[ad_1]

Depart encashment is an often-ignored employment profit, regardless of being a major accrued part within the general worker remuneration over the course of their skilled life. This 12 months, Indian labor legal guidelines have mandated go away encashment for unutilized leaves by workers.

Consequently, workers can now. Whereas contemplating the advantages of go away encashment, it is usually essential to think about its computation technique. Apart from, the impression of taxation on the encashed go away, and the way in which the related legal guidelines and insurance policies are structured wants a more in-depth understanding. This put up is geared toward simplifying the complexities surrounding go away encashment for HR professionals.

What’s Depart Encashment?

At its core, go away encashment is the choice to obtain financial compensation for unutilized leaves. Normally, it comes into impact when an worker resigns, is terminated, or retires. The provision of go away encashment can fluctuate amongst employers, with some providing it yearly.

Moreover, go away encashment clauses also can fluctuate relying on the employer in addition to the geography’s native legal guidelines, which solely underscores the necessity for a deeper understanding of related statutory rules.

A number of legal guidelines affect go away encashment. As an illustration, within the case of members of the All-India Providers (AIS), the foundations stipulated by the All-India Providers Act, 1951 are pivotal. Nonetheless, in relation to go away encashment, All India Providers (Circumstances of Service—Residuary Issues) Guidelines, 1960 is the related act.

Equally, termination and resignation also can add layers of complexity, and there are distinct guidelines dictating the tax implications and eligibility standards throughout these transitions.

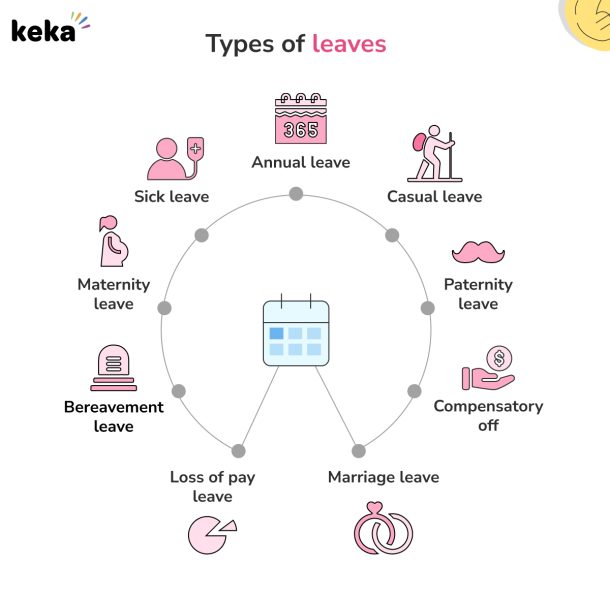

What are the kinds of leaves?

Workers can apply for various kinds of go away. These are supposed to cater to numerous life occasions and circumstances. Here’s a simplified overview of the first kinds of leaves:

1. Annual Depart

Each worker is eligible for a selected variety of paid leaves yearly. That is communicated on the time of becoming a member of the group. To avail annual go away, workers should inform their supervisor in writing upfront (often at the least 15 days prior) to availing annual go away.

2. Informal Depart

Such a go away is used for private causes and permits workers to take quick breaks with out lack of pay.

The variety of informal leaves and the components that govern eligibility for go away encashment could fluctuate based mostly on the group’s insurance policies.

3. Sick/Medical Depart

Such a go away is supposed for health-related points. Medical go away permits workers to take day without work with out shedding their pay.

Organizations typically have particular insurance policies governing the variety of medical leaves and their eligibility for encashment.

4. Maternity Depart

Maternity go away supplies feminine workers with prolonged paid leaves throughout being pregnant and childbirth.

The length and circumstances of maternity go away are regulated by labor legal guidelines and isn’t thought-about for go away encashment.

5. Paternity Depart

Paternity go away is designed to supply male workers with paid day without work across the start of their little one.

Much like maternity go away, the circumstances and length of paternity go away are topic to organizational insurance policies and authorized rules.

6. Paid Time Off (PTO)

Such a go away contains classes corresponding to Trip Depart, Informal Depart, Sick Depart, and a Firm Break Interval.

Workers can apply for PTO go away after the approval of their reporting managers topic to enterprise wants.

7. Trip Depart

In India, workers are granted 1.25 trip leaves each month, totaling to fifteen days per calendar 12 months. Unused leaves carry over to the following 12 months as much as a most of 45 days.

Approval and scheduling require prior approval from reporting managers and are additionally topic to enterprise wants. Any remaining steadiness is encashed upon termination.

8. Informal Depart

India workers obtain 8 days of paid informal day without work per calendar 12 months, lapsing if unused.

9. Sick Depart

In India, workers can often avail as much as 10 days of paid sick time per calendar 12 months. Prior notification to the reporting supervisor is a requirement.

10. Firm Break Interval / Winter Break

In particular cases, corporations could supply their workers a winter break with 5 days of informal time-off deducted for wage fee. If no informal time-off is obtainable, deductions happen from trip/annual go away.

This type of go away includes automated deductions with no separate go away utility required.

11. Depart With out Pay (LWP)

Depart with out pay is often granted on the discretion of the worker’s reporting hierarchy. Throughout LWP, workers obtain no compensation however proceed to be eligible for advantages. LWP extending past 30 days is often categorized as Depart of Absence.

This type of go away requires approval, and workers should exhaust any accrued PTO earlier than collaborating in go away with out pay.

12. Bereavement Depart

Relying on the group coverage, an worker could also be granted as much as 20 days of bereavement go away. This go away contains pay and is granted within the occasion of loss of life of specified members of the family. It’s obligatory to instantly notify the supervisor.

13. Depart of Absence (Medical LOA, Private LOA)

Relying on the group coverage, common workers could also be eligible for a Depart of Absence, topic to written approval from the supervisor. Extensions past 30 days might impression advantages.

Advantages of Depart Encashment: A complete look

We are going to now take a more in-depth take a look at go away encashment advantages from each views – workers and employers.

Worker Perspective

1. Monetary Flexibility: For workers, the basic profit is bigger monetary flexibility. It serves as a tangible financial profit that’s in any other case misplaced. Furthermore, it addresses the fast monetary wants or aspirations of the worker.

2. Enhanced Work-Life Stability: By selecting to encash go away as an alternative of taking day without work, workers can preserve an optimum work-life steadiness. This flexibility empowers people to align their skilled and private commitments extra successfully.

3. Retirement: The choice to encash accrued go away turns into notably important throughout retirement. A shock lumpsum obtained in later years is usually a increase for retirees, including to their monetary safety.

4. Tax Implications: Relying on the authority and particular circumstances, the tax remedy of go away encashment varies. Understanding these implications permits workers to make knowledgeable selections about when and easy methods to make the most of this profit.

Employer Perspective

1. Elevated Productiveness: From an employer standpoint, go away encashment assures workers that there’s a reward for not taking day without work work. As workers select to stay at work and encash their go away, the accessible man-days improve, thereby positively impacting productiveness.

2. Price Administration: Regardless of growing prices within the quick time period, go away encashment provides a clear and manageable strategy to handle worker advantages. This readability in value administration permits corporations to plan and funds successfully.

3. Avoidance of Work Disruptions: In key positions or vital operations, worker absence can result in disruptions. Encouraging go away encashment, particularly in such roles, helps organizations keep away from sudden work stoppages and ensures continuity in operations.

4. Worker Satisfaction and Retention: Providing the choice of go away encashment contributes to worker satisfaction. It displays a dedication to flexibility and acknowledges various wants of the workforce, doubtlessly enhancing worker retention.

5. Actuarial Valuation Perception: Understanding the monetary implications of go away encashment includes actuarial valuation. This includes assessing the legal responsibility related to go away encashment, contemplating components corresponding to go away consumption charges, worker age, and dynamic go away accrual.

Eligibility of go away encashment: Navigating the trail to monetary flexibility

Depart encashment is a beneficial profit that bridges the realms of labor and monetary wellbeing. It’s topic to particular eligibility standards that align with organizational insurance policies and rules.

1. Employment Tenure

Normally, workers grow to be eligible for go away encashment after finishing a selected length of service, typically measured in years. This tenure-based criterion ensures that the profit is prolonged to dedicated and long-serving people.

2. Firm Insurance policies

Every group defines its insurance policies concerning go away encashment eligibility. These insurance policies define the circumstances underneath which workers can avail themselves of this profit, contemplating components corresponding to job roles, hierarchical ranges, and the general construction of the corporate.

3. Amassed Depart Balances

Eligibility typically hinges on the buildup of go away balances. Workers could also be required to accrue a minimal variety of go away days earlier than changing into eligible for go away encashment. This ensures that the profit is proportionate to the dedication and dedication demonstrated by accrued go away.

4. Regulatory Compliance

In sure jurisdictions, labor legal guidelines or trade rules prescribe eligibility standards for go away encashment. Organizations should adhere to those authorized frameworks to make sure equitable and lawful distribution of advantages amongst eligible workers.

5. Retirement or Separation

Eligibility for go away encashment may additionally be linked to particular occasions, corresponding to retirement or voluntary separation. In such circumstances, workers grow to be eligible to encash their accrued go away as a part of the transition to the following section of their skilled journey.

6. Annual Depart Quotas

Some corporations set up annual go away quotas as a prerequisite to being eligible for go away encashment. This method ensures a constant and honest distribution of the profit, stopping misuse whereas encouraging workers to make the most of their allotted go away responsibly.

Navigating the eligibility standards for go away encashment requires a nuanced understanding of organizational insurance policies, trade norms, and authorized frameworks. Workers who familiarize themselves with these standards will be capable to make extra knowledgeable selections associated to their work-life equation.

As organizations proceed to evolve their go away insurance policies, staying abreast of updates ensures workers can maximize the advantages aligned with their devoted service.

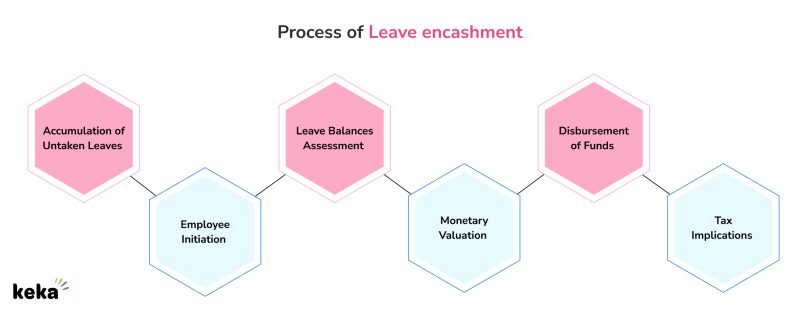

What’s the Means of Depart Encashment?

Understanding the go away encashment course of is essential for workers searching for to leverage this beneficial side of their employment.

1. Accumulation of Untaken Leaves

Workers accrue leaves all year long, encompassing annual go away, informal go away, and different relevant varieties. If these leaves stay untaken by the tip of the 12 months, the choice to encash them turns into accessible.

2. Worker Initiation

The method usually commences with the worker expressing their intent to encash accrued go away. This initiation can contain formal communication with the HR division or following particular protocols outlined by the group.

3. Depart Balances Evaluation

The HR or payroll division assesses the worker’s go away balances, figuring out the variety of days accessible for encashment. This analysis ensures accuracy within the calculation of the financial profit to be disbursed.

4. Financial Valuation

The financial worth of the go away days is calculated based mostly on the worker’s wage or a predetermined formulation established by the group. This valuation is an important step in figuring out the monetary impression of go away encashment.

5. Approval Course of

The request for go away encashment typically undergoes an approval course of, involving related authorities throughout the group. This step ensures compliance with firm insurance policies and prevents misuse of the go away encashment profit.

6. Disbursement of Funds

As soon as permitted, the funds equal to the calculated go away encashment worth are disbursed to the worker. This quantity is often included within the common wage cycle or as a separate disbursement, relying on organizational practices.

7. Tax Implications

Workers ought to pay attention to the tax implications related to go away encashment, because the disbursed quantity could also be topic to earnings tax. Understanding these implications ensures transparency in monetary planning.

Depart encashment, a course of designed to supply monetary flexibility, underscores the employer’s dedication to holistic worker well-being. By navigating this course of with readability and adherence to organizational tips, workers can harness the monetary advantages accrued by their untaken leaves.

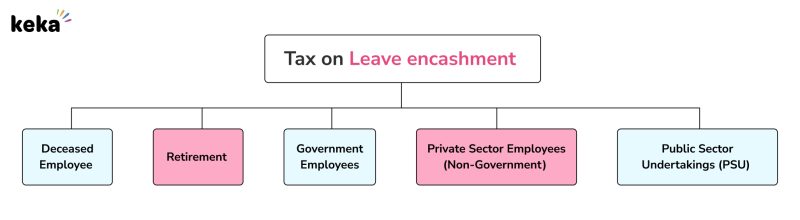

Is Depart Encashment Taxable?

Understanding the tax implications of go away encashment is essential, and the tax remedy varies based mostly on particular circumstances.

1. Deceased Worker

The tax remedy for go away wage obtained after the loss of life of an worker relies on the person’s tax standing on the time of demise.

Particular tips govern the taxation of go away encashment in case of a deceased worker.

2. Retirement

Depart encashment on the time of retirement enjoys sure tax exemptions.

Workers of Central or State Authorities obtain full exemption underneath part 10(10AA)(i) of the Earnings Tax Act for the interval of earned go away on the time of retirement.

Different workers have exemptions as much as the least of sure circumstances, together with 30 days go away for yearly of service, 10 months’ common wage, the government-specified quantity (at the moment ₹3 Lakh), or the precise obtained quantity.

3. Authorities Workers

Authorities workers, each Central and State, profit from favorable tax remedy on go away encashment, with full exemption on the time of retirement.

4. Non-public Sector Workers (Non-Authorities)

Non-government workers have limitations on tax exemptions for go away encashment at retirement, topic to specified circumstances.

The current ceiling of ₹3 Lakh was set about 20 years in the past and is a degree of dialogue for potential revision.

5. Public Sector Undertakings (PSU)

Tax remedy for go away encashment in PSUs aligns with that of personal sector workers, with concerns based mostly on the desired limits.

Knowledgeable Insights

As per tax legal guidelines, funds for encashment of earned leaves on the time of retirement are exempt from tax, topic to specified limits.

The time period ‘retirement’ is interpreted broadly, doubtlessly together with resignations, making go away encashment upon resignation eligible for exemption, topic to particular calculations and limits.

Any prior exemptions claimed affect the whole restrict accessible in subsequent employments.

At the moment, the general go away encashment exemption throughout an worker’s lifetime can’t exceed the whole specified restrict (presently ₹25 lakh).

Understanding the nuances of taxation associated to depart encashment ensures workers make knowledgeable selections based mostly on their particular circumstances.

Circumstances of Exemption from Tax

Understanding the circumstances and limits related to tax exemptions for go away encashment is essential for workers, various throughout completely different eventualities.

1. Deceased Worker

Tax exemption circumstances for go away encashment obtained on behalf of a deceased worker depend upon the person’s tax standing on the time of demise.

Particular tips govern the taxation of go away encashment in case of a deceased worker.

2. Retirement

Depart encashment due to retirement is tax exempt. Nonetheless, it’s topic to particular circumstances. Retirement doesn’t refer solely to superannuation (occurring at an outdated age) however also can cowl circumstances of resigning from the job.

Within the case of Central or State governments, your entire go away encashment quantity obtained is exempt, with out limits or circumstances.

3. Authorities Workers

Authorities workers, each Central and State, profit from favorable tax remedy on go away encashment, with full exemption on the time of retirement.

4. Non-public Sector Workers (Non-Authorities)

Within the case of non-government workers, varied tax exemption circumstances apply for go away encashment. Whereas computing exemption for go away encashment, it can’t exceed 30 days for every year of service.

As well as, it can’t exceed 10 months. Exemption is calculated based mostly on the typical wage drawn throughout the 10 months previous retirement. An general cap on the exemption quantity is notified by the federal government.

5. Public Sector Undertakings (PSU)

Tax remedy for go away encashment in PSUs aligns with that of personal sector workers, with concerns based mostly on specified limits.

Exemptions underneath 10(10AA)

Part 10(10AA) of the Earnings Tax Act supplies the framework for exemptions associated to depart encashment.

The exemptions differ for presidency and non-government workers, with particular standards.

Exemption Restrict

The latest notification elevated the exemption cap on go away encashment from ₹3 lakh to ₹25 lakh (efficient from April 1, 2023). This enhanced restrict is aimed to bridge a long-standing disparity between authorities and non-government workers.

Calculation of Depart Encashment

Utilizing the Depart Encashment Formulation ,

To grasp how go away encashment is calculated, allow us to take into account the instance of Ms. Aisha, a devoted worker retiring after 20 years of service. All through her illustrious profession, she gathered an annual go away entitlement of 30 days, leading to a complete of 600 earned go away days over time.

She utilized 200 days of go away throughout her tenure leaving her with an unutilized go away steadiness of 400 days. When she retires, her month-to-month compensation together with a fundamental wage and a dearness allowance (DA) sums as much as a complete month-to-month bundle of ₹40,000.

The Depart Encashment is calculated utilizing the next formula:

Money Equal = ((Fundamental Pay + DA)/30) x No. of earned go away (capped at 10)

Aisha’s total monthly salary (Fundamental Pay + DA) is ₹40,000. The number of earned leave days are 400 (maxed at 10 days per the formulation) Aisha’s total monthly salary (Fundamental Pay + DA) is ₹40,000. The number of earned leave days are 400 (maxed at 10 days per the formulation)

Calculation:

Wage per day = (Whole month-to-month wage/Variety of Days in a month) = 40,000/30 = ₹1,333.33 (roughly)

Successfully, the go away encashment quantity works out to:

Depart Encashment Obtained = Variety of Unutilized Depart Days × Wage per Day

Depart encashment obtained = 400 × 1,333.33 = ₹5,33,332.00 (roughly)

Subsequently, Ms. Aisha is eligible for a go away encashment fee of roughly ₹5,33,332.00 upon her retirement. This computation ensures a good and clear calculation based mostly on the established go away encashment formulation, offering workers with a transparent understanding of their entitlements.

Automated Depart Encashment with Keka HR

Keka Depart Administration Software program takes the effort out of go away encashments by seamlessly integrating with our payroll engine. With the potential to configure encashment guidelines and customise formulation with completely different wage parts, Keka simplifies your entire course of.

Key Options:

1. Configurable Encashment Rule

Outline your group’s encashment guidelines effortlessly. Customise formulation based mostly on completely different wage parts to make sure accuracy.

2. Mundane Math Made Simple

Let Keka handle intricate calculations, eliminating the necessity for handbook effort. Merely set your guidelines, and the system takes care of the remainder for all of your workers.

3. Seniority-based Depart Accrual

Simply configure accrual charges based mostly on probation and expertise. Keka automates the accrual course of, guaranteeing accuracy and effectivity.

4. Lack of Pay Integration

Seamlessly combine with payroll for automated arrear calculations. Outline guidelines, and Keka ensures correct lack of pay calculations.

5. Lack of Pay Reversal Arrears

Effortlessly cancel an worker’s unpaid go away from the previous with a single button. Keka routinely encashes it within the payroll, streamlining the method.

6. Depart Carry Over Simplified

Set go away carry-over guidelines and let Keka handle encashments and carry-overs into the next years. Guarantee a easy transition of go away balances with out handbook intervention.

7. Easy Lack of Pay Calculation

Outline insurance policies and guidelines aligned with organizational rules. Keka automates the lack of pay calculation, saving time and lowering errors.

8. Streamlined Depart Carry Over Guidelines

Configure your individual go away carry-over guidelines and insurance policies. From go away encashment to carry-over, Keka ensures compliance together with your organizational tips.

Keka Payroll Software program has revolutionized the Indian payroll trade, simplifying enterprise payroll administration. With a deal with user-friendly design and highly effective automation, Keka ensures that managing go away encashments and payroll integration is just not solely environment friendly but in addition stress-free.

FAQs

1. What’s go away encashment?

Depart encashment refers back to the compensation workers obtain from their employers for untaken leaves. It turns into a part of the ultimate settlement throughout retirement or resignation, offering monetary worth for unused go away days.

2. What number of leaves will be encashed?

The variety of leaves that may be encashed varies, usually topic to the corporate’s coverage. Workers ought to consult with their firm’s go away coverage to grasp the utmost restrict on go away encashment.

3. Can informal go away be encashed?

Sure, informal go away will be encashed, however the course of and eligibility standards depend upon the corporate’s insurance policies. It typically includes notifying the employer and adhering to particular tips outlined within the firm’s go away encashment coverage.

4. What’s the go away encashment formulation?

The go away encashment formulation is an easy calculation: Money equal = [(Basic Salary + Dearness Allowance) / 30] * No. of Earned Leaves. Understanding this formulation helps workers estimate their go away encashment quantity.

5. How is go away encashment calculated?

To calculate go away encashment, multiply the variety of unutilized go away days by the day by day wage charge, following the formulation: Money equal = [(Basic Salary + Dearness Allowance) / 30] * No. of Earned Leaves. This simple calculation empowers workers to gauge their potential go away encashment.

6. Is go away encashment taxable for financial institution workers?

The taxability of go away encashment for financial institution workers varies based mostly on particular person circumstances and tax rules. In search of recommendation from a tax skilled is advisable to grasp the precise tax implications for financial institution workers.

7. Is go away encashment taxable for Authorities workers?

Depart encashment for Authorities workers is absolutely exempt from taxation, as per Part 10(10AA)(ii) of the Earnings Tax Act. This exemption supplies a monetary profit to authorities workers throughout retirement or resignation.

8. Is go away encashment taxable for Non-public workers?

Sure, go away encashment is taxable for personal workers. The quantity obtained is a part of their earnings and is topic to earnings tax. Understanding this tax implication helps non-public workers plan accordingly.

9. Is go away encashment taxable after resignation?

Depart encashment obtained after resignation is taxable. The particular tax remedy could fluctuate, and workers should take into account particular person circumstances and search skilled steering to handle tax implications successfully.

10. Is go away encashment taxable after Termination?

Depart encashment after termination is usually taxable. Understanding the tax remedy of go away encashment in such conditions is important, and workers should search skilled recommendation to navigate tax obligations after termination.

[ad_2]

Source link