Nastassia Samal/iStock through Getty Pictures

Expensive Co-Investor

The SaltLight Worldwide Versatile Fund returned 30.8% in 2023 – the ultimate quarter turned out to be a really robust end for the yr with a +15.4% return.

What went in our favour? We had been lucky to have some publicity to a few of the ‘Magnificent Seven’ – Amazon (AMZN), Nvidia (NVDA), META Platforms and Google (GOOG,GOOGL, though in mixture, we nonetheless maintain a smaller weighting than the S&P500). The return wasn’t all because of the so-called ‘AI Winners’. Our investments in MercadoLibre (MELI), Roblox (RBLX), and the Brookfield (BN) entities contributed considerably to the return.

While we’re happy with the fund’s consequence, the acute variance highlights to us, as soon as once more, that predicting short-term inventory market gyrations is virtually unattainable.

All through 2023, we had the idea that the fund was enterprise a yr of ‘sowing’ – laying the groundwork for our 2028 funding horizon with the potential of ‘inexperienced shoots’ showing in 2024 (we’ll discuss these later within the letter).

Our inside metrics point out that, when correct, our capital deployed right into a enterprise is usually early. Nonetheless, by the 18 to 24-month mark, our funding theses begin to manifest in tangible metrics and are subsequently recognised by the inventory market.

We’re left with a quandary about attributing our ability or luck to the fund’s efficiency in 2023. It is a difficult enterprise to attempt to divine whether or not the market is lastly catching a glimpse of what we have been seeing all alongside or if we’re simply using a wave of beneficial threat situations.

Turning to 2024

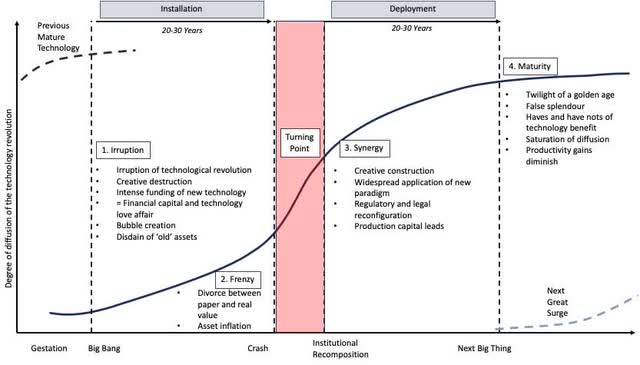

Determine 1 – Expertise Epochs (Technological Revolutions and Monetary Capital)

At SaltLight, we have been considerably candid about our constructive view of AI and its transformative potential throughout varied industries. In our 1Q23 letter, we confirmed this chart, an extract from Carlota Perez’s e book ” Technological Revolutions and Monetary Capital“.

Summed up, all expertise epochs take a very long time, however comply with a broadly comparable diffusion framework over a multi-decade interval. The place are we at the moment? We’ll inform you with excellent hindsight in ten years. However the price-inferred odds and a few broad unknown, unknown questions make us cautious within the AI Infrastructure house.

How will all this AI infrastructure capex generate a return on capital over the following 5 years while expertise diffusion remains to be very low?

Historical past tells us that if a expertise incumbent doesn’t adapt within the early section of an epoch change, it may possibly fall behind. Subsequently, the rationale for the Giant Tech spend is considerably logical – within the hope that if spaghetti is thrown towards the wall, some will stick.

The difficulty is that the true AI alternative within the enterprise is unlikely to occur inside the subsequent 2-3 years as most are projecting. Not due to AI expertise however as a result of firstly it is nonetheless too tough for even essentially the most expert enterprise to create something of considerable worth for a company. To get to a spot the place enterprises can use AI on their area information, they’re going to have to considerably rearchitect how they retailer and utilise information. This can take time.

Secondly, AI compute is simply too costly and subsequently hinders every-day adoption.

How does this present batch of capex not turn into quickly out of date?

We’re conscious about the fast tempo at which AI expertise, significantly giant language fashions (LLMs), is advancing. The heuristic is: LLM efficiency doubles with a tenfold improve in information and compute emphasises a marked departure from conventional Moore’s Legislation scaling (2x each 18 months). At present’s cutting-edge AI infrastructure may swiftly turn into outdated.

Our basic unease is that what we began with: the market can rapidly overestimate what could be completed within the quick time period and underestimate what’s going to occur in the long run.

We consider that the market has discounted formidable adoption charges in AI infrastructure companies by a large margin. There’s a excessive threat of disappointment and so we’ve got pared a few of our AI infrastructure investments. It is a robust factor to promote a broad alternative set that has unimaginable potential however at these costs, we predict the constructive anticipated worth in AI alternatives now rests within the palms of sure AI software program purposes (extra on this letter). Whereas there’s all the time the danger that our assessments could miss the mark, these choices are made to steadiness our portfolio’s threat when it comes to our resilience and optionality framework.

On this letter, we’ll discuss three portfolio firms: Meta Platforms, AppLovin (APP) and Transaction Capital.

Whereas we’re cautious in AI infrastructure, we do assume there are mispriced alternatives in areas of utility software program the place AI could be infused to make a step change enchancment.

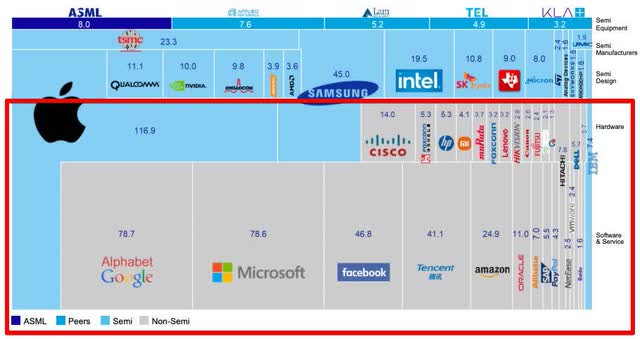

Posted in our workplace is that this chart that ASML gives at every of its investor days. This chart is slightly outdated from 2021, however we predict illustrates how worth (in working revenue) was distributed throughout semiconductors, {hardware}, after which software program & companies.

It is very clear that a lot of the financial worth up to now has accrued to the software program companies (in gray) constructed on the backs of extremely technical firms run by extraordinarily good folks.

Determine 2 – Working Margin Distribution in Expertise (Supply: ASML)

Why is that this? We expect it is because of a mixture of distribution and community results. Our working speculation proper now could be that this may seemingly stay an identical final result within the AI epoch. One outlier proper now could be Nvidia which is capturing 80% margins.

To place it in perspective, if present estimates are right, $100bn has been spent on AI information centre expenditure with Nvidia. At 80% margins, NVIDIA is conserving $80bn and their suppliers – the fabs, designers, and tools producers are solely sharing $20bn.

We are able to provide no forecast of how lengthy this aggressive state will final. The arguments for his or her distinctive capabilities and ecosystem that justify their margin seize are excellent. We’ll remark that their present value is determined by the scenario lasting for a really very long time.

While we can not predict this necessary issue, we’re focusing our consideration (and capital) on AI and software program beneficiaries.

Our funding technique hinges on figuring out and capitalising on alternatives inside sectors the place we discern a site benefit, be it by means of deep business data or a novel perception right into a enterprise mannequin.

The purpose for us is to repeatedly fortify our aggressive edge by immersing ourselves additional into these area of interest areas. This course of is laborious and, to some, would possibly seem extreme. However generally a number of concepts intersect to yield a ‘Eureka!’ second.

A main instance of this method is the convergence of three areas of our analysis: AI, community economies and digital promoting. This trifecta has emerged as a fertile floor for alternative and these insights have been repeatable and worthwhile throughout our portfolio.

Promoting and AI are an Wonderful Answer to Generate Profitability

With rising rates of interest during the last two years, traders have demanded that fast-growing expertise firms ‘get match’ and transfer in direction of free money move (‘FCF’) profitability. An unmistakable dispersion now exists within the software program sector. Primarily based on analysis by Meritech, a cashflow-positive firm trades at a 33% premium a number of relative to a cash-burning firm1 If there are not any distribution or community prices. The message is now: develop at a excessive price however do it profitably!

Promoting is without doubt one of the simpler levers for administration to drag. AI is a key enabler to facilitate focusing on and effectivity within the promoting providing.

Promoting Is a Swap That Can ‘Flipped On’ To Generate Margins.

In lots of instances, a enterprise with a sufficiently giant buyer base can have a low-margin core product after which monetise it with high-margin promoting. Digital promoting2 generates excessive incremental margins (as excessive because the ~80% degree). The low margin product can nearly turn into the shopper acquisition price, and the ‘actual’ enterprise turns into promoting. This technique has confirmed efficient throughout a broad spectrum of industries, from e-commerce at Amazon, MercadoLibre, and Shopee (SEA Ltd) to meals supply companies reminiscent of Uber and Simply Eat Takeaway, and even in conventional retail by means of Walmart’s promoting platform.

The important thing perception for us was that the high-margin nature of promoting justifies the heavy funding in costly AI compute for higher outcomes.

Why is promoting so enticing? Promoting networks have robust pure community results – connecting advert consumers with advert customers. The most important advert networks generate a disproportionate share of worth for either side of the community. There are few variable prices to digital promoting, so scale generates excessive working leverage (revenue progress exceeding income progress).

Now, add a dose of AI to reinforce the promoting proposition for the community and a magical (win, win, win) suggestions loop begins to happen (see Meta case examine later).

The Nature of the Promoting Knowledge to Practice AI Fashions

The sign information required to serve performant adverts are typically well-structured, excessive quantity and excessive worth (provided that proprietary information from an aggregator’s owned distribution channels).

Importantly, AI allows real-time optimisation as new sign inputs are available. Extra just lately, programmatic promoting (particularly header-bidding3) helps assess and leverage the financial worth of customers.

We thought it value taking two portfolio firms (Meta Platforms and AppLovin) as an example our factors. Each are demonstrating tangible financial advantages in current earnings outcomes.

Meta Platforms

Meta’s main mission is all about capitalising on consumer engagement and sustaining its community results. AI is augmenting their aims in two methods:

- Enhancing engagement time per each day energetic consumer (AI Job One)

- Matching advert consumers (advertisers) with advert customers (AI Job Two)

Enhancing Engagement Time per Each day Lively Consumer

Meta is within the enterprise of constructing certain that while you’re scrolling by means of your feed or watching movies, you are glued to the display so long as potential. Why? As a result of the longer you watch, the extra adverts they’ll slip into your viewing expertise (consider digital billboards). However these ‘digital billboards’ are a finite useful resource – solely extra engagement time creates them.

And here is the place the magic of ‘AI job one’ is available in – discovering that excellent video that retains you hooked – thereby growing the time you spend on the platform. It is a cycle that feeds itself: extra engagement means extra alternatives to serve adverts, which in flip means extra income.

Meta should earn the very best potential yield on every unit of advert stock – or it’s misplaced. Advert impressions are auctioned off to the very best bidder.

Matching Advert Patrons (Advertisers) with Advert Customers

Promoting networks play an important function in connecting advertisers with their target market, aiming to optimise advertisers’ advertising and marketing aims reminiscent of viewers constructing, model consciousness, and gross sales conversion. Within the realm of efficiency advertising and marketing, the purpose is to maximise the return on advert spend (ROAS) by means of environment friendly focusing on. AI expertise enhances this course of by figuring out the very best match between the advertiser, the commercial, and the buyer, making certain that adverts are delivered to essentially the most appropriate viewers on the perfect time and place by means of a classy rating algorithm.

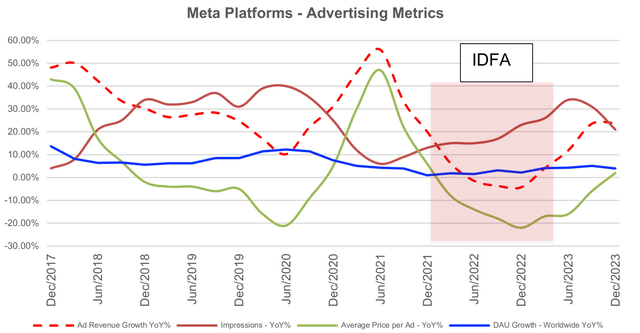

Determine 3 – Meta Platforms Promoting Metrics (Firm, SaltLight Estimates)

The evolution of digital promoting over the previous a long time has made the method extra analytical. In contrast to the broad, time-specific attain of conventional TV or radio adverts, digital promoting initially adopted a extra focused method. Advertisers would create and check varied advert variations to align with totally different consumer personas, a technique extra exact than conventional broadcasting however nonetheless suffering from the problem of irrelevant advert supply. This misalignment represents a missed alternative for platforms like Meta, resulting in wasted advert stock and a diminished consumer expertise.

Pre-2022, digital advertisers relied on deterministic focusing on strategies3 to trace advert interactions and conversions. The panorama shifted dramatically in 2021 when Apple launched iOS 14.5 disrupting deterministic focusing on by limiting the flexibility to trace customers (known as IDFA4 by the business), considerably impacting Meta’s advert focusing on capabilities and consequently its share value.

It took Meta eighteen months to adapt and re-tool by incorporating AI to leverage contextual and first-party information to enhance advert focusing on. This adaptation has not solely helped Meta recuperate misplaced advert spend but additionally positioned it strongly towards rivals.

Generative AI guarantees a profound period of personalised and automatic promoting, the place adverts are dynamically customised for every consumer. This innovation will permit advertisers to save lots of on service suppliers creating a number of advert variants and reallocate financial savings to additional promoting spend. Personalisation will seemingly result in extra related adverts for customers, enhancing engagement charges and the propensity of conversion – a win for Meta’s income seize.

Placing this all collectively, AI’s function in promoting has led to elevated consumer engagement and improved focusing on accuracy, making a useful situation for all events concerned.

AppLovin

AppLovin operates on the intersection of sport advertisers, publishers, and over one billion sport gamers, functioning as a pivotal monetisation enabler within the free-to-play gaming ecosystem.

Certainly one of AppLovin’s strengths lies in its main use of contextual information for advert matching. Whereas any such information could not provide the excessive precision of first-party information like Meta’s, it stays invaluable, particularly in environments the place conventional information indicators are weaker. Contextual focusing on turns into more and more related in areas like related TV (‘CTV’), the place direct consumer monitoring is more difficult.

Related TV, which incorporates gadgets (good TVs, consoles, or sticks) that stream TV content material, represents a flourishing alternative set for performance-based digital promoting. As extra households transfer away from conventional satellite tv for pc or terrestrial TV in favour of internet-connected gadgets, the potential for monetising this viewership grows. Nonetheless, promoting on CTV remains to be working in the identical seventy-year-old manner as linear TV – with model promoting because the dominant a part of the funnel.

AppLovin sees appreciable alternative in utilizing its capabilities in contextual sport focusing on to supply performance-based promoting on CTV. They’re focusing on a kind of family slightly than a particular consumer. This house is shifting rapidly – significantly within the US – with tech firms investing in sports activities content material and even retailers reminiscent of Walmart shopping for TV working methods firms. Related TV promoting has the potential to be a considerably bigger market than the $100bn gaming market.

Transaction Capital (‘TCP’)

Throughout 2023, we mentioned Transaction Capital often. As we suspected, in November, administration introduced that they had been contemplating spinning off WeBuyCars (‘WBC’). This was confirmed in February 2024. We anticipate that our entry value will exceed the worth of the spun-off firm and we’ll nonetheless have the rest of the ‘rump’ consisting of the troubled SA Taxi and the resilient Nutun.

WBC is the ‘hidden diamond’ that we have been ready for. Administration’s IPO presentation has a projection that they are going to double their second-hand automobile market share over the following 5 years from 10%-12% at the moment – a grand goal that we’ll have fun in the event that they hit. The extra alluring half for us is that this progress, in response to administration, would require marginal capex to get there.

Since Transaction Capital acquired WBC in 2020, the corporate has considerably elevated its operational capability, increasing parking bays from 4,000 to 10,500 and witnessing a 2.5-fold improve in automobile gross sales. The profit-driving lever for this enterprise is stock turnover. This enterprise mannequin is extra akin to a grocer that should flip recent produce over rapidly at skinny margins slightly than a tech SaaS enterprise that earns excessive gross margins. One constructive is that automobiles do not expire in a number of days. Ought to WBC double its market share inside the capital expenditure parameters offered, we anticipate progress in free money move progress exceeding gross sales progress by a big measure.

The attention-grabbing query post-unbundling that we ponder is: what turns into of the remaining TCP enterprise? Lenders now not have leverage over the holding firm by means of HoldCo debt cross-default clauses. Theoretically, if SA Taxi lenders select to not help debt-rollover aid, TCP may merely put SA Taxi into enterprise rescue in an orderly course of slightly than the voluntary exercise course of they’re following on the date of writing. We’ll know in two months how issues will look put up unbundling.

As we all the time remind traders, most of our liquid wealth is in the identical fund as yours. We share within the inevitable ups and downs proper with you. Please free to achieve out when you’ve got any questions.

David Eborall, Portfolio Supervisor

|

Footnotes 1Meritech Software program Pulse, 22 February 2024 for the cohort of firms with 20%-40% NTM income progress. At present’s medium NTM income a number of is 11.6x for money constructive cohort’s vs 8.7x ‘burning money’ cohorts. 2If there are not any distribution or community prices. 3Header bidding is a programmatic promoting approach that permits publishers to supply their advert stock to a number of advert exchanges concurrently earlier than making calls to their advert servers. Every occasion can bid on the identical stock in actual time, generative excessive yield for a list vendor. 4Deterministic focusing on strategies in advert expertise contain utilizing exact and identifiable consumer information, reminiscent of e-mail addresses or machine IDs, to focus on commercials on to particular people. This method ensures excessive accuracy in advert supply, focusing on customers primarily based on verified private data. 5The change pressured a consumer to ‘opt-in’ to share information for monitoring. Additionally it is known as ATT (App Transparency Monitoring) Disclaimer Collective funding schemes are typically medium to long-term investments. The worth of participatory curiosity (models) or the funding could go down in addition to up. Previous efficiency just isn’t essentially a information to future efficiency. Collective funding schemes are traded at ruling costs and might have interaction in borrowing and scrip lending. A schedule of charges, fees, minimal charges, and most commissions, in addition to an in depth description of how efficiency charges are calculated and utilized, is obtainable on request from FundRock Administration Firm (‘RF’) (‘PTY’) Ltd (“Supervisor”). The Supervisor doesn’t present any assure with respect to the capital or the return of the portfolio. The Supervisor could shut the portfolio to new traders to handle it effectively in response to its mandate. The Supervisor ensures honest remedy of traders by not providing preferential charges or liquidity phrases to any investor inside the similar technique. The Supervisor is registered and accredited by the Monetary Sector Conduct Authority beneath CISCA. The Supervisor retains full obligation for the portfolio. FirstRand Financial institution Restricted is the appointed trustee. SaltLight Capital Administration (‘PTY’) Ltd, FSP No. 48286, is authorised beneath the Monetary Advisory and Middleman Companies Act 37 of 2002 to render funding administration companies. |

Unique Put up

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.