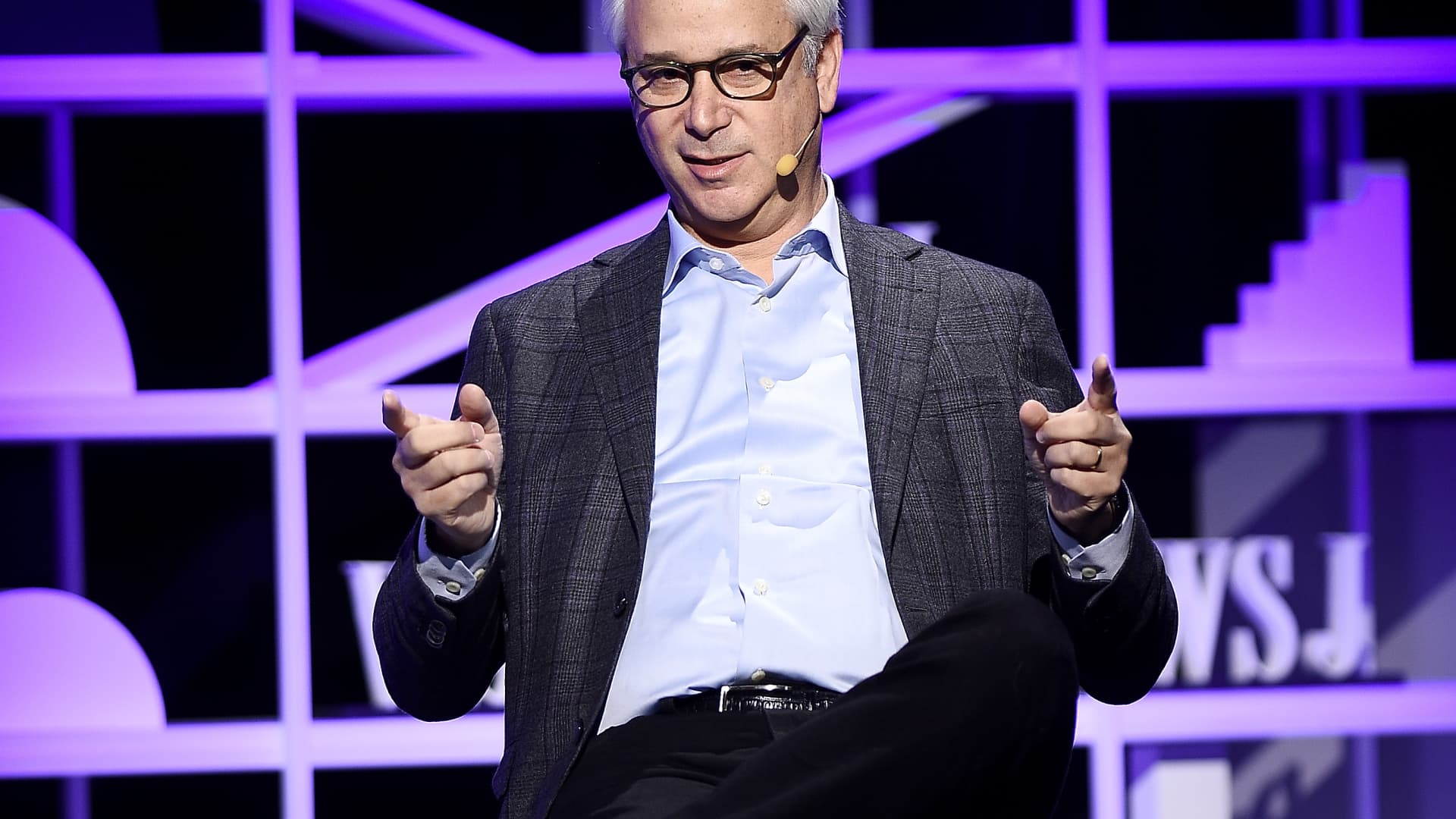

Wells Fargo President and CEO Charlie Scharf attends The Way forward for All the things offered by The Wall Road Journal at Spring Studios in New York Metropolis, on Might 17, 2022.

Steven Ferdman | Getty Pictures Leisure | Getty Pictures

Wells Fargo stated Thursday considered one of its major regulators has lifted a key penalty tied to its 2016 faux accounts scandal.

The financial institution stated in a launch that the Workplace of the Comptroller of the Foreign money terminated a consent order that pressured it to revamp the way it sells its retail services and products.

Shares of the financial institution jumped greater than 6% on the information.

Wells Fargo, one of many nation’s largest retail banks, has retired six consent orders since 2019, the 12 months CEO Charlie Scharf took over. Eight extra stay, most notably one from the Federal Reserve that caps the financial institution’s asset dimension, in line with an individual with information of the matter.

In a memo despatched to workers, Scharf referred to as the event a “milestone” for the lender. The 2016 faux accounts scandal — through which the financial institution admitted to placing clients into greater than 3 million unauthorized accounts — unleashed a wave of scrutiny that exposed issues associated to the servicing of mortgages, auto loans and different client accounts.

The eye tarnished the financial institution’s status and compelled the retirement of each ex-CEO John Stumpf in 2016 and successor Tim Sloan in 2019.

“The OCC’s motion is affirmation that we have now successfully put in place new methods, processes, and controls to serve our clients in another way at present than we did a decade in the past,” Scharf stated. “It’s our accountability to make sure we proceed to function with these disciplines.”

The termination of the OCC order “paves the way in which” for the Fed asset cap to finally be eliminated, RBC analyst Gerard Cassidy stated Thursday in a analysis word.

— CNBC’s Leslie Picker contributed to this report.

Do not miss these tales from CNBC PRO: