[ad_1]

Because the enterprise world will get aggressive, firms are on the lookout for increasingly methods to curb this competitors. Getting the workforce to develop into extra productive is without doubt one of the some ways to remain forward of the race. Manufacturing will be elevated by extra time working hours.

With extra time working hours or prolonged working hours comes extra time pay. It has existed for a very long time now. However the data of it or the right pointers relating to it have but to be well-known.

Getting paid for extra time hours is sort of a bonus for hourly employees after they put in additional than the same old 40-hour workweek. So, should you work longer than 40 hours every week, you get more money for these further hours. It’s like a reward on your further effort.

Why is it so necessary?

Correct monitoring of extra time hours is tremendous necessary for a couple of key causes.

- It ensures that employees receives a commission proper after they put in further hours, which retains them joyful and motivated. Messing this up can result in lawsuits and fines for employers.

- It helps decide how effectively the group is doing and the place we will enhance. Once we research extra time hours, we will spot areas that want enchancment and make work smoother.

- It helps us management labor prices well. By understanding when and why extra time occurs, we will use our assets properly and make modifications to spice up our income.

Within the following sections, we’ll be taught in regards to the fundamentals of extra time pay together with its calculation strategies. We dive extra into the topic from two views: worker and employer. Maintain studying to find ideas and customary errors relating to extra time hours and their pay.

What’s Time beyond regulation Pay?

Time beyond regulation pay is the speed of cost staff obtain for working further hours along with their common working hours. As an example, if the usual working hours in your state is 40 hours and also you’ve labored for 45 hours, you’ll obtain an additional cost for five hours.

The aim of extra time pay is to offer a good compensation measure for workers and to make sure that companies adjust to the suitable labor legal guidelines. Nonetheless, the cost differs throughout companies and the form of work executed by staff.

In India, extra time pay guidelines are fairly clear. Should you work greater than 48 hours every week, you receives a commission double your regular wage for these further hours. Nonetheless, there are exceptions for sure job roles like authorities employees, contractual employees, and freelancers, who may not qualify for such pay.

There are two predominant legal guidelines governing these guidelines in India:

- Minimal Wages Act, 1948: Beneath the Minimal Wages Act of 1948, when a employee’s hours transcend their common shift, they need to get extra time pay per hour.

- Factories Act, 1948: In accordance with the Factories Act of 1948, if a employee places in additional than 9 hours in a single day or exceeds 48 hours in every week, they’re entitled to obtain extra time pay, which is twice their regular wage.

Time beyond regulation Pay Calculation Strategies In India

In India, extra time pay is usually based mostly on an worker’s fundamental wage and will embody allowances like dearness allowance. Nonetheless, bonuses and incentives are normally not factored into extra time calculations in line with labor legal guidelines. It’s necessary to notice that extra time hourly pay doesn’t contemplate your complete gross wage.

This part contains the way to calculate the extra time pay for normal salaried staff and hourly staff.

The next formulation include these parts:

- Primary Pay: Primary pay refers back to the fastened amount of cash an worker receives as a part of their common wage. It doesn’t embody any extra allowances, bonuses, or extra time pay.

- DA (Dearness Allowance): DA is an allowance supplied to staff to assist them address the rising price of residing. It’s typically a proportion of the essential pay and is periodically adjusted to account for inflation.

- RA (Threat Allowance): RA is a further allowance supplied to staff who work in hazardous or dangerous circumstances. Not all staff obtain this allowance; it’s usually particular to sure job roles.

- Whole no. of days in a month: This refers back to the complete variety of days labored within the month. It normally ranges from 26 to 30 days.

- Most working hours: Most working hours characterize the utmost variety of hours an worker is anticipated to work in a single day. This could range however is usually 8 to 9 hours a day.

- Time beyond regulation hours: Time beyond regulation hours are the extra hours labored by an worker past their common working hours, which can set off the eligibility for extra time pay. These further hours are usually compensated at the next price than common hours.

1. Salaried Staff

Hourly extra time pay = 2 * [Basic Pay + DA + RA / (Total no. of days in a month (26-30 days)) * Maximum working hours in a day (8-9 hours)] * extra time hours.

2. Hourly Staff

Time beyond regulation wage = Primary pay / (Whole no. of days (26-30)) * Most working hours in a day (8-9 hours)

Time beyond regulation cost guidelines can differ based mostly on the kind of work and the state or union territory in India. For instance, extra time guidelines in Karnataka may not match these in Gujarat. Nonetheless, on common, for industries below central legal guidelines, the above extra time calculation components is commonly utilized in India.

How one can Calculate Time beyond regulation Pay (With an instance)

The straightforward components for calculating extra time pay for an worker is the common price of pay of the worker * 2 * hours labored extra time. Right here is an instance describing this calculation.

Time beyond regulation Pay Calculation Instance:

Let’s calculate the extra time hourly pay for a salaried worker with a 6 LPA (Lakhs Per Annum) wage utilizing the given components:

Hourly extra time pay = 2 * [Basic Pay + DA + RA / (Total no. of days in a month (26-30 days)) * Maximum working hours in a day (8-9 hours)] * extra time hours.

Given Values:

- Primary Pay (Annual Wage): 6,00,000 LPA

- DA (Dearness Allowance): Rs. 5,000 monthly

- RA (Threat Allowance): Rs. 2,000 monthly

- Whole no. of days in a month: 30 days

- Most working hours in a day: 8 hours

- Time beyond regulation hours labored: 5 hours

Calculate Month-to-month Primary Pay:

Month-to-month Primary Pay = Annual Wage / 12

Month-to-month Primary Pay = 6,00,000 / 12 = Rs. 50,000

Hourly Time beyond regulation Pay = 2 * [(Monthly Basic Pay + DA + RA) / (Total no. of days in a month * Maximum working hours in a day)] * Time beyond regulation hours

= 2 * [(50,000 + 5,000 + 2,000) / (30 * 8)] * 5 Hourly Time beyond regulation Pay = 2 [57,000 / (30 * 8)] * 5

= (2 * 237.5) * 5

Hourly Time beyond regulation Pay = 475 * 5 = Rs. 2,375

So, an worker with a fundamental wage of 6 LPA who has labored 5 hours extra time will obtain a complete of Rs. 2,375.

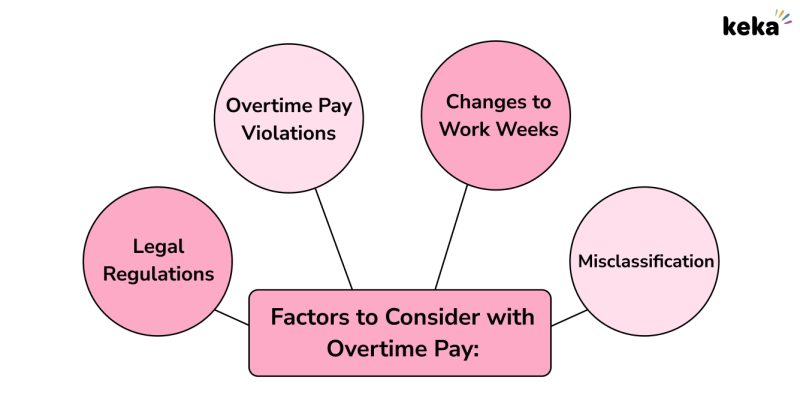

Components to Think about with Time beyond regulation Pay

Time beyond regulation pay insurance policies will be extra difficult than you think about. It operates equally to minimal wage rules, the place the employer is required to stick to the upper normal. Which means staff working extra time hours should obtain compensation based mostly on the usual that ends in a higher payout.

Regardless that the federal government has laid down the actual guidelines and acts that ought to be adopted whereas calculating extra time pay, there are nonetheless a number of elements at play.

The next are a few of them:

1. Authorized Rules

The provisions and allowances of this remuneration differ throughout numerous legislations. Moreover, it might not be the identical for each state of the nation as talked about beneath. Additionally, there are completely different legal guidelines for various industries.

To call a couple of, listed below are some legal guidelines. This isn’t an exhaustive checklist and might be mentioned intimately within the following sections.

- The Code on Wages, 2019

- Cost of Wages Act, 1936.

- Minimal Wages Act, 1948.

- Cost of Bonus Act, 1965.

- Equal Remuneration Act, 1976.

- Store/ Institution: Retailers and Institutions Act of States/ UTs

- Factories Act, 1948

- Minimal Wages Act, 1948

- Bidi and Cigar Staff (Situations of Employment) Act, 1966

- Contract Labour (Regulation & Abolition) Act, 1970

- Constructing and Building Staff Act 1996

- Working Journalist and Miscellaneous Provisions Act, 1955

- Plantation Labour Act, 1951

2. Time beyond regulation Pay Violations

Within the US, unpaid extra time is without doubt one of the most frequent wage and hour violations. A placing 90% of again wage settlements ensuing from Division of Labor investigations concerned extra time violations. The information covers DOL investigations spanning the previous eight years.

In India, The Factories Act, of 1948, outlines penalties for employers who violate its extra time guidelines. In such instances, employers might face imprisonment for as much as 2 years, a nice of as much as Rs. 1 lakh, or each.

Therefore, it is vital for companies to be aware to not violate these legal guidelines. Listed here are some recommendations on the way to stop violations:

- Analysis extra time hour legal guidelines and legislations and draft clear insurance policies.

- Monitor extra time hours of staff repeatedly.

- Arrange an automatic extra time hours cost system.

- Leverage expertise and payroll automation software program to make issues simpler.

Keka’s attendance administration system permits for biometric attendance built-in with time-tracking API, making monitoring extra time hours simpler. Additionally it is built-in with the payroll administration system, eliminating the necessity so that you can change between methods when processing month-to-month payroll.

3. Modifications to Work Weeks

In India, a piece week can lengthen as much as 48 hours, which is 8 hours for six days every week. Nonetheless, a number of firms apply a 40-hour work week the place staff work 8 hours for five days.

Just lately, firms worldwide have additionally began accepting a 32-hour work week resulting from a rise in productiveness ranges benefitting each the employer and worker. When crafting extra time insurance policies, it’s important to have in mind fluctuations in workweeks to make sure they’re mutually advantageous for each employers and staff.

The thought behind a four-day workweek is to realize the identical ends in fewer hours, so individuals have extra time to pursue different pursuits, spend time with family members, and handle their lives.

– Amy Fontinelle.

4. Misclassification

Misclassification within the context of extra time hours and pay happens when an worker is categorized incorrectly as both “exempt” or “non-exempt” from extra time rules.

- Exempt: These staff are usually salaried and exempt from extra time pay. Misclassification can occur when somebody is labeled as exempt regardless that their job duties and weekly hours qualify them for extra time.

- Non-Exempt: These staff are eligible for extra time pay for hours labored past a sure threshold (normally 40 hours per week). Misclassification can happen if somebody is labeled as non-exempt however doesn’t obtain extra time hours pay when they need to.

Getting these classifications proper is essential to make sure truthful compensation and compliance with labor legal guidelines. It’s important to seek the advice of together with your group’s authorized division to keep away from misclassification pitfalls.

Time beyond regulation Pay Legal guidelines & Rights For Company Staff

In India, every state has its personal Retailers and Institution Act (SEA), which lays down guidelines for workers who work further hours past their common work schedule. This Act applies to a variety of companies however doesn’t apply to sure sorts of enterprises reminiscent of factories and mines.

Right here’s a listing of the sorts of companies that fall below the purview of this act:

- Retail institutions, together with shops, malls, and warehouses.

- Meals institutions, lodges, film theaters, and amusement parks.

- Entities concerned in amusement and leisure.

- Service-oriented organizations like these in finance, healthcare, prescribed drugs, and hospitality.

- Info expertise (IT) firms.

The principles of this Act are relevant to all staff, whether or not they’re managers or non-managers, in the kind of companies talked about above.

Staff who work extra time in these companies or institutions are compensated at a price decided by the respective state or union territory. In some states, extra time hours are twice so long as common working hours. Solely the essential wage and allowances are thought of to calculate the extra time pay price, with out together with any bonuses.

Listed here are the important thing circumstances that should be met for extra time to be relevant:

- Day by day working hours usually vary from 8 to 10 hours.

- The whole weekly working hours mustn’t exceed 48 hours.

- Time beyond regulation can range from 1 to three hours every day.

- Staff mustn’t work repeatedly for greater than 5 hours and not using a break.

- The weekly restrict for working hours ranges from 50 to 60 hours.

- There’s a quarterly restrict of fifty to 150 hours for extra time.

- The unfold over restrict for work hours ranges from 10 to 14 hours.

These guidelines assist guarantee truthful remedy and compensation for workers who put in further time at their workplaces.

Ideas for Monitoring Time beyond regulation Pay

Some of the necessary features of monitoring time is its guide workload. With the onset of automated methods of time monitoring and attendance, it’s time to maneuver away from conventional strategies of monitoring your staff’ working hours.

Transitioning to automated time monitoring brings a number of benefits.

- It simplifies the method for workers to document their work hours

- It streamlines the executive duties for HR or workplace employees

- It ensures 100% accuracy in timesheets

- It eliminates the necessity for rounding.

As an example, platforms like Keka’s Attendance Administration System and Shift Administration Software program provide a time-tracking API that allows staff to simply log their work begin occasions. It could possibly additionally handle breaks lunches, and end-time making certain they’re constantly included within the recorded hours.

Moreover, you possibly can set up guidelines to make sure staff work the required hours, neither extra nor much less. This shift to automation simplifies and enhances the accuracy of time monitoring for paying staff for extra time hours.

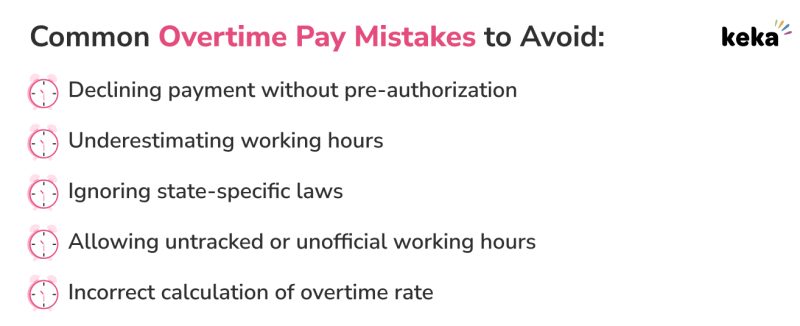

Widespread Time beyond regulation Pay Errors to Keep away from

Calculating extra time pay can develop into just a little difficult particularly when it’s not automated or built-in with some form of extra time monitoring software program.

If issues are executed manually, errors are certain to occur. On this part, we talk about some widespread errors to keep away from whereas calculating extra time hours:

1. Declining cost with out pre-authorization

If non-exempt staff work over 40 hours, they have to receives a commission for extra time, even when it wasn’t accredited beforehand. A coverage in opposition to unscheduled extra time doesn’t exempt the employer from paying extra time. When you can take disciplinary motion for unauthorized extra time, you possibly can’t withhold their cost.

2. Underestimating working hours

From an employer’s standpoint, the hours staff work embody their productive work time and numerous nonproductive actions. These embody issues like relaxation breaks, journey, and coaching. It’s necessary to think about all of this time when calculating whether or not extra time is warranted.

3. Ignoring state-specific legal guidelines

In India, extra time pay rules range from state to state. As an example, some states might require cost for extra time if an worker works greater than a sure variety of hours in every week or in a single day. Moreover, every state might have its personal technique for calculating extra time hours.

For instance, in some states, like Maharashtra, completely different guidelines apply when calculating extra time for workers who obtain fixed-sum bonuses. It’s important for employers in India to concentrate on and observe the extra time guidelines particular to their state.

4. Permitting untracked or unofficial working hours

As an employer, it’s essential to compensate staff for on a regular basis they commit to work-related duties. It’s not permissible to request or allow these staff to work with out recording their hours. It’s advisable to ascertain a transparent coverage explicitly forbidding any off-the-clock work and implement measures to stop it from occurring.

5. Incorrect calculation of extra time price

To calculate extra time charges appropriately, employers want to soak up a number of elements apart from the hourly price. This common price encompasses not simply their hourly wage but in addition contains the worth of non-discretionary bonuses, shift differentials, and sure different sorts of compensation. Neglecting to incorporate these extra types of compensation can result in underpayment of staff for his or her extra time hours.

Wrapping Up

Time beyond regulation pay is a crucial part to encourage staff for the additional effort put into their jobs. It’s not simply in regards to the cash; it’s a good acknowledgment of our dedication and arduous work.

All individuals have payments to pay and desires to chase and generally, these further funds could make an actual distinction. Therefore, understanding our rights and making certain we’re paid for what we deserve can present respect for our time and dedication.

It’s a win-win when employers and staff work collectively to make sure truthful compensation for these further hours.

Steadily Requested Questions

1. What’s a variety over?

Unfold over encompasses your complete period from the start of your workday to its finish. It contains not solely your precise working hours but in addition the time you spend on breaks, lunch, and relaxation. For instance, should you begin your workday at 10 am and end at 7 pm, your complete 9-hour interval is your unfold over. Should you take a 1-hour lunch break throughout this time, then your efficient working hours develop into 8 hours.

2. What’s extra time pay?

Time beyond regulation pay is more money that staff obtain for working extra hours than their normal workweek or workday. Usually, it’s paid at the next price than their common hourly wage, typically 2 occasions their regular pay. It’s a method to compensate them for the extra effort and time they put into their job.

3. Who’s eligible for extra time pay?

In India, in line with the laws given by the federal government, staff who work past 48 hours every week qualify for extra time pay at a price twice their common wages.

4. What are the exceptions to extra time pay necessities?

Exceptions to extra time pay necessities embody particular classes of staff like authorities employees, managers, and supervisors. Moreover, people engaged on a contract or freelance foundation might not be eligible for extra time pay.

5. Is there a most restrict for weekly hours earlier than extra time applies?

In accordance with Part 51 and Part 59 of the Factories Act – 1948[2], staff mustn’t work past 48 hours in every week or 9 hours in a day. In the event that they exceed these limits, they’re entitled to obtain extra time pay, which is usually double their common wages.

6. Can extra time pay be given in types apart from cash?

No, cost for extra time can’t be given by means of different types than cash. It can’t be substituted with non-monetary alternate options. Whereas some advantages or perks could also be provided to staff, reminiscent of extra day off or versatile work preparations; these are separate from extra time pay and are usually negotiated individually or provided as a part of an total compensation package deal.

7. Can employers mandate staff to work extra time?

No, employers can’t mandate staff to work extra time. Staff ought to willingly select to undertake extra time work and shouldn’t be coerced into it by means of involuntary or fraudulent agreements. Employers must also have in mind particular elements earlier than allowing extra time for an worker. This contains conditions the place there’s an sudden surge in workload or demand.

8. What can I do about incorrect extra time funds from my employer?

Should you’ve obtained incorrect extra time funds out of your employer, begin by speaking to your HR or finance division. Share any related paperwork like timesheets to assist resolve the difficulty. Good communication can normally resolve the issue. If it persists, contemplate looking for help from authorized or labor authorities.

[ad_2]

Source link