Flex Level Safety

Aquestive Therapeutics (NASDAQ:AQST) is rapidly approaching a key topline knowledge readout for the Anaphylm (epinephrine) sublingual movie that’s slated for Q1 of this 12 months. The corporate introduced in December that they’ve commenced the primary affected person dosing in its Part III pivotal examine evaluating Anaphylm’s pharmacokinetics “PK” and pharmacodynamics “PD”. If the information is optimistic, Anaphylm can be heading in the direction of a attainable NDA in 2024 as a groundbreaking oral epinephrine candidate within the multi-billion greenback extreme life-threatening allergic response and anaphylaxis market. In my earlier Aquestive Therapeutics article from November of 2022, I mentioned how I used to be “all-in” on AQST-109 (Anaphylm) on account of its immense business potential, and that outlook stays the identical regardless of the share worth rising ~167% since its publication. In consequence, I consider buyers must be ready for these slated catalysts and have a sport plan for the AQST place for 2024.

I intend to offer a quick background on Aquestive Therapeutics and Anaphylm. Then, I’ll talk about the chance, in addition to the dangers for Aquestive. Lastly, I reveal my plan for my AQST going into this important knowledge readout.

Background On Aquestive Therapeutics

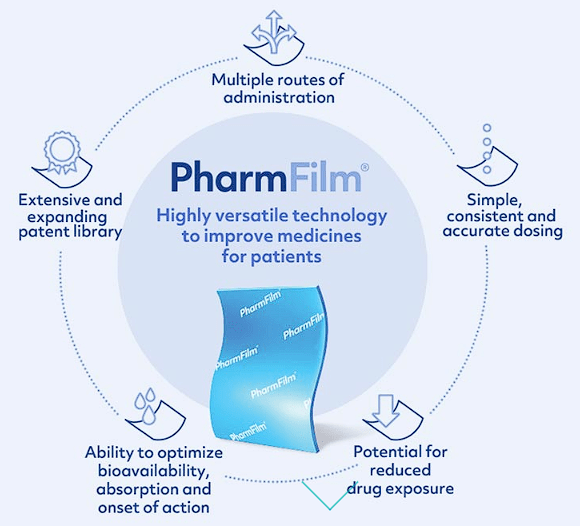

Aquestive Therapeutics is advancing medicines with their distinctive supply applied sciences. Aquestive’s core expertise, PharmFilm, is integral to its product portfolio, with key formulations like AQST-108 (epinephrine) and Libervant (diazepam) focusing on numerous indications globally by way of strategic licensing agreements. PharmFilm is a skinny movie that may absorbed within the affected person’s mouth and permits for the supply of complicated molecules in an orally administered format.

Aquestive Therapeutics PharmFilm Overview (Aquestive Therapeutics)

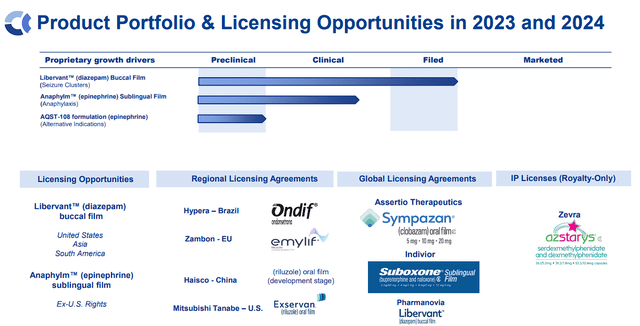

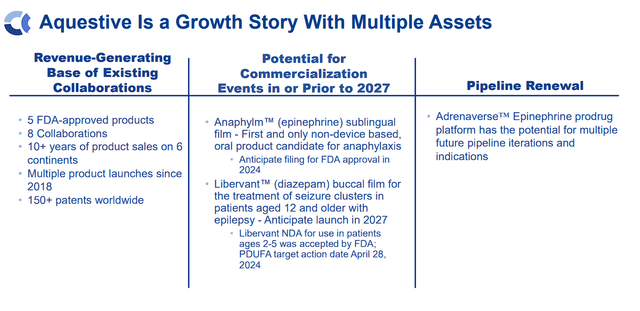

Aquestive’s focus extends to treating illnesses of the CNS, with each early and late-stage pipelines. With 5 commercialized merchandise and a number of other collaborations, Aquestive has confirmed its drug growth and commercialization capabilities.

Aquestive Therapeutics Pipeline (Aquestive Therapeutics)

The corporate’s pipeline renewal consists of the “Adrenaverse” prodrug platform, holding the potential for a number of future iterations and indications utilizing epinephrine.

Aquestive Therapeutics Progress Prospects (Aquestive Therapeutics)

Within the coming years, Aquestive goals to develop collaboration income, acquire FDA approval for Anaphylm within the U.S., and launch Libervant within the U.S. by 2027.

Taking A Look At Anaphylm

Anaphylm (Previously AQST-109), an epinephrine sublingual movie, has the potential to be the primary and solely non-device-based, oral remedy for anaphylaxis. Anaphylm stands out as a polymer matrix-based epinephrine prodrug that’s comparable in measurement to a postage stamp and weighs lower than an oz. Its distinctive characteristic is that it dissolves involved with saliva, eradicating the necessity for water or swallowing throughout administration. The packaging is designed to be compact and simply moveable, much like the size of a bank card. The corporate made Anaphylm’s packaging strong sufficient to outlive numerous climate circumstances, equivalent to publicity to rain and UV from daylight.

To date, Anaphylm has demonstrated favorable PK and PD parameters, offering a speedy and clinically efficient response. In scientific trials, Anaphylm has exhibited a positive security profile, with the vast majority of reported hostile occasions being delicate or reasonable in severity. The cardiovascular hostile occasion profile aligns with permitted comparators, underlining Anaphylm’s security and tolerability.

The present Part III examine consists of two components, meant to comprehensively gauge the efficiency and security of Anaphylm versus permitted epinephrine supply merchandise. Half A, a three-period examine, will pit Anaphylm 12mg towards an epinephrine autoinjector and epinephrine handbook intramuscular injection. Half B will take a look at a single dose of Anaphylm 12mg towards EpiPen and Auvi-Q and the handbook IM injection. The first aim is to match the PK and PD following the one administration of Anaphylm to single administration of epinephrine IM injection in wholesome grownup topics.

Anaphylm’s Implications

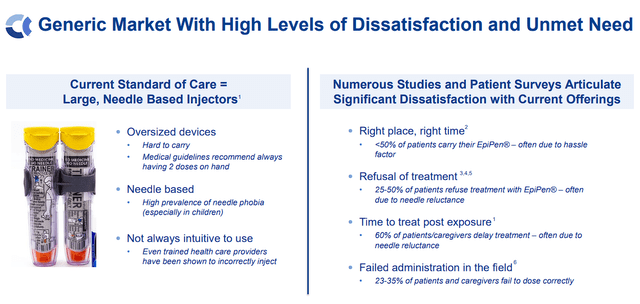

The large alternative comes from Anaphylm’s potential to be the “first and solely non-invasive”, oral epinephrine product that produces comparable outcomes similar to auto-injectors for the emergency administration of acute allergic reactions, together with anaphylaxis. The epinephrine market is trending in the direction of important progress, with Anaphylm presenting a novel and patient-friendly different to present requirements of care. So, Anaphylm addresses the frustration and limitations of latest injector merchandise.

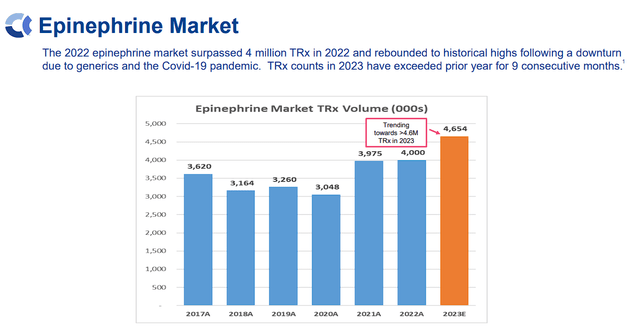

Aquestive Therapeutics Epinephrine Market Overview (Aquestive Therapeutics)

If permitted Anaphylm may gain advantage from a big and rising epinephrine market, which surpassed 4M TRx in 2022, and was on tempo for greater than 4.6M in 2023, which is predicted to provide a $2.83B world market.

Aquestive Therapeutics Epinephrine Market Overview (Aquestive Therapeutics)

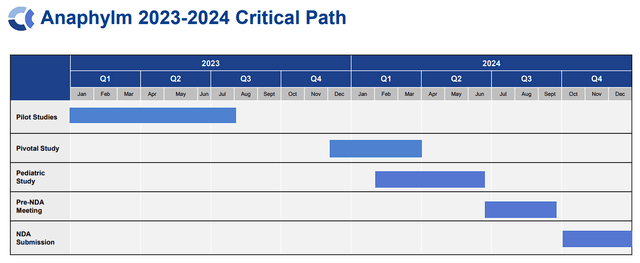

Subsequently, the potential approval of Anaphylm can be a monumental occasion for Aquestive. The corporate anticipates submitting Anaphylm’s New Drug Software (NDA) with the FDA in This fall of this 12 months, which ought to put a possible business launch in 2025.

Aquestive Therapeutics Anaphylm Vital Path (Aquestive Therapeutics)

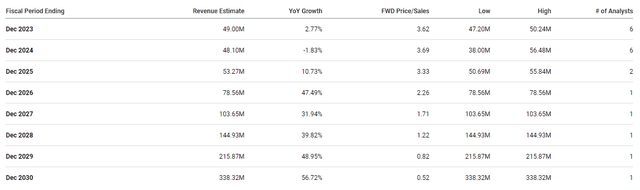

A possible business launch in 2025 should ship important income progress for Aquestive within the coming years. In actual fact, the Road expects Aquestive to report robust double-digit income progress for the rest of the last decade and break $300M in some unspecified time in the future in 2030.

Aquestive Therapeutics Income Estimates (Searching for Alpha)

Though the corporate has different sources of income and pipeline merchandise, we’ve got to anticipate that Anaphylm is the first contributor in these fashions. So, I feel secure to say that Anaphylm is important to Aquestive’s success in each the near-term and long-term.

Anaphylm’s Influence On Valuation

I’ve been overlaying AQST for some years now, and all through that point, Aquestive’s low cost valuation has been one of many main points of interest of the ticker. I’ve pointed to the corporate’s projected income progress, which has constantly indicated that the ticker was buying and selling properly beneath the sector median ahead price-to-sales of 4x. At the moment, AQST has a ~$145M market cap, which might be round 3.6x price-to-sales for the 2023 income estimate, so it’s already undervalued in a single metric for its present business efficiency. That valuation is predicted to enhance within the coming years as Anaphylm faucets into a worldwide epinephrine market that’s anticipated to hit almost $5.8B in 2032. Anaphylm would solely want to say roughly 5% of that market to hit the Road’s forecasts for the tip of the last decade. Even when the corporate out-licenses the product, Anaphylm does not have to develop into the dominant epinephrine product available on the market to satisfy the Road’s numbers and dramatically change Aquestive’s long-term outlook. Over the previous twelve months, Aquestive has pulled in $48.1M in income with $26.6M in gross revenue with $48.5 in complete OpEx, resulting in roughly -$22M in internet revenue. That loss may simply be eradicated in a number of years of income progress, or an upfront cost from out-licensing.

Admittedly, we do not know if Aquestive will hit the Road’s estimates, nevertheless, they do illustrate how Aquestive can go from being barely undervalued, to absurdly undervalued by the tip of the last decade because of Anaphylm upside potential.

Take into account, that this evaluation is eradicating all different sources of income that Aquestive has now, and some other potential income streams, together with Libervant, which will contribute sooner or later.

Dangers To Think about

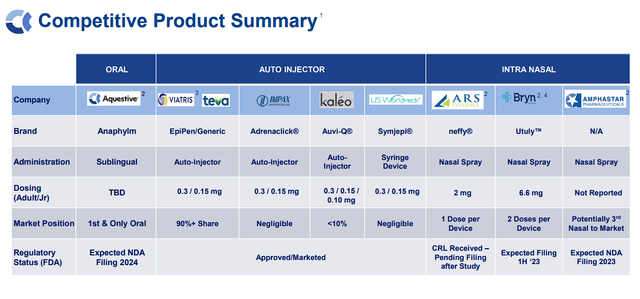

Like several pharmaceutical firm, Aquestive faces dangers equivalent to regulatory hurdles, scientific trial setbacks, and market competitors. Aquestive operates in a aggressive enviornment, contending with different firms growing epinephrine remedies for comparable indications.

Aquestive Therapeutics Epinephrine Competitors (Aquestive Therapeutics)

Along with auto-injectors, Aquestive will almost definitely have competitors from intra-nasal epinephrine gadgets. Certainly, Anaphylm has some aggressive benefits over the present competitors, together with being a non-invasive sublingual movie. Nonetheless, I consider we’ve got to anticipate some sufferers would think about an intra-nasal choice, which is a extra widespread route of administration.

As well as, the corporate nonetheless has to face dangers from exterior components, financial circumstances, and surprising challenges which will affect Aquestive’s efficiency. Furthermore, the corporate solely had $24.92M in money on the finish of Q3, which can almost definitely not be adequate to fund a business launch. Admittedly, we do not have a transparent thought of what the bills can be for a business ramp-up for Anaphylm as a result of we do not have their sport plan to reference. It seems as if the corporate goes to proceed with out-licensing, which might restrict any further bills. Nonetheless, if the corporate decides to “go-it-alone” in commercialization, they must rent a military of reps to hit the best prescribing allergists, and probably scale up from there. In fact, the corporate may additionally resolve to discover a business companion for Analphylm, which might in all probability contain an upfront cost, milestones, and royalties. In consequence, we can not forecast the corporate’s money burn going ahead presently, however buyers ought to observe that Aquestive has a monitor document for dilution, and settle for there’s a robust probability of a fundraising occasion in some unspecified time in the future this 12 months. Though I would not anticipate a devastating stage of dilution to fund an organization that has diminished their bills over the previous couple of years, any risk of an providing tends to place a darkish cloud over the ticker till the risk has been resolved.

Contemplating these dangers, I’m sticking with a conviction ranking of three out of 5 and can stay within the “Bio Growth” speculative portfolio.

My Plan

Aquestive Therapeutics’ Part III scientific examine for Anaphylm marks a big step ahead for the corporate and positions them as a possible game-changer within the discipline. Because the examine progresses and topline knowledge is anticipated within the first quarter of 2024, the funding group eagerly awaits the information, which may point out a possible approval and commercialization of this groundbreaking orally delivered epinephrine product.

I do anticipate the information to be optimistic and will level to a possible approval in 2024. Nonetheless, I feel a lot of the market is anticipating the identical outcomes, so a possible “promote the information” occasion is perhaps on the desk following the information launch… particularly if the shopping for quantity is low and bulls have been exhibiting weak spot all through the quarter.

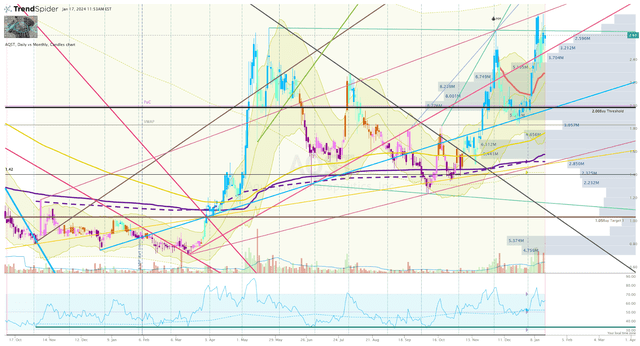

Trying on the Every day Chart, we will see AQST buying and selling above my Purchase Threshold with a possible double-top setup at $2.75 per share. If the ticker fails to interrupt above this stage over the course of Q1, I think we are going to see a possible promote the information as buyers look to e-book income on a spike, and quick sellers anticipate weak spot and a void under.

AQST Every day Chart (Trendspider)

If this happens, I’ll think about reserving income on the spike and can look to reload if the share worth drops under my Purchase Threshold, which is the utmost I’m prepared to pay for AQST contemplating its present technical ranking.

If the share worth rises above $3 per share earlier than the information readout, I’ll look to e-book income forward of the information launch and can set a big purchase order under my Purchase Threshold. If the share worth sells off forward of the information launch, I’ll look forward to the information launch and can add to my place as soon as I determine and powerful reversal setup.

Long run, if the information is optimistic, I anticipate to keep up my AQST place for at the least 5 extra years and the ticker will stay a “High Concept” within the Compounding Healthcare investing group. Nonetheless, if the information doesn’t help approval or is inferior to up to date merchandise, I’ll promote the vast majority of the place and can think about revisiting the ticker in the direction of the tip of the 12 months.