[ad_1]

The labor disaster has taken its toll on the startup market. After 47 million Individuals give up their jobs in 2021, small enterprise leaders are dealing with a nationwide ability scarcity.

With extra competitors than ever earlier than, the post-pandemic on-line taking part in discipline is ripe with rivals, but stagnant with workforce gamers. Whereas the e-commerce trade might have grown by a 3rd in simply two years, a world labor scarcity is bound to place many entrepreneurial ventures out of enterprise if firm leaders don’t act quick.

Hiring Developments to Counteract At present’s Staffing Challenges

That is the place the gig financial system comes into play. On the again of versatile working developments, a digital shift and a world lockdown, extra Individuals than ever earlier than have change into their very own boss. Switching from that nine-to-five company routine to a distant various, 12% of the U.S. workforce joined the gig financial system in 2020 alone.

Actually, consultants predict that over half of company America might swap to a gig financial system by 2027 as versatile working schedules change into extra fascinating.

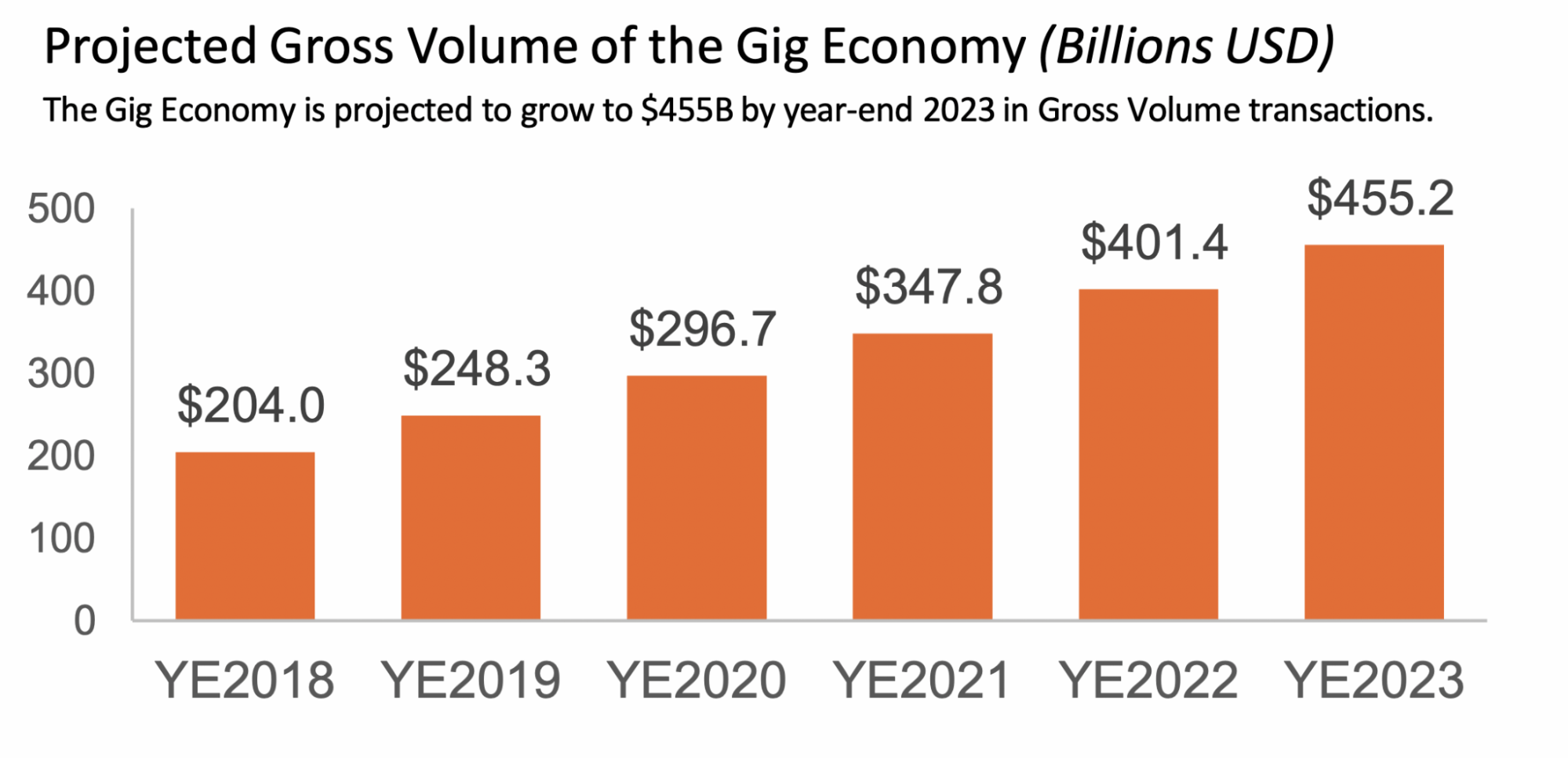

(Picture Supply: Mastercard Newsroom)

As we step into a versatile future, the gig financial system is anticipated to be price slightly below $500 billion by 2023.

The query is, can low-budget startup leaders profit from its success? Learn on as we delve deeper into the worldwide labor disaster and expose why the gig financial system might be the reply to a small enterprise proprietor’s prayers.

What’s gig work?

Outlined by Investopedia, “the gig financial system is predicated on versatile, short-term, or freelance jobs, typically involving connecting with purchasers or prospects by a web based platform.”

In a gig financial system, members are their very own bosses. As an alternative of committing to only one place, gig employees handle a number of tasks for a number of corporations on the similar time. Not solely does this profit the gig employee as they get full management over their hours, workloads and pay, however startup leaders who can not afford to rent full-time employees, acquire entry to area of interest ability units as and when required with no strings connected.

Gig work has change into extra fashionable because the onset of the worldwide pandemic. After lockdown measures despatched a hefty variety of company America again to their house workplace, distant working developments have surfaced throughout the nation.

Not solely do WFH staff say they’re extra productive in a versatile surroundings, however a whopping 99% of employees would select to work remotely for the remainder of their life if they may based on statistics from Buffer.

Because the gig financial system prospers within the wake of versatile working developments, many startup leaders are benefiting from its success. Whereas the labor disaster could also be in full swing, let’s have a better have a look at how the gig financial system might save the day for small enterprise homeowners.

How Freelancers Can Pivot within the Gig Economic system

Addressing the labor disaster

Earlier than we delve into the advantages of partaking with the gig financial system as a small enterprise proprietor, we should first handle the rationale why the startup market wants saving.

After Covid-19 triggered important havoc for America’s labor drive, almost 50 million employees have since give up their jobs searching for a versatile work/life steadiness. In a surge of distant hiring, competitors for expertise continues to rise.

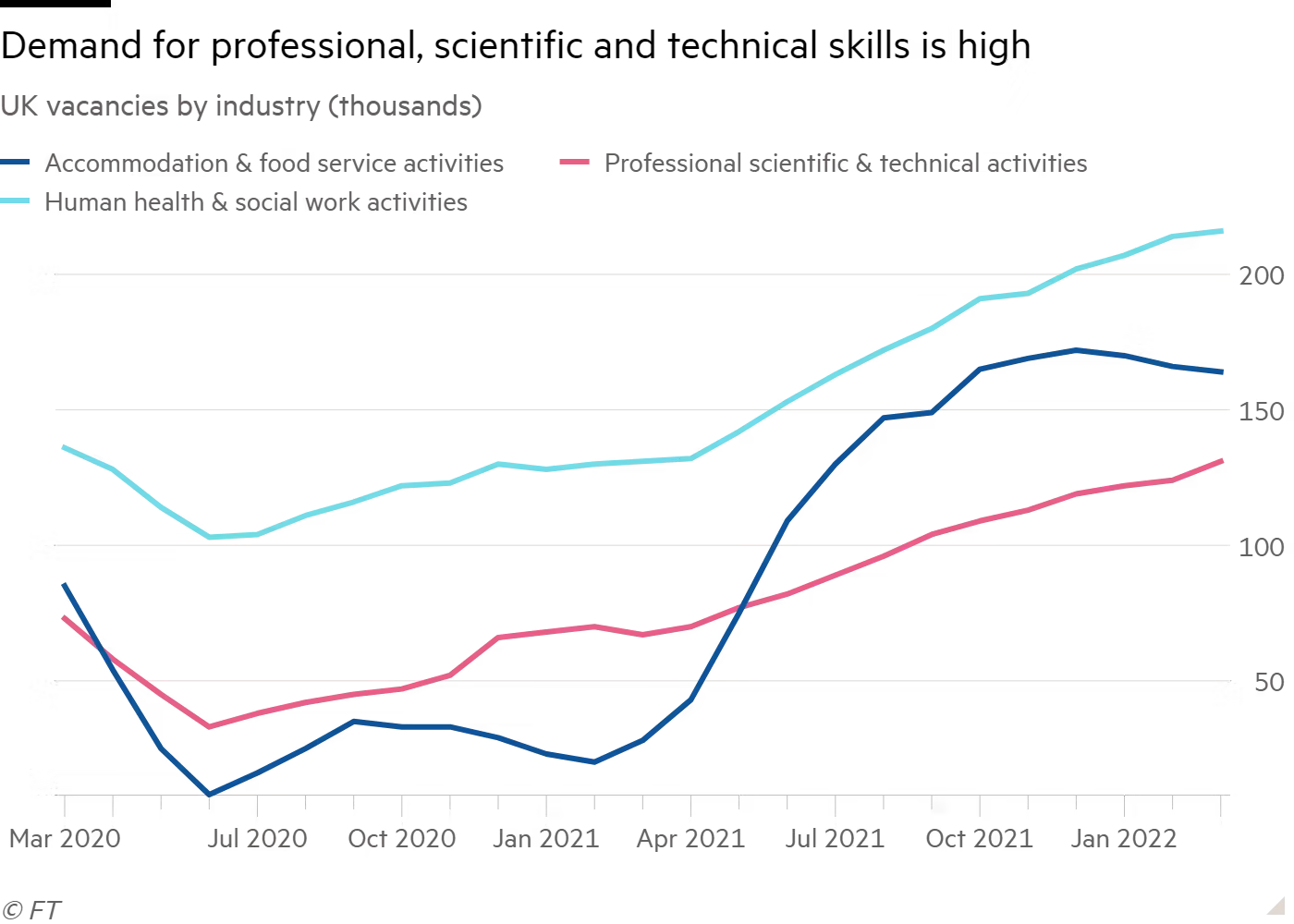

In response, the demand for skilled, scientific and technical expertise is at an all-time excessive, as enterprise leaders battle to maintain up with rising trade competitors and elevated shopper demand.

Recruitment firm SThree CEO Timo Lehne claims {that a} labor scarcity might be the downfall for small opponents with much less to supply potential expertise.

“The very fact there are fewer individuals accessible to cowl the excessive demand particularly inside white-collar knowledgeable STEM roles is changing into an immense drawback for corporations,” he commented.

(Picture Supply: Buyers Chronicle)

As you may see, human well being and social work have seen the largest ability hole rise, as trade vacancies peak at greater than 200,000.

Nonetheless, based on the Director of Hays, Paul Venables, a digital ability scarcity might be the silent startup killer of the longer term as opponents proceed to automate their processes.

“Most corporations wish to closely enhance the automation and digitization of their operations,” he acknowledged. “And, in fact, the higher the diploma of expertise shortages, the extra necessary and pressing it turns into to seek out automated methods of doing issues as nicely.”

Can startup leaders use gigging to deal with ability shortages?

The gig financial system opens the startup market as much as a world expertise pool on an advert hoc foundation. For brand new entrepreneurs seeking to merely dip their toes into the taking part in discipline, listed here are a number of the most rewarding advantages of hiring gig employees throughout a labor disaster.

A quick-tracked avenue to success

For startup leaders in determined want of a sure ability set, the gig financial system is a good way to fast-track the hiring course of, particularly if a enterprise is on the lookout for an worker on a contract foundation.

Most gig employees are consultants of their discipline and handle quite a lot of tasks inside their ability set at one time. Used to hopping from one gig to a different, freelancers typically want subsequent to no coaching and are capable of full duties with a fast turnover.

This could save startup leaders each money and time on coaching whereas offering them with a no-nonsense service, an ideal ROI technique.

Widening the ability pool

In a extremely aggressive labor market, with an absence of expertise to go round, it may be exhausting for smaller enterprise leaders to stand out from the gang through the hiring course of.

In a gig financial system, jobs are each versatile and distant, opening up the expertise pool to a world viewers for startup leaders. Due to this fact, enterprise homeowners can rent consultants from around the globe, for a value-producing workforce that may rival trade giants.

No dedication

When beginning a brand new enterprise, dedication could be a threat. Using the gig financial system provides a startup the prospect to develop with out the dedication and to chop again on money on the subject of hiring full-time employees.

With a 20% fail fee within the first 12 months alone, startups are studying to be extra versatile. Hiring expert employees on an advert hoc foundation permits a enterprise chief to enhance one facet of the corporate with out cash-based strings connected, the right resolution to a aggressive post-pandemic labor market.

StartupNation unique reductions and financial savings on Dell merchandise and equipment: Study extra right here

[ad_2]

Source link