[ad_1]

With extra and extra individuals ordering meals from dwelling — a development that gathered momentum at a time when it was safer to eat at dwelling than in eating places — the proliferation of so-called “ghost kitchens” is constant apace. These kitchens deal with takeaway orders and wish a layer of know-how to maintain issues working easily.

“When COVID started, all eating places have been required to have some relationship with know-how in an effort to survive, however the significance of this relationship has been drastically enhanced by the rise of the omicron variant,” Nabeel Alamgir, co-founder and CEO of Lunchbox, informed TechCrunch by way of e mail. “That is probably the most troublesome battle eating places have ever confronted in latest reminiscence.”

Lunchbox noticed a possibility, elevating $20 million in 2020 after which $50 million again in February. On this submit, I’m having a look on the deck the corporate used to boost its $50 million spherical and convey on board a formidable cadre of traders.

We’re on the lookout for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

Lunchbox raised its $50 million Sequence B with a really tight, 15-slide deck, which the corporate very kindly shared with us. Your entire deck is unabridged, which makes it a very wonderful deck to be taught from. Let’s dive in:

- Cowl slide

- Lunchbox is the working system … — mission slide

- Finest Rising Manufacturers — buyer slide

- third get together firms are costly — downside slide

- Constructing your individual ordering system — downside slide

- Multi functional resolution — resolution slide

- Outcome: third get together killer — affect slide

- Case Examine: Clear Juice — buyer deep-dive slide

- Assembly visitors the place they’re — buyer journey slide

- Product Led Group — product highway map slide

- An exploding ghost market — market development slide

- Aggressive Positioning — competitors overview slide

- Toast vs Lunchbox — competitors deep-dive slide

- Future Panorama — market development slide

- Let’s get cooking — contact slide

Three issues to like

That is going to be a kind of instances after I remorse limiting myself to solely writing about three issues I liked in a pitch deck.

This deck is a grasp class in how an organization can carve out its story and exhibit the way it reveals up. Lunchbox efficiently explains the way it impacts its prospects’ lives with out rabbit-holing too deep into product options. It capably paints an image of precisely the way it stands out in a fiercely aggressive panorama.

The deck additionally tells us how Lunchbox can see a transparent path to an exit with out making that specific. Very properly executed certainly. Let’s pull up some highlights!

Illustrate the affect

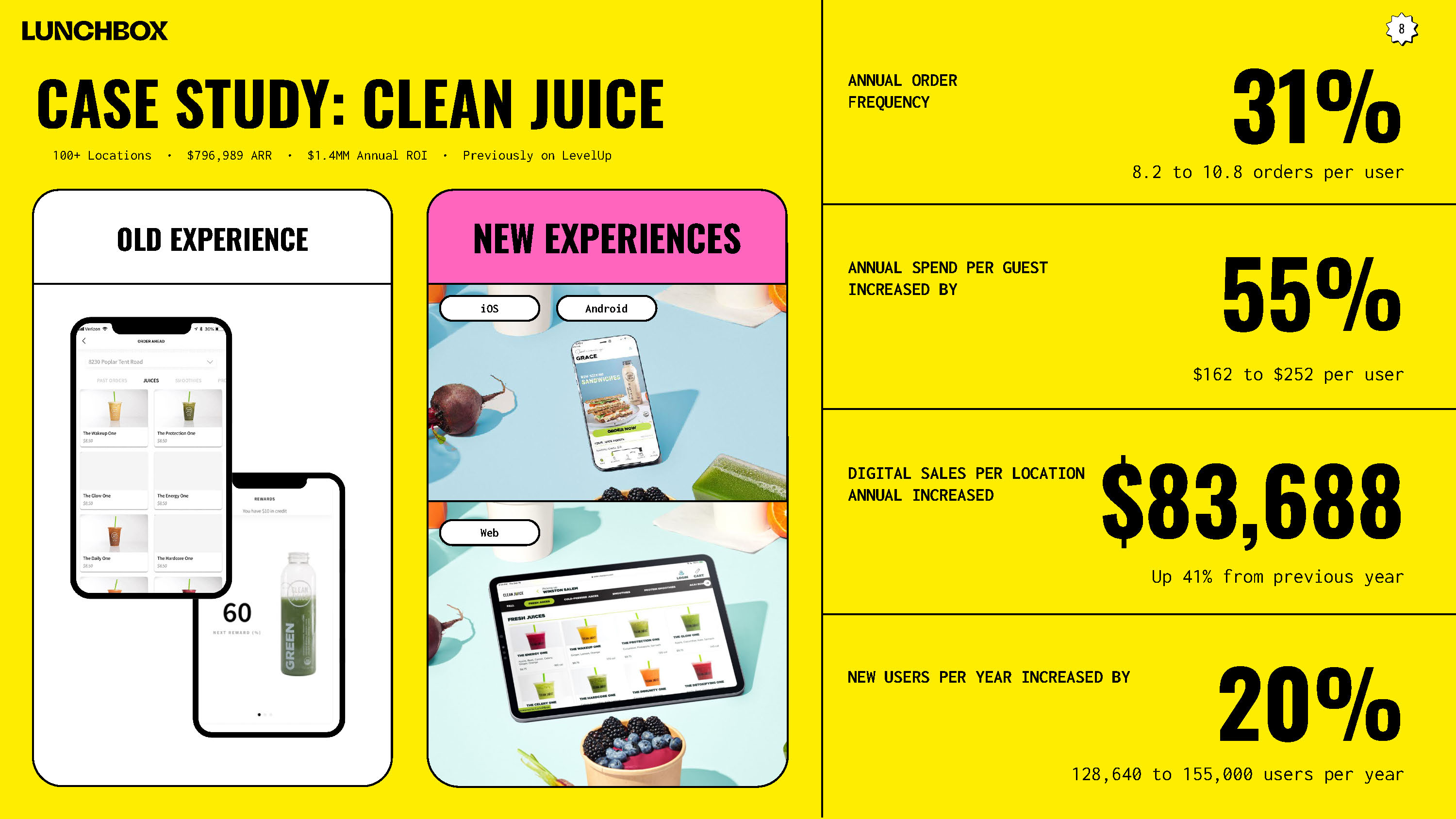

[Slide 8] By displaying the affect on a buyer, it turns into straightforward to grasp why the corporate is vital. Picture Credit: Lunchbox

About midway by way of the pitch, Lunchbox performs a card — or a slide, if you’ll — that basically rams dwelling its raison d’etre. The slide tells the story of how Lunchbox helps a buyer — juice bar Clear Juice.

Click on “order now” on the Clear Juice web site, and also you’re taken to a gorgeous, white-labeled model of Lunchbox, the place you’ve gotten the choice to decide on an outlet near you and place an order. That’s one layer of this slide — you’d greatest imagine that any investor value their salt would attempt to place an order from Clear Juice to see the product in motion.

Living proof: As I write this teardown, I’m saddened that the closest Clear Juice outlet is simply too distant to ship to my home. If Lunchbox is intelligent, they’d notice that I submitted my tackle and would feed that again to Clear Juice to inform them that maybe there’s curiosity in an outlet in Oakland, California.

As an investor, all I have to know proper now could be that the product works, that the shoppers discover actual worth in it and that they’re prepared to pay for it.

The opposite layer showcases the affect Lunchbox has had on Clear Juice with arduous information, figures and numbers — the way of storytelling traders respect most.

A 31% enhance so as frequency, a 55% enhance in annual spend per person and a 41% enhance in digital gross sales per outlet, plus a 20% bump in new customers yr over yr? These are unbelievable numbers for any enterprise and would definitely be sufficient to make me lean in and concentrate if I have been working a sequence of meals shops. Extra importantly, if Lunchbox is in a position to attract a transparent parallel between the instruments and companies it offers and the sharp uptick in site visitors its prospects see, it’s going to have some unbelievable gross sales collateral.

To me, the perfect half about this slide is that it doesn’t go too deep into precisely how it accomplishes these numbers. Little doubt that’ll be a subject for dialog later within the pitch course of. As an investor, all I have to know proper now could be that the product works, that the shoppers discover actual worth in it and that they’re prepared to pay for it.

These numbers inform that story in a strong means.

Why now? That is why now!

The perfect slides hardly ever whisper; they shout.

[Slide 11] The Why Now slide additionally contains traction figures which might be outrageously impactful. Picture Credit: Lunchbox

My goodness, slide 11 is a shouty slide. Let me be clear: There’s no means I might have designed this slide like this. It’s three totally different slides masquerading as one — it tackles macroeconomic market developments (70% of eating places have used a ghost kitchen, and 69% mentioned they’re planning to open extra), the moat/defensibility of the product (“patented product”) and provides us the uncooked numbers.

The final bit is my favourite. Within the prime proper nook, the corporate hides probably the most spectacular stat in the whole deck in muted colours, virtually shyly telling us that it’s on an unbelievable progress trajectory. It grew 541% from 2020 to 2021 and one other 365% from 2021 to 2022 to virtually $15 million in annual recurring income (ARR).

If I have been pitching this firm to traders, these numbers could be on the second slide within the deck, and I’d be shouting about it very loudly certainly: We discovered a repeatable enterprise mannequin, and we’re elevating $50 million to lean closely on the gasoline.

It’s towards this context that I really like this slide a lot. It isn’t how I might have executed issues, however any investor studying this might lean in and begin paying shut consideration. It’s a mic drop, a humble brag, a “Hey, we’ve got one thing defensible in an exploding market, and we’re hanging on tight as this rocket ship vanishes into the stratosphere.”

What this slide tells me is that Lunchbox must strive to not be wildly profitable. And that, girls, gents and everybody who doesn’t establish as both, is the way you pitch a Sequence B spherical — clarify how your success is inevitable.

Does it must be the reality? Completely; you may’t lie. However what you can do is inform your organization’s story in a strong means and let that be the opening salvo for dialogue between you and your traders.

A humble brag plus a aggressive overview

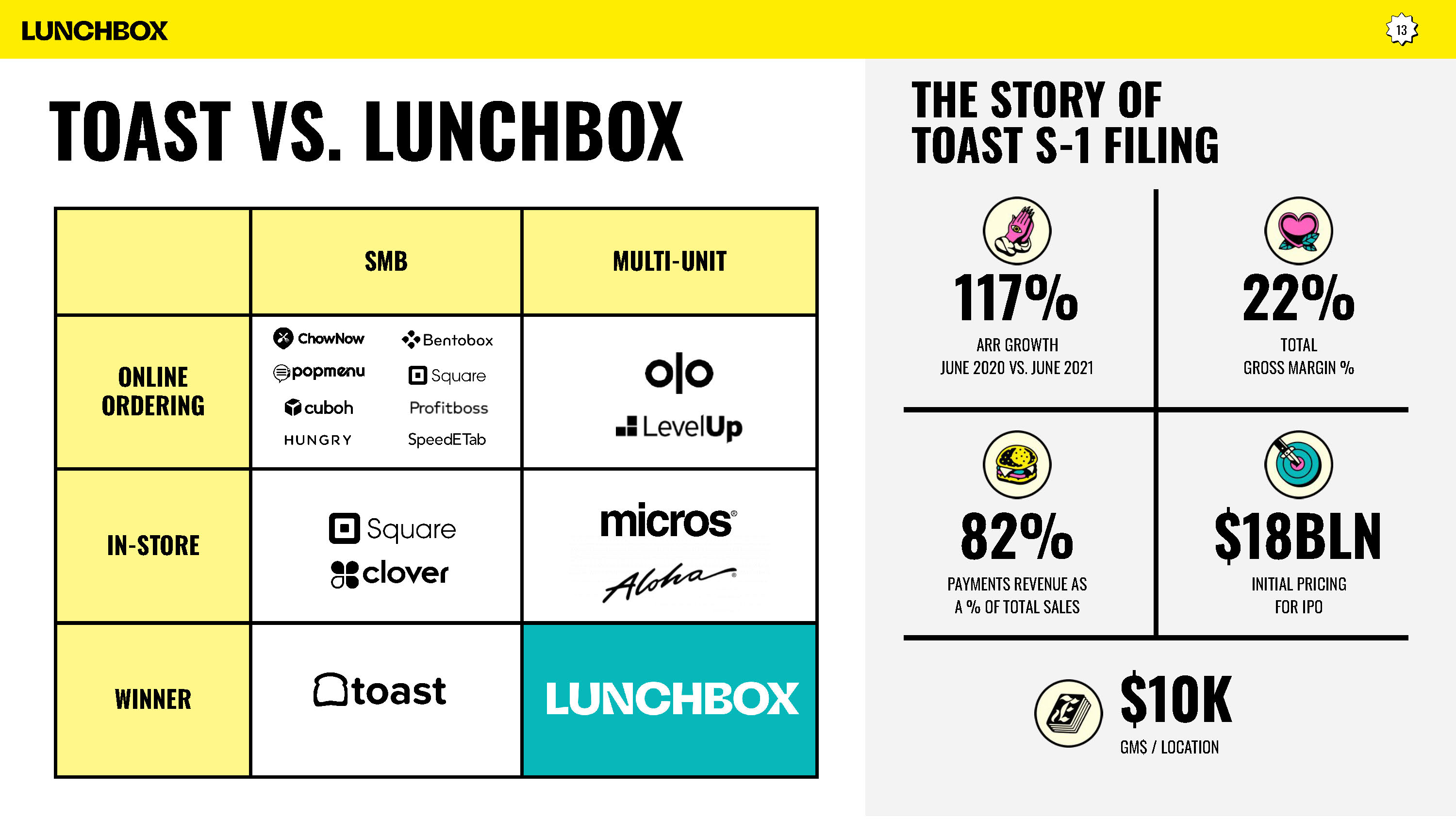

[Slide 13] Lunchbox positioning itself towards Toast. Picture Credit: Lunchbox

Toast is an attention-grabbing competitor for Lunchbox to place itself towards, not least as a result of the previous not too long ago filed a type S-1 for an IPO and posted a (more moderen) 10Q quarterly report.

In case you’re not used to studying these, Alex has a unbelievable evaluation of the corporate’s S-1, however Lunchbox did an important job at pulling out the salient particulars vis-a-vis traders taking a better look.

Realizing that Toast exists and has a present market cap of $8 billion in a market the place Lunchbox can argue that it has entry to a probably larger market is a reasonably clean means of telling this a part of the story.

To me, this slide mainly screams, “Hey, we’re spooling up for an IPO!” Given the present fundraising measurement of $50 million, I wouldn’t be stunned if a part of the technique following this spherical is to rent a workforce of finance individuals, a wunch of bankers (sure, a “wunch” is a collective noun for bankers; don’t suppose too arduous about it) and strengthen the operations of the group to cement a stable progress trajectory.

If Lunchbox manages to do all of these issues, an IPO would possibly transform the logical subsequent step. Alternatively, it would spend the money on hyperscaling its progress, after which increase a Sequence C to finance the IPO course of.

One factor is for sure: This slide is inserting a stake within the floor for Lunchbox to gear up for explosive progress — and makes it appear fully cheap based mostly on in-market competitor predicates.

In the remainder of this teardown, we’ll check out three issues Lunchbox may have improved or executed otherwise, together with its full pitch deck!

[ad_2]

Source link