Michael Vi

I mentioned my bullish view on MongoDB (NASDAQ:MDB) inventory in my initiation article, highlighting their strengths within the document-based database market. They launched their This autumn FY24 consequence on March 7th, delivering 27% income progress and 86.1% adjusted working revenue progress. I’m nonetheless assured that MongoDB will ship above 20% income progress over the following few years. I reiterate the ‘Robust Purchase’ ranking with a good worth of $475 per share.

Wholesome Atlas Consumption Progress

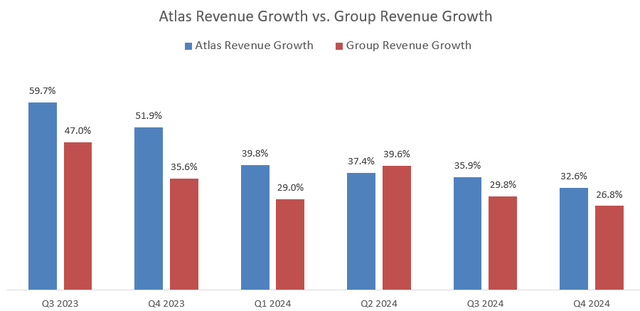

As highlighted in my initiation report, MongoDB Atlas supplies cloud-based database providers, with a consumption-based pricing mannequin. In This autumn FY24, Atlas accounted for 68% of group income, with income rising by 32.6% year-over-year, surpassing the group income progress. Clearly, MongoDB Atlas has changing into a big progress driver for MongoDB.

MongoDB Quarterly Outcomes

The sturdy Atlas progress is contributed by the next elements:

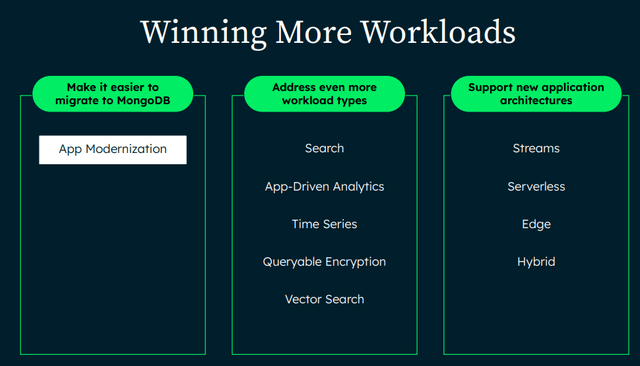

Atlas’s progress is primarily tied to knowledge consumptions, that means its growth is determined by the variety of workloads operating on the Atlas database. MongoDB has excelled in successful extra workloads within the public cloud market. As illustrated within the slide under, MongoDB has developed App Modernization instrument that permits builders to seamlessly migrate knowledge from legacy database to cloud-based ones. Moreover, MongoDB has been increasing engines like google, knowledge analytics, and AI-based vector search, which can assist a variety of workloads.

MongoDB Investor Presentation

Maximize Market Analysis forecasts that the cloud database market will develop at a CAGR of 24.85% from 2023-2029, pushed by cloud computing and AI workloads. To carry out AI machine learnings, workloads need to be mitigated to cloud, and the legacy on-premises databases need to be transformed into cloud database like MongoDB. The quick progress within the cloud database market will assist MongoDB’s growth of their Atlas database over the following few years, for my part.

Lastly, MongoDB helps each structured knowledge and unstructured knowledge, and the database platform could be operating on each on-premises and within the cloud. The unified platform simplifies knowledge administration for enterprises, offering a big expertise benefit over legacy database providers.

In brief, I anticipate MongoDB Atlas will maintain their progress momentum within the close to future.

$80 Million Progress Headwinds in FY25; Mid-Teen Progress in Headcount

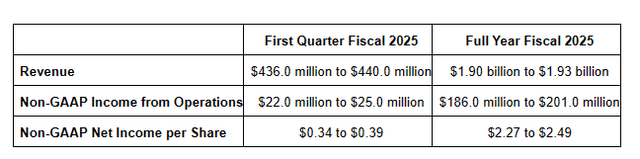

The corporate guides round 20% income progress in FY25 and roughly 25% decline in non-GAAP revenue from operations, as proven within the desk under.

MongoDB This autumn FY24 Earnings

For topline progress, MongoDB goes to come across $80 million in progress headwinds. As disclosed over the earnings name, MongoDB generated $40 million in income in FY24 from unused Atlas commitments; nonetheless this income stream will diminish in FY25, as a consequence of modifications within the incentive construction, leading to diminished fee funds for upfront commitments. Consequently, there won’t be any upfront dedication income sooner or later for my part.

As well as, MongoDB’s non-Atlas enterprise acknowledged $40 million from multi-year license offers in FY24, and their administration anticipates non-Atlas income progress moderating in FY25. As such, there are a complete of $80 million in progress headwinds in FY25, leading to 4.7% of year-over-year income progress headwind.

The $80 million in revenues signify high-margin companies as disclosed by their administration; due to this fact, it creates extra margin headwinds for the corporate.

On the fee facet, MongoDB’s headcount grew by 9% in FY24, and the corporate anticipates mid-teen progress in FY25. The brand new hirings are primarily for his or her Atlas enterprise and salesforce growth. The rising headcount poses one other problem for his or her working margin in FY25.

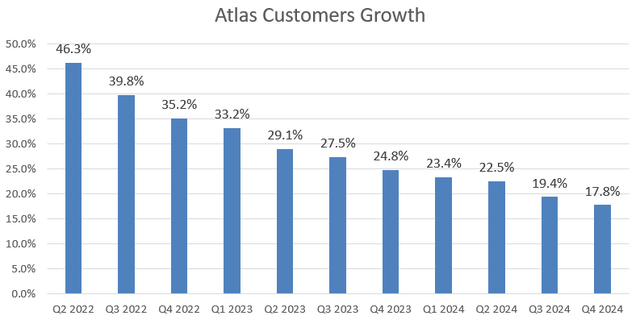

I consider the $80 million income headwind will probably be one-time situation and it gained’t happen once more in FY26. I anticipate their Atlas enterprise will develop by round 35% in FY25, supported by the rising variety of Atlas prospects, rising workloads within the Atlas cloud, secure database consumption patterns, and increasing salesforce capabilities.

MongoDB Quarterly Outcomes

As such, Atlas is predicted to attribute 23.8% to the topline progress in FY25, as per my calculation. Making an allowance for the $80 million income headwinds, the non-Atlas income is forecasted to say no by 10% year-over-year and the group income is predicted to develop by 20% in FY25, as per my estimates.

Redburn Atlantic downgraded MongoDB’s inventory as a consequence of considerations about rising storage prices for enterprises. Their thesis doesn’t make an excessive amount of sense to me. It’s true that with the rising demand of cloud computing, knowledge analytics and AI workloads, enterprises are going through rising storage prices. Nonetheless, in comparison with legacy proprietary database distributors like Oracle (ORCL), MongoDB’s consumption-based pricing mannequin allows enterprises to regularly scale up their database structure. As well as, enterprises don’t have to buy costly proprietary {hardware} to run these conventional database programs; as a substitute, MongoDB’s cloud database doesn’t require enterprises to have big preliminary capital expenditures.

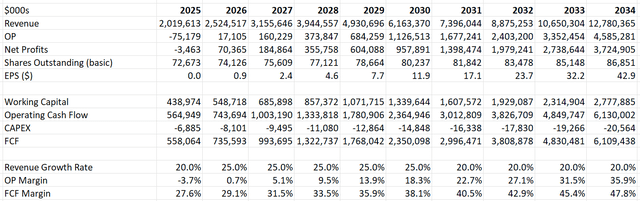

Valuation Replace

I assume 20% income progress in FY25 as mentioned above. Because the $80 million income headwind will probably be gone in FY26, I anticipate the corporate returning to a 25% progress. The normalized progress fee aligns with the market progress forecasted by Maximize Market Analysis.

I anticipate their non-Atlas income as a share of group income will regularly decline over the following decade, as extra workloads will probably be migrated to the cloud, and MongoDB has allotted extra assets in direction of Atlas associated companies.

For a mature database firm, it’s fairly lifelike to realize greater than 35% of working margin, as demonstrated by Oracle earlier than FY20. I estimate MongoDB will develop their working bills by 18% year-over-year, and their working margin will probably be expanded to 35.9% by FY34.

MongoDB DCF – Creator’s Calculation

MongoDB’s beta is 2.09 in response to SA, a reasonably excessive degree. The WACC is calculated to be 12% with the next assumptions:

-Danger free fee: 4.26%. 10-12 months U.S. Treasury Yield

-Market danger premium: 7%; price of debt: 7%

-Debt: $1.14 billon; Fairness: $1 billion

With these assumptions, the enterprise worth is calculated to be $33 billion within the mannequin. Adjusting the money and debt balances, the truthful worth is estimated to be $475 per share.

Key Dangers

Though cloud database is poised for develop quickly within the close to future, there are lots of rivals within the new market, corresponding to main Hyperscalers, Oracle, MariaDB, MemSQL, DataStax, Couchbase and so on. Much like different fast-growing applied sciences, many present firms are prone to go out-of-business sooner or later, leaving only some key gamers to dominate the cloud database market. MongoDB has the primary transfer benefit over different small gamers; nonetheless, it is necessary for traders to watch Oracle and IBM’s initiatives of their cloud-based database enterprise.

Moreover, MongoDB allotted 28.7% of complete income in direction of their SBC in FY24, barely decrease than 29.7% in FY23. The excessive SBC payout is typical for high-growth tech firms; nonetheless, the corporate does want to cut back the SBC ratio over time with a purpose to fulfill traders and enhance their working margins.

Conclusion

I view the $80 million income headwind as a one-time situation for MongoDB, and I’m fairly optimistic about their future progress in cloud-based database market. MongoDB is a excessive progress firm with a fairly excessive beta, and the inventory is appropriate for progress portfolios. I reiterate the ‘Robust Purchase’ ranking with a good worth of $475 per share.