Shutter2U

Funding Thesis

On February 27, 2024, MPZZF launched its This autumn figures. It reported This autumn revenues of $153 million and EBITDA of $94 million. The market didn’t like these numbers, and its 2024 steerage despatched the share value down nearly 11 p.c from its shut on February 26. This text updates my earlier article on (MPZZF), written on November 28, 2023. In that article, I argued that its latest value drop supplied a pretty pricing level for buyers however warned that 2024 and onwards have been prone to convey decrease yields.

MPZZFs operational and monetary monitor document is superb; it sports activities a fleet of greater than 60 intra-regional container ships (<8k TEU dimension ships), has roughly 1.4 years of contract backlog, and low leverage with no vital maturities till 2027. Nonetheless, considerations about international fleet progress and an unsure market outlook present headwinds. Moreover, the inherent dangers of buying and selling in a comparatively small inventory listed in a comparatively illiquid foreign money could pose a problem for a lot of buyers. Consequently, MPZZFs obtain a maintain ranking.

Firm Overview

MPC Container Ships (OTCPK:MPZZF) is an intra-regional container ship lessor specializing in the 1k-8k TEU segments. Listed on the Oslo Inventory Change since 2017, it controls 62 vessels with a complete carrying capability of 138,000 TEU.

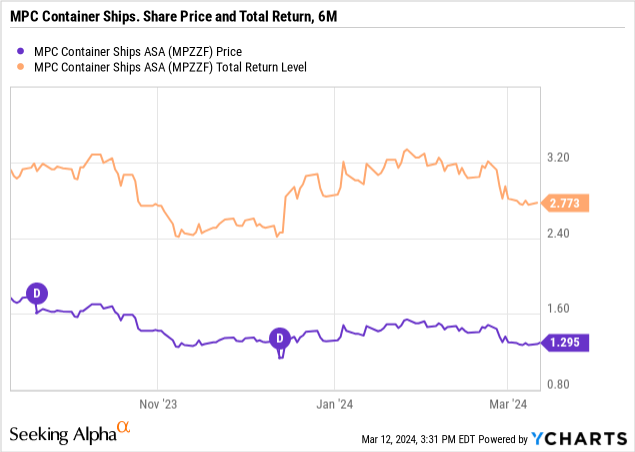

Let’s study its share value growth over the previous six months. Each share value and whole return have moved sideways since then. Word that MPZZF is listed in NOK, and the chart beneath is transformed to USD:

Contract Backlog: Extra Contracted Days, Decrease Charges

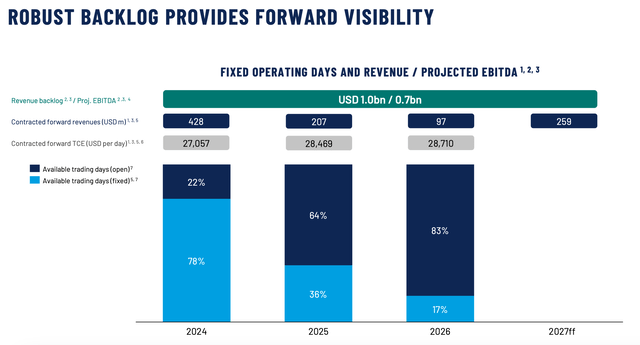

In its newest quarterly report, MPZZF supplied the next contract backlog overview.

Contract Backlog as This autumn, 2023 (This autumn presentation, p. 18)

Evaluating this with its earlier report (Q3 2023, p.16), we observe the next (earlier report in parenthesis):

- ⬆️ 78% (67%) of days contracted for 2024, at a ahead TCE of ⬇️ 27,057 (29,410)

- ⬆️ 36% (25%) of days contracted for 2025, at a ahead TCE of ⬇️ 28,489 (35,098)

In different phrases, MPZZF may contract extra days however at decrease charges. Contracted ahead TCE for 2024 declined by 8 p.c and 19 p.c for 2025.

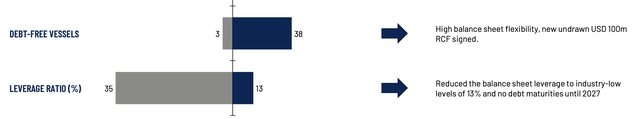

Leverage: Business-Main, With no Maturities till 2027

MPZZF’s leverage is simply 13 p.c, down from 35 p.c in This autumn 2021 (illustration from This autumn presentation, p. 16):

MPZZF Leverage Growth, 2Y (This autumn 2023 presentation, p. 16)

Moreover, it had 38 debt-free vessels in comparison with simply three two years earlier.

Market Outlook

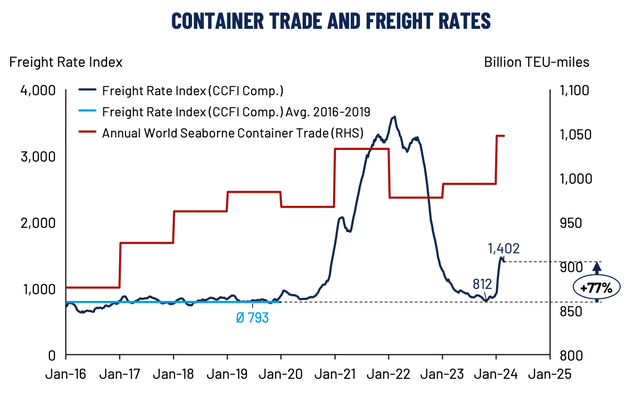

MPZZF supplied the next illustration of constitution fee developments (This autumn 2023 presentation, p. 11):

Charges, Jan 16-Jan 24 (This autumn 2023 presentation, p. 11)

It famous that whereas the same old Chinese language New Yr uptick was noticed, it was “enormous” this yr because of the Purple Sea disturbances. However – MPZZF doesn’t observe any uptick in long-term contract charges, citing sluggish negotiations.

As compared, its peer Danaos Company (DAC) reported closing offers at “wholesome ranges” in a information bulletin. It said that

(..) it’s anticipated that field charges will stay elevated so long as the [Red Sea] disruption continues. Towards this backdrop, we now have some secured further charters for our vessels at very wholesome ranges.

BIMCO, the biggest membership group for transport gamers, reported in its container outlook (This autumn 2023, highlights) that

The provision/demand stability will proceed to weaken and freight charges, time constitution charges, and second-hand costs will come underneath additional strain.

It expects provide to develop 6.8% in 2024 and 6.4% in 2025, whereas demand is anticipated to develop simply 3 to 4 p.c in 2024 – and three.5 to 4.5 p.c in 2025.

Provide outpacing progress will not be a very good factor, after all. Within the close to time period, this dynamic exerts downward strain on container charges. Within the medium to long run, I stay basically optimistic in regards to the feeder phase (<8k TEU) of the container market because of the world deglobalizing (the significance of areas growing). Take into account a rustic like China. In 2006, 64 p.c of its financial system was commerce, in comparison with 37 p.c in 2023. This opens up alternatives for different international locations. This constitutes a transfer from comparatively fewer giga ports (which favor mega ships) to a number of comparatively extra minor ports (which favor smaller vessels). As well as, maritime choke factors just like the Suez Canal (results of battle) and the Panama Canal (climate) are more and more underneath strain, supporting tonnage demand as crusing distances enhance. Presumably, the South China Sea, too, as China continues to claim its territorial claims.

Dangers Particular to this Funding

Withholding tax on dividends. U.S.-based buyers ought to contemplate the impact withholding taxes could have on returns on their investments in Norwegian shares. The Tax Administration has extra.

The NOK. MPZZF trades in NOK, a small and comparatively illiquid foreign money, in comparison with extra vital and liquid currencies just like the USD and the EUR. Overseas buyers might even see decrease – or larger – returns based mostly on fluctuations on this foreign money. In instances of uncertainty, buyers often attempt to keep away from riskier bets, which the NOK would signify. The Norwegian Central Financial institution’s main aim is low and predictable home inflation – it doesn’t try and peg the NOK to another foreign money.

Conclusion

This text updates my earlier article about MPZZF and reiterates its essential promoting factors: its low leverage, glorious administration document, supply of its formidable GHG objectives, and younger fleet. Nonetheless, it’s going through headwinds in a still-uncertain market. The Purple Sea points enhance crusing distances, requiring larger tonnage provide, however the market outlook remains to be unsure. Coupled with particular issues with the MPZZF inventory, this funding is just for some.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.