Jinda Noipho

Co-authored with “Hidden Alternatives”

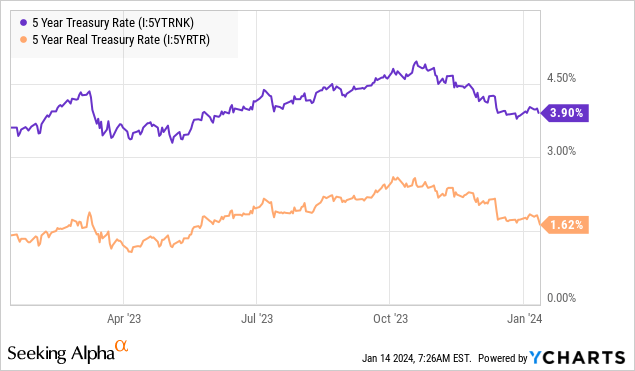

As rates of interest keep north of 5%, cash market funds proceed to see file inflows from retail traders. Funding Firm Institute information exhibits whole cash market property at $5.87 trillion. There are early indicators of institutional capital transferring out whereas retail traders continued piling on into these assured devices.

There isn’t a doubt that cash market funds and CDs supply low-risk and regular curiosity revenue, and retail traders are dashing into these to lock within the yields earlier than the Fed begins fee cuts. CDs are beating inflation for the primary time in latest reminiscence and producing constructive adjusted returns; what may go incorrect?

Saving for near-term wants, emergencies, and sudden bills is one factor, however CDs aren’t actual investments. Regardless of increased yields, CDs barely beat inflation within the sensible sense of rising prices round us. Furthermore, these devices include important renewal threat. Locking in excessive CD yields now will restrict your exit choices, and virtually assure a discount in your revenue stream upon maturity.

As retail traders are dashing to lock what they will in CD charges, we’re trying elsewhere for near-low-risk certified dividend revenue with important capital upside. In that spirit, allow us to evaluation our high picks.

Decide #1: JPM Preferreds – Yields Up To five.5%

JPMorgan Chase & Co. (JPM) is the biggest financial institution within the U.S. with over $2.2 trillion in property below administration. JPM is thought for its prudent threat administration, and continues to develop in an surroundings that’s seen as powerful for smaller gamers within the business. Beneath the management of Jamie Dimon, the financial institution has demonstrated readiness for the following disaster, being able of power to learn if one have been to strike. JPM efficiently acquired First Republic’s deposits and most of its property at 87 cents on the greenback for round $10 billion and boosted its wealth division’s AUM by 10%.

Regardless of fee uncertainties, JPM made a 5% dividend increase in September, an indication of continued dividend stewardship. The financial institution’s present dividend comes at a modest 22% payout ratio, indicating that the financial institution is well-positioned to keep up and develop the funds within the coming years.

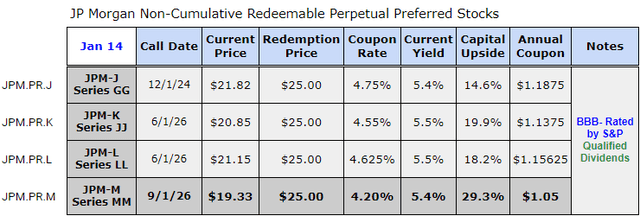

Among the many totally different most popular securities for JPM, we be aware the next to be the very best revenue alternatives with important upside when charges come down.

Creator’s Calculations

JPM-M affords a 5.4% certified yield and 29% capital upside to par worth, and its Yield-To-Name calculates to a powerful 14.7%. Throughout the 9 months of FY 2023, the financial institution spent $10 billion in dividends paid (together with ~$9 billion on frequent inventory dividends and $1.2 billion on most popular dividends), which is satisfactorily lined by the $40.2 billion web revenue for the interval. The popular enjoys 33.5x protection for its dividends from the corporate’s operations. As well as, JPM repurchased $7.6 billion of its shares YTD 2023, below the licensed $30 billion repurchase program indicating its sturdy liquidity and profitability place.

Decide #2: BAC Preferreds – Yields Up To five.7%

Financial institution of America (BAC) is the second largest U.S. financial institution by AUM. With operations in additional than 35 nations, BAC is likely one of the largest and most globally diversified monetary establishments on this planet.

Regardless of rising rates of interest, BAC inventory has been the worst performer amongst its huge financial institution friends in 2023 because the lender piled into low-yielding, long-dated securities through the pandemic. These securities misplaced worth as rates of interest climbed at file tempo, leaving the financial institution with $131.6 billion in unrealized losses and weighing down its potential to learn from increased charges.

BAC maintains the very best degree of insured deposits within the banking sector, and the financial institution got here forward of its steering Internet Curiosity Earnings for Q3, delivered 10% increased YoY web revenue, and reported lesser than anticipated provision for credit score losses and maintains web charge-offs beneath the pre-pandemic interval.

Regardless of turmoil within the banking sector, BAC made a 9% YoY dividend enhance. This frequent inventory dividend comes at a modest 29% payout ratio.

Throughout the 9 months of FY 2023, BAC spent $1.3 billion on most popular and $6.8 billion on frequent inventory dividends. These shareholder commitments loved glorious protection from the financial institution’s $23.3 billion web revenue. As well as, BAC repurchased $3.7 billion of its frequent inventory YTD 2023 indicating general consolation with its liquidity place.

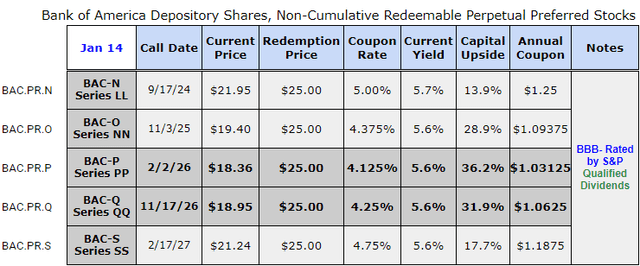

Creator’s Calculations

Amongst BAC preferreds, we particularly see BAC-P and BAC-Q providing regular dividends to attend for important upside. BAC-Q comes with a powerful YTC of 15%, yielding 5.6% and presenting ~32% upside to par.

Decide #3: WFC Preferreds – Yields Up To five.9%

Wells Fargo & Firm (WFC) is the third largest financial institution within the U.S. with $1.8 trillion in AUM.

For over 150 years, WFC has performed a pivotal position within the nation’s banking panorama, providing a variety of monetary providers to hundreds of thousands of shoppers. Regardless of the historic significance, the financial institution has confronted notable controversies in recent times, impacting its status and resulting in important fines and penalties and notable adjustments in management and company technique.

WFC has the largest dependence on client banking and lending vs. friends and stands to be a big beneficiary of upper rates of interest. In Q3 2023, WFC reported a 6.5% YoY enhance in revenues and an 8% enhance in web revenue to $5.7 billion, supported by increased rates of interest offsetting the slower lending surroundings. In July, WFC introduced a 16.7% increase of their frequent inventory dividend, and this fee comes at a 22% payout ratio.

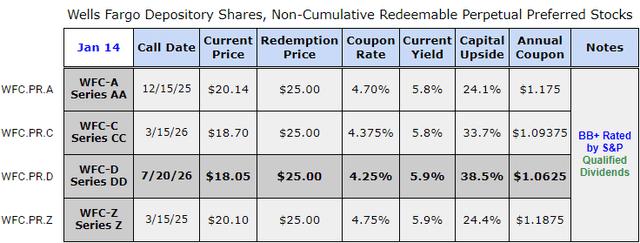

Creator’s Calculations

With an 17% YTC, WFC-D affords 5.9% yield and 38% upside to par. Throughout the first 9 months of 2023, the financial institution repurchased 220 million shares of frequent inventory at a value of $9.6 billion (from its $30 billion share repurchase program). As well as, the financial institution paid $874 million in most popular inventory dividends, and $3.5 billion in frequent inventory dividends. Each shareholder commitments have been adequately lined by the financial institution’s $15.7 billion web revenue, reflecting an 18x protection for the preferreds.

Conclusion

Within the face of the tempting proposition of locking in a excessive rate of interest with a 5-year CD, contemplate the true returns – the inflation-adjusted whole return and the sacrifice of liquidity till maturity. Whereas CDs could present a safe harbor in your financial savings, they fall quick with regards to producing substantial revenue and supply no roadmap to attaining monetary independence or constructing wealth.

“A financial savings account shouldn’t be an funding. It is a cushion for these instances when life offers you an unfair blow. You are by no means going to get wealthy off them” – Dave Ramsey

We’re about constructing a portfolio that delivers a lifestyle-sustaining revenue stream by means of dividends. Our portfolio consists of over 45 rigorously chosen fixed-income choices, that includes most popular shares and child bonds, all geared toward attaining an inflation-beating +9% general yield.

As patrons of high quality income-producing property, we view volatility as a strategic ally in turbocharging our revenue technology. Presently, prime quality fixed-income securities like investment-grade child bonds and most popular shares are buying and selling at rock-bottom costs, providing historic excessive yields. We’re seizing this second earlier than any potential strikes by the Fed. This text dives into three investment-grade preferreds from main world monetary establishments, boasting sturdy dividend protection and a possible double-digit capital upside to par worth. We’re aggressively buying these property earlier than the shift within the fee cycle. What strategic strikes are you making in anticipation of the Fed’s potential fee cuts?