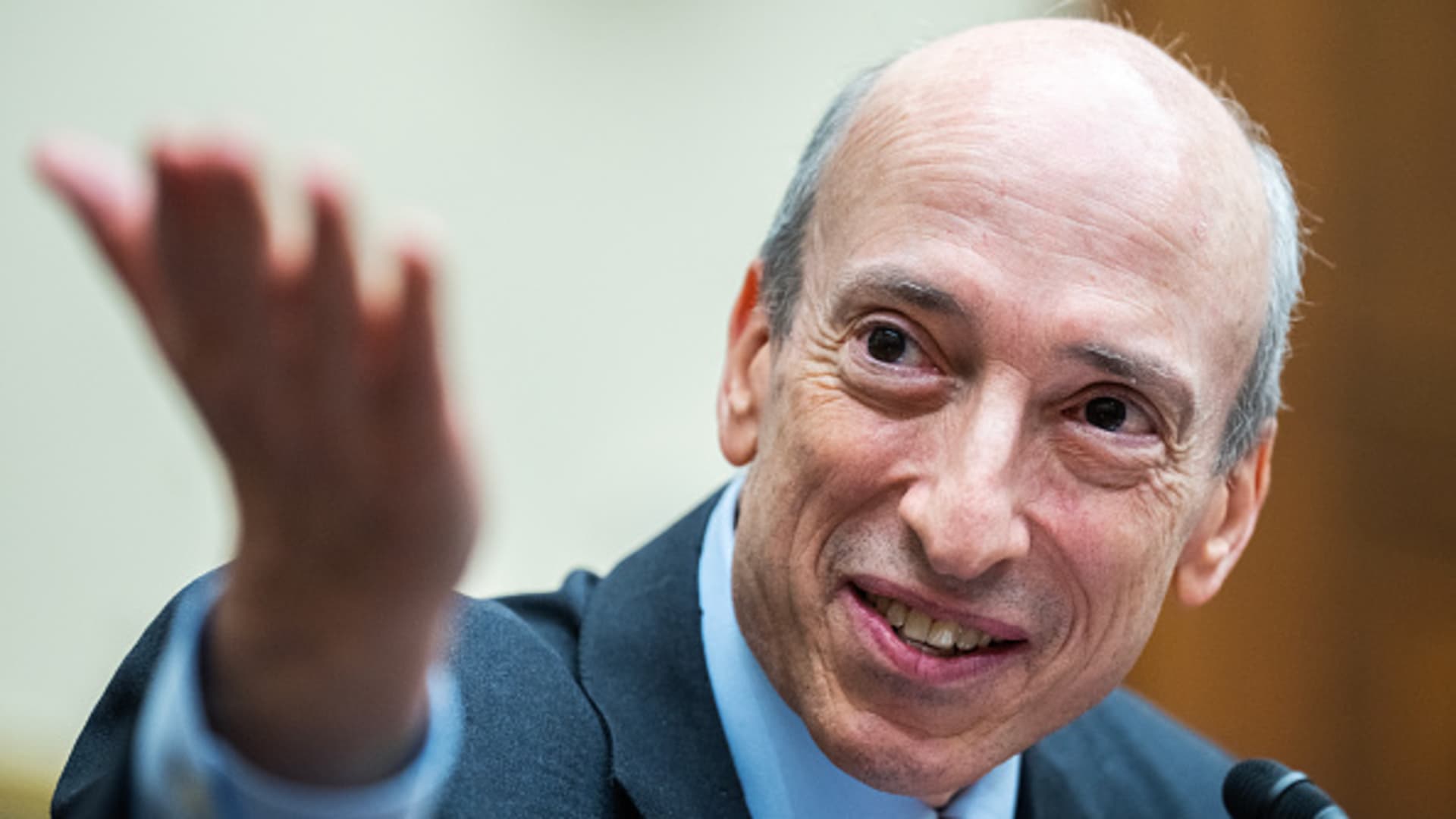

SEC Chair Gary Gensler testifies through the Home Monetary Companies Committee listening to titled “Oversight of the Securities and Alternate Fee,” in Rayburn Constructing on Wednesday, September 27, 2023.

Tom Williams | Cq-roll Name, Inc. | Getty Photographs

The Securities and Alternate Fee, lead by Chair Gary Gensler, is voting Wednesday on new guidelines to curb SPACs.

Particular Function Acquisition Firms, generally referred to as “clean test firms,” are firms shaped to lift capital by means of an preliminary public providing for the aim of shopping for or merging with an current firm.

Gensler says the brand new guidelines are mandatory to guard buyers.

“Functionally, the SPAC goal IPO is getting used in its place means to conduct an IPO,” Gensler stated in a March 2022 assertion on the proposed laws.

Gensler isn’t any fan of SPACs

Gensler has been hostile to SPACs because the starting of his tenure on the SEC. In a video printed on the SEC web site in December 2021, Gensler was overtly disdainful of SPACs:

“Suppose a gaggle of strangers got here as much as you and stated, ‘I’ve an organization that does not do a lot of something, however someday within the subsequent two years will merge with one other firm. I do not know what that firm is but.’ Would you spend money on the stranger’s firm?” Gensler says within the clip. “That is basically what a particular goal acquisition firm, a SPAC, does.”

Gensler has additionally been important of the excessive 20% sponsor charges related to SPACs, in addition to different charges for bankers and monetary advisors.

He is additionally been important of how SPAC buyers have been diluted by way of so-called non-public investments in public fairness, which permit buyers, principally huge establishments, an extra alternative to place cash into the SPAC. PIPE buyers can usually should buy shares at a reduction after a goal merger, Gensler has asserted.

SPACs: Way more disclosures might be required

The brand new guidelines will:

1) Increase disclosure necessities concerning SPAC sponsors, SPAC sponsor compensation, conflicts of curiosity, dilution, and the goal firm. After a blank-check SPAC goes public, it would often announce inside two years the acquisition of a goal firm, which is named a de-SPAC transaction. The brand new guidelines would additionally require extra disclosures from a board of administrators about whether or not the de-SPAC transaction is in one of the best pursuits of the SPAC and its shareholders.

2) Extra carefully align disclosure and authorized liabilities for de-SPACS with these of conventional IPOs. Executives advertising de-SPACs usually made wild claims concerning the future profitability of their firms, claims which might by no means have been attainable to make had a conventional IPO route been used.

“The thought is that events to the transaction should not use overly optimistic language or over-promise future ends in an effort to promote buyers on the deal,” Gensler stated in a March 2022 information launch.

The brand new guidelines would make the authorized obligations and liabilities for a de-SPAC transaction just like these of conventional IPOs. It will, for instance, make the goal firm legally chargeable for any assertion made about future outcomes by assuming accountability for disclosures.

Ahead-looking statements: No protected harbor

Firms are supplied with a “protected harbor” once they make ahead wanting statements, which give them with safety in opposition to sure authorized legal responsibility.

Nevertheless, IPOs usually are not afforded this “protected harbor” safety, which is why forward-looking statements in an IPO registration are often very cautiously worded. The proposed guidelines would additionally make the “protected harbor” authorized protections for forward-looking statements unavailable for clean test firms, that means they may extra simply be sued.

The SPAC market has already collapsed

2020 and 2021 have been file years for SPAC IPO submitting. As compared, there have been 86 SPAC IPOs in 2022, a major lower in comparison with the final two years, in accordance with Statista.

In 2023, the SPAC craze collapsed. Bloomberg information cited by Forbes indicated that 21 companies that had gone public by way of SPACs went bankrupt in 2023, the most important of which was versatile office supplier WeWork, which filed for Chapter 11 safety in November 2023. Lordstown Motors additionally filed for chapter.

When requested if the SPAC craze was over on CNBC’s “The Alternate” on Tuesday, Duncan Davidson of Bullpen Capital laughed and stated, “Sure. The SPAC firms have been extremely speculative and so they collapse and no one desires to the touch a SPAC.”

Nonetheless, higher late than by no means.

“Traders deserve the protections they obtain from conventional IPOs, with respect to data asymmetries, fraud, and conflicts, and on the subject of disclosure, advertising practices, gatekeepers, and issuers,” Gensler stated within the March 2022 assertion when the principles have been proposed.

An SEC spokesman acknowledged there had been a decline in SPAC exercise since 2021, however there’s nonetheless exercise within the market.

“The varieties of guidelines we’re recommending are investor protections and disclosures that we expect are mandatory no matter market fluctuations,” the spokesman stated.