PhonlamaiPhoto

Funding Introduction

For the previous 10 years, the efficiency on funding in Avnet, Inc. (NASDAQ:AVT) has been lackluster primarily based on inventory value appreciation, up 11.1% however a bit larger when accounting for the dividend as properly. Nevertheless, AVT has underperformed the broader markets for fairly a very long time now and the query comes up whether or not or not it’s going to proceed to take action.

Inventory Value Return (In search of Alpha)

The valuation of the corporate would possibly point out a major upside if AVT would obtain an analogous a number of as the remainder of the data expertise sector. The latest quarterly report did not do something to assist any purchase thesis right here as the highest and backside strains fell drastically. Worth can nonetheless be discovered within the firm dividend, however it’s not a worthwhile funding alternative proper now, however only a maintain as an alternative.

Firm Introduction

AVT is included within the data expertise sector and extra particularly within the expertise distributors business. Starting again in 1921 the corporate has grown to a valuation of $4.1 billion proper now. AVT has divided the operations into two completely different segments, these being Digital Elements and Farnell. The largest phase is by far the Digital Elements phase which had $5.812 billion in revenues final quarter, in comparison with $393 million for the Farnell phase. The merchandise that AVT makes on this phase produce electromechanical parts utilized in industrial monitoring for instance. The phase additionally covers design chain assist and logistical providers in addition to show options. Within the smallest phase, the corporate focuses on distributing kits and instruments together with industrial automation parts.

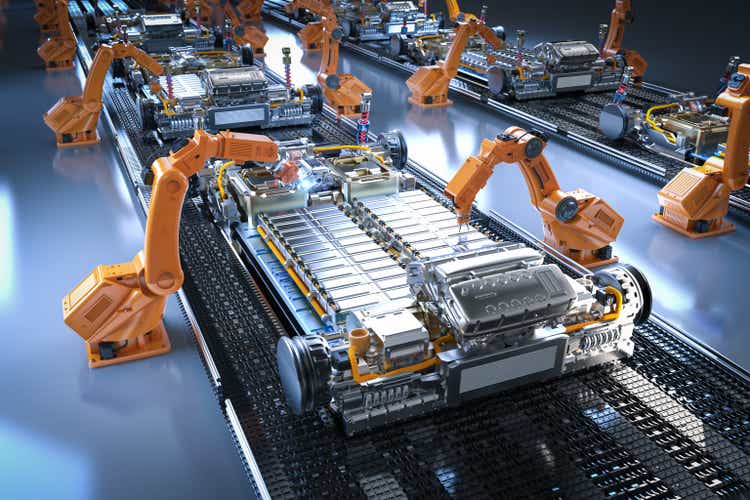

AVT Overview (Investor Materials)

Diving a bit bit deeper into the income sources and what markets that AVT focuses on. 92% of revenues got here from digital parts in FY2021, and this development has continued as we noticed within the final earnings report. The first marketplace for the corporate is semiconductors at round 75% and likewise the one which I can see rising quick for the following decade. Analysts estimate that the worldwide marketplace for semiconductors goes to succeed in $1.38 trillion in 2029. The primary driver behind this progress comes from how semiconductors in all of the shapes and methods they’re made are being built-in into expertise and manufacturing today. It is troublesome to discover a product that does not have one or has been involved with one.

Now that we all know a bit about what the corporate does, let’s look a bit at what the administration sees of their present state of affairs. The Q2 FY2024 outcomes have been launched on 31 January and the earnings name had the CEO Phil Gallagher say the next:

As I discussed beforehand, we’re within the midst of a list correction. And our group has finished a very nice job navigating it with a deal with optimizing our stock investments immediately and lowering stock ranges within the coming quarters”.

I believe that is what must be considered essentially the most within the subsequent few quarters, the stock ranges of AVT. The poor sentiment would possibly come from the dearth of value hikes within the business, which occurred when demand skyrocketed following important provide chain points after the COVID-19 pandemic. Now corporations like AVT must navigate a totally completely different market atmosphere the place they want environment friendly stock turnover. Stock is at $6.116 billion and has quickly risen since FY2021, practically rising 100% from $3.226 billion. The CEO adopted up by saying:

However with the near-term gross sales outlook, we’re centered on lowering stock, have been elevated and bettering our money conversion cycle”.

That is the technique I need to see now, and it ought to assist AVT preserve revenues regular for the following few years, and doubtlessly develop as soon as the following market cycle begins for semiconductors.

Valuation

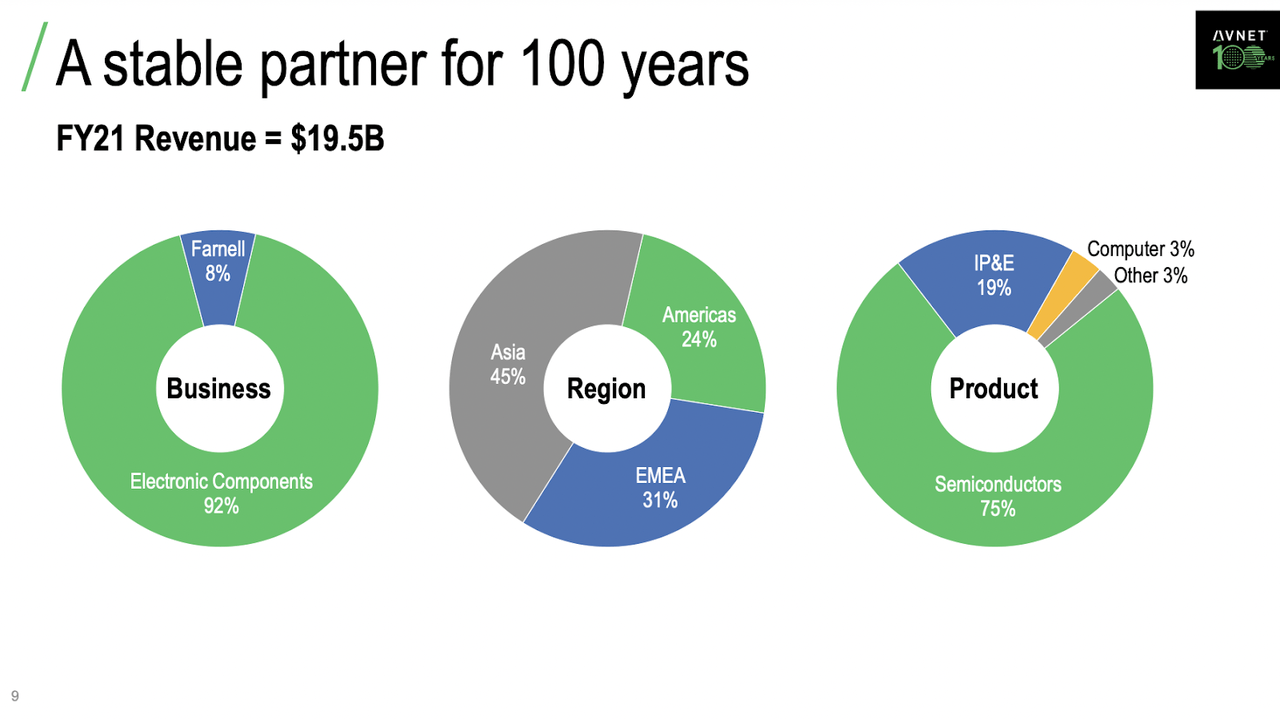

Rankings Abstract (In search of Alpha)

Rankings for AVT should not very blended, with it being as a maintain proper now. I fall on this similar class as AVT is navigating to handle its stock ranges. The administration can also be fairly centered on distributing a dividend, which could not essentially be unhealthy for inventors, however for a semiconductor firm, it does go away with the sensation they won’t develop as quick and robust as different friends.

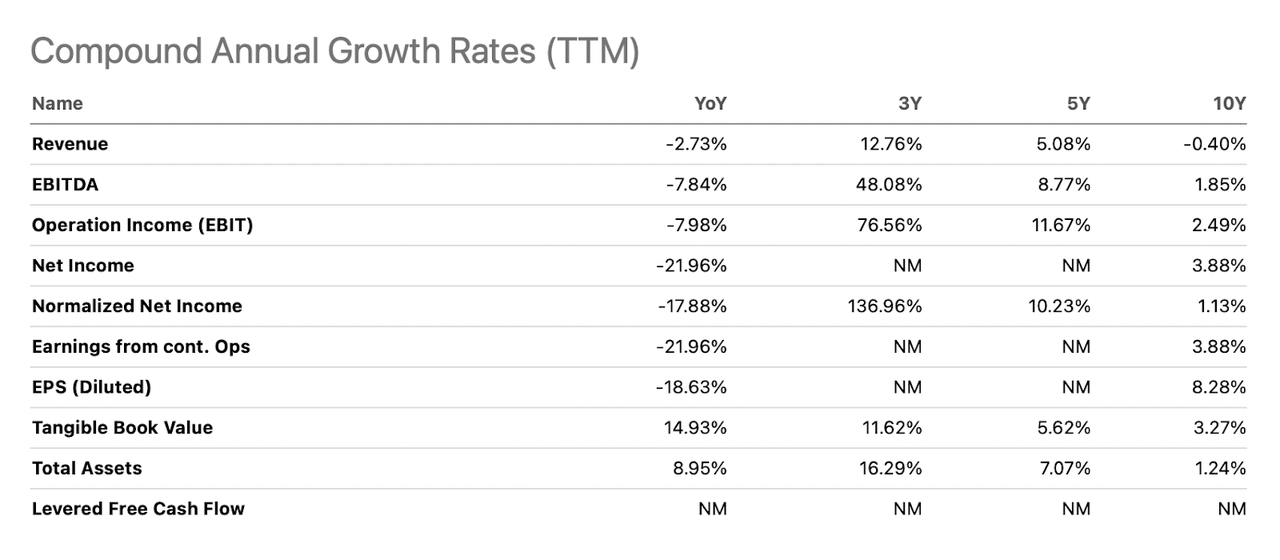

Progress Charges AVT (In search of Alpha)

Despite the fact that historic numbers are by no means one thing that you need to fully depend on when making investments, they do reveal usually how an organization has managed to place itself beforehand to progress alternatives. As I believe most traders know, the semiconductor business has seen speedy demand prior to now years, and AVT has captured a few of it, with revenues rising 12.78% yearly over the previous 3 years. Nevertheless, prior to now 10 years, revenues have fallen. I believe this comes right down to elevated competitors within the business and AVTs missing the flexibility to counter this and compete themselves. Revenues could also be steady, however that stability ought to include the low valuation that AVT trades at proper now.

The Worth You Get

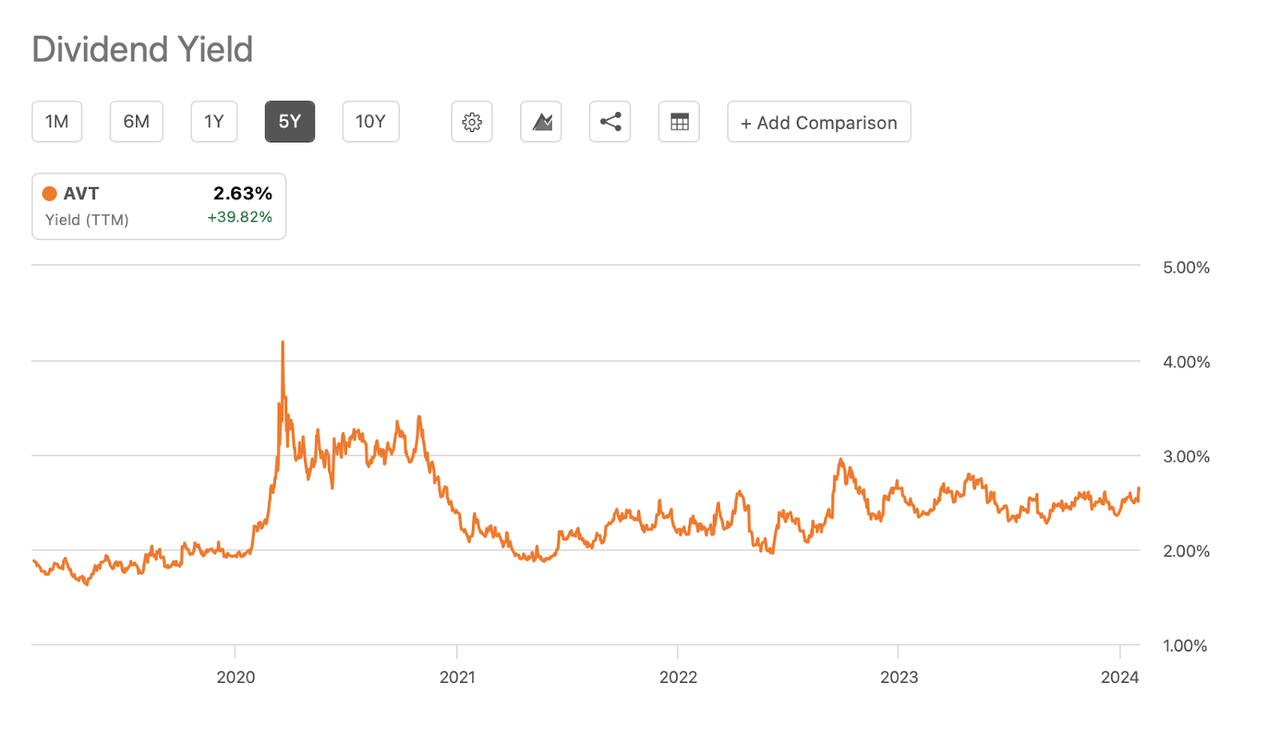

Dividend Yield (In search of Alpha)

The worth that traders can get proper now with AVT could be very a lot across the dividend, sitting at a FWD yield of two.63%. It has been trending larger the previous few years each as a result of AVT has been elevating it but in addition as a result of the share value has been reducing. I’m fearful that AVT will attain a degree the place they can not afford to boost it on the CAGR 9% it has maintained the previous 5 years. I say this as a result of the revenues present an absence of progress. TTM dividend distributions amounted to $109 million and with a 9% CAGR stored up it will not be lengthy till the payout ratio is above 50% and the danger profile considerably larger as properly.

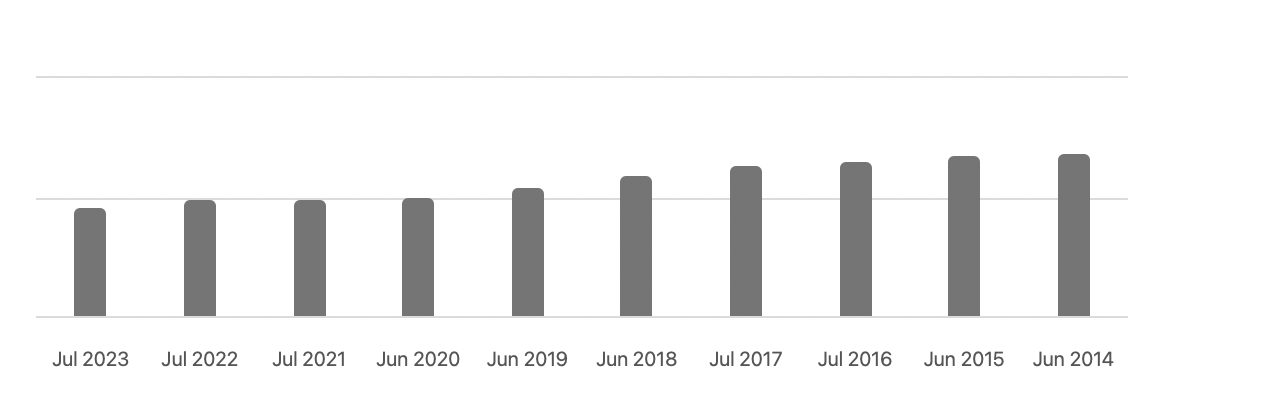

Share Buybacks (In search of Alpha)

Aside from an elevated deal with elevating the dividend, AVT can also be steadily shopping for again shares. Prior to now 10 years, it has decreased at an annual charge of 5.2%. Along with a dividend yield of two.63% traders are getting a close to 8% quick return right here from the earnings of AVT. Nevertheless, as the worth chart reveals this hasn’t meant an appreciation, however as an alternative only a regular declining valuation as shares are being purchased again, however natural progress within the prime and backside line shouldn’t be essentially reflecting that.

Value Goal

The consensus score for AVT is a maintain proper now and that’s what I might be score as properly. However I do need to set a value goal to get to some extent the place the worth is simply too good to not purchase into. I will not anticipate a major quantity of EPS progress for AVT these subsequent few years, so I’ll as an alternative take a look at the quick worth that you’d get at a sure value level. I discussed that AVT has a close to 8% quick worth proper now with the share buyback and dividend yield. I do suppose AVT can afford to purchase again between 2 – 3% of inventory yearly if operations keep the place they’re proper now. On the midpoint that may equate to round $100 million with the present market cap of $4.1 billion. Now, I need to get a minimum of a 9% return with an funding to beat out most index funds. This implies the yield must be 6.5% for AVT to get me there. At that yield, the annual payout would keep at $1.24 for instance, and the worth at $19.07. It is a close to 50% drop from present ranges. I say that I do not estimate any important EPS progress within the subsequent few years because the semiconductor market is in a droop, and traditionally AVT has not had any spectacular NI progress numbers to point out off both, and nothing main has modified within the enterprise for to suppose in any other case concerning the close to future. I would find yourself unsuitable, however I’m assured taking a extra cautious method right here might be rewarded.

The Bear Thesis

The bear thesis for AVT revolves quite a bit across the cyclicality of the business they’re in, however maybe extra so now with the stock ranges as properly. Stock ranges have ballooned as much as $6.116 billion, an enormous improve prior to now few years. Because the CEO of AVT talked about, they should deal with eliminating a few of this stock to construct up extra as soon as once more and never discover themselves in a bottleneck. If they can not get stock out quick sufficient it would imply decrease web earnings however nonetheless the identical operational bills as earlier than. Estimates are a bit up and down for the following few years, however that 2024 and 2025 may very well be powerful years for the business I believe is true. Seeing how AVT navigates this might be fascinating, however with that stated, I believe the valuation is sensible and it seems to be like a worth lure.

State Of The Firm

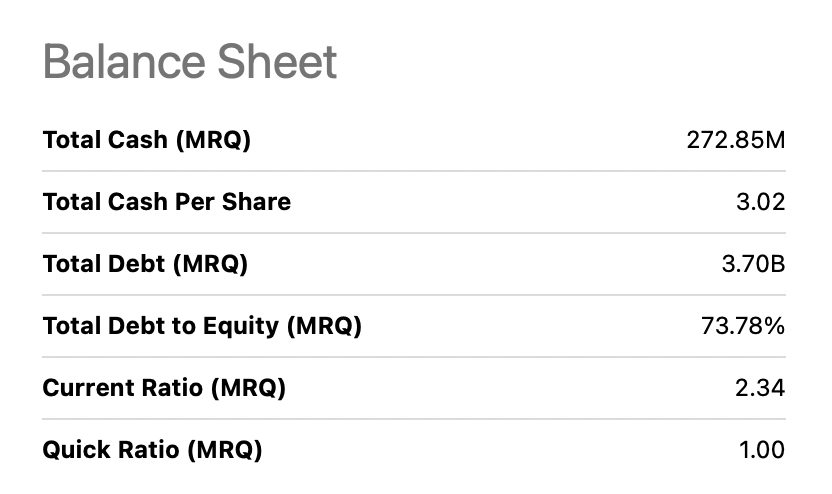

Steadiness Sheet (In search of Alpha)

With a market cap of $4.1 billion, I maintain the opinion that AVT would not have that sturdy of a stability sheet proper now. The money place, which is essentially the most liquid asset an organization may maintain could be very low compared to the whole money owed, $272 million in comparison with $3.7 billion. Over the previous years, AVT hasn’t prioritized essentially to boost its liquid property and being in a greater place as soon as these money owed mature. Debt has practically tripled since 2021 and leveraging like this was very unlucky for the corporate as rates of interest rose shortly after, which means that AVT now pays $291 million in curiosity bills. All in all, I discover the state of the corporate to be needing a whole lot of enhancements. Paying down debt over the following few years might be capital that in any other case may have been used to increase the enterprise. With a small present asset AVT can also be in a dangerous place ought to there be short-term earnings challenges and so they have money owed maturing.

Funding Conclusion

AVT has been in operation for a really very long time, however the efficiency these previous 10 years has been disappointing I’ve to say. The corporate ought to profit from the demand for semiconductors however I do not suppose AVT has been capable of correctly seize this. The market has persistently given the corporate a low valuation, which when dissecting the corporate makes a whole lot of sense. I believe the draw back is decrease and a few flooring may need been established across the $43 – $45 vary. However with out something concrete to purchase into I’ll assess AVT as a maintain score.