A dealer reacts as a display screen shows the Fed price announcement on the ground of the New York Inventory Trade (NYSE) in New York Metropolis, U.S., January 31, 2024.

Brendan McDermid | Reuters

The U.S. inventory market is in a “very harmful” spot as persistently sturdy jobs numbers and wage progress recommend the Federal Reserve’s rate of interest hikes haven’t had the specified impact, in accordance with Cole Smead, CEO of Smead Capital Administration.

Nonfarm payrolls grew by 353,000 in January, recent knowledge confirmed final week, vastly outstripping a Dow Jones estimate of 185,000, whereas common hourly earnings elevated 0.6% on a month-to-month foundation, double the consensus forecasts. Unemployment held regular at a traditionally low 3.7%.

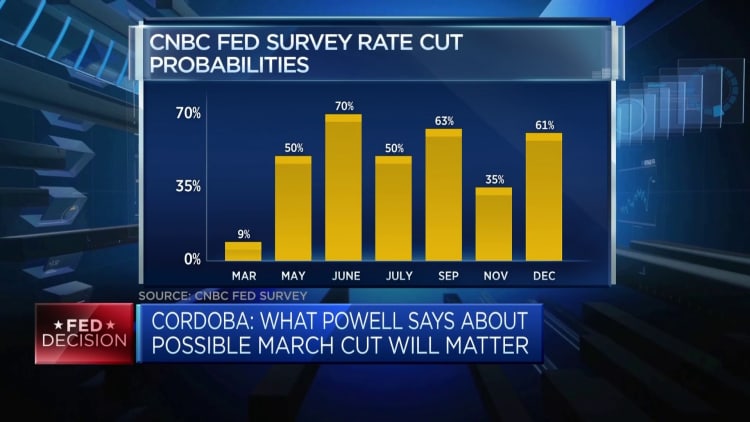

The figures got here after Fed Chair Jerome Powell mentioned the central financial institution would probably not reduce charges in March, as some market individuals had anticipated.

Smead, who has to this point accurately predicted the resilience of the U.S. shopper within the face of tighter financial coverage, advised CNBC’s “Squawk Field Europe” on Monday that “the true danger this complete time has been how sturdy the economic system has been” regardless of 500 foundation factors of rate of interest hikes.

“We all know the Fed has raised charges, we all know that induced a banking run final spring and we all know that is broken the bond market. I believe the true query could be ‘do we all know that the decreasing of CPI has really been brought on by these short-term coverage instruments they’ve used?'” Smead mentioned.

“Wage features proceed to be very sturdy. The Fed has not affected wage progress, which continues to outpunch inflation as we converse, and I take a look at the wage progress as a very good image of inflationary pressures going ahead.”

Inflation has slowed considerably from the June 2022 pandemic-era peak of 9.1%, however the U.S. shopper worth index elevated by 0.3% month-on-month in December to deliver the annual price to three.4%, additionally above consensus estimates and above the Fed’s 2% goal.

Smead argued that the autumn in CPI ought to be chalked as much as “good luck” as a result of contributions of falling vitality costs and different components exterior the central financial institution’s management, somewhat than the Fed’s aggressive cycle of financial coverage tightening.

Ought to energy within the jobs market, shopper sentiment and family stability sheets stay resilient, the Fed could must maintain rates of interest greater for longer. This may finally imply increasingly more listed corporations having to refinance at a lot greater ranges than beforehand and subsequently the inventory market could not profit from energy within the economic system.

Smead highlighted a interval between 1964 and 1981 wherein the economic system was “usually sturdy” however the inventory market didn’t proportionately profit as a result of persistence of inflationary pressures and tight financial circumstances, and urged the markets could possibly be coming into an identical interval.

The three main Wall Avenue averages on Friday closed out a thirteenth successful week out of the final 14 regardless of Powell’s warning on price cuts, as bumper earnings from U.S. tech titans resembling Meta powered additional optimism.

“The higher query is perhaps why is the inventory market priced like it’s with the financial energy and the Fed being pigeonholed into having to maintain these charges excessive? That is a really harmful factor for shares,” Smead cautioned.

“And to observe on that, the financial profit we’re seeing within the economic system has little or no tie to the inventory market, it does not profit the inventory market. What did the inventory market do final yr? It had valuations go up. Did it have so much to do with the earnings progress tied to the economic system? In no way.”

Charge reduce want changing into ‘much less pressing’

Nonetheless, some strategists have been eager to level out that the upside from latest knowledge means the Fed’s efforts to engineer a “smooth touchdown” for the economic system are coming to fruition, and {that a} recession is seemingly not within the playing cards, which might restrict the draw back for the broader market.

Richard Flynn, managing director at Charles Schwab U.Okay., famous on Friday that up till not too long ago, such a robust jobs report would have “set alarm bells ringing out there,” however that does not appear to be taking place anymore.

“And whereas decrease rates of interest would absolutely be welcomed, it’s changing into more and more clear that markets and the economic system are coping properly with the excessive price atmosphere, so buyers are maybe feeling that the necessity for financial coverage to ease is much less pressing,” he mentioned.

“[Friday’s] figures could also be one other issue delaying the Fed’s first price reduce nearer to summer time, but when the economic system maintains its snug trajectory, which may not be a foul factor.”

This was echoed by Daniel Casali, chief funding strategist at Evelyn Companions, who mentioned the underside line was that buyers have gotten “somewhat extra snug that central banks can stability progress and inflation.”

“This benign macro backdrop is comparatively constructive for shares,” he added.