demaerre

Lots of the most profitable enterprises are slicing

On January 12 Layoffs as reported in Quick Firm: Discord: The moment messaging and communications platform instructed workers this week that it could lay off 17% initially reported in The Verge, Audible: Amazon’s (AMZN) audiobook firm introduced it could lay off 5% of its workforce. Alphabet (GOOGL): The search big is shedding a whole lot of individuals engaged on the corporate’s Google Assistant product, Semafor reported, which final 12 months was made to look somewhat archaic with the rise of generative AI chatbots like ChatGPT. The corporate additionally laid off a whole lot of employees on its data and knowledge product groups. Instagram: The Meta Platforms (META) -owned firm is eliminating the roles of about 60 workers at its well-liked image-sharing app, reported Enterprise Insider. The staff are all technical program managers. Instagram declined to remark. On January 12, Forbes reported: that Twitch, a live-streaming website owned by Amazon, introduced plans to chop 35% of its employees, Amazon additionally introduced plans to chop “a number of hundred” workers at its Prime Video and MGM Studios divisions. Online game software program developer Unity Software program (U) introduced it’ll minimize one-quarter of its employees. The job slicing is not only restricted to the most important and finest know-how corporations, as The Wall Road Journal reported additionally on January 12 that BlackRock (BLK) The world’s largest asset supervisor stated it could round 3% of its whole workforce, in addition to Citigroup (C). The financial institution stated it could get rid of 20,000 jobs by the tip of 2026. What’s going on? I’d say proper off that every one the businesses on this abstract of layoffs are fairly profitable. The exception can be C, which is being reorganized by the brand new CEO, who by all reviews is making progress in restructuring the corporate. On Friday they reported greater earnings however decrease income, they’re vacating companies I can’t handle to ding them on that proper now all that stated this isn’t about an endorsement of C. That is a couple of bigger macroeconomic undercurrent that’s working by the economic system. I wish to tie this information with this headline from the Friday earlier than. On January 5, the Partitions Road Journal reported that IT Employment Grew by Simply 700 Jobs in 2023, Down From 267,000 in 2022.

My purpose is to not induce panic, massive firms are usually not the job development engines in America.

That doesn’t appear proper at first blush as a result of we deal with the Magnificent 7, and the remainder of their cohort has been delivering excessive development recently. In my view that isn’t how it’s with conventional massive corporations. The best way they increase earnings is thru efficiencies and slicing prices. By the way, Mark Zuckerberg the founder and CEO of Meta Platforms (META) referred to as 2023 the 12 months of effectivity, and lots of the different CEOs of the Tech Titans have adopted swimsuit that’s a part of the rationale I’m optimistic concerning the mega-cap tech and communications corporations for earnings reviews within the subsequent a number of weeks.

Effectivity is just not the one driver of decrease demand for tech demand and different white-collar administration and employees for that matter.

On the software program aspect, LLM can be utilized to generate software program, even earlier than the emergence of Massive Language Fashions ingesting code or within the parlance “skilled” and taking these constructing blocks and developing usable software program for the enterprise. Earlier than the rise of LLM there already had been no-code cloud-based providers, similar to ServiceNow (NOW), and monday.com (MNDY). These no-code programs at the moment are fortified with LLM and able to take all kinds of enterprise features for all sorts of workplace employees. As well as, there’s a new age of productivity-driven, not simply LLM, but additionally RPA – Robotic Course of Automation, most famously additionally the entire group flattening instruments like Slack, Staff, Anaplan, Smartsheet, DocuSign (DOCU), and Zoom (ZM). I feel it’s no accident that giant firms witnessed so many employees socially distanced through the pandemic, forcing a flattening of organizations. The necessity for center managers was demonstrably much less, as employees proved that they might (for probably the most half) function with out somebody hovering, and calling pointless conferences, Additionally LLM is taking up all kinds of interactive functions from Name Middle providers, to bookkeeping, and even automating contracts, however these features are rising by leaps and bounds.

Will this harm the economic system?

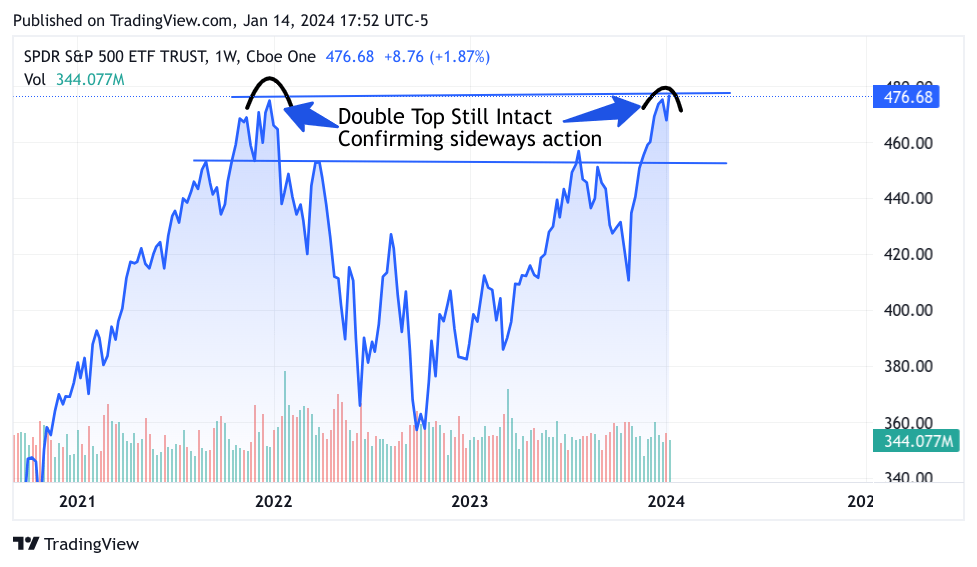

No, that is simply how a wholesome economic system works, as the good economist and political scientist Joseph Schumpeter in his landmark guide Capitalism, Socialism, and Democracy, coined the time period “artistic destruction” — the concept that in a free-market economic system, “the previous means” of doing issues is changed by a more recent, higher course of, or know-how. Simply consider all these expert employees unleashed to create new companies or shifting to smaller extra nimble corporations that want know-how experience that in prior years was onerous to get. Of these 20,000 individuals from C, there can be some which have transferable experience to create new monetary companies that may fund underserved market niches or ship higher providers to established ones. That stated, an excessive amount of of factor, in any kind won’t be all that good. Proper now the best way I see it, these reductions in workforce aren’t resulting from a slowing economic system however a possibility to run leaner, extra responsive, and naturally extra worthwhile corporations. There may very well be an issue, be it non permanent if extra firms discover that they want fewer clerical, center administration, and software program improvement employees , it may start to have an effect on total job development. That also gained’t take down the economic system, in line with Schumpeter destruction comes from creation. Simply suppose how cheaply a enterprise could be began with all these new automation applied sciences. Nevertheless, the employment numbers may tick decrease quickly, and that would lay the groundwork for a retreat from the present elevated stage. That is the purpose of the knowledge I’ve laid earlier than you. Whereas the present earnings season will serve to buoy the indexes, as I imagine many of the S&P 500 corporations reporting will exceed each income and earnings. Later within the quarter, the shedding of employees may name forth the “recessionistas” one thing I spoke about months in the past. There’s a faction of market commentators who’ve been predicting a recession solely to be made to look silly. They’ll’t wait to select up on any new pattern of information that would level to a marked slowdown within the economic system. Even a barely greater unemployment quantity, and any trace of deflation, may additionally present up as extra employees get laid off. Their voices may very well be the catalyst to the touch off a sizeable sell-off later this Quarter. Till then the market ought to go sideways or perhaps a contact above. To this point, my double-top chart which foretold a sideways pattern has held all week,

TradingView

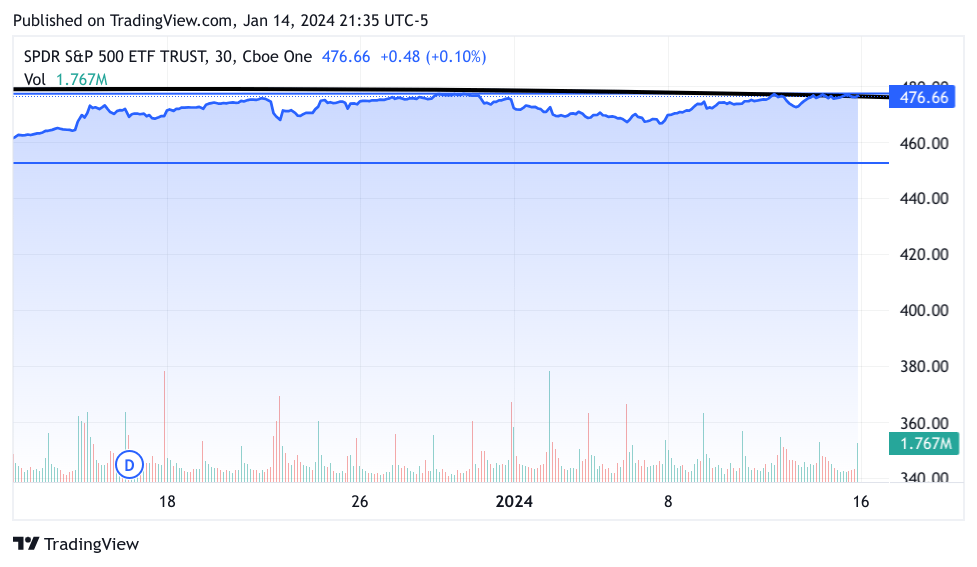

Let’s zoom in a bit nearer and discuss what occurred this week, maybe it’ll give us a touch of what occurs this week. Effectively, the one month isn’t telling us a lot apart from confirming that we’re sidling alongside.

TradingView

We did see makes an attempt to interrupt above the prior intraday highs on Wednesday, Thursday, and Friday, but the index backed off sharply closing at 4783 for the week. I’ve to say that this double prime might not maintain if earnings prove like I feel they’ll. Although I feel this coming week can be extra of the identical, a sideways market is nice for inventory pickers like us.

My Trades

With the Boeing (BA) information and watching the value motion I bought lengthy for a commerce. I’m in on the 220 strike, it closed at 217, I’ll stick with this identify a roll down additional if I’ve to. My expiration is out to April and I’m keen to roll out Could and so forth. Right here is why, and it’s completely by my intestine, and never the charts, or a detailed studying of the information, although I’m very centered on that. I imagine that David Calhoun the CEO of BA goes to resign or retire to spend extra time along with his household, take your decide. When that information goes out the inventory will bounce 20 factors, and the brand new CEO will announce a take care of the FAA to overtake their approval course of. The brand new CEO will reconfirm the expansion in 737 MAX output. I anticipate the BA inventory worth will proceed to enhance. as soon as the change within the C-suite occurs. Anybody who noticed that interview on CNBC noticed somebody deeply affected by the accident. When the FAA strongly suggests he step apart, he gained’t resist.

I’m additionally lengthy Apellis (APLS) Calls on the 65 strike. APLS is a conviction purchase in our Microcap Biotech 30 checklist, and I’m an investor on this identify as effectively.

Good luck on Tuesday!