Murat Taner/The Picture Financial institution Unreleased through Getty Photographs

As I count on the extension of the bull run in 2024, it is likely to be a very good technique to capitalize on the uptrend by way of growth-focused ETFs like Vanguard Development Index Fund ETF Shares (NYSEARCA:VUG). VUG not solely supply the potential to completely capitalize on the potential bull run, however its diversified portfolio can even decrease the danger issue throughout downtrends and tail occasions. A decrease expense ratio, excessive liquidity and strong momentum additionally make VUG a horny choice to carry for the long run. That is an replace to my earlier article printed final yr.

The Bull Market is More likely to Final

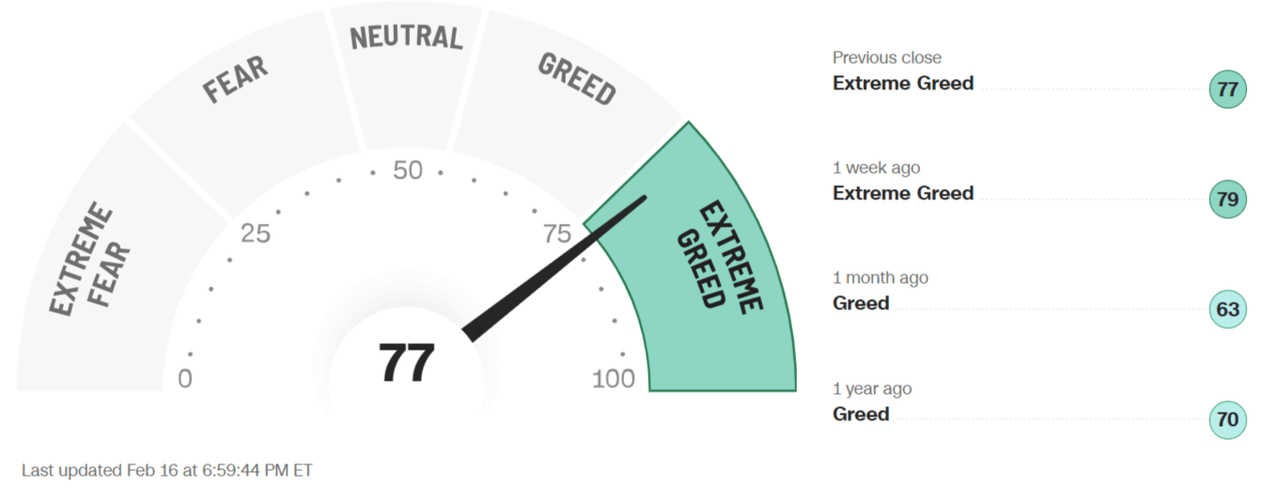

CNN Worry & Greed Index (CNN)

The US inventory market prolonged the uptrend into 2024 with developments indicating that the bull run is more likely to final for an extended time. For occasion, CNN’s Worry & Greed index, which consists of seven technical indicators, means that the market’s temper is bullish and buyers look extraordinarily grasping to capitalize on the potential positive aspects. Robust technical bullish indicators embrace low volatility together with strong breadth and power of the market. The US market’s power appears excessive given a lot of shares buying and selling round their 52-week excessive whereas a couple of commerce close to their 52-week low.

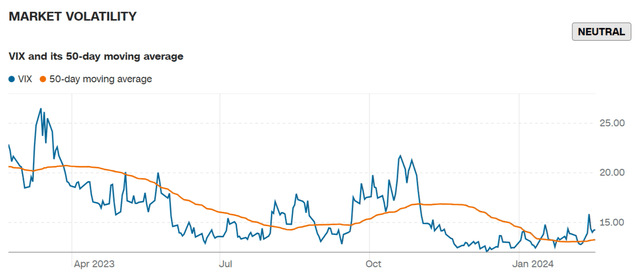

CBOE Volatility Index (CNN)

Because the well-known CBOE Volatility Index has been trending decrease, it alerts a declining worry and low volatility. Quite a few elements, similar to financial and earnings power, have been contributing to decreasing investor worry within the inventory market. The US shares are additionally buying and selling effectively above their 125-day transferring common, whereas the put & name ratio hints at greater shopping for than promoting.

Moreover technical indicators, robust fundamentals favour the extension of the bull pattern. The Fed has achieved its price hike goal and forecasts counsel at the very least three cuts in 2023. Rate of interest cuts would deliver extra investor confidence in dangerous belongings and contribute to financial and monetary stability.

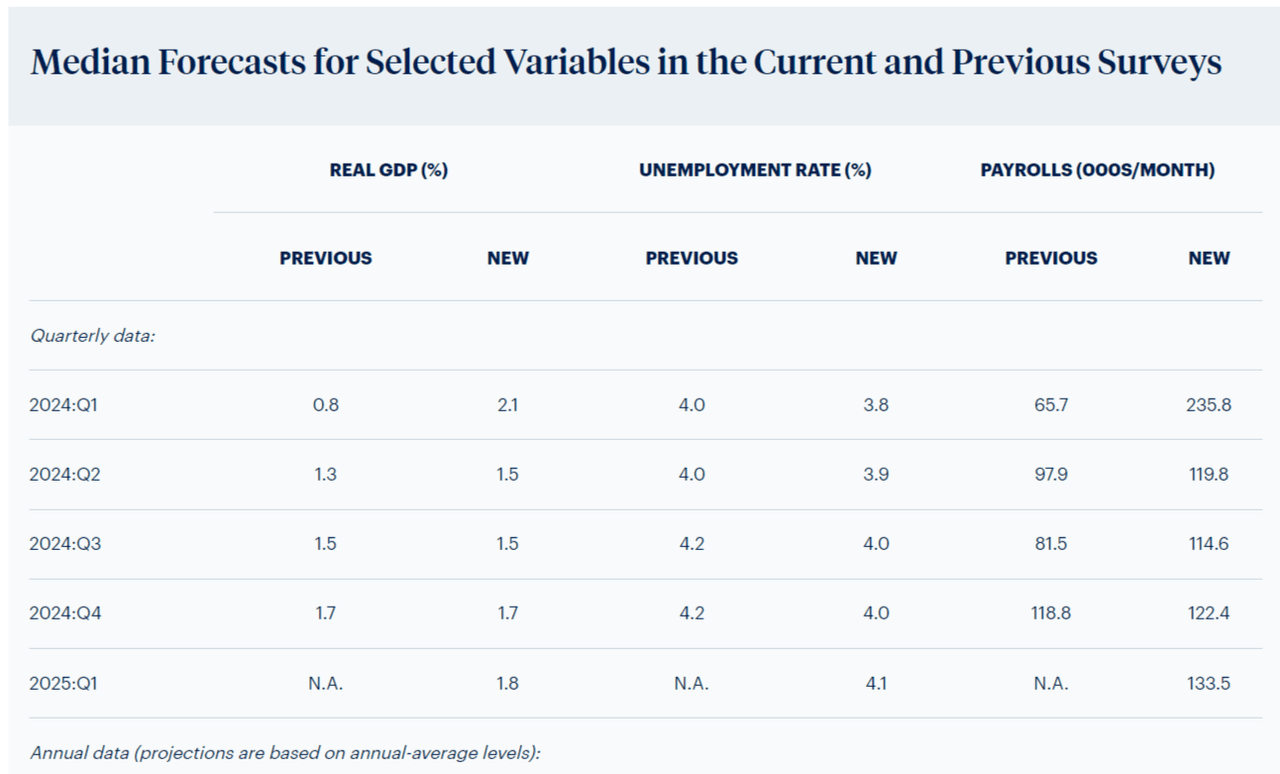

2024 GDP forecast (Federal Reserve Financial institution of Philadelphia)

The robust client spending, greater output and strong job market, which paved the trail for distinctive GDP development in 2023 in comparison with preliminary expectations for extreme recession, is once more more likely to play a key position in strengthening financial development in 2024. The Federal Reserve Financial institution of Philadelphia’s survey of 34 forecasters expects the US GDP to develop by 2.6% in 2024, up from 2.5% in 2023 and above from the earlier forecast of 1.7%. In the meantime, the Fed Atlanta anticipates even greater development for 2024, with first-quarter GDP development of two.9%. The U.S. job market information backs greater forecasts. The US added 353,000 jobs in January and wages grew 4.5% greater than a yr earlier whereas unemployment continues to hover effectively under the focused degree of 4%.

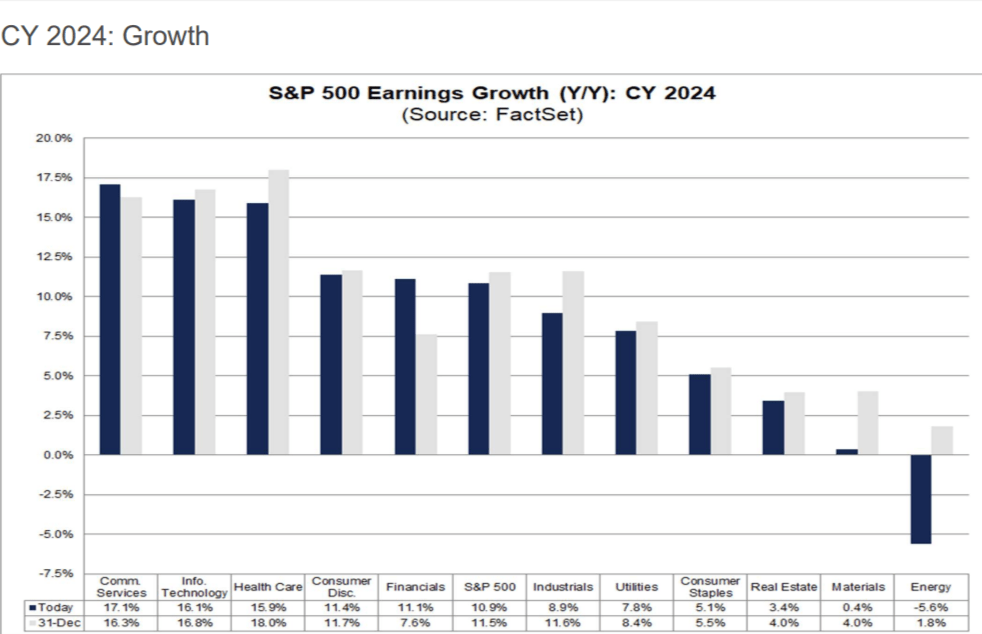

2024 earnings forecast (FactSet)

Earnings development additionally backs the uptrend. The S&P 500’s earnings are more likely to develop at a double-digit price in 2024, due to strong development from the knowledge expertise, communication and client cyclical sectors. The earnings development pattern has already begun within the ultimate quarter of 2023, with the communication, client cyclical and tech sectors reporting 45%, 32% and 20% earnings development, respectively.

Microsoft (MSFT), which is the most important tech firm, is anticipated to generate 20% earnings development in fiscal 2024. The precise quantity could exceed Wall Avenue expectations due to Microsoft’s main place within the AI market, which is anticipated to develop at a compound annual price of 37% by 2030. Microsoft topped income and earnings expectations within the December quarter, due to its cloud income development of 24% in comparison with the previous yr interval. Azure income grew 30% yr over yr and displays 6% development from the earlier quarter as a consequence of AI. Wedbush Securities analyst Dan Ives believes Microsoft’s strong outcomes and steering are just the start of the advantages of its main place in synthetic intelligence.

“With over 60% of the MSFT put in base in search of to implement AI performance throughout the whole enterprise and business panorama over the following few years based mostly on our estimates, we imagine that that is the early innings of a significant monetization alternative as the corporate doubles down on its AI technique with its Copilot generate important demand,” Wedbush Securities analyst Dan Ives mentioned.

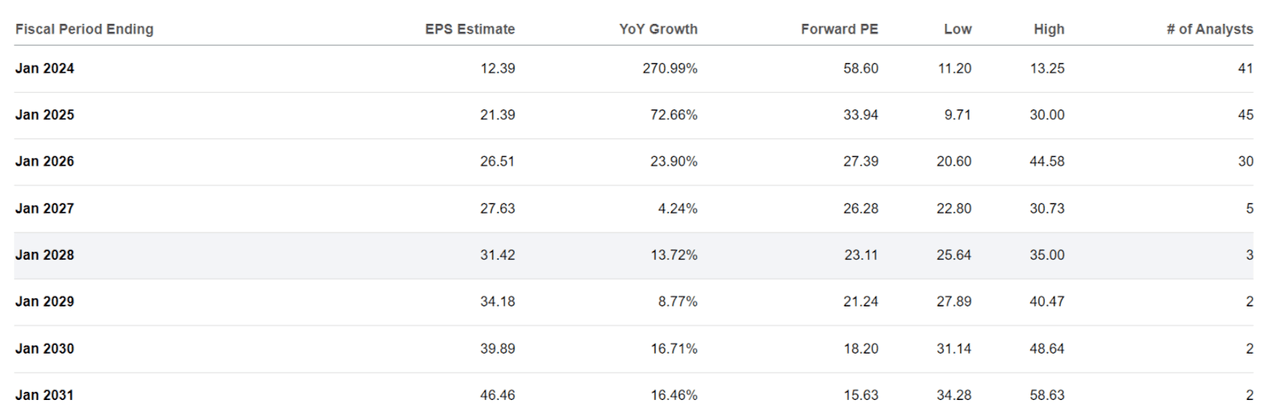

NVIDIA earnings forecast (Looking for Alpha)

NVIDIA’s (NVDA) whopping share value rally additionally seems sustainable as a result of the corporate anticipates large income and earnings in fiscal 2024 as a consequence of excessive demand for its AI-related chips in information centres. Wall Avenue expects NVIDIA’s earnings per share to hit $40 ranges by 2023 from $12 per share in 2024. NVIDIA’s income grew greater than 200% within the September quarter and the corporate forecast December-quarter income to be between $20 billion.

Moreover mega-cap info expertise shares, fast-growing client cyclical and communications shares, similar to Amazon (AMZN) and Meta Platforms (META), are probably so as to add to the upside. Amazon generated 12% income development in 2023 whereas its working earnings surged to $36.9 billion from $12.2 billion prior to now yr. Wall Avenue expects Amazon’s income and earnings development momentum to proceed within the following years. Meta considerably topped the December quarter estimates as its quarterly income grew 25% yr over yr and earnings of $5.22 per share elevated considerably from $1.76 per share within the year-ago interval. Wall Avenue expects its 2024 earnings to hit a report $20 per share in 2024 in comparison with $14.87 per share in 2023. There are a selection of different gamers within the development class with excessive double-digit income and earnings development forecast.

Development Investing More likely to Outperform

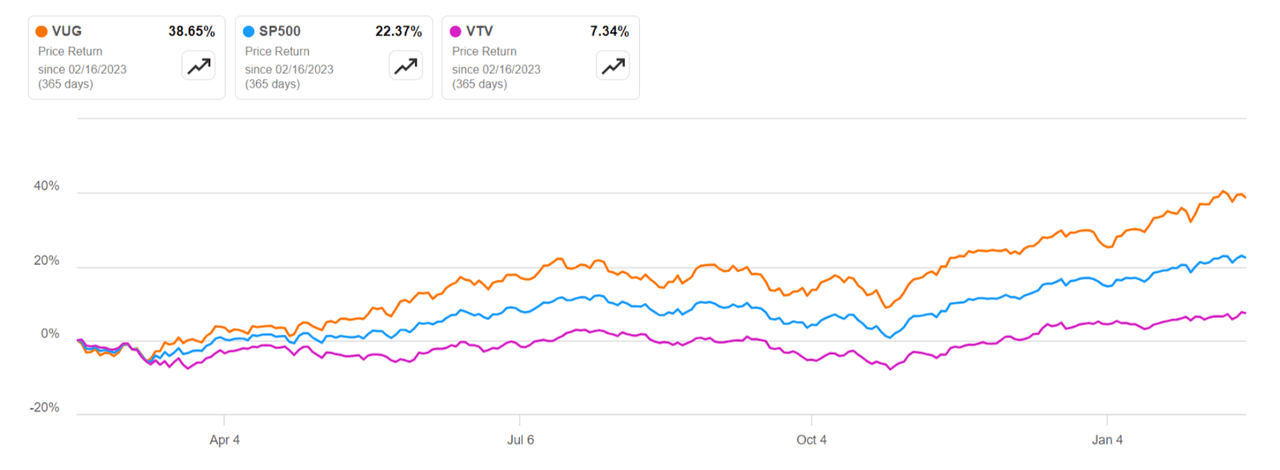

VUG Vs. VTV and S&P 500 share value (Looking for Alpha)

Development investing thrived within the final twelve months, outperforming worth and the S&P 500 by a big share. As an illustration, VUG’s share value rallied almost 39% within the final twelve months in comparison with S&P 500 and Vanguard Worth Index Fund ETF Shares (VTV) positive aspects of twenty-two% and seven.34%, respectively. The outperformance is especially attributed to bettering financial developments and strengthening investor confidence in high-beta shares. Historic developments additionally counsel that investor confidence will increase in development shares throughout financial enlargement whereas the worth class performs effectively throughout bear runs.

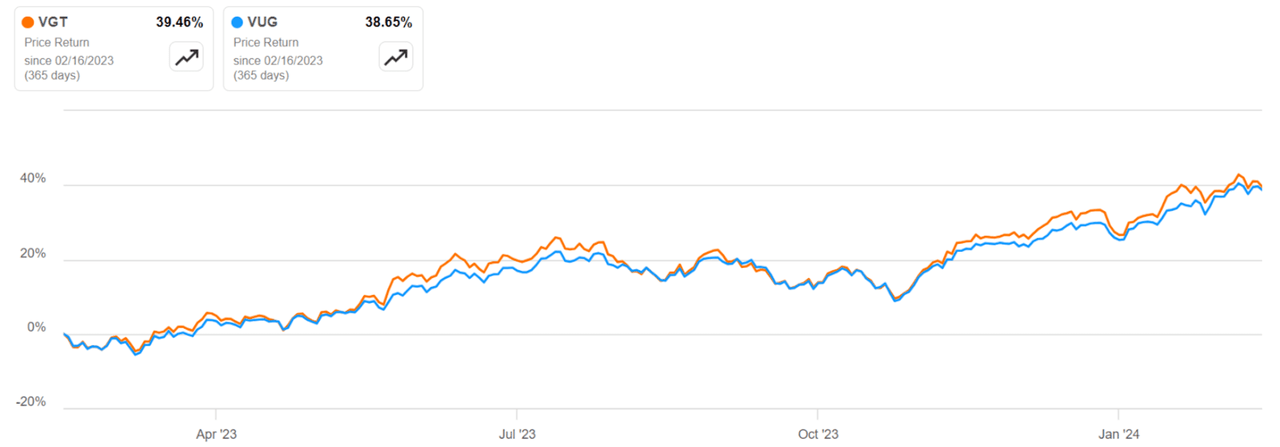

VUG Vs. VGT share value efficiency (Looking for Alpha)

Though the expertise sector has been in focus within the final twelve months with regards to producing excessive returns, I imagine the expansion class appears extra engaging than tech sector-focused investing. As an illustration, VUG’s shares rally was up barely from Vanguard Info Know-how Index Fund ETF Shares (VGT) within the final twelve months. VUG’s greater returns than the tech-focused ETF replicate the advantage of its diversification to fast-growing sectors like client cyclical and communications. VUG’s portfolio consists of 211 development shares with a big focus in mega-cap expertise, communication and client cyclical sectors. The knowledge expertise sector represents 47% of VUG’s portfolio whereas client cyclical and communication shares make up 17% and 13%. Its high 10 shares characterize 55% of the whole portfolio with an impressive 7 representing the key share.

Furthermore, with tech-focused ETFs like VGT, buyers gained’t have the ability to profit from gorgeous positive aspects from the magnificent 7 group, which generated greater than 100% share value development in 2023. VGT’s portfolio comprises solely three shares from the group, together with Microsoft, Apple (AAPL) and NVIDIA. I imagine publicity to fast-growing shares similar to Meta, Amazon, Telsa (TSLA) and Alphabet (GOOG) (GOOGL) could make an enormous distinction in returns as a consequence of their robust earnings development energy and strong share value momentum. As an illustration, Meta’s shares rallied 180% within the final twelve months and Wall Avenue anticipate its earnings to develop by 34% yr over yr in 2024.

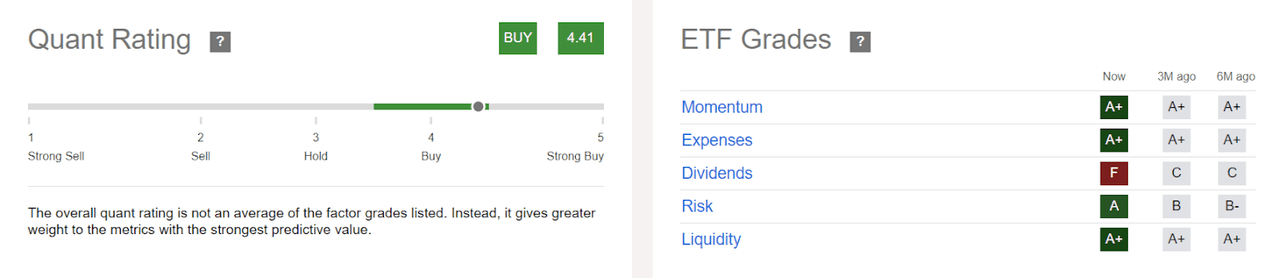

VUG quant score (Looking for Alpha)

Chasing tech ETFs carries a better threat than growth-focused ETFs like VUG as a consequence of an absence of portfolio diversification to different sectors. Looking for Alpha’s quant score additionally hints at robust momentum and a low-risk issue for VUG. It earned an A-plus grade on the momentum issue whereas an A on the danger issue. On the flipside, VGT earned a B grade on the danger issue as a consequence of an absence of portfolio diversification. VGT’s expense ratio of 0.10% can also be greater than VUG’s 0.04%.

I additionally choose VUG over its friends similar to SPDR Portfolio S&P 500 Development ETF (SPYG) and Vanguard S&P 500 Development ETF (VOOG) due to its low expense ratio, higher portfolio combine and excessive share value momentum. VUG shares are up almost 40% within the final twelve months in comparison with a 30% enhance from SPYG and VOOG. VUG is ranked 13 out of 84 growth-focused ETFs based mostly on Looking for Alpha quant score whereas SPYG and VOOG stand at twenty seventh and twenty ninth spot.

In Conclusion

As prospects of the extension of the bull run are excessive in 2024, it is likely to be a very good technique to chase the bull run with growth-focused ETFs like VUG. Its portfolio of 210 shares with a focus on mega and large-cap shares from the expertise, client cyclical and communication sectors will increase its potential to completely capitalize on the potential bull whereas decreasing the dangers related to sector-focused investing. Furthermore, its low expense ratio and better liquidity make it a strong decide for long-term investing.