After overtaking Hong Kong’s inventory market in December, India at present has the fourth largest on the planet, and is now valued at over $4 trillion.

Javier Ghersi | Second | Getty Photographs

India’s market capitalization can simply develop to $40 trillion within the subsequent 20 years, pushed by stronger investor confidence and strong financial progress, analysts mentioned.

“We are able to simply hit $40 trillion by that point,” mentioned Sujan Hajra, chief economist at Anand Rathi Share and Inventory Brokers, citing the nation’s sturdy financial progress and “much more steady” forex.

Manish Chokhani, director of funding companies agency Enam Holdings, is much more bullish and predicted Indian markets might surge to $60 trillion within the subsequent 20 years.

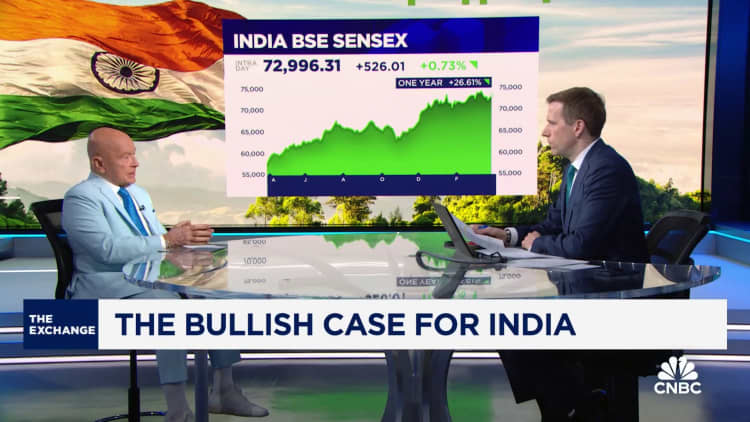

India’s benchmark Nifty 50 index soared 20% in 2023. After overtaking Hong Kong in December, the nation’s market is now ranked the fourth largest on the planet, valued at over $4.6 trillion. On Monday, the Nifty 50 and BSE Sensex surged to recent closing highs of twenty-two,666 and 74,742, respectively, Refinitiv information confirmed.

“India’s GDP progress has led to firms rising their earnings and that’s ensuing within the inventory market efficiency,” mentioned Atul Singh, CEO and managing director of wealth administration agency LGT Wealth India.

India’s Ministry of Statistics mentioned the nation’s economic system grew 7.2% for monetary 12 months 2023 and is estimated to develop 7.6% in monetary 12 months 2024. The nation’s monetary 12 months begins on April 1 and ends on March 31.

In distinction, Singh famous that China’s financial progress has not led to inventory market appreciation in recent times. Final 12 months, China’s economic system grew 5.2%, matching the official goal of round 5%. Nonetheless, the benchmark CSI 300 has declined three years in a row, shedding 11.4% final 12 months.

“So the expansion in India’s inventory market is pushed by actual earnings progress … That technique of nominal GDP progress changing into earnings progress and inventory market returns will stay intact even within the subsequent 20 years,” Singh instructed CNBC in an interview.

India additionally has a “pipeline of recent capital” that may proceed to spice up market valuations, Hajra mentioned. India noticed 220 preliminary public choices in 2023, the best of any nation in accordance with EY.

“India has the biggest variety of listed firms on the planet globally at over 6,000 and so they like elevating fairness earlier of their life cycle,” defined Hajra.

‘Alternatives are in all places’

India’s markets have grow to be costlier after the current rallies. The benchmark BSE Sensex has a price-to-earnings ratio of 25.44, in comparison with the Shanghai Inventory Change and Shenzhen Inventory Change’s common P/E ratio of 12.25 and 21.12, respectively.

Regardless of these excessive valuation multiples, analysts mentioned India ought to nonetheless be a part of an investor’s core allocation.

Goldman Sachs’ Asia-Pacific portfolio strategist Sunil Koul suggested buyers to pay extra consideration to massive cap shares as he predicts there shall be a shift away from small and mid-cap shares.

“One of many key views now we have coming into the 12 months is that it is best to see a rotation within the markets. It was the 12 months of mid and small-caps, and that appears to be altering already over the previous one month,” Koul instructed CNBC’s “Avenue Indicators Asia” final week.

LGT Wealth India’s Singh, nevertheless, mentioned “alternatives are in all places.”

He beneficial taking note of the monetary companies sector as “there are nice firms which have quite a lot of secular progress,” he famous.