champc

By Nikhil Mohan, Economist, Franklin Mounted Revenue

US gross home product stunned to the upside within the fourth quarter of 2023, primarily led by US shoppers and the federal government. Franklin Mounted Revenue Economist Nikhil Mohan sees the expansion combine remaining largely the identical in 2024.

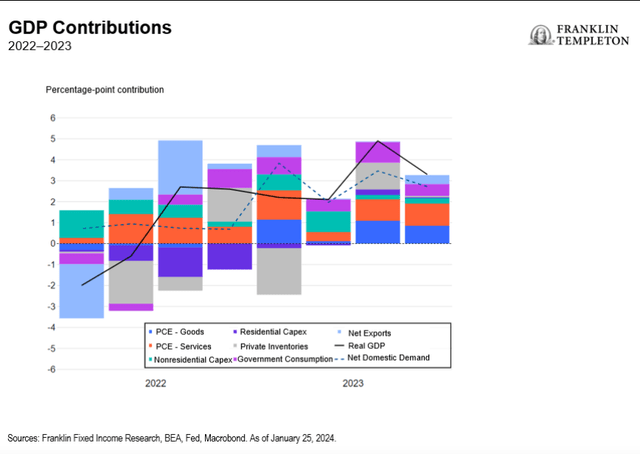

US gross home product (GDP) stunned to the upside within the fourth quarter of 2023, rising 3.3% on a quarterly annualized foundation—properly above our expectations (2.1%) in addition to consensus expectations (2.0%).1 A few of the upside shock was possible because of the lower-than-anticipated worth deflator progress (1.5% precise vs. 2.2% anticipated) and the constructive contribution from internet exports.2 Nevertheless, it was the buyer and authorities consumption that continued to do a lot of the heavy lifting, with the 2 alone contributing 2.6 proportion factors (PP) to headline GDP. Development and contributions from each residential and non-residential funding remained muted.

We anticipate the expansion combine to stay broadly comparable going ahead, with the buyer and the federal government (particularly given it’s an election 12 months) more likely to energy progress in 2024 as properly. Whereas inflation has slowed notably (the Core Private Consumption Expenditure [PCE] deflator is already at 2% on a quarterly annualized foundation), the labor market and wages haven’t softened fairly as swiftly.3 Due to this fact, actual incomes ought to stay supportive of family consumption. Likewise, the constructive wealth impact from the rise in valuations for actual property and equities over the previous 2–3 quarters must also be a internet constructive for consumption. Furthermore, as inflation has receded, client sentiment has risen, as indicated by each the College of Michigan and Convention Board surveys. We imagine that constructive outlook from households ought to maintain the financial system on observe for additional enlargement, even when different drivers of progress stay lackluster.

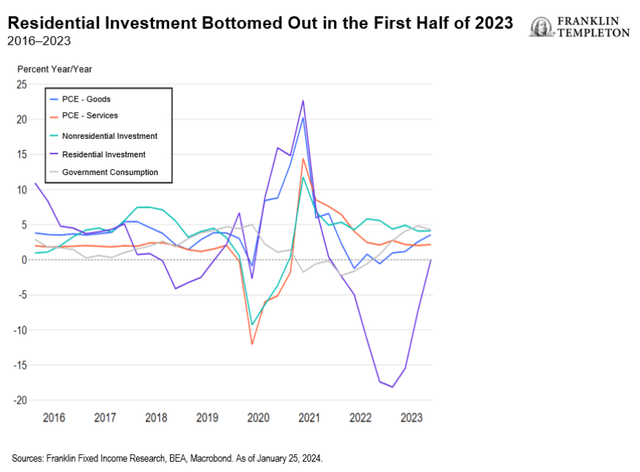

Though enterprise funding slowed markedly on a sequential foundation within the second half of 2023, it nonetheless ended up 4.1% larger on a year-over-year (y/y) foundation, which places it proper according to the 2015-2019 common, and that is regardless of a considerably larger interest-rate surroundings. Nevertheless, trying forward, enterprise funding might stay muted given the uncertainty forward of elections in November, together with rising issues about weaker world progress.

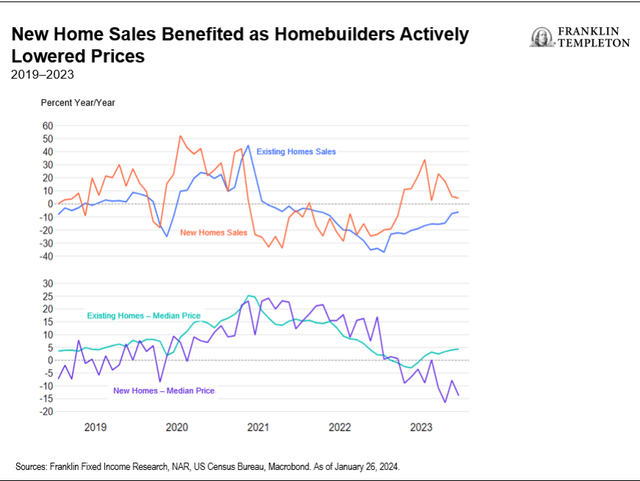

As for residential funding—there already seem like some inexperienced shoots within the type of rising new house gross sales, constructing permits and housing begins, whereas present house gross sales have turned much less unfavorable (all on a y/y foundation). Furthermore, with mortgage charges down over a 100 foundation factors since late October, mortgage functions have began to show up once more (albeit from very low ranges). Whereas decrease borrowing prices ought to assist residential funding (significantly within the second half of 2024), a good housing market has meant that present house costs have continued rising by means of a lot of 2023—up over 4% y/y.4 Nevertheless, new house costs have bucked this pattern as homebuilders tried to offset the excessive charges surroundings by actively decreasing costs by means of 2023—down virtually 14% y/y—which in flip aided gross sales.5 Nevertheless, new houses account for roughly 14%-15% of whole house gross sales.6 Due to this fact, the shortage of inexpensive housing will possible proceed to offset a few of the positives at the same time as borrowing prices edge decrease.

WHAT ARE THE RISKS?

All investments contain dangers, together with attainable lack of principal.

Mounted earnings securities contain rate of interest, credit score, inflation and reinvestment dangers, and attainable lack of principal. As rates of interest rise, the worth of fastened earnings securities falls. Low-rated, high-yield bonds are topic to better worth volatility, illiquidity and risk of default.

Unique Publish

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.