Bloomberg/Bloomberg by way of Getty Photos

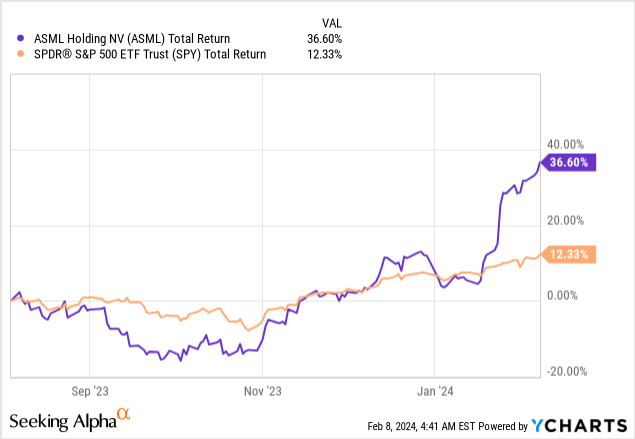

ASML Holding N.V. (NASDAQ:ASML) ended its fiscal yr in exceptional style, beating the S&P after ASML didn’t ship an excellent return all through its complete fiscal yr. ASML has impressively crushed Wall Avenue expectations, and that is the steering.

In August, I printed an article titled “ASML’s Combined Outlook: Close to-Time period Headwinds, Lengthy-Time period Promise.” In that article, I argued that ASML is a monopoly firm with a powerful long-term funding thesis, regardless of combined outcomes for the second quarter of 2023.

In my final article, ASML: Close to-Time period Headwinds Weigh On Q3 Outcomes. I defined the Q3 highlights, and the headwinds that affected Q3.

Let’s dive into the corporate’s fourth-quarter outcomes, see how my projection fared in comparison with the consensus, and discover out if the funding thesis stays.

Funding thesis

I consider that ASML is a superb funding for the long run. The corporate has a powerful monitor file of development, and it’s well-positioned to learn from the expansion of the semiconductor market. Nevertheless, I consider that the corporate’s valuation is presently considerably stretched, and I’d suggest a Maintain ranking till the corporate’s near-term challenges are resolved.

Background

In August, I started to see a restoration in ASML’s efficiency. Nevertheless, up till the fourth quarter outcomes had been launched, ASML’s returns had been fairly just like these of the (SPY) and didn’t outperform it.

Now that it has been noticed that ASML outperformed the S&P 500 within the fourth quarter, it is essential to look at the elements that led to this achievement and whether or not they’re sustainable. Moreover, it is essential to research the explanations behind the ten% rise in ASML’s inventory worth following the discharge of their monetary outcomes.

This autumn-23 Highlights

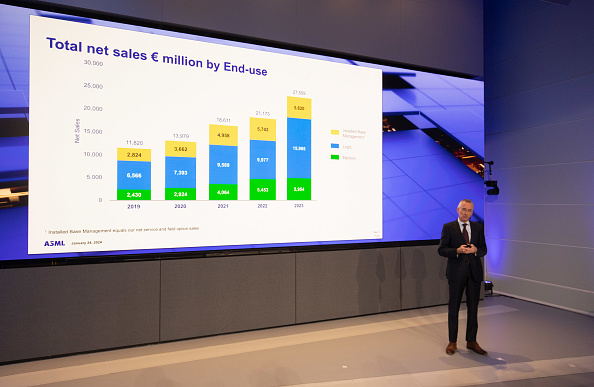

In This autumn-23, ASML’s consolidated income stood at €7.2 billion, indicating a 12.6% YoY development. For the whole 2023, it reported a income of €27.5 billion, up 30.2% YoY. Apparently, the EUV system gross sales witnessed a exceptional development of 30%, which could be attributed to the excessive demand for Lithography machines from the earlier yr.

ASML’s monopoly out there is because of its edge in producing EUV lithography, which is a big benefit as there are not any different corporations that presently supply this expertise. If we analyze the small print, we are able to perceive how this benefit contributes to their main place within the business.

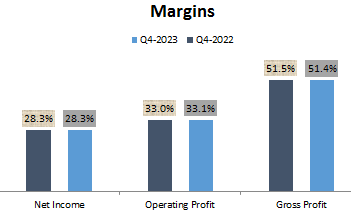

Margins (This evaluation is predicated on information sourced from official Asml monetary paperwork)

Our clients throughout completely different market segments are presently extra cautious as a consequence of continued macroeconomic uncertainties, and due to this fact anticipate a later restoration of their markets. Additionally, the form of the restoration slope remains to be unclear.

Peter Wennink, CEO, Q2-2023 Press Launch

The corporate anticipates a small decline in demand quickly. This is because of macroeconomic uncertainty and a restoration that’s slower than anticipated. However, in my opinion, as a monopoly firm with a excessive pricing energy and robust demand, I would like that the corporate to handle its prices and lift the costs for its merchandise, which didn’t occur.

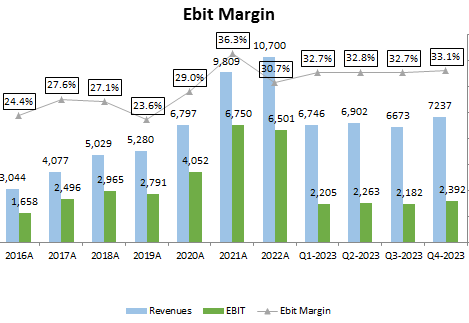

In my earlier publication concerning ASML, I knowledgeable you that the corporate’s administration has acknowledged the upcoming decline in demand. Regardless of this, we are able to observe that the corporate has a powerful aggressive benefit by its large moat. One of many methods that is evident is by trying on the firm’s constant margins, which have been maintained at a spread of 32% to 33%, as demonstrated within the graph under.

Ebit Margin (This evaluation is predicated on information sourced from official Asml monetary paperwork)

Regardless of the present unsettled macroeconomic circumstances and a gradual restoration charge, ASML has managed to keep up its margins with none important decline. This can be a testomony to the robustness of their moat and speaks volumes concerning the firm’s capacity to climate powerful occasions.

Outlook

Primarily based on completely different market scenarios1 as offered throughout our Investor Day in November 2022, we modeled a possibility to achieve annual income in 2025 between roughly €30 billion and €40 billion, with a gross margin between roughly 54% and 56% and in 2030 an annual income between roughly €44 billion and €60 billion, with a gross margin between roughly 56% and 60%

As per the newest replace from ASML’s administration, the corporate is anticipated to keep up its constructive steering within the foreseeable future, primarily because of the strong demand for its lithography machines. ASML stays on the forefront of the semiconductor business because the main provider of superior lithography methods, that are important for the manufacturing of high-performance pc chips.

Valuation

I performed a valuation of ASML utilizing a DCF methodology. In my evaluation, I projected a CAGR of 11% for the corporate’s income from 2024 to 2031, bearing in mind its monopoly place and excessive pricing energy. Moreover, I estimated a 2.4% FCF yield for the 2025 exit.

ASML’s Fwd PEG ratio presently stands at 2.22x, which is a tad excessive, indicating the presence of excessive near-term concern. Though ASML witnessed a ten% upside bounce after earnings, I nonetheless consider it to be a worthwhile long-term funding. Though ASML goes to face some demand issues, it’s nonetheless anticipated to carry out properly in the long term. Nevertheless, within the close to time period, it might not carry out higher than SPX.

Dangers

It is essential to acknowledge potential dangers that might influence my thesis:

Macroeconomic headwinds: The continuing international financial uncertainty, inflation, and potential recession might dampen demand for semiconductors, impacting ASML’s gross sales and profitability.

Technological developments: Though ASML holds the present edge in EUV expertise, rivals might develop various lithography options or catch up in EUV improvement, eroding ASML’s monopoly energy.

Geopolitical dangers: Commerce tensions and disruptions in key markets, notably China, might pose challenges for ASML’s provide chain and buyer base.

Execution danger: Failure to fulfill manufacturing targets, delays in technological developments, or mismanagement might negatively influence ASML’s efficiency.

Conclusion

ASML navigated a difficult yr to emerge as a winner within the fourth quarter, outperforming the S&P 500 and exceeding expectations. Its monopoly in EUV lithography stays a powerful moat, mirrored in constant margins regardless of macroeconomic headwinds. Whereas a near-term demand slowdown is anticipated, the corporate’s long-term outlook stays vivid, with potential for important income and margin development.