[ad_1]

Estimated studying time: 6 minutes

Flexibility is without doubt one of the greatest challenges dealing with organizations at the moment. Staff need flexibility and it’s onerous to design office packages, insurance policies, and procedures with large quantities of flexibility. This doesn’t imply we shouldn’t attempt.

For instance, I’ve lately seen some articles about life-style spending accounts (LSA) and their capability to supply workers flexibility in terms of their wellness wants. In response to CFO Journal, 75% of huge employers provide LSAs to their workers. So, what are life-style spending accounts and why would organizations take into account one?

To assist us perceive this new frontier, I reached out to Lindsay Steckler, well being and efficiency supervisor for HUB Worldwide. She has over 10 years of expertise within the wellness business, and a confirmed monitor report in strategic planning, program growth, and vendor administration. Lindsay consults on wellbeing methods with all kinds of organizations, ranging in measurement from 50 to fifteen,000 workers. She assists purchasers with knowledge analytics, enterprise planning, incentive design, and program analysis.

Lindsay, thanks for being right here. Are you able to briefly clarify what life-style spending accounts (LSA) are?

[Steckler] Way of life Spending Accounts (LSA) are a post-tax profit that permit workers to buy wellbeing services they worth most. Not solely are LSAs extremely versatile however they are often launched at any time serving to employers ship advantages that enchantment to at the moment’s workforce.

In contrast to particular person vendor reductions, wellness stipends present selection which will increase the profit’s enchantment to a geographically and demographically numerous workforce. When employers associate with a vendor administrator, they’ll provide inclusive perks with out spending some huge cash or HR time to take action.

It’s my understanding that LSAs are completely different from well being spending accounts (HSAs). If organizations already provide HSAs, does including a LSA make any enterprise sense?

[Steckler] LSAs are distinctly completely different from Well being Spending Accounts (HSAs) or Well being Reimbursement Accounts (HRAs) in just a few methods:

LSAs are funded by the employer solely and as a taxable profit, they’re not topic to nondiscrimination necessities underneath the Inner Income Service (IRS) code. Per the Inexpensive Care Act (ACA), HRAs should be ‘built-in’ and solely these enrolled in medical protection can take part. If the employer gives a excessive deductible well being plan (HDHP), the HRA would should be HDHP compliant.

However, an LSA could be supplied to all workers no matter enrollment as a result of an LSA can’t embody medical care. In any other case, this is able to make it an HRA. The employer determines eligible standards for utilizing the LSA and the employer retains any unused funds.

Why would an employer wish to provide a life-style spending account? What are the benefits for workers?

[Steckler] There are two major advantages to workers: flexibility and excessive worth.

- Flexibility: The worker determines how they’d like to make use of the fund (topic to the employer’s standards).

- Excessive worth: Due to this flexibility, these advantages are extremely valued by workers.

Advantages to the employer embody:

- Flexibility: With an LSA, an employer designates after-tax funds to assist workers prioritize wellness actions of their selecting for bills that aren’t lined by conventional advantages. This ensures that employer {dollars} are being utilized in a approach that workers worth whereas eliminating the necessity for a number of level options.

- Inclusiveness: Offering flexibility in how the stipend is used permits employers to deal with profit gaps and create a extra inclusive profit program.

- Recruiting and retention device: Way of life advantages like wellness stipends display to workers that their employer cares about them as an individual, not only a employee.

- Worker enchantment: LSAs permit workers to spend on a broad vary of wellness wants no matter the place they stay or work, making them an incredible choice for supporting the fashionable workforce.

When workers really feel cared for, worker engagement and productiveness enhance, and employers take pleasure in decrease charges of absenteeism and turnover. Moreover, since LSAs will not be topic to nondiscrimination guidelines, an employer can use the funds to acknowledge service milestones for a selected class of workers (Instance: recognizing name middle staff after 12 months of employment).

Are there any disadvantages or issues that employers want to think about in terms of life-style spending accounts?

[Steckler] There are two areas that organizations must be cognizant of in terms of LSAs: profit design and compliance.

On the compliance aspect, LSAs can’t cowl ‘medical care’. Watch out for bills equivalent to remedy classes, chiropractic care, and acupuncture that are more likely to be medical care (though not all the time) and bills equivalent to nutritional vitamins, massages, and health club memberships will also be medical care (although much less frequent). The identical applies for journey (medical journey = medical expense).

There’s additionally the idea of constructive receipt, which is a tax time period that determines when a person has acquired earnings. Constructive receipt happens when a person obtains earnings that isn’t but bodily acquired however has been credited to the taxpayer’s account and over which they’ve instant management. This locations heavy restrictions and necessities on employers looking for to present workers a selection between taxable and non-taxable advantages (i.e., providing an LSA or HRA). It may be triggered when an employer permits an LSA stability to rollover and make earnings taxable within the 12 months it turns into out there.

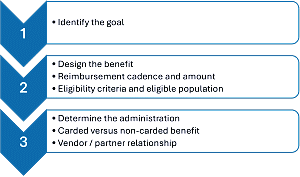

The opposite consideration is profit design. Employers should be conscious that structuring the profit as a reimbursement could unintentionally discriminate in opposition to workers who do not need the funds out there for the acquisition. It’s vital to method the LSA program design strategically: establish the purpose, design the profit, and decide the administration.

Final query. You talked about earlier that LSAs could be launched at any time. Since many organizations have already achieved their open enrollment for the 12 months, how straightforward is it to arrange an LSA mid-year?

[Steckler] LSAs could be launched at any time (and subsequently terminated at any time, pursuant to administrative vendor contracts).

Most employers set an annual cap of $500-$1,000/per worker. Every LSA can have its personal design, eligible inhabitants, greenback quantities, funding frequency, reimbursement processes, and spending timeframe. This can be a extremely utilized profit this must be thought of when organizations finances for this profit.

I wish to lengthen an enormous because of Lindsay for sharing her information with us. For those who’re in search of methods to make your advantages extra versatile, take a look at HUB Worldwide’s Outlook 2024 report. Not solely does it discuss methods to strengthen the worker expertise, however it outlines alternatives to mitigate threat.

Wellness and wellbeing packages are tremendously fashionable and for apparent causes. Nevertheless, there are current research indicating that they won’t be as efficient as they sound. The rationale? They’re not tailor-made to satisfy particular person wants. What this implies is that organizations want to seek out methods to construct extra flexibility into their advantages packages. This leads to the group utilizing their assets correctly and workers utilizing the profit the way in which they need and must.

Picture captured by Sharlyn Lauby on the SHRM Annual Convention in New Orleans, LA

The submit Every thing HR Must Know About Way of life Spending Accounts (LSA) appeared first on hr bartender.

[ad_2]

Source link