JazzIRT

Medical Properties Belief (NYSE:MPW) is managing its poor liquidity place by performing asset gross sales, a profile that isn’t sustainable, and a critical liquidity crunch can occur within the coming quarters.

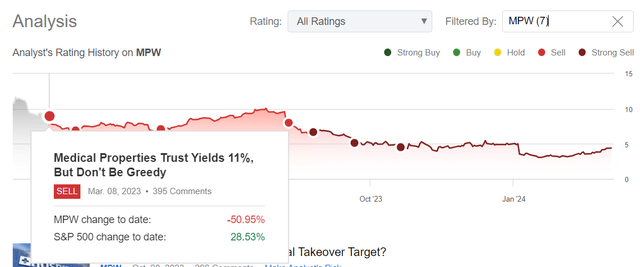

As I’ve analyzed in earlier articles, I have been bearish on MPW over the previous 12 months, on account of its basic points that led to a big dividend reduce and since I’ve critical issues about its ongoing money burn. Since my first article on MPW in March 2023, its shares are down by greater than 50%, together with dividends, whereas the market went up by greater than 28% throughout the identical time-frame.

MPW protection (Looking for Alpha)

On this article, I replace MPW’s latest occasions and analyze its liquidity points within the coming quarters, which might result in critical monetary misery forward.

Latest Occasions & Liquidity

Since my final article on MPW, again in October 2023, the corporate introduced intentions to enhance its liquidity place by doubtlessly performing some asset gross sales or evaluating three way partnership alternatives, plus it was additionally contemplating to boost secured debt financing. The corporate anticipated to boost some $2 billion in funding over the next twelve months, which might be greater than sufficient to cowl its debt maturities over the following couple of months.

As I’ve analyzed intimately in a earlier article, MPW’s money circulation era and liquidity place usually are not nice, thus one in every of my key issues is its money burn that would result in a monetary misery state of affairs throughout 2024.

If MPW have been capable of elevate new funding within the anticipated $2 billion quantity, this will surely be an important step in the fitting course, however up to now the corporate has been capable of solely elevate about $500 million by the sale of belongings and a mortgage funding. On condition that it has now handed virtually six months since this announcement, this raises critical questions on MPW’s skill to boost new funds, notably secured financial institution loans.

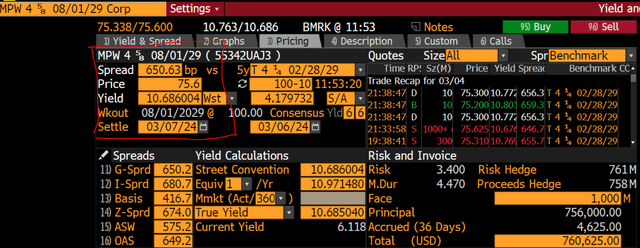

Certainly, market issues concerning the banking business publicity to the Industrial Actual Property (CRE) sector don’t assist MPW to boost secured loans, whereas elevating new bonds within the capital markets stays at prohibitive ranges. As an example, its senior bonds that mature in 2029 are at the moment buying and selling with a yield-to-maturity of round 10.7%, thus issuing new bonds doesn’t appear to be an possibility for the corporate on account of very excessive potential prices.

2029 Bond (Bloomberg)

Buyers also needs to word that MPW’s credit standing is ‘excessive yield’, thus it’s not going that MWP’s funding prices will come down considerably within the brief time period, even when the Federal Reserve finally begins to chop rates of interest within the coming months.

Past its refinancing points, MPW additionally introduced a few months in the past that its largest tenant Steward Well being Care System solely paid 25% of lease and curiosity owed in This autumn 2023, which is one other headwind for MPW’s liquidity profile within the brief time period. For traders who observe MPW intently, this was not stunning, as there have been issues about Steward’s monetary profile over the previous few years, thus it was solely a matter of time till Steward would turn into a significant drawback for MPW.

As I’ve coated beforehand, MPW’s publicity to Steward goes past rental revenue, provided that MPW has financed its tenant for years and has a number of actual property ventures along with its largest tenant, plus different fairness and loans investments in its steadiness sheet. Which means that MPW has virtually $1 billion publicity to Steward in its accounts, on high of about 20% of its annual rental revenue generated from Steward.

With its largest tenant now publicly in monetary misery, it makes it much more troublesome for MPW to boost new funding, thus I believe it will likely be robust for the corporate to boost $1.5 billion throughout 2024, as the corporate expects. Which means that MPW most probably will proceed to do asset gross sales to boost money, and also will use its personal money circulation from operations to finance upcoming debt maturities.

Nevertheless, as I’ve mentioned a number of occasions earlier than, its money circulation from operations shouldn’t be sufficient to cowl its capital expenditures and dividend funds, resulting in unfavorable free money circulation. This implies MPW has been burning money on a quarterly foundation, a profile that’s clearly not sustainable over the long run.

To date, the corporate has been capable of offset this working money burn by borrowing from its revolving credit score facility with JPMorgan (JPM). This revolving credit score facility solely has about $200 million nonetheless left to make use of as of February 2024, thus, going ahead, it will likely be harder for MPW to cowl its money burn and a few critical liquidity constraints might emerge within the coming quarters.

On the finish of 2023, its money was about $250 million, a small improve in comparison with the tip of 2022 ($235 million). This might counsel a secure money place all year long, however as I’ve analyzed this was solely potential by rising indebtedness from the revolving credit score facility. Along with its revolving credit score facility, which means MPW’s liquidity was about $450 million on the finish of 2023.

Whereas this may occasionally look like sufficient to cowl upcoming debt maturities, this isn’t more likely to be the case, provided that MPW’s working efficiency has been fairly weak and will proceed to burn money on a quarterly foundation.

Certainly, MPW’s monetary efficiency was fairly weak in 2023, as the corporate’s asset gross sales to boost money and handle debt maturities, plus its struggling tenants, led to annual revenues of solely $872 million, representing an annual decline of 43% YoY. Its profitability was additionally hit by impairments associated to Steward, resulting in a unfavorable web revenue of $556 million within the 12 months. Its Funds From Operations (FFO) have been solely $288 million in 2023, a decline of 69% YoY. Relating to its money circulation, the corporate generated $505 million from working actions (-32% YoY), which weren’t sufficient to finance capex of about $350 million and $615 million in dividends.

This clearly reveals that MPW wants urgently to boost money, by asset gross sales or new loans, or it’ll face a liquidity scarcity within the coming months.

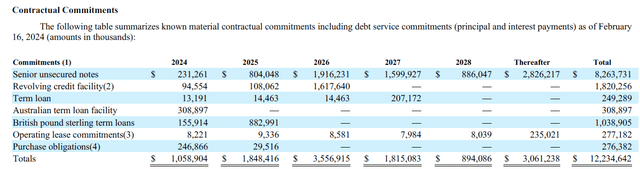

Certainly, MPW has moreover financed Steward by greater than $100 million because the starting of 2024, plus its quarterly dividend paid final January represents a money outflow of about $75 million. This implies its present money place ought to have declined to about $75 million, assuming that MPW has not borrowed extra from its revolving credit score facility. Whereas MPW has already some agreements that may elevate about $350 million within the coming months, this isn’t sufficient to cowl its greater than $1 billion commitments in 2024, as proven within the subsequent desk.

Contractual commitments (MPW)

Whereas MPW, when discussing liquidity, solely talks about two maturing loans in 2024 for a complete quantity of $430 million, as proven within the earlier desk, there are a lot different money outflows already dedicated, placing important stress on the corporate’s liquidity place.

Furthermore, its refinancing wants and contractual commitments in 2025 quantity to shut to $1.9 billion, and a few $3.6 billion in 2026. Which means that MPW’s money outflows are enormous within the subsequent couple of years, placing its enterprise mannequin beneath critical menace. Certainly, REITs have to roll over debt to keep up a sound enterprise mannequin, one thing that MPW has already proven it isn’t at the moment succesful to do.

Due to this fact, elevating money by performing asset gross sales shouldn’t be sustainable over the long run, thus traders shouldn’t overlook MPW’s threat of going bankrupt within the subsequent 12-18 months, for my part, as the corporate’s liquidity place is more likely to not be sufficient to cowl its anticipated money outflows.

Alternatively, if the corporate can elevate new funds, most probably secured financial institution loans, this may give it some extra time to doubtlessly concern new bonds at affordable prices. Nevertheless, this largely depends upon when the Fed begins to chop rates of interest considerably, one thing that’s out of the corporate’s management. Furthermore, even when the Fed cuts by 1-2% within the coming 12 months, this may solely cut back MPW’s senior funding prices to 8-9%, which continues to be above its cap charges and does not make a lot sense financially to do.

Conclusion

Medical Properties Belief working efficiency has clearly deteriorated in latest quarters, and the corporate is doing asset gross sales to maintain it afloat, however critical liquidity points are more likely to emerge within the coming quarters. Whereas MPW can handle its liquidity within the brief time period by promoting belongings, this isn’t sustainable over the long run and large refinancing wants in 2025 and 2026 are more likely to lead the corporate into critical monetary misery, most probably not leaving a lot worth left for shareholders.