Synthetic intelligence (AI) is likely one of the hottest expertise traits proper now, and buyers broadly need to spend money on corporations that might win large from this tech. That is pure, as AI has the power to remodel a number of industries and contribute considerably to the worldwide financial system over the following decade and past.

In response to a forecast from Bloomberg Intelligence, the generative AI market may generate a whopping $1.3 trillion in income in 2032, accounting for 12% of all tech spending in that 12 months. That might be a large leap over this 12 months’s estimate of $137 billion in generative AI spending. With that outlook in thoughts, now could be a superb time for buyers to purchase and maintain shares of stable corporations which are positioned to capitalize on the looming progress of this profitable market.

Nvidia (NASDAQ: NVDA) and Palantir Applied sciences (NYSE: PLTR) are already making the most of this large alternative. Whereas Nvidia’s graphics processing models (GPUs) are vital {hardware} for coaching and powering giant language fashions (LLMs), Palantir helps clients combine AI into their operations and use it to enhance productiveness with its software program platform.

This is why buyers ought to take into account shopping for these two AI shares and holding them for the following decade.

1. Nvidia

The demand for chips able to powering AI functions is ready to soar large time within the coming decade. In response to Allied Market Analysis, the AI chip market may generate annual income of roughly $384 billion in 2032 as in comparison with simply $15 billion in 2022. Nvidia at present has a couple of 90% share of the AI chip market, which places it in a stable place to benefit from this chance.

The nice half is that Nvidia is already witnessing eye-popping progress. The corporate will launch its fiscal 2024 outcomes subsequent week, and analysts expect it to report that its income elevated 119% to $59 billion. What’s extra, Nvidia’s earnings are anticipated to leap from $3.34 per share in fiscal 2023 to $12.33 in fiscal 2024 due to the super pricing energy it enjoys in AI chips.

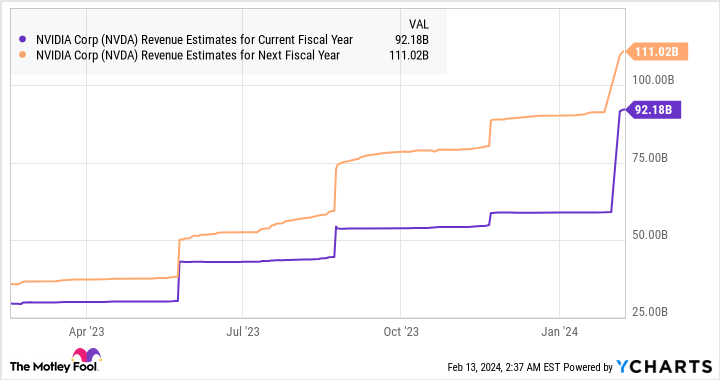

Extra importantly, Nvidia’s enterprise is predicted to develop at a wholesome fee. That is evident from the chart beneath, which additionally exhibits that analysts have been elevating their progress expectations.

Once more, Nvidia’s earnings are forecast to extend at an astounding compound annual fee of 102% over the following 5 years. All this explains why Nvidia is likely one of the high AI shares you possibly can purchase proper now, particularly contemplating that the corporate is transferring shortly to make sure that it stays the highest participant on this market.

As an illustration, Nvidia up to date its product roadmap final 12 months to remain forward of its rivals. It is going to be releasing up to date AI chips yearly as a substitute of following a two-year cycle. That schedule may assist Nvidia keep its spectacular share of the AI chip market. And now, stories counsel that Nvidia is seeking to make customized AI chips as effectively.

Reuters stories that Nvidia is citing a brand new enterprise unit to make bespoke AI chips for cloud infrastructure service suppliers and others. Although the demand for Nvidia’s GPUs has been so sturdy that would-be clients could have to attend for so long as a 12 months to get their fingers on them, some corporations have additionally been growing customized chips internally to deal with particular AI-related workloads. Transferring into this market goes to open one other profitable income alternative for Nvidia; the customized chip market was value an estimated $30 billion final 12 months.

In all, it may be stated that Nvidia may stay the highest AI semiconductor decide over the following decade contemplating the potential progress on provide and the corporate’s present market share. Additionally, Nvidia trades at 35 occasions ahead earnings, which is a reduction to its five-year common ahead earnings a number of of 42. As such, buyers would do effectively to purchase it proper now — its sunny AI prospects may result in wholesome positive factors over the following decade.

2. Palantir Applied sciences

Whereas Nvidia is likely one of the greatest methods to faucet the AI {hardware} market, Palantir Applied sciences offers buyers a possibility to learn from the software program facet of issues. Market analysis supplier Priority Analysis predicts that the AI software program market may generate a whopping $1 trillion in income in 2032. To hit that will require it to clock a compound annual progress fee of just about 23% over the following decade.

Market analysis agency IDC ranked Palantir No. 1 within the world AI software program platform market in 2021 when it comes to each market share and income. The corporate’s newest outcomes point out that the AI software program alternative will quickly begin driving significant progress.

Whereas Palantir’s income in This autumn 2023 was up 20% 12 months over 12 months to $608 million, its business enterprise grew by 32% to $284 million. The sooner progress of the business enterprise was a results of the rising adoption of Palantir’s Synthetic Intelligence Platform (AIP) by clients.

Palantir witnessed a 44% year-over-year improve within the variety of business clients final quarter. What’s extra, the adoption of AIP helped Palantir shut 103 offers value over $1 million final quarter — twice as many as within the prior-year interval. “The demand is off the charts for AIP, with bootcamps because the supply mechanism for AIP, and we’re seeing AIP drive the increasing addressable market, that we’re seeing,” stated Chief Income Officer and Chief Authorized Officer Ryan Taylor on the newest earnings convention name.

So Palantir might be at the start of an enormous progress curve. Sure analysts assert that the corporate could also be sitting on a possible income alternative of $1 trillion within the AI software program area. Analysts’ consensus forecast is that Palantir’s earnings will improve at a compound annual fee of 85% for the following 5 years.

Contemplating the large end-market alternative the corporate is sitting on, it may maintain spectacular ranges of progress for an extended interval and ship wholesome positive factors over the following decade, which is why buyers ought to take into account shopping for this tech inventory earlier than it flies larger following its terrific positive factors prior to now 12 months.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

2 Synthetic Intelligence Shares You Can Purchase and Maintain for the Subsequent Decade was initially revealed by The Motley Idiot