Dennis Garrels

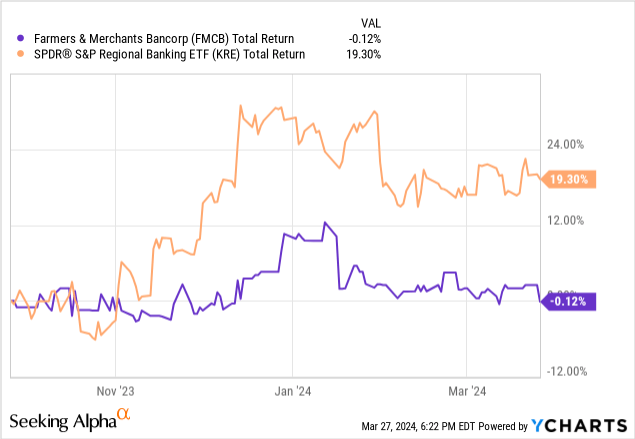

Tucked away on the pink sheets with fairly skinny buying and selling quantity, life can typically transfer fairly slowly for the shares of Farmers & Retailers Bancorp (OTCQX:FMCB). Certainly, simply as this California-based lender averted the sell-off that hit different regional banks within the early a part of 2023, it additionally missed out on the end-of-year rally, finally leading to round 20ppt of underperformance since my final replace in September.

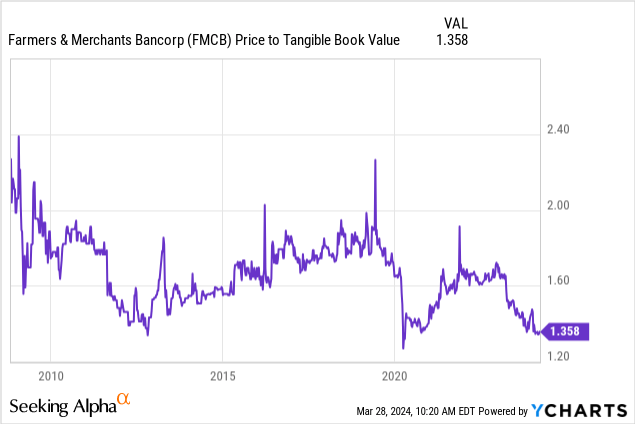

Headwinds to revenue stemming from increased funding prices and weak mortgage progress drove my Maintain score again then. Whereas high quality was/isn’t a difficulty with this financial institution, a then-valuation of 1.45x tangible e-book worth per share (“TBVPS”) seemed about proper given FMCB’s mid-teens return on tangible widespread fairness (“ROTCE”) and doubtlessly declining earnings.

Earnings have been pleasingly steady right here – higher than I anticipated and representing a really robust efficiency given how robust comps had been for regional banks within the second half of final 12 months. With the shares now right down to round 1.35x TBVPS, FMCB appears to be like extra fascinating for long-term traders, and I improve the inventory to Purchase.

FMCB Recap

To rapidly recap from preliminary protection, FMCB is the holding firm of F&M Financial institution, a circa $5b asset neighborhood lender that operates predominately in California’s Central Valley. As its title suggests, agricultural and agricultural actual property lending is a major a part of the mortgage e-book right here, accounting for just below 30% of whole loans on the finish of final 12 months. The financial institution is the fourteenth largest agricultural lender in the USA.

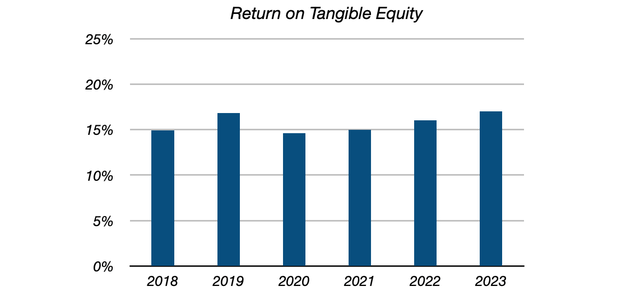

FMCB has persistently generated top quality earnings, with ROTCE averaging within the mid-teens space lately. As a mark of its consistency, ROTCE was within the double-digits even in years of very subdued returns for the broader banking business, together with in COVID-hit 2020.

Knowledge Supply: Farmers & Retailers Bancorp Varieties 10-Ok

Price benefits clarify the above. For one, FMCB controls a superb core deposit franchise, with non-interest-bearing (“NIB”) and low-cost interest-bearing demand balances at the moment funding near half of its stability sheet. On a blended common foundation, these value the financial institution a measly 9bps final 12 months in comparison with a mean interest-earning asset yield of over 5%.

Moreover, FMCB has a superb underwriting monitor report, persistently reporting very low ranges of internet charge-offs. Through the International Monetary Disaster, for instance, the financial institution’s annual internet charge-off price peaked at simply 57bps – considerably decrease than the business common.

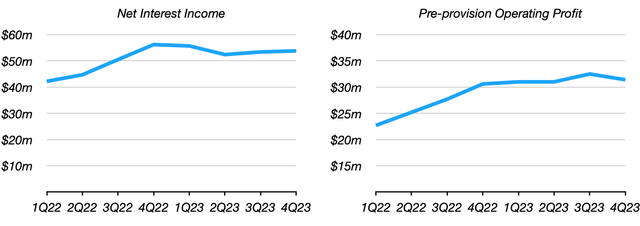

Earnings Nonetheless Comparatively Secure

Whereas funding value strain was a major headwind for the business within the again half of final 12 months, FMCB has really been reporting comparatively steady revenue. At ~$107 million and ~$64 million, respectively, H2 2023 internet curiosity revenue (“NII”) and pre-provision working revenue had been each mainly flat on H1. Likewise, the This fall annualized run-rates for NII (~$215 million) and pre-provision working revenue (~$126 million) had been additionally pretty steady.

Knowledge Supply: Farmers & Retailers Bancorp Varieties 10-Q and 10-Ok

To be clear, each deposit migration and a better value of interest-bearing balances have been points, it’s simply that these headwinds have been much less extreme right here, permitting FMCB to largely offset them with modest mortgage progress and better yields on incomes property.

Moreover, the drivers of upper funding prices proceed to average. NIB balances, for instance, now look to have settled down having fallen steeply earlier within the 12 months. Finish-of-year balances of $1.48 billion had been really a shade increased than Q3.

Deposit prices are additionally stabilizing, with This fall curiosity expense of $13.6 million implying an annualized value of funding of roughly 1.15%. That may make the determine round 11-12bps increased than Q3, however with the speed of change a lot decrease than the 28bps enhance seen between Q2 and Q3 and the 40bps rise seen between Q1 and Q2. In consequence, This fall internet curiosity margin of round 4.2% was really up just a few foundation factors sequentially.

Sequential mortgage progress additionally seemed pretty robust right here at just below 3% in This fall (versus round 0.9% for the business). Whereas one quarter would not make a pattern, mortgage progress may present a tailwind to NII and pre-provision revenue this 12 months within the face of doubtless decrease rates of interest, with the present ahead curve and Fed steering pointing to 75bps of cuts by the tip of the 12 months.

Credit score high quality continues to be excellent, supporting internet revenue and profitability. Internet charge-offs had been once more nearly zero in 2023, with This fall internet revenue of $21.4 million mapping to a robust ROTCE of round 15%. Provisioning bills of $9 million (~27bps value of threat) resulted in a 15bps enhance within the financial institution’s credit score loss reserves, and with this now standing at 2.05% of gross loans FMCB stays conservatively positioned to satisfy any downturn. That stated, there may be at the moment little or no signal of decay in its mortgage e-book, with each NPLs and whole overdue loans primarily zero.

Shares Look Attention-grabbing At This Stage

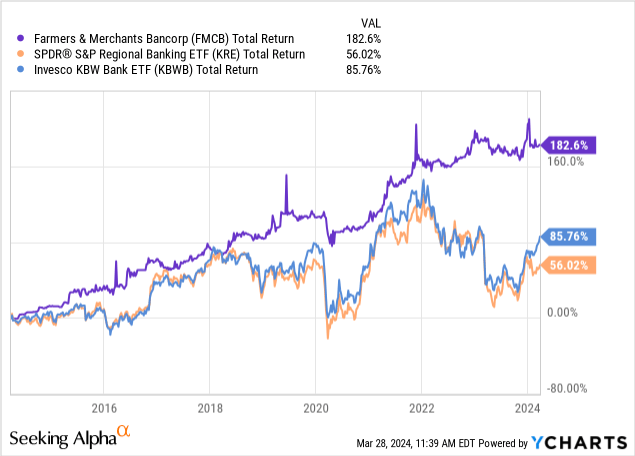

FMCB inventory trades OTC and quantity is often skinny. As such, this financial institution will most likely solely enchantment to retail traders with a long-term buy-and-hold type outlook. Whereas this additionally means the shares can drift from quarter-to-quarter, over longer-term horizons FMCB has outperformed varied regional financial institution indices by a good margin.

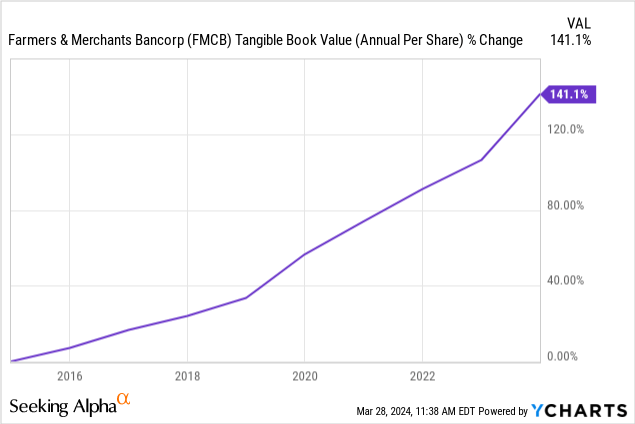

Extra importantly, the present valuation appears to be like comparatively enticing. TBVPS elevated by round 17% final 12 months to $717.50, and is round 8% increased than it was at earlier protection. Because the inventory value has been nearly flat in that point, its a number of has derated to simply above the 1.35x mark. That’s traditionally low-cost; certainly, except for COVID-affected 2020, traders usually have not been capable of purchase at these ranges.

On a mid-teens ROTCE and 1.35x TBVPS, FMCB presents traders a pleasant double-digit inside price of return. Capital returns are a bit so-so; the dividend payout ratio is simply 15% of internet revenue, equating to a present yield of simply 1.8%, whereas the financial institution has been decreasing the share depend at a circa 2-3% annualized clip lately. Nonetheless, FMCB has made up for this with stronger charges of stability sheet progress, growing TBVPS at a 9-10% CAGR over the previous decade.

Summing It Up

I said final outing that I believed FMCB would supply traders higher long-term entry factors within the coming quarters. Whereas earnings have thus far been extra resilient than I anticipated, these shares seem to commerce at near their lowest premium to tangible e-book worth in years regardless of the financial institution nonetheless reporting excellent ranges of ROTCE. Between stability sheet progress, a number of enlargement and its modest dividend, FMCB now appears to be like priced for double-digit annualized returns for long-term traders, and on that foundation I improve the inventory to ‘Purchase’.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.