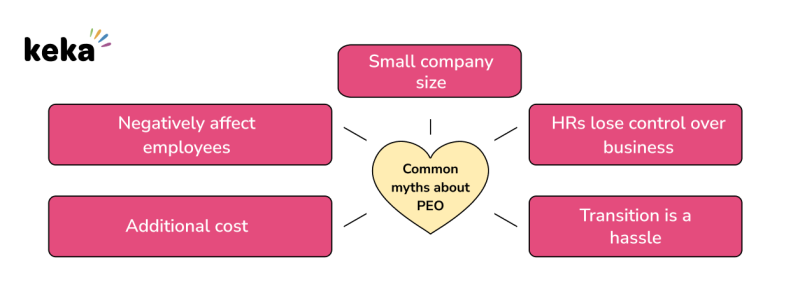

Myths about Skilled Employer Organizations

Regardless of all of the environment friendly methods you recognize a PEO might enable you, there should be some doubts relating to their use. Outsourcing your organization’s HR actions might make you are feeling such as you’re giving the facility of managing your folks to some exterior entity. However that’s not true.

Let’s discover some myths about PEOs and the way a lot reality they maintain.

1. PEO negatively impacts workers

HR professionals often assume that outsourcing HR hurts worker expertise, but it surely’s typically the alternative. Co-employment with a PEO can supply enhanced advantages, safe employment practices, and peace of thoughts for staff.

2. HR loses management over a enterprise

Some concern that partnering with a PEO means shedding management, however that’s not true. As an alternative, it’s a strategic partnership that shares HR duties, permitting enterprise house owners to concentrate on core actions with out shedding management.

3. The corporate is simply too small for a PEO

There’s a false impression that PEOs are just for particular enterprise sizes. In actuality, the suitable PEO can work with a wide range of firm sizes, providing tailor-made options.

4. Pointless bills are being spent

Considerations about costly, generic plans are frequent. Nonetheless, it’s all about discovering the correct of PEO. It customizes plans to economize and improve worker advantages, making it essential to analysis and discover the perfect match.

5. PEOs should not cost-effective

Some consider PEOs are too costly, however experiences present they will really save as much as 35% on HR administration prices, contributing to elevated income and effectivity.

6. There’s no want for an HR division when there’s a PEO

It’s not obligatory to switch in-house HR groups with a PEO. As an alternative, PEOs can complement present HR personnel, helping with duties and offering extra sources, particularly in compliance points.

7. The PEO transition is an excessive amount of of a problem

Switching to a PEO could appear daunting, however most PEOs have devoted groups to assist companies transition easily. These professionals keep linked to handle considerations and information shoppers via varied HR matters.

Wrapping Up

Within the ever-evolving world of HR, the place calls for are rising, counting on consultants is a clever transfer. Bringing in a PEO not solely simplifies operations but in addition ensures that your HR practices are each compliant and environment friendly within the face of evolving complexities.

Outsourcing your HR capabilities, particularly via a Skilled Employer Group (PEO), is a brilliant alternative for many companies, particularly these in growth mode. Having a devoted outsourced HR staff means you may chill out, realizing that seasoned professionals are successfully dealing with the complexities of HR.

PEOs help you focus in your core enterprise targets turning into a vital asset for continuous development and success. Moreover, you may confidently navigate via the challenges of a dynamic enterprise surroundings.

Ceaselessly Requested Questions

1. What’s a PEO?

A Skilled Employer Group (PEO) is an organization that companions with companies to handle varied HR capabilities, together with payroll, advantages administration, compliance, and worker relations. By outsourcing these duties to a PEO, corporations can concentrate on their core actions, whereas the PEO handles the complexities of HR administration.

2. What are the companies PEO gives?

PEOs supply a variety of companies, together with HR help, payroll processing, tax filings, worker advantages administration, danger administration, and compliance help. They typically present entry to superior HR applied sciences, permitting companies to streamline their processes and improve worker experiences.

3. Can small companies profit from utilizing a PEO?

Sure, small companies can profit considerably from partnering with a PEO. Small companies often have a restricted funds and sources. Therefore, outsourcing their HR actions via a PEO can show to be cost-effective and environment friendly.

4. What kinds of corporations sometimes use PEO companies?

Varied corporations, together with startups, small and medium-sized enterprises (SMEs), and even bigger firms, use PEO companies. Small and mid-sized companies typically discover PEOs notably beneficial, as they lack the sources to keep up an in-house HR division however nonetheless require complete HR options.

5. How does a PEO deal with payroll processing and tax duties?

PEOs deal with payroll processing by calculating salaries, issuing paychecks, managing deductions, and guaranteeing well timed funds. Additionally they deal with tax duties, together with withholding and depositing employment taxes, getting ready and submitting tax types, and staying up-to-date with tax laws, relieving companies of those advanced duties.

6. What benefits do PEOs supply when it comes to worker advantages?

PEOs leverage their collective bargaining energy to supply workers with a spread of advantages, together with medical insurance, retirement plans, and wellness applications. This enables companies, particularly smaller ones, to supply aggressive advantages packages that may assist appeal to and retain high expertise within the job market.

7. What components ought to a enterprise think about when selecting a PEO?

Companies ought to think about components reminiscent of

- Vary of companies provided

- Pricing construction

- Business experience

- Buyer critiques

- Flexibility in customization

- Stage of help supplied

Evaluating these points helps companies choose a PEO that aligns with their particular wants and funds.

8. Do companies lose management over HR choices when working with a PEO?

No, companies don’t lose management over their HR resolution whereas working with a PEO. Enterprise house owners retain full management of their operations when partnering with a PEO. They preserve authority over their workers whereas receiving beneficial help in managing the HR points of their enterprise operations.

9. What’s the price construction of PEO?

PEOs often impose a price calculated as a proportion of your general payroll bills, starting from 2% to fifteen%. As your payroll prices rise, your PEO bills will improve in proportion.

[ad_2]

Source link