arthon meekodong

Nuveen S&P 500 Purchase-Write Earnings Fund (NYSE:BXMX) is an actively managed CEF (closed finish fund) that primarily focuses on producing earnings by writing lined calls on its holdings. The fund at present comes with a distribution yield of about 7.2% and trades at a reduction near 10% which we’ll focus on in additional element beneath. All in all, this looks like a good fund to generate some earnings, however it has some negatives as effectively, equivalent to underperforming in complete returns and missing dividend progress.

Coated name funds have been gaining an enormous recognition currently as a result of they generate earnings yields starting from 6% to 12% for index primarily based funds equivalent to JPMorgan Fairness Premium Earnings ETF (JEPI) and JPMorgan Nasdaq Fairness Premium Earnings ETF (JEPQ) and as a lot as +50% on funds which can be primarily based on particular person shares equivalent to YieldMax NVDA Choice Earnings Technique ETF (NVDY). These funds are available all shapes and varieties. Some are actively managed, some are passively managed which promote calls at a sure strike value robotically month after month with out human intervention no matter market circumstances. Some funds promote lined calls in opposition to 100% of their property, whereas some promote lined calls in opposition to 50% of their property whereas letting the remaining property to run larger. Some promote lined calls on the cash, some promote out of cash. Some promote every day calls, whereas others might promote weekly or month-to-month calls.

One cause folks appear to essentially love these funds currently is as a result of they’ve the power to generate earnings in all market circumstances, not less than in principle. When you write lined calls, you accumulate a premium and that is yours to maintain no matter whether or not the market went up, down or stayed flat. In fact, promoting lined calls means you might be giving up both all or a part of the upside which suggests if the market have been to have a monster rally prefer it has been doing for probably the most of 2023 (which even accelerated after October) you is likely to be left behind however that solely means you’ll be underperforming the market, not essentially that you’ll be dropping cash. You may nonetheless earn a living, however much less so than shopping for and holding shares.

Then when precisely do you lose cash once you spend money on funds that promote lined calls? When the market goes up and down in a violent vogue in a brief time period (W form market) you might even see some NAV decay in your aspect. It is because promoting lined calls limits your upside, however you continue to take part in most draw back actions which suggests if the market have been to drop -10%, then climb 10%, then drop -10% once more and climb 10% once more, you would possibly undergo from most of these -10% drops whereas not absolutely benefiting from following 10% features. In that state of affairs the place the market goes -10%, +10%, -10% and +10% in precisely that order, your portfolio might go -8%, +2%, -8%, +3% respectively, the place the general market adjustments little or no however your NAV suffers decay.

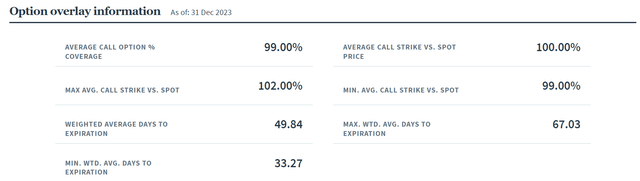

BXMX holds about 250 shares to put in writing lined calls in opposition to. These are principally the highest 250 shares within the S&P 500 index, which account for greater than 90% of the overall weight of the index. The fund has a lined possibility protection of 99% which suggests it writes lined calls in opposition to nearly all of its portfolio, sparing nearly none. Strike value to identify ratio ranges from 99% to 102% with common being 100%. This refers back to the written lined calls to inform us how out of cash these are. A strike value to identify ratio of 100% signifies that calls written are precisely on the cash, whereas numbers above 100% point out calls being written out of cash, whereas something beneath would point out calls written within the cash. This fund appears to put in writing most choices both on the cash or inside 1-2% of the present value. One other attention-grabbing factor to notice is that the fund’s possibility expiration days vary from 33 to 67 with the common being 50 which is completely different from most lined name funds that sometimes write calls which can be wherever from 7 to 30 days away at most. It’s extremely uncommon to see funds that write name choices past 30+ days, and this appears to be considered one of them.

Choices Technique Traits (Nuveen)

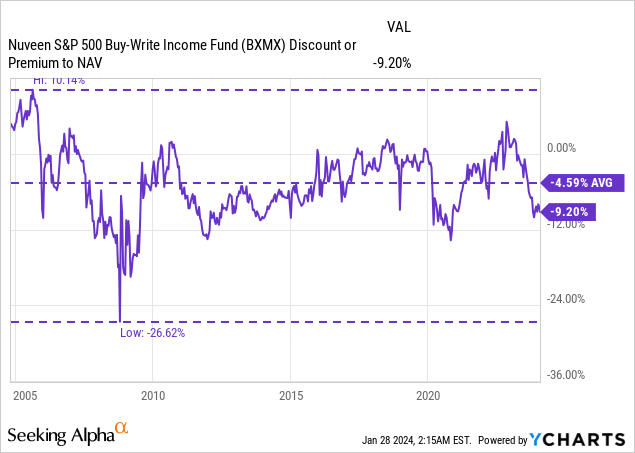

In contrast to most extremely in style lined name funds out there as we speak, this fund hasn’t been launched within the final couple of years. The truth is, it was launched nearly 2 a long time in the past. All through its historical past, the fund sometimes traded at a slight NAV low cost, averaging about -4.59%. At present, it is buying and selling a NAV low cost of -9.20% which signifies that it is buying and selling at a better than common low cost. It’s extremely uncommon for the fund to commerce at a premium, however there have been just a few occasions the place it traded at precisely NAV worth or at a slight premium, the final of them being not way back in January 2023. The fund by no means traded at a reduction bigger than -12% except in the course of the 2008-2009 interval which coincided with the Nice Recession.

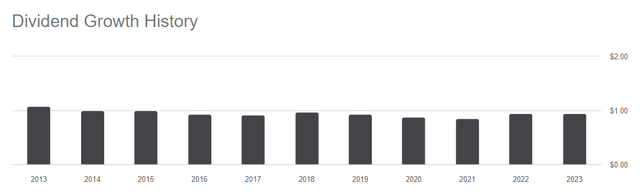

The fund sometimes has a distribution yield round 7% and its distributions have been kind of secure through the years, however this additionally means there hasn’t been any dividend progress. This fund is prone to disappoint dividend progress buyers who’d prefer to see their earnings develop yr after yr. In fact, you may generate your individual dividend earnings by reinvesting some or your whole dividends, however not earlier than paying tax on that distribution earnings first.

Distribution Historical past (Searching for Alpha)

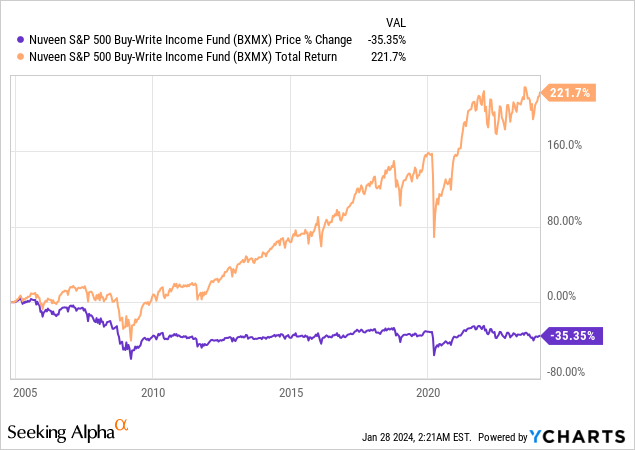

Just about the entire fund’s returns got here from distributions, whereas the share value hasn’t proven any appreciation through the years. That is to be anticipated for the reason that fund writes calls in opposition to 100% of its positions with the common strike value being precisely on the cash, so it eliminates all upside potential past the premiums collected. Since all premiums are distributed to buyers, there isn’t a room for NAV itself to develop. This is the reason the fund’s share value is down -35% since inception and nearly all of its 222% complete return (about 6.2% annualized, which is beneath the general market’s efficiency of 9.5% annualized throughout the identical interval) got here from name premiums and distributions.

All in all, that is an attention-grabbing fund. It generates predictable fixed earnings yr after yr with no progress however no shrinkage both. Alternatively, you do not get to take part in any upside out there, and you might be prone to undergo NAV decay if the market enters right into a W form kind. Whether or not you want to make investments on this fund or not will depend on how bullish you might be concerning the total market. In the event you suppose the general market will rise greater than 7% per yr for the foreseeable future, you may ignore this one and purchase an index fund as an alternative. In the event you suppose that the market will likely be flat or downward for the following few years, this could possibly be a good place to park your cash to generate a yield of seven.2%.