Riska

It has not been a simple 2023 for any regional financial institution, however Residence Bancshares (NYSE:HOMB) has confirmed fairly resilient. The banking disaster triggered by SVB’s chapter triggered no small quantity of concern for administration; nevertheless, the worst appears to be behind us and 2024 could maintain new alternatives for progress.

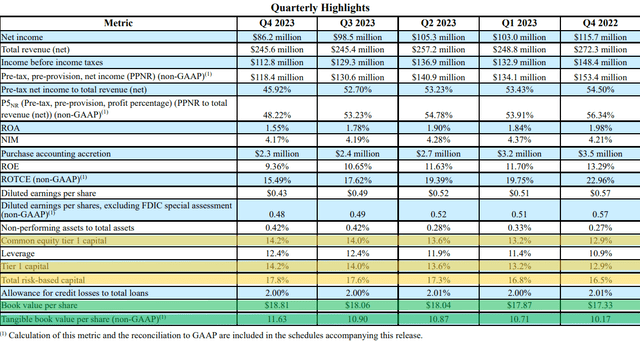

This fall 2023 outcomes beat analysts’ expectations, each by way of income and EPS:

- This fall Non-GAAP EPS of $0.48 beats by $0.02.

- Income of $245.6M beats by $3.07M.

Total, it was a great quarterly end result, however one shouldn’t get too excited: 2024 might also maintain some disagreeable surprises.

FY 2023 vs. FY2022

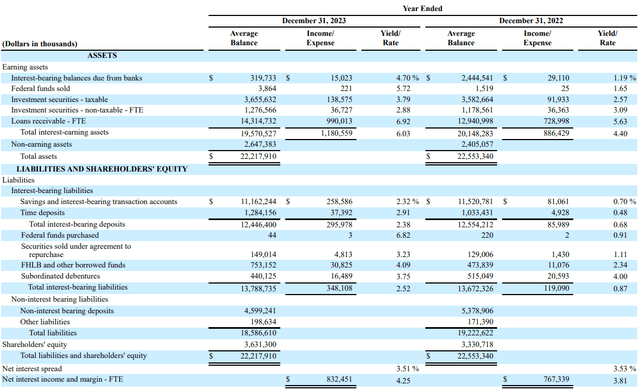

First, let’s check out how common balances have modified since final 12 months.

Residence Bancshares, Inc. This fall 2023 Earnings Name

Whole interest-earning belongings amounted to $19.57 billion, down 2.86% from final 12 months. This lower was primarily pushed by interest-bearing balances due from banks, down $2.12 billion.

Loans and the securities portfolio each grew by 10.60% and a pair of.03%, respectively, over final 12 months. That is fairly good progress, particularly in loans since demand for credit score is step by step declining attributable to excessive charges. Additionally rising was the yield on the 2 portfolios: +129 foundation factors within the case of loans and +122 foundation factors within the case of securities. In whole, the yield on interest-earning belongings elevated by 163 foundation factors from final 12 months. So, with fewer belongings available, HOMB earns greater than earlier than.

After all, an analogous level should be made on the legal responsibility aspect as nicely: simply because the return on belongings elevated, so did the price of deposits/loans.

Specifically, the price of interest-bearing deposits reached 2.38%, up 170 foundation factors from final 12 months. As well as, loans elevated by $224 million and non-interest-bearing deposits decreased by $779 million. All of this clearly led to a worsening by way of the price of financial institution funding, however the enhance in asset yields managed to greater than offset the harm. Actually, the web curiosity margin elevated by 44 foundation factors and reached 4.25%. On the similar time, web curiosity earnings additionally improved and reached $832 million, +8.50%.

Residence Bancshares, Inc. This fall 2023 Earnings Name

Past an enchancment on the earnings aspect, there’s additionally excellent news on the fairness aspect. Each BV and TBV per share achieved regular enchancment all through 2023, significantly within the final quarter. The rise in fairness is principally because of the $101.50 million enchancment in AOCI and the $49.90 million enhance in retained earnings, partially offset by $17.80 million in share repurchases.

Lastly, all capital ratios improved from final 12 months. CET1 reached 14.20%, a sign that the financial institution is nicely capitalized.

Outlook for progress

Progress prospects had been one of the vital mentioned subjects of the This fall 2023 convention name. Administration repeatedly reiterated its positivity about 2024, referring a number of instances to its low loan-to-deposit ratio.

We’re seeing payoffs sluggish considerably in numerous markets as a result of they cannot get it financed. We’re blessed with the truth that we did not make the errors that 95% of the banks did and now we have cash to mortgage. So, we’re able to mortgage cash. Because of that, that is the place you noticed the mortgage progress are available, within the quarter was as a result of the very fact, we had cash to mortgage and never many banks within the nation had cash to mortgage. So, they got here to us and we made some good relationships.

John Allison, Chairman

In different phrases, whereas many different banks have gone overboard with mortgage issuance over the previous few years, HOMB has resisted the temptation to right away immobilize new incoming deposits. The result’s that many banks at this time discover themselves with a loan-to-deposit ratio above 100%, whereas HOMB continues to be at 85.90%. So, it nonetheless has ample room to proceed issuing new loans at present market charges. Total yield on originations continues to enhance with a median coupon of 9.18% within the fourth quarter.

Lending at such a median yield means giving a serious increase to NIM progress, which is why it’s anticipated to rise in 2024. Based on CLO Kevin Hester, there are nonetheless a number of markets to faucet the place demand for credit score continues to be alive. Specifically, alternatives reside in Texas and South Florida, locations the place individuals are transferring to. As well as, not all banks working in these territories have the liquidity to challenge new loans, which makes it even simpler for HOMB to work. All in all, the most important problem will not be a lot about competitors however about convincing folks to tackle debt at present charges.

Some unfavourable features

As already anticipated, the quarterly outcomes had been optimistic, as was your entire FY2023 regardless of quite a few difficulties. Nevertheless, there are a selection of much less optimistic features that should be highlighted.

The primary issues the FDIC’s bills to get well losses from failed banks. These bills amounted to $13 million and resulted in a discount in EPS of $0.05. This unexpected expense clearly didn’t prefer it in any respect:

I do not learn about different banks paying their fair proportion, however we actually did then and we at the moment are. We’re having to pay $13 million due to the stupidity of different administration groups. I do not like that, however it’s the easiest way for banks to repay the Fed. In any case, the Fed did entrance the cash to avoid wasting many, many, many banks. I feel the failures would have been huge.

John Allison, Chairman

The second draw back issues potential authorized issues in a part of its West Texas operation. This challenge generated by the unethical and probably prison actions of some people has resulted in a lack of income. On this challenge the courtroom will take into account what to do, thus far not a lot is thought about it.

Lastly, the final concern is what number of price cuts the Fed will make this 12 months. Presently, HOMB estimates at most 4 cuts for the NIM to enhance in 2024, but when there are extra cuts the scenario may change.

If now we have six price cuts this 12 months, we’ll be in a number of bother. I hope that is not appropriate, as a result of I hope it isn’t politically motivated behind it. But when now we have six price cuts, it is a signal that we’re in bother. So, the nation is in bother, not HOMB. The nation is in bother. In order that’s fairly scary to suppose that we may have six price cuts. And I perceive they’re pricing these six price cuts in. I am nonetheless a higher-for-long-growth man.

John Allison, Chairman

The phrase recession has been talked about a number of instances, however administration appears able to function in that situation as nicely. HOMB’s biggest benefit is the pliability of its monetary construction.

Conclusion

This fall 2023 was optimistic general, as was FY2023. The financial institution achieved enchancment by way of NIM and NII and probably this pattern can proceed given the low LTD ratio. As well as, competitors in Texas and South Florida is proscribed for the reason that different banks have LTD near or above 100%. In any case, FDIC and particularly the issues in West Texas are the unfavourable notes. The TBV per share continues to extend regardless of the buyback and the unrealized losses within the securities portfolio are step by step shrinking. At the very least in the intervening time, there’s a foundation for 2024 to be a great 12 months for HOMB.