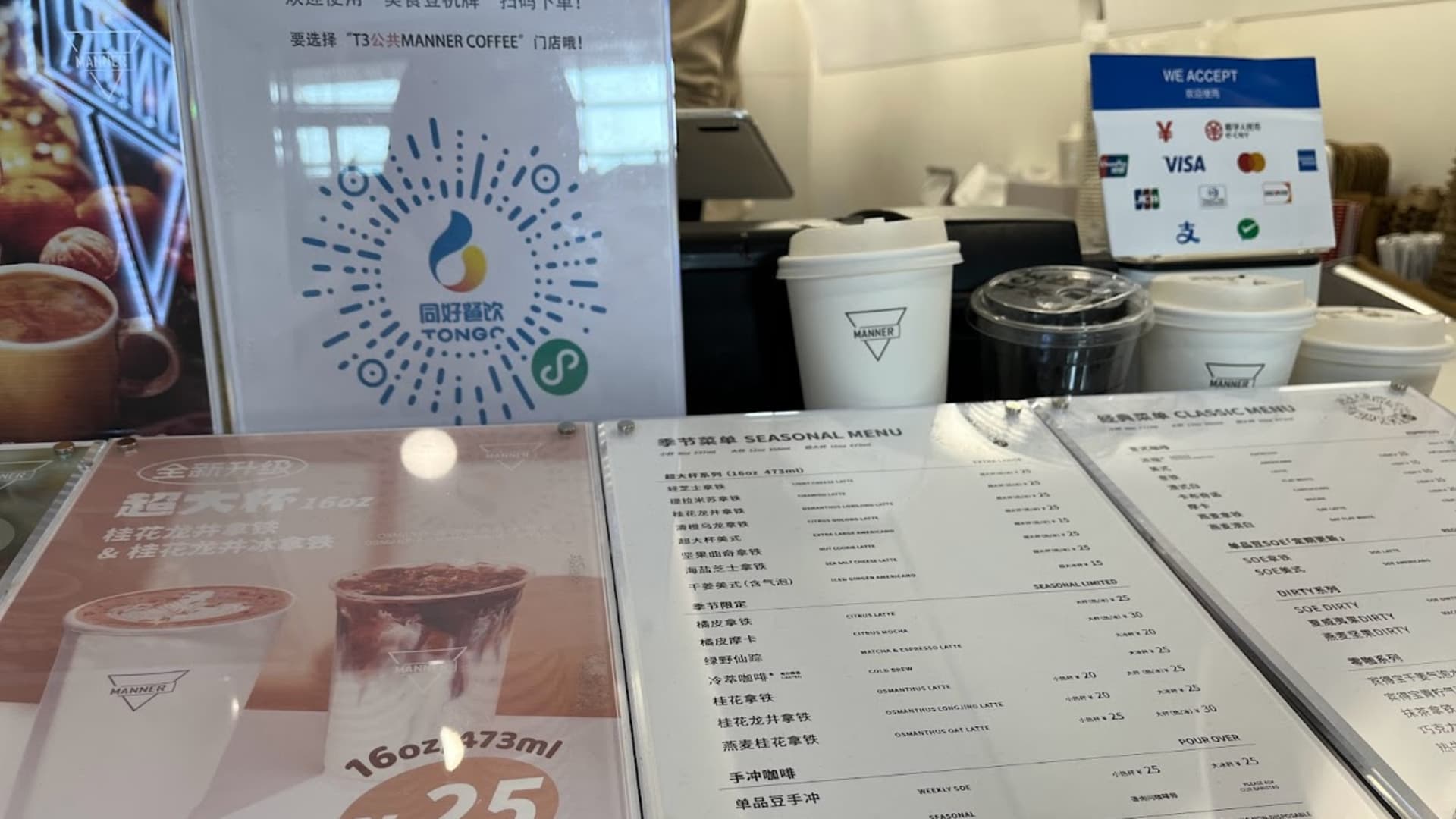

A espresso store at Beijing Capital Airport reveals prospects can use Visa, Mastercard, the digital Chinese language yuan and different fee strategies.

CNBC | Evelyn Cheng

BEIJING — China is encouraging banks and native companies to simply accept international financial institution playing cards and is contemplating different steps to make cellular pay for worldwide guests even simpler, mentioned Zhang Qingsong, deputy governor of the Folks’s Financial institution of China.

“Banks and distributors (comparable to resorts, eating places, malls and even espresso outlets) are inspired to simply accept international bankcards,” Zhang mentioned.

His written feedback, unique to CNBC, come as Beijing has stepped up efforts to encourage visits from international vacationers and enterprise individuals. In the previous couple of months, authorities have enacted visa-free journey insurance policies for residents of a number of European and Southeast Asian nations — after stringent border controls throughout the pandemic.

Cell pay took off in China within the final a number of years. However whereas it has been handy for locals to scan a QR code with a smartphone to pay, monetary system restrictions have additionally meant foreigners typically discovered it tough to make funds. Purchasing malls have more and more most well-liked to not settle for international bank cards.

However that is began to alter in current months.

Final summer time, the 2 dominant cellular pay apps WeChat and AliPay began permitting verified customers to attach their worldwide bank cards — comparable to these from Visa. Tencent owns WeChat, whereas AliPay is operated by Alibaba affiliate Ant Group.

“We’re totally conscious that international guests care very a lot about their privateness,” Zhang mentioned “We take this subject significantly and have put in place measures for info safety.”

“Now, when utilizing Alipay or WeChat Pay, international guests don’t want to supply ID info if their whole annual transaction quantity is below $500,” he mentioned. “It’s estimated that over 80% transactions are beneath this threshold. We’re additionally the potential of elevating the $500 threshold sooner or later.”

Zhang and different officers attended an occasion Monday at Beijing Capital Airport to formally open a funds service middle for visiting foreigners.

Whereas their public remarks talked about the digital yuan, they centered on discussing the provision of money forex alternate, better acceptance of abroad playing cards and extra cellular pay assist.

The variety of vacationers out and in of mainland China has “continued to enhance however each remained beneath 2019 ranges,” Visa executives mentioned on an earnings name in late January, based on a FactSet transcript.

Overseas monetary providers companies have additionally began to see improved entry to China, after years of ready throughout which worldwide corporations criticized Beijing for favoring home gamers till they grew giant sufficient.

Mastercard in November introduced its three way partnership in China acquired approval from the PBOC to start processing home funds. The enterprise waited practically 4 years since its software to start preparations was authorised in precept.

Zhang mentioned China’s plan for supporting foreigners’ funds within the nation would concentrate on permitting card transactions for giant funds and cellular pay for smaller quantities.

Customers of 13 international cellular pockets apps may instantly use QR fee codes in China, Zhang claimed, with out naming the apps.

“On the identical time money is all the time out there and accepted,” he mentioned.

Ant Group in September mentioned customers of 10 main cellular fee apps in nations comparable to Singapore, South Korea and Thailand may use the identical apps to scan AliPay QR fee codes in mainland China — a product the corporate calls Alipay+.