adventtr

The Exscientia Experiment: When AI Meets Pharma Realities

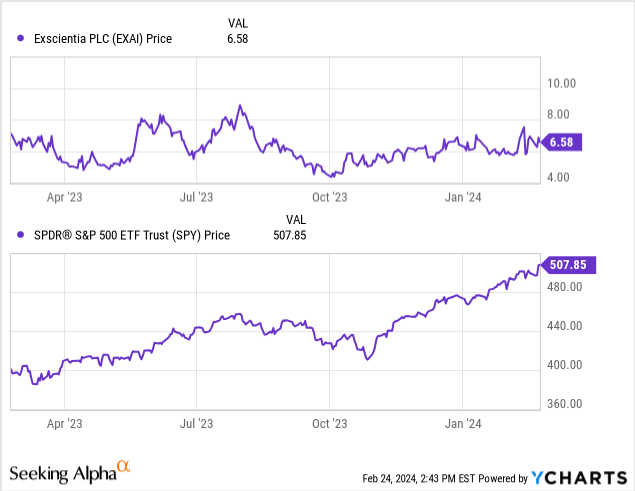

Exscientia’s (NASDAQ:EXAI) inventory is off 22% since my “Purchase” advice in August. It seems I referred to as a high. The inventory has been primarily flat previously 12 months. The corporate has garnered some curiosity at the moment resulting from its utilization of synthetic intelligence [AI] in drug discovery. Whereas that is an thrilling software within the biotechnology sector, we additionally must see progress and leads to scientific trials.

Not too long ago, the corporate introduced it terminated CEO Andrew Hopkins resulting from “inappropriate conduct” with staff. Hopkins was the founding father of Exscientia, so this information is particularly disappointing. Traders responded by dropping the inventory’s worth by 20%, which is fairly exceptional given the circumstances are, predominately, unrelated to enterprise developments. However this serves as a reminder of the character of biotechnology investing and the “unseen” dangers concerned with investing. These valuations the market assigns to speculative, clinical-stage biotechs, specifically, are fickle. In any case, I do not interpret this as a significant occasion that warrants a significant change in valuation or thesis.

Transferring on to pipeline efforts, as of November’s replace, Exscientia’s ELUCIDATE trial for CDK7 inhibitor GTAEXS617 progresses, concentrating on a number of cancers. The agency focuses on advancing the LSD1 inhibitor EXS74539, with scientific trials beginning this 12 months. At ESMO 2023, preclinical knowledge on EXS74539 for AML and its mixture potential have been showcased.

Our preclinical knowledge demonstrated ex vivo efficacy of ‘539 towards AML blast cells and supported the combinatorial potential of ‘539 with first line scientific AML remedy methods. Leveraging the reversibility of ‘539 allowed the design of tailored drug regimens, to protect the protection profile of this inhibitor on non-transformed wholesome cells.

Lastly, its MALT1 inhibitor EXS73565 is advancing, with updates anticipated quickly, with a deal with its security profile.

In December, Exscientia introduced a collaboration with pharma large Sanofi (SNY). Sanofi will make the most of Exscientia’s AI-discovery platform to develop a drug. Exscientia might be owed as much as $45 million in upfront and preclinical milestones, in addition to a further $300 million and tiered royalties, assuming the asset advances by means of trials, achieves approval, and finds success in the marketplace.

Given the above occasions, it isn’t stunning that Exscientia’s inventory has been stagnant for a while. The corporate awaits a “sign” that demonstrates their supposed technological moat (AI-driven drug discovery) really results in differentiated outcomes.

Monetary Well being

Turning to Exscientia’s steadiness sheet, the corporate’s liquid belongings whole roughly £366.6 million, comprising £109.3 million in money and money equivalents and £257.3 million in short-term financial institution deposits. When evaluating these belongings to the corporate’s liabilities, which embody £10.3 million in commerce payables, £2.3 million in lease liabilities, and £22.5 million in contract liabilities amongst different present liabilities totaling £66.4 million, the present ratio is roughly 5.52, indicating a powerful liquidity place. The month-to-month money burn, derived from a web money utilized in working actions of £118.8 million over 9 months, averages about £13.2 million. This implies a money runway of roughly 27.8 months, primarily based on present burn charges. Nonetheless, these figures are primarily based on previous efficiency and should not precisely predict future circumstances.

Exscientia’s important money outflow in the direction of working actions, alongside a considerable funding in short-term financial institution deposits regardless of a web loss, signifies a method centered on safeguarding liquidity. The probability of needing further financing throughout the subsequent twelve months appears low, given the present money runway and the corporate’s technique to handle liquidity effectively.

(Observe: As of writing, 1 pound sterling (£) equals 1.27 United States {dollars}.)

Market Sentiment

In keeping with In search of Alpha knowledge, EXAI presents a nuanced profile with a market capitalization of $822.10 million, signaling a mid-tier biotech participant. Analysts undertaking a income bounce to $77.47 million by 2024. Nonetheless, inventory momentum trails the SPY, notably over 6 to 12 months, highlighting potential underperformance.

Per Fintel, quick curiosity stands at 3,439,455 shares, a average 3.76% of float, suggesting a balanced but cautious market sentiment. Institutional possession sees a dynamic shift, with 632,411 acquired shares versus 2,036,845 offered out, indicating an institutional perspective that’s leaning unfavourable. Key establishments like Softbank Group and Laurion Capital Administration alter holdings, reflecting strategic realignments. Glancing at Nasdaq knowledge didn’t reveal any insider exercise previously twelve months.

Given these components, EXAI’s market sentiment qualifies as “fragile.” Unfavorable institutional sentiment and poor inventory efficiency dominate the image right here.

Is EXAI Inventory a Purchase, Promote, or Maintain?

Exscientia’s trajectory publish my “Purchase” nod has been fraught with challenges, notably a key shift in management and prevailing investor skepticism, regardless of strides in AI-facilitated drug discovery. The ousting of CEO Hopkins, a pivotal determine, casts a shadow on the agency’s journey, diluting the influence of current pipeline developments and a notable collaboration with Sanofi. Financially, Exscientia stands on agency floor, boasting commendable liquidity and a prudent money burn technique. But, the market’s tepid reception hints at underlying apprehensions in regards to the speedy worth and outcomes of its AI-driven endeavors.

The cornerstone of Exscientia’s potential success hinges on its AI prowess. The tangible advantages of this technological superiority in drug improvement and gaining market approval are, nonetheless, pending realization. Indicators from the market, together with shifts amongst institutional backers and a modest quick curiosity, level to a guarded optimism, indicating potential hurdles in maintaining the momentum.

In gentle of the amalgamation of breakthrough expertise, stable monetary well being, but blended market sentiments and up to date govt upheaval, my advice shifts to “maintain.” This cautious strategy is in anticipation of definitive indicators of scientific achievement and market endorsement that would pivot Exscientia’s development path. Stakeholders ought to maintain a vigilant eye on imminent trial knowledge and the mixing of AI discoveries into the market. These parts are pivotal in gauging the agency’s functionality to translate its technological vanguard into long-lasting, distinctive success.