George Pachantouris/Second through Getty Photos

Typically, it may be tough to put an organization. Some are simply clearly enticing, whereas others are clearly unattractive. However every now and then, there are companies that sit someplace within the center. One firm that I might level to the place this was the case, not less than for me, is The First of Lengthy Island Company (NASDAQ:FLIC). On the one hand, shares are extremely low-cost relative to ebook worth. However alternatively, there are different methods wherein the enterprise is unremarkable. It additionally has a excessive uninsured deposit publicity and up to date monetary efficiency has been something however nice. When confronted with a blended alternative like this, the most effective factor I can do is to be cautious and err on the conservative aspect. And on this occasion, that leads me to fee the enterprise a ‘maintain’.

A financial institution I am going to cross on

In accordance with the administration crew at First of Lengthy Island, the establishment dates again to its founding in 1927. Since its humble beginnings, it has grown right into a multifaceted enterprise with 41 department places largely centered across the Nassau and Suffolk Counties of Lengthy Island, and in addition all through the 5 boroughs of New York Metropolis. Identical to most any regional financial institution, the enterprise provides prospects a big selection of companies. Examples of the merchandise provided embrace deposit accounts, loans for small and medium sized companies, dwelling fairness strains of credit score, residential mortgage loans, building and land improvement loans, client loans, and extra. The financial institution additionally has different companies that it provides reminiscent of funding administration companies, belief companies, property and custody companies, and extra.

Creator – SEC EDGAR Information

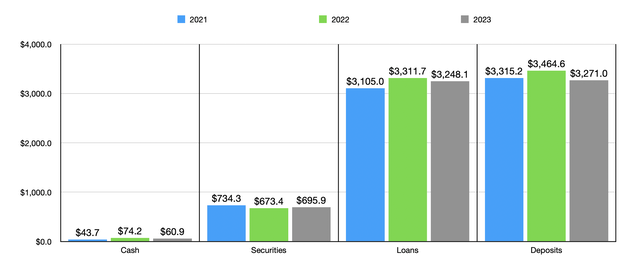

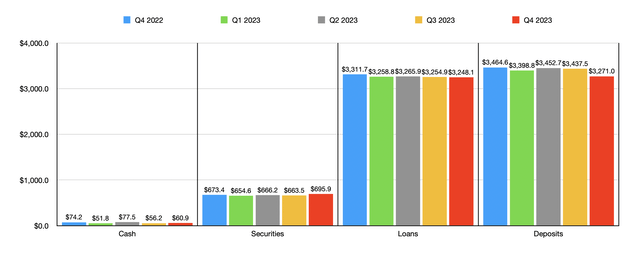

Current monetary efficiency achieved by the financial institution has been blended and, in some respects, disappointing. Contemplate, as an illustration, the worth of deposits on its books. Deposits grew from $3.32 billion in 2021 to $3.46 billion in 2022. After seeing a small decline in deposits within the first quarter of 2023, there was a rebound within the second quarter. However that was brief lived. By the top of 2023, deposits had declined to $3.27 billion. The excellent news is that uninsured deposit publicity had fallen from 58% on the finish of 2022 to 38% in the present day. However that is nonetheless above the 30% threshold that I set as a most for what I sometimes choose on this house.

Creator – SEC EDGAR Information

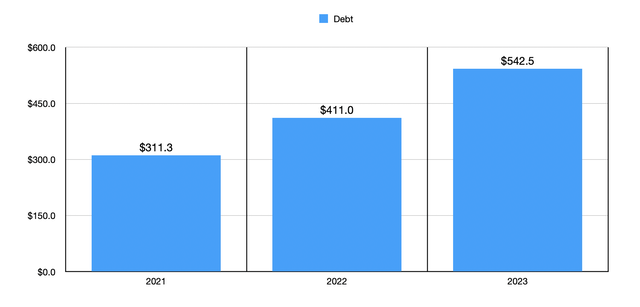

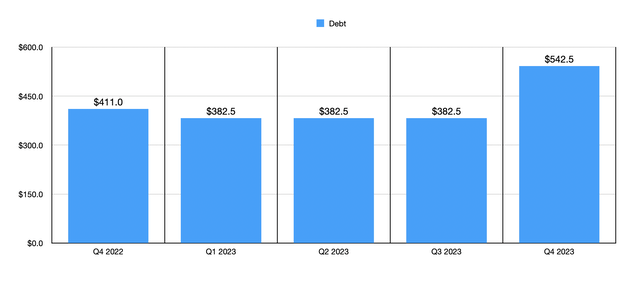

On the mortgage aspect, the image has adopted an analogous trajectory. After rising from $3.11 billion in 2021 to $3.31 billion in 2022, loans dropped to $3.25 billion in 2023. There have been different methods wherein the establishment has proven blended outcomes. The worth of securities on its books, as an illustration, did rise from $673.4 million in 2022 to $695.9 million in 2023. That is a optimistic. However that is nonetheless down from the $734.3 million that the financial institution had in 2021. The worth of money has remained in a reasonably slender vary, significantly over the previous few quarters. However debt has really elevated. Again in 2021, it got here in at $311.3 million. By the top of 2023, it had grown to $542.5 million. And the overwhelming majority of that improve from 2021 occurred from the third quarter of final 12 months to the ultimate quarter.

Creator – SEC EDGAR Information Creator – SEC EDGAR Information

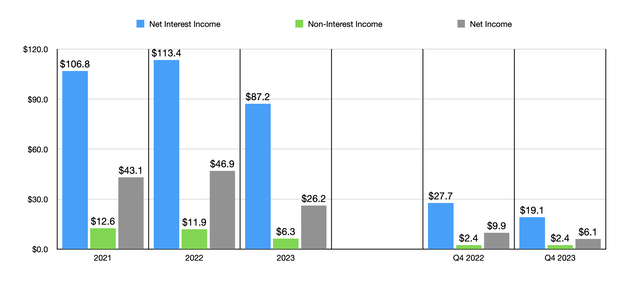

This ache on the steadiness sheet has confirmed instrumental in impacting the revenue assertion for the financial institution. After seeing web curiosity revenue rise from $106.8 million in 2021 to $113.4 million in 2022, it plunged to $87.2 million final 12 months. That drop was pushed partly by a decline within the worth of loans and better curiosity funds wanted to be paid out to depositors to be able to maintain their funds inside the financial institution. The rise in debt additionally has confirmed to be an issue right here, particularly when you think about the position that larger rates of interest cannot play on the image. Because the chart beneath illustrates, different profitability metrics for the financial institution haven’t fared significantly nicely. Non-interest revenue declined by almost half from $11.9 million in 2022 to $6.3 million in 2023. And web income plunged from $46.9 million to $26.2 million.

Creator – SEC EDGAR Information

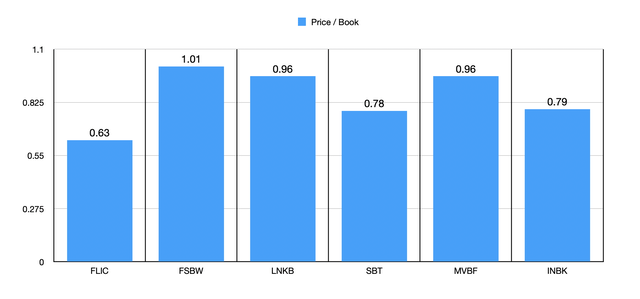

Virtually with out exception, the information that we have now lined up so far has been disappointing. However the upside to that is that the value to ebook a number of of the financial institution is kind of low. Sadly, the ebook worth per share has jumped far and wide, with no clear development over the previous a number of quarters. That’s seemingly factoring into the general value to ebook a number of of 0.63, as can be the opposite weak spots for the establishment. In truth, as a part of my evaluation, I in contrast First of Lengthy Island to 5 related companies. As you may see within the chart beneath, it has the bottom value to ebook a number of at the moment. Maintaining all else the identical, this is usually a web optimistic as a result of it might point out important upside potential. However once we begin trying on the image in different methods, issues begin to look lower than excellent.

Creator – SEC EDGAR Information

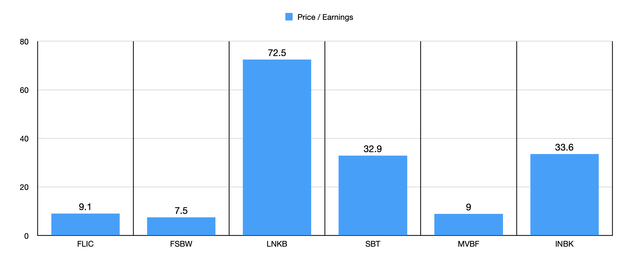

Within the subsequent chart, you may see the value to earnings a number of, not just for First of Lengthy Island, but additionally for these similar 5 corporations as earlier than. With a studying of 9.1, the establishment is mainly on the excessive finish of what I sometimes choose. There are some banks that also commerce at ranges of between 6 and 9 and that is the place I really feel most snug. Because the aforementioned chart illustrates, solely two of the 5 corporations that I in contrast it to have value to earnings multiples decrease than what it does. In order that locations it across the center of the pack.

Creator – SEC EDGAR Information

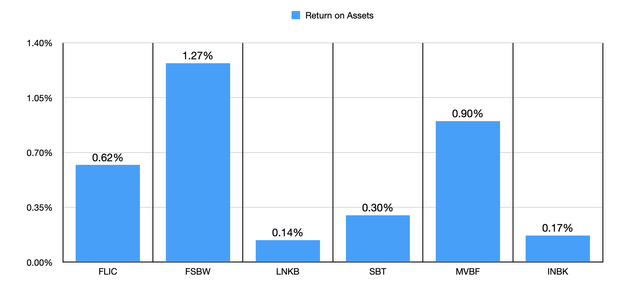

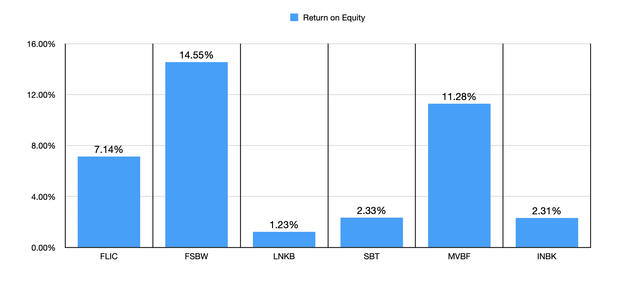

After all, generally establishments should commerce the place they do. And one factor that we are able to have a look at to see whether or not or not that is the case can be its return relative to different measures. Return on property, as an illustration, are significantly low for the financial institution at solely 0.62%. As the primary chart beneath illustrates, this isn’t the bottom of the group by any means. However I’ve seen a number of establishments with readings of 1% or larger. There’s additionally the subject of return on fairness. And as soon as once more, First of Lengthy Island appears to be across the center of the pack on this entrance.

Creator – SEC EDGAR Information Creator – SEC EDGAR Information

Takeaway

Operationally talking, First of Lengthy Island is pretty unremarkable. What I do like in regards to the financial institution is that shares are very low-cost relative to ebook worth. And relative to the opposite companies that I in contrast it to, sure metrics place it in the midst of the pack or thereabouts. However whenever you begin different elements, it turns into fairly clear that the image is problematic. Regardless of how low-cost the inventory is, the big variety of points like declining deposits, excessive uninsured deposit publicity, declining mortgage values, and a drop in income and income, leads me to consider {that a} ‘maintain’ ranking solely is smart at this cut-off date.