fatido/E+ through Getty Pictures

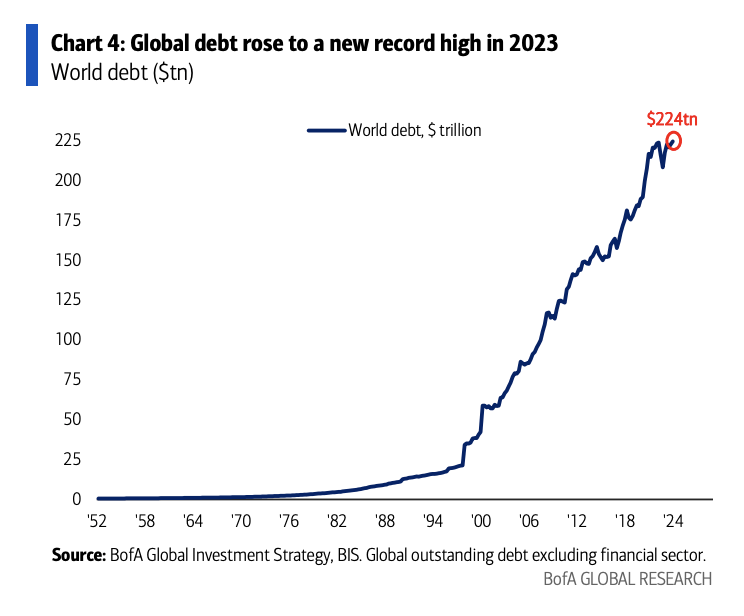

International debt hit a brand new document of $224 trillion in This autumn.

That determine was $150 trillion in 2013 and $75 trillion in 2003, in line with BofA Securities strategist Michael Hartnett.

Up to now 10 years, “authorities debt +60% to $83tn, company debt +50% to $86tn, family debt +40% to $55tn,” Hartnett wrote in his weekly Circulate Present word.

Fiscal extra and the “authorities bubble” stay huge explanations for U.S. development “exceptionalism,” he mentioned, noting that the fiscal deficit of seven.5% of GDP below President Joe Biden and the 6.6% deficit below President Donald Trump have been the most important for the reason that Nice Melancholy/World Battle II.

Certainly, “governments & corporates issued extra debt in Jan than ever earlier than ($760bn … of which $410bn govt & $350bn company),” he added. The underside line is that the price of capital “ain’t falling” very a lot with a giant recession.

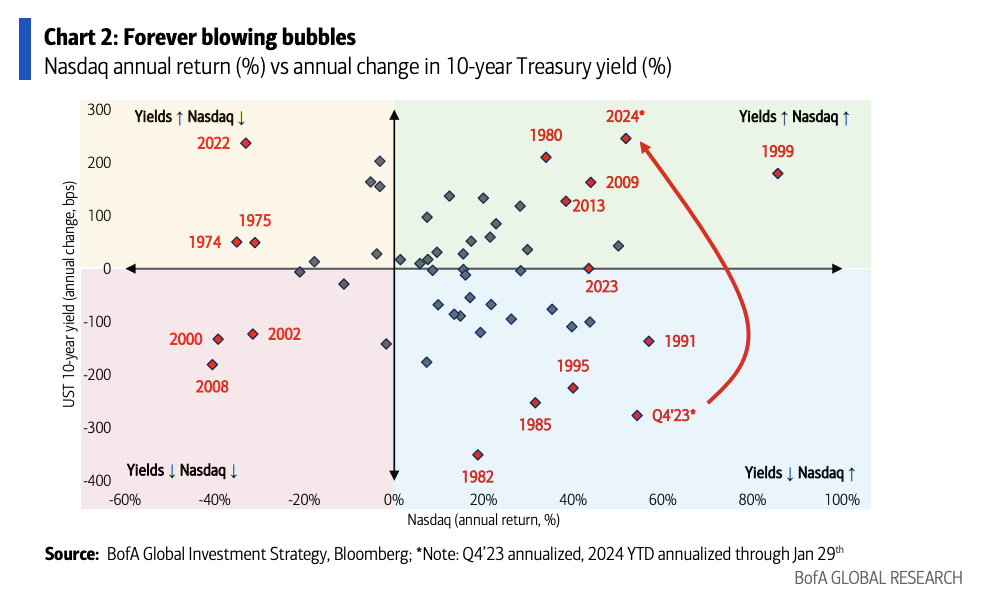

Hartnett additionally famous that the standard narrative of “bonds grasp, shares servant” appears to be like to be altering — and that solely occurs in occasions of bubbles and deflation.

Treasure yields (TBT) (TLT) (SHY) (IEI) (IEF) have been down and the Nasdaq (NASDAQ:QQQ) was up “bigtime” in This autumn, “however script flipped to ‘Nasdaq up = yields up'” within the first 4 weeks of 2024, Hartnett mentioned.

That is price-action that happens both post-recession (2009) or with bubbles (1999),” he added.

Traders positioning for “Fed cuts/AI-mania” say the optimum technique is barbell of bubble shares and really distressed belongings, which have been rising markets (EEM) in 1999 and certain China (MCHI) (FXI) (CQQQ) (GXC) or small cap (IWM) (SCHA) in 2024.