Anthony Bradshaw

Gold costs proceed to surge. The spot value of the valuable metallic touched $2,400 per ounce on Friday, April 12, a brand new file. It comes after a years-long consolidation that annoyed many traders looking for diversification and security from geopolitical dangers and ballooning US federal debt. With a decisive breakout above $2100 per ounce earlier this yr, it seems to be clear skies forward. What has made the most recent thrust increased all of the extra spectacular is that it has come amid rising actual rates of interest and a firming greenback – each are regarded as headwinds for gold. In fact, rising geopolitical dangers within the Center East is a bullish issue.

Bespoke notes that gold has risen for the eighth time prior to now ten days, at the moment buying and selling 20% above its 200-day transferring common (97th percentile) and 12% above its 50-day transferring common (99th percentile) as of Friday, April 12.

I’ve a purchase score on Agnico Eagle Mines Restricted (NYSE:AEM). I see the inventory as having robust upside momentum, although its valuation will not be a screaming purchase. However with increased gold costs, the agency ought to be capable to ship wholesome earnings.

Gold Costs Contact $2,400 Per Ounce for the First Time

Looking for Alpha

For background, AEM is a gold mining firm engaged within the exploration, growth, and manufacturing of treasured metals. It explores primarily for gold. The corporate’s mines are in Canada, Australia, Finland, and Mexico, with exploration and growth actions in Canada, Australia, Europe, Latin America, and the US.

Again in February, AEM reported a powerful set of This fall outcomes. The agency boasted file quarterly gold manufacturing, serving to to drive non-GAAP EPS of $0.57 and income that rose 28% from year-ago ranges. Shares traded increased by 2.5% after the February report, and there was a slew of EPS upgrades within the final two months.

Forward of its Q1 report, the choices market has priced in a big 5.1% earnings-related inventory value swing when analyzing the at-the-money straddle expiring soonest after the reporting date, in accordance with knowledge from Choice Analysis & Expertise Providers (ORATS). $0.58 of working EPS could be unchanged from per-share earnings in Q1 final yr.

Within the This fall report, the administration workforce provided steering that was consistent with expectations, with gold manufacturing forecast within the 3.35 million to three.55 million ounces vary. With reducing web debt and new reserves within the East Goldie zone, there are monetary and operational tailwinds.

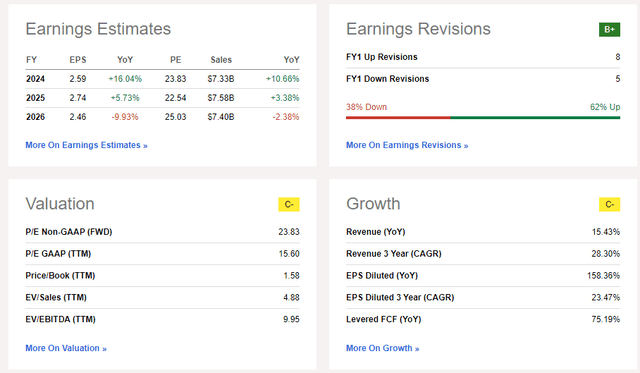

On valuation, analysts anticipate $2.59 of non-GAAP EPS in 2024 with rising earnings within the out yr. Income is seen growing by 10% this yr, however then holding regular round $7.5 billion yearly. With the very current run-up in gold, I might anticipate additional upward earnings revisions from the sell-side neighborhood. Furthermore, with strong free money stream prior to now 12 months and wholesome margins, AEM seems well-positioned to capitalize on gold’s breakout.

AEM: Earnings, Valuation Forecasts

Looking for Alpha

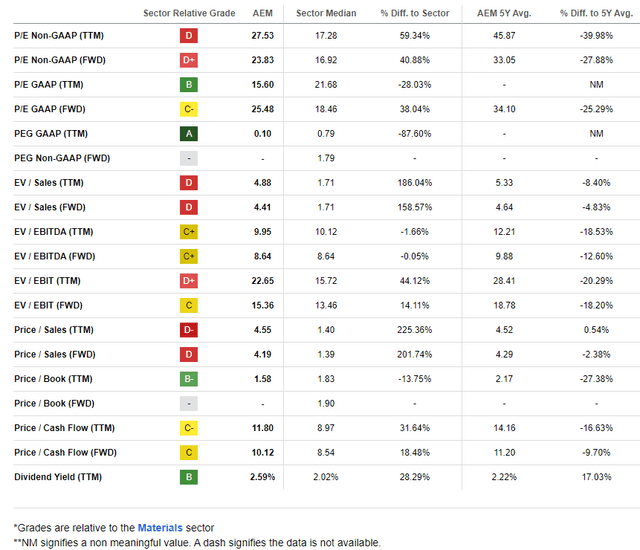

AEM trades below its 5-year historic ahead non-GAAP price-to-earnings ratio. If we assume $3 of normalized EPS contemplating that gold is now into the mid-$2000s per ounce and apply a 25 a number of, under its long-term common, then shares ought to commerce close to $75, making the inventory undervalued as we speak.

AEM: Shares Traditionally Low-cost, However Not an Absolute Worth, Constructive FCF

Looking for Alpha

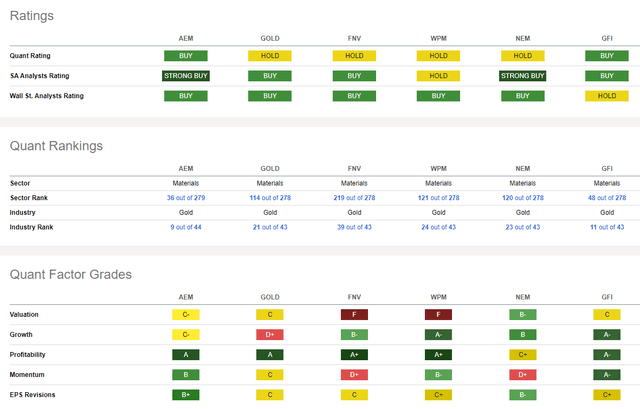

In comparison with its friends, AEM contains a blended valuation grade, whereas its progress trajectory is likewise muted. However with strong earnings progress in 2024 and the prospect of robust commodity costs serving to profitability tendencies, the basics look extra sanguine as we speak in comparison with simply six months in the past. Share-price momentum tendencies are strong, whereas EPS revisions have been on the nice facet within the final 90 days.

Competitor Evaluation

Looking for Alpha

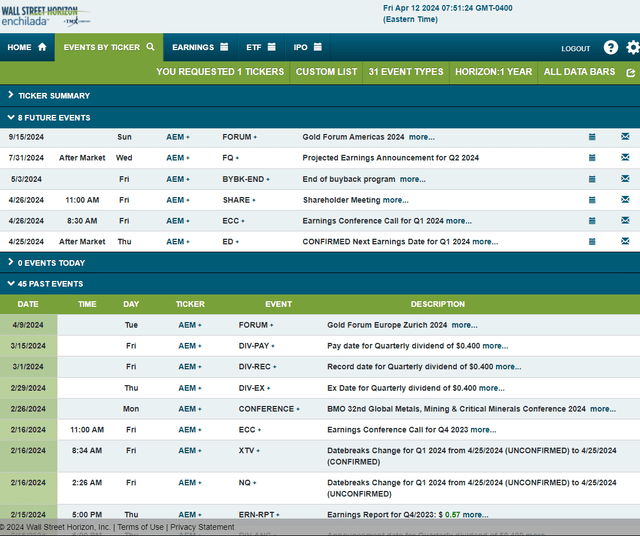

Trying forward, company occasion knowledge supplied by Wall Road Horizon present a confirmed Q1 2024 earnings date of Thursday, April 25 after the shut, with a convention name the next morning. You may pay attention reside right here. The agency then hosts its annual shareholders’ assembly on the identical day.

Company Occasion Threat Calendar

Wall Road Horizon

The Technical Take

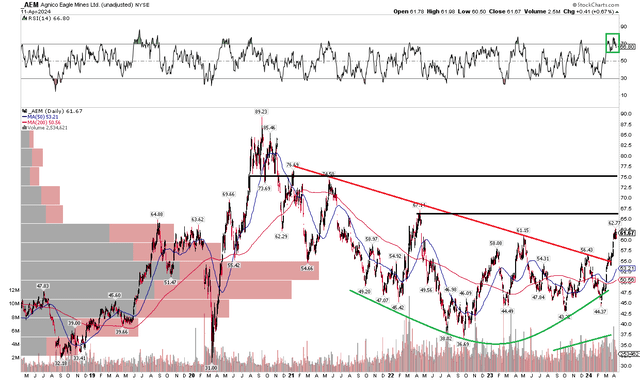

A transparent beneficiary of upper gold costs, AEM’s technical chart seems a lot more healthy in comparison with the consolidation that was seen in 2022 and 2023. Discover within the graph under that AEM has undergone a bearish to bullish reversal sample. The inventory additionally broke out above a downtrend resistance line of the early 2021 peak, all the way down to the $55 stage earlier this yr.

Additionally, check out the quantity profile on the backside of the graph – there have been growing shares traded as AEM has ascended, and that’s typically thought-about a bullish signature. Furthermore, the RSI momentum indicator on the high of the chart confirms the upside value transfer. I want to see the long-term 200-day transferring common inflect increased, although. When it comes to upside targets, the $67 early 2022 excessive is in play, with the mid-$70s providing a longer-term goal.

General, AEM’s momentum is powerful, and the inventory seems to have damaged out from a long-term downtrend.

AEM: Bearish to Bullish Reversal, Rising Quantity & Sturdy RSI

StockCharts.com

The Backside Line

I’ve a purchase score on AEM. I see shares undervalued as we speak with upside momentum from the fabric enhance in gold costs. With earnings progress forward this yr and an improved chart, shares of this gold miner look robust for the stability of 2024.