wolv

Funding Thesis

The entire Canadian O&G sector is valued on a budget facet, with the very best high quality corporations providing double-digit returns. Fuel costs (NG1:COM) are bouncing from inflation-adjusted multidecade lows, with future costs pointing to AECO C$3.5 in contrast with present C$1.6, attributable to rising demand for gasoline resulting from improved LNG export capability from NA.

Peyto (OTCPK:PEYUF),(TSX:PEY:CA) is Canada’s lowest-cost gasoline producer, which makes its FCF (free money move) yield very resilient. The strong hedge e book helped Peyto to report nice FCF even within the present depressed market.

The corporate made a really profitable acquisition from Repsol (OTCQX:REPYF) and entered 2024 with 30 years of 2P (proved + possible) reserves. These acquired lands give Peyto many choices for development, with a present development plan pointing to 10% yearly manufacturing development for the following 5 years. The brand new property additionally present higher economics with increased liquid content material in comparison with Peyto’s unique reserves.

The inventory at present provides a secure, excessive month-to-month dividend of C$0.11 (9.3% dividend yield, inventory worth C$14.2), which makes it an ideal place to be whereas ready for increased gasoline costs.

With the present worth of gasoline futures and 12.5% price of fairness, DCF valuation leads to C$21.3 per share, suggesting a 50% upside to honest worth or five-year common ROI of 23% with exit a number of 8xFCF. This makes me fee the inventory as a Sturdy purchase.

Peyto Exploration & Improvement Corp.

Peyto simply celebrated 25 years of existence. Over its existence, the corporate grew into the fifth-largest Canadian gasoline producer. Whereas the inventory trades at low-cost multiples, I think about the underlying enterprise of top quality with nice aggressive benefits, leading to a full-cycle ROCE of 14% or ROE of 25%.

Peyto solely focuses on the Alberta Deep Basin with excessive 88% gasoline content material reserves. This slim focus leads to higher geological estimations and excessive expertise leverage within the space.

Manufacturing and Hedging

Peyto just lately launched its 2023 outcomes with a median manufacturing of 105.000 boe/d (12% liquids), with the final quarter’s output already as much as 120.000 boe/d, using its manufacturing development plan.

Throughout final yr, gasoline costs dropped by approx 50% to inflation-adjusted multidecade lows. Most gasoline producers lower their capital spending to decrease the deliberate outputs, as the present gasoline worth makes them FCF unfavorable.

The low 12% liquid content material in its manufacturing combine is the bottom amongst its friends. In such occasions when gasoline costs are on the backside of the cycle, producers depend on their liquids manufacturing to maintain them FCF constructive. Peyto’s technique is completely different.

As I see it, Peyto’s technique of safety in opposition to low gasoline costs is constructed on three pillars.

- The primary is gasoline pricing diversification throughout NA with no direct publicity to risky AECO pricing. For instance, its participation within the Rockies LNG Consortium, or the 9,200 boe/d provide of gasoline to the Cascade energy plant, is anticipated to start out subsequent quarter.

- The second is Peyto’s industry-leading low prices, that are the outcomes of long-term focus and expertise within the space and the possession of the infrastructure.

- The third is a sturdy hedge e book with 70% of gasoline costs hedged into 2024. This hedging technique brings the corporate a small further revenue whereas smoothing the volatility of gasoline costs. Whereas the gasoline costs dropped 50% in 2023, Peyto’s realized costs dropped solely 13%.

These are the the explanation why Peyto reported a constructive FCF of C$268M for the yr.

Peyto Repsol acquisition

Final yr, Peyto acquired Repsol’s (REPYF) non-core property, and there’s a lot to love about it. Contemplating the low-price setting, the timing could not be higher. The acquisition makes excellent sense, as these new property go hand in hand with Peyto’s unique acreage. Thus, the administration knew very effectively what they had been shopping for, with many concepts for using the long run synergies between these adjoining property.

The manufacturing profile of the brand new property additionally appears superior to Peyto’s unique property, with decrease decline charges and better liquids content material.

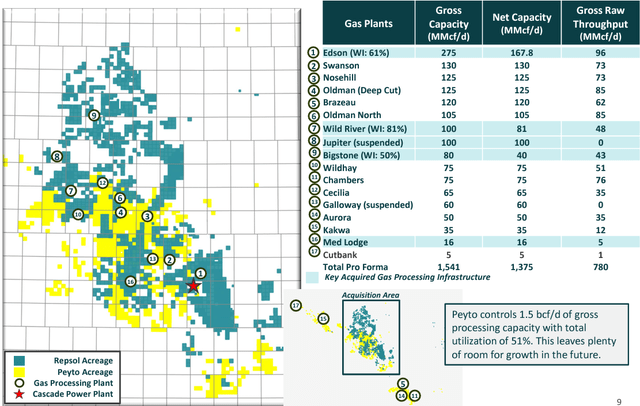

Peyto & Repsol acreage (Peyto’s presentation)

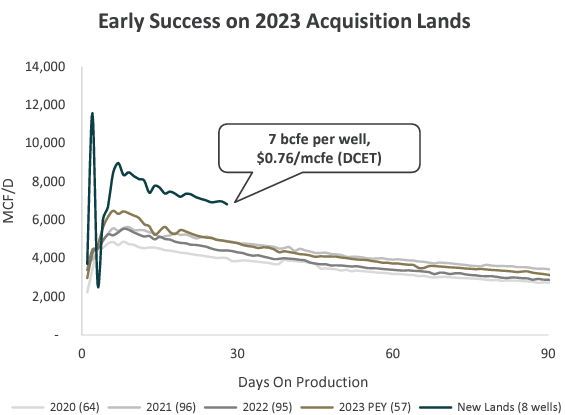

Administration offered early wells outcomes, with a declare of the being superior in comparison with earlier years’ averages. Whereas that is nice to see, eradicating traders’ issues concerning the operations outcomes of the brand new property, I’m not bought but, as when you consider it, the administration will at all times select essentially the most promising wells first. Whereas I consider within the superiority of those new wells, I feel the full-year common will likely be decrease in comparison with the primary eight wells.

Early wells outcomes (Peyto’s presentation)

Capital allocation

The acquisition resulted in taking up a brand new debt, which at present sits at 2xD/CF. Whereas I do not think about this stage of debt a danger, the entire {industry} nonetheless remembers 2020 lows, so the administration is dedicated to reducing the debt to a stage of 1xD/CF.

Within the meantime, the C$0.11 month-to-month dividend is roofed by money move as a result of hedge e book, whereas different gasoline producers are working FCF unfavorable with the necessity to tackle new debt to cowl their dividends.

Regardless of low gasoline costs, Peyto’s administration guides for regular manufacturing volumes. Shut-in would happen solely with a lot decrease or unfavorable AECO costs.

Alternatively, administration is guiding Capex spending on the low finish, stating that they do not need to increase manufacturing output and waste the potential of the property by promoting increased volumes right into a depressed market.

Administration will likely be observing the gasoline market and react accordingly.

- If costs keep low for longer, administration will prioritize debt repayments whereas conserving the bottom dividend.

- If costs observe strip pricing, administration is able to improve manufacturing output

- With even increased costs, the D/CF ratio will maintain itself with increased money move. Administration would use all of the capital to considerably increase manufacturing whereas conserving the dividend.

Market dynamics

As for all commodity producers, the primary driver of their inventory worth is the underlying commodity worth setting. As I wrote intimately in my ARC Assets (ARX:CA) thesis, there are forces in play which can be bettering the gasoline worth outlook. Greater LNG export capability from NA is the core of the thesis.

Valuation

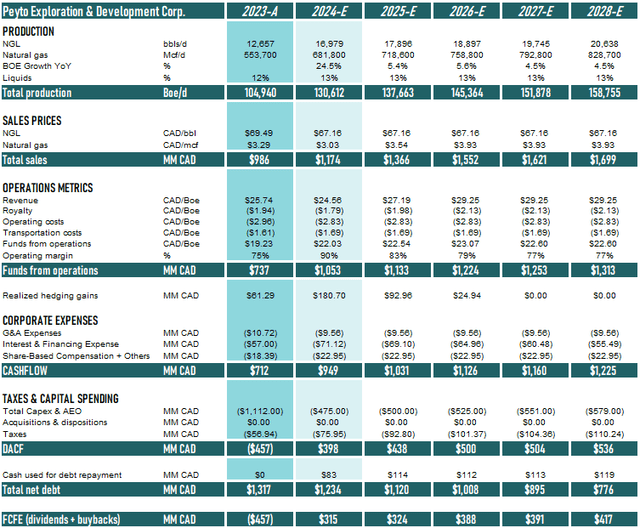

I’m modeling the base-case situation based mostly on strip pricing with AECO’s 12-month strip at C$2.7 going as much as a 36-month strip of C$3.5.

I’m utilizing manufacturing development steerage whereas conserving in thoughts that administration is versatile round capital allocation reacting to gasoline pricing improvement.

I additionally account for an up to date base decline fee of 25%. Whereas practically irrelevant in the long run, I’m counting of their present hedges.

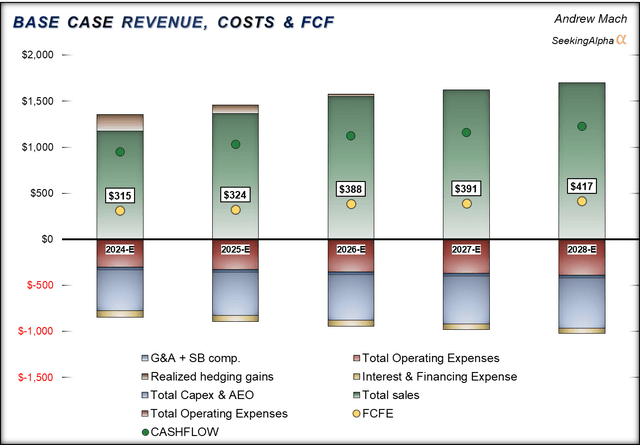

Right here is the graph representing the projection. A desk is under if you wish to evaluation the numbers.

5-year projection (Writer’s Calculation) 5-year projection (Writer’s Calculation)

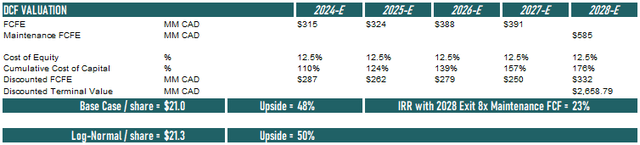

Discounted Money Circulate (DCF) Valuation

Now, I’m discounting the ensuing dividends and buybacks by a price of fairness of 12.5%, which I take advantage of throughout the Canadian O&G upstream sector.

DCF mannequin (Writer’s Calculation)

The bottom-case situation yields a good worth of $C21 per share, implying a 48% upside or 23% annual returns for the following 5 years with an assumed exit a number of of 8x upkeep FCF.

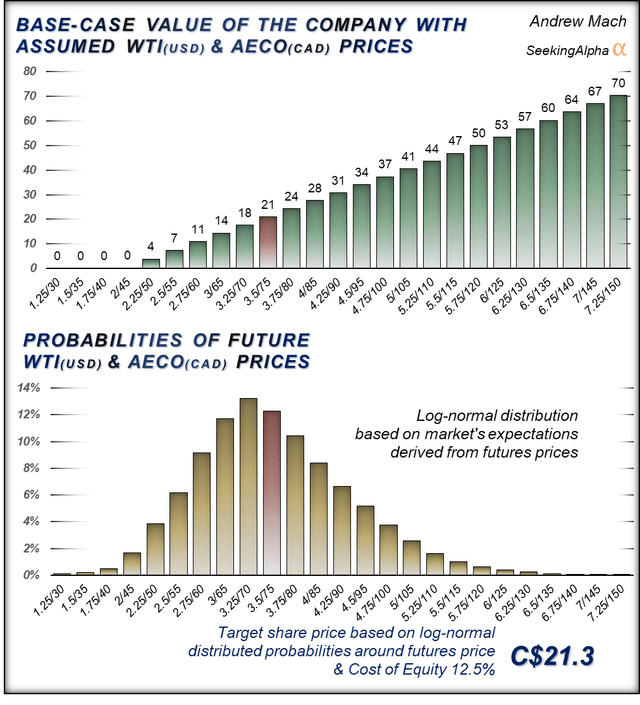

As I do not need to worth the corporate based mostly on a single situation, I’m log-normally distributing the chances of pricing eventualities round futures costs with a worth goal of C$21.3 per share. This valuation methodology higher displays the potential good points with increased costs and guarded FCF with decrease costs in comparison with the only situation mannequin.

Goal worth with Log-normal distributed possibilities round futures costs (Writer’s Calculation)

In case your basic evaluation of gasoline costs differentiates from the futures costs, you’ll be able to evaluation the corporate valuation below completely different long-term pricing within the desk above.

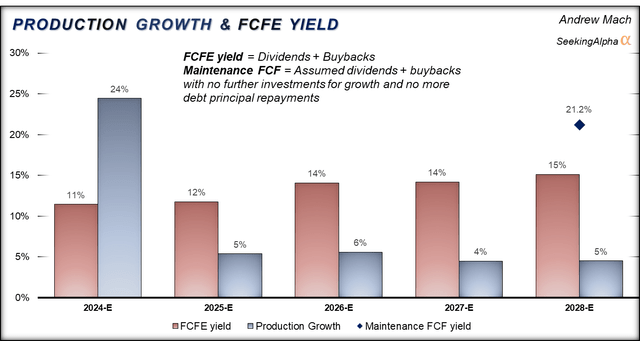

Shareholders yield

Shareholders are rewarded by manufacturing development, dividends, and buybacks. Assuming the base-case situation accounting for strip pricing, you get a double-digit FCF yield with rising manufacturing, with a possible 21.2% yield if the corporate doesn’t spend for additional development after 2028.

Progress + FCFE yield (Writer’s Calculation)

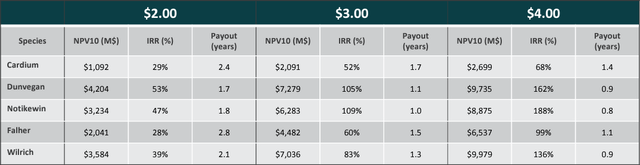

Asset-Primarily based Valuation

Whereas my DCF valuation might sound overly bullish, the property valuation offered by Peyto speaks for itself.

Assuming a really low future AECO worth of $C2, the current worth of the long run money flows from these property discounted yearly by 10% equals $C14.2B or C$53 per share, or over $C100 per share if AECO averages $C3. Not accounting for debt of C$6.8 per share.

Asset Primarily based Valuation (Peyto’s presentation)

This solely accounts for 1,571 booked places, with one other 1,800 recognized by Peyto, which aren’t included on this calculation.

Dangers to contemplate

The Canadian freezing climate has negatively affected 2024Q1 manufacturing, with administration noting an approximate 1,150 boe/s decrease manufacturing quantity.

The water provide is being addressed, with solely 0.3% of the water used from floor water provides.

The debt is manageable, and I don’t think about it a extreme danger.

Fuel pricing is the very best worth mover, as I confirmed you within the valuation. Slight variations in future costs can considerably swing the corporate’s valuation. That is additionally a chance, as the corporate’s low prices make it stand up to unhealthy occasions and thrive in good ones.

Funding Resolution

Professionals:

- Peyto efficiently acquired Repsol’s property, bettering its future development outlook and manufacturing profile resulting from increased liquids proportion and decrease base declines.

- Manufacturing is anticipated to develop from 105,000 boe/d (barrel of oil equal) in 2023 to 130,000 boe/d subsequent yr and 160,000 boe/d in 2028.

- After the acquisition, the 2P reserves life index is now 30+ years.

- The inventory provides a 9.3% dividend yield, coated by FCF even with costs of AECO C$2.2/mcf and even decrease if accounted for hedges.

- Profitable hedging technique smoothens the commodity worth volatility and makes further revenue within the course of.

- Flexibility of manufacturing reducing and boosting makes the corporate well-prepared for future volatility.

- Structural enhancements in LNG export from NA creates a greater worth setting for NA gasoline costs.

Cons:

- A number of different Canadian O&G producers are deleveraged and give attention to returning 100% of FCF to shareholders, making them extra interesting to traders in comparison with Peyto.

- The administration at present prioritizes debt reimbursement over share buybacks.

Peyto is at present out of favor. With the entire O&G sector being cheaply priced, traders have many choices to select from and like higher-payout, deleveraged corporations that assist their shares with massive buybacks.

Additionally, traders noticed how rapidly the gasoline worth dropped, ensuing within the doable favoring of upper liquid content material producers.

Traders like myself, who consider in long-term demand for gasoline, will recognize the lengthy lifetime of the corporate’s reserves, which I think about extremely unappreciated by the market.

Revenue traders will recognize the excessive dividend yield of 9.3%, which I think about very secure resulting from Peyto’s very low-cost construction.

The excessive certainty of survival bottom-cycle costs makes it an ideal selection for long-term traders, who will profit from increased gasoline costs sooner or later.

I hesitated to take a position, however the deeper dive opened my eyes, and I’ll provoke a long-term place. With the present worth of gasoline futures and 12.5% price of fairness, DCF valuation factors at C$21.3 per share, suggesting a 50% upside to honest worth, which makes me fee the inventory as a Sturdy purchase.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.