M_a_y_a/E+ by way of Getty Photos

Essential Thesis & Background

The aim of this text is to debate the state of the broader market as a complete. This can be a reflection on how completely different belongings and sectors have carried out within the first half of 2022 and, maybe extra importantly, areas I imagine may maintain up effectively within the second half of the 12 months. Sadly, this reflection is pretty detrimental given how poorly most corners of the market have fared. However there have been a number of vibrant spots, and there are definitely areas I feel warrant placing some money to work.

To be truthful, there are many unknowns out there proper now – from battle in Europe, power provide crunches, continued above-average lead instances for items, and elevated inflation. All of those elements may weigh on returns in Q3 and This autumn. All of them may really worsen and make the top of the 12 months fairly painful. However that could be a very pessimistic view, and I really see some mild on the finish of the tunnel. With that in thoughts, I’ll cowl a number of concepts that I feel shall be fruitful going ahead, however I might urge readers to not get too aggressive right here. In case you are already closely invested and/or cannot stand up to extra volatility, it could be greatest to attend on the sidelines. However for individuals who have been ready for a sell-off, can deal with some extra threat, or usually take a longer-term view on their investments, there are some spots that I imagine we will benefit from as retail traders.

2022 Has Been Off To A Very Poor Begin

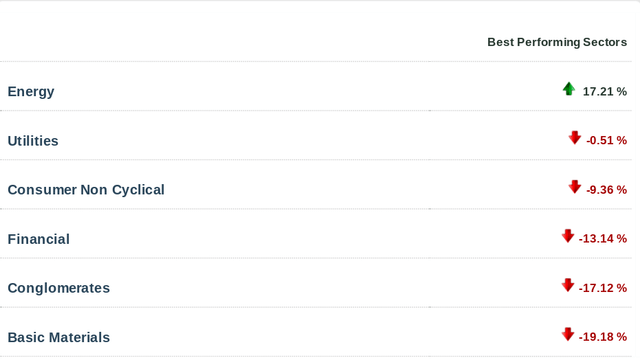

As I’m positive everyone seems to be already conscious, this calendar 12 months has been a really troublesome one. On the backdrop of a powerful 2021 and the prospects for cheap progress this 12 months, it wasn’t alleged to be this manner. However challenges with inflation, supply-chains and shortages, battle in japanese Europe, rising rates of interest, and renewed COVID-lockdowns in China have all taken their toll. Actually, there is not a complete lot to be upbeat about. Because of this, nearly all fairness sectors are closely within the crimson year-to-date. That is to the purpose the place it’s actually a “win” to be flat, or simply barely down (similar to Utilities). With most cyclical and discretionary sectors down closely, the one vibrant spot that has been pretty constant till very not too long ago is Power:

YTD Efficiency (Varied Sectors) (CSI Markets) YTD Efficiency (Varied Sectors) (CSI Markets)

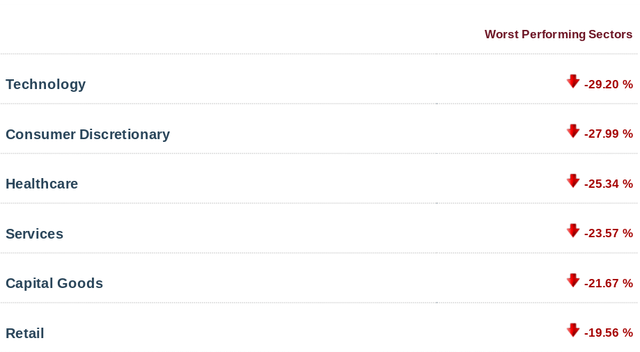

Trying previous simply U.S. fairness sectors, we see this weak spot has prolonged into different asset lessons. Whereas crude oil has surged (serving to the Power sector out-perform) and the U.S. greenback has risen, U.S. fairness hedges like bonds, gold, and international shares have all seen detrimental returns as effectively:

YTD Efficiency (BlackRock)

There is not a complete lot I can say besides that traders have been punished this 12 months. Worse, there weren’t many locations to “cover” throughout this onslaught. Conventional knowledge would point out that if shares have been performing this badly bonds can be doing effectively. That is alleged to offset losses and stability one’s portfolio. However 2022 has not seen that thesis play out. That is primarily as a result of inflation has roiled bond and fairness sectors alike. Even different asset lessons similar to crypto haven’t supplied any sort of hedge – which is why I see little benefit to holding them now.

With this backdrop in thoughts I feel it ought to give readers pause and an opportunity to replicate on what has really been working and the place potential worth is. With nearly each sector having sold-off, it’s simple to see worth all over the place. In any case, such massive drops in worth sometimes point out shopping for alternatives. However my thought is there shall be continued weak spot forward in lots of cyclical areas and that being extra selective on what to purchase is the proper transfer. I’ll now shift to some areas that I do imagine have worth, and comply with that with a dialogue on why different “low cost” sectors don’t pique my curiosity but.

Let’s Stick With Power, Which Has Been Working Till Not too long ago

It’s simple to look-back and rehash all of the issues that have not labored in 2022. However the extra vital train is determining what will work sooner or later. Clearly, 2022 has not been sort, and there are many causes to counsel the second half of the 12 months shall be simply as troublesome. The macro-headwinds I discussed above usually are not going to simply merely go away. The worldwide economic system is in a decent spot, so selective shopping for shall be key going ahead.

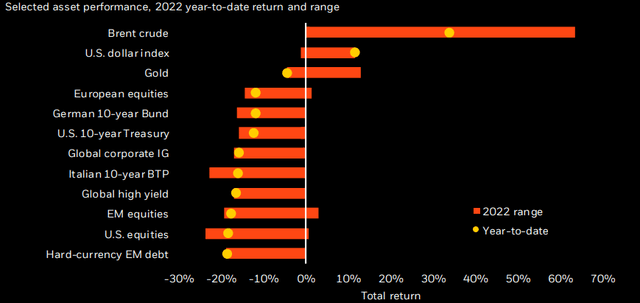

With that in thoughts, I proceed to love Power positions in my portfolio. This may occasionally appear too apparent, given the run the sector has had this 12 months. However whereas the sector has certainly pumped out double-digit features in 2022, we also needs to acknowledge the sector is definitely in a bear market (outlined as a 20% decline off its excessive). How can a sector be performing so effectively however be in a bear market? As a result of the features within the first half of the 12 months have been so sturdy initially, that the sector remains to be up roundly regardless of 20%+ drops within the short-term. Actually, within the final month alone the Vanguard Power ETF (VDE), the iShares World Power ETF (IXC), and the crude oil benchmark have all dropped by double-digits:

1-Month Efficiency (Google Finance)

With this weak spot it ought to be logical to query why I might advocate this theme. The momentum is unquestionably detrimental, however I feel it is a bit unjustifiable proper now.

There are a number of causes for this. One, crude costs nonetheless stay elevated. Whereas they’ve retreated a bit not too long ago, $100+ for a barrel of crude remains to be very worthwhile for the oil majors. This can help the sector within the close to time period, and I do not see a state of affairs the place demand actually falls off a cliff. Sure, recession fears are looming, however the provide backdrop stays optimistic (for supporting costs). Demand can fall and costs will nonetheless be larger than they have been a 12 months in the past. That’s optimistic for shares.

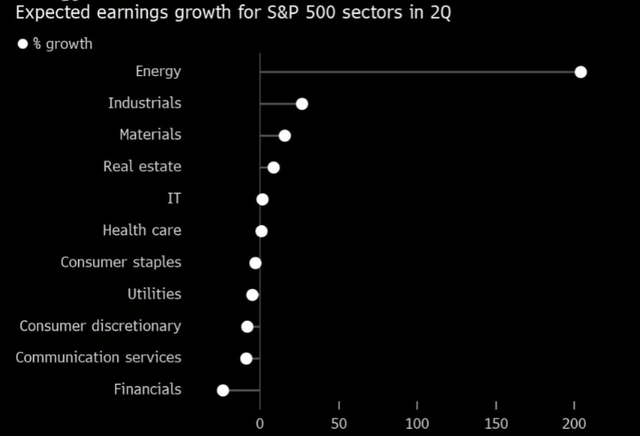

Additional, earnings season is kicking-off and Power shares are poised to shine. After such a pointy sell-off, I feel this units the sector up properly. My level being that if shares had stored rising and expectations have been very excessive, promoting into earnings could make sense. However the reverse is definitely true in the meanwhile. Shares have been falling and traders are pessimistic – a ripe alternative for a contrarian play. That is supported by the truth that earnings progress for the Power sector is anticipated to be fairly sturdy in Q2. Figures ought to be effectively forward of different sectors, providing the prospect for post-earnings boosts:

Anticipated Earnings Progress in Q2 (By Sector) (Yahoo Finance)

My thought is I see a current sell-off and the potential for sturdy earnings stories as a purchase catalyst. This can be a theme that has been working for many of 2022, so I see little incentive to not keep lengthy within the second half of the 12 months. I do not see a sufficiently big change in tone out of Washington to see the availability imbalance right itself, and that is an space I really need to add publicity to, not divest.

**My private holdings are VDE and the ProShares Extremely Bloomberg Crude Oil (UCO), which is a double-leveraged crude oil play.

NASDAQ Not often Has Such Extended Weak spot

The following space I see some worth could come as a little bit of a shock. That is the NASDAQ index, which has been under-performing each the Dow and the S&P 500 this calendar 12 months. With this backdrop, it’s justifiable to being cautious at this juncture. Just like the market as a complete, the headwinds which have plagued this index are nonetheless in place. This contains progress issues, the potential for a recession, inflation, and a basic risk-off mode. So, once more, I would not get carried away right here. However I might use massive one-day drops or extended weak spot as shopping for alternatives.

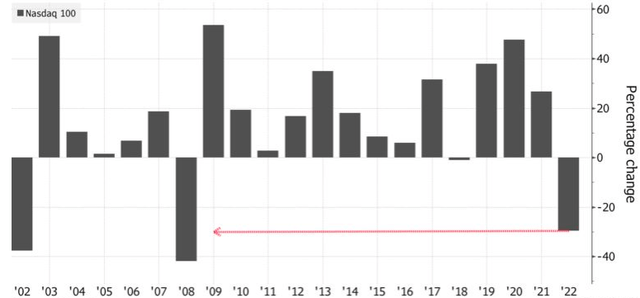

At these ranges, I feel one can be well-served so as to add to their publicity. Sure, the drop in extra of 20% this 12 months alone is frightening. However now we have to keep in mind that this kind of worth motion could be very uncommon. The NASDAQ nearly all the time finishes a calendar 12 months within the inexperienced, and the years following an analogous sell-off in 2088 noticed substantial features:

Annual Returns (NASDAQ 100) (S&P World)

The conclusion I draw right here is pretty simplistic however I imagine it’s supported all the identical. The NASDAQ’s valuation has moved right into a normalized vary, and its heavy sell-off suggests higher days are forward. Historic returns do not assure something, however they are often helpful indicators. For me, I see the weak spot as overdone, and can additional down days as possibilities to purchase, not panic.

**My private holdings embrace the Invesco QQQ ETF (QQQ).

Munis Offered-Off Too Aggressively

My subsequent matter is one which I do suppose traders ought to method considerably cautiously. This can be a longer-term play as a result of a key issue that has pummeled this sector is inflation, which is able to in all probability persist within the coming months. So, whereas I see worth right here, it isn’t going to be a straight shot upwards. Buyers can buy this for tax-free revenue stream, and look so as to add on weak spot, of which I’m positive there’s extra to return.

The sector I’m referring to as municipal bonds, particularly tax-exempt ones. As I discussed, inflation has hammered the sector, which is historically a defensive nook of the market. With period ranges have risen too excessive throughout most ETFs and CEFs on this area, with inflation charges and fee hikes adopted, share costs went broadly south.

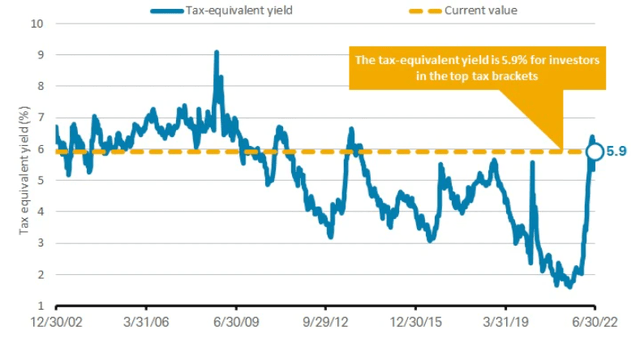

The upside is that this caused some worth. Many common CEFs on this area are seeing steep reductions to NAV. Additional, credit score high quality really stays sturdy. This has stored distributions secure and defaults uncommon. The fact is that the revenue could be very excessive on a historic foundation, particularly as soon as we alter the yield internet of tax financial savings:

Tax-Adjusted Muni Yields (Common) (Charles Schwab)

The takeaway right here is that traders shall be arduous pressed to discover a high quality revenue stream within the 6% vary. You may completely discover this in the event you transfer down in credit score high quality, however for investment-grade debt, that is very engaging.

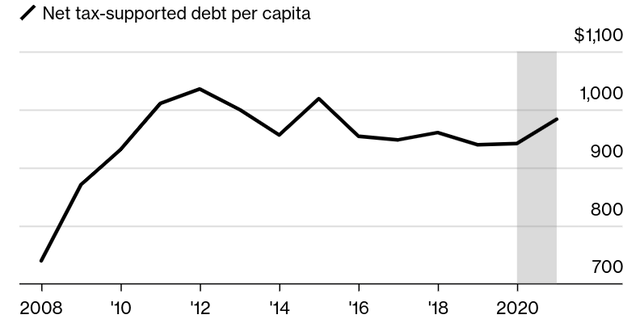

Moreover, I feel issues over state and native budgets is overblown. The present U.S. administration has made support to the states a high precedence in current laws. Additional, whereas debt ranges rose in 2021, I’m not overly involved as a result of this nonetheless retains debt burdens in-line with the place they’ve stood over the previous decade:

U.S. State Debt (Bloomberg)

As my followers know it is a sector I’ve favored for a long-time. But, I took a extra cautious stance a couple of 12 months in the past, primarily due to that period threat I discussed. The impression of that did come to cross, however for full disclosure I acquired bullish on this sector too early in 2022. I felt like I prevented to sell-off and patted myself on the again, solely to see munis fall additional. Thankfully, there was a rebound not too long ago, and my outlook stays optimistic from right here. However I say this as a result of I need to emphasize that period ranges stay excessive, and this sector has seen extra volatility over the previous 12 months than is typical. This can be a phrase of warning to not get too daring at these ranges, until your main focus is the revenue (which could be very engaging certainly) and you’ll stand up to the continual volatility I anticipate to see.

**My private holdings are the Nuveen AMT-Free High quality Municipal Earnings Fund (NEA) and the BlackRock Taxable Municipal Bond Belief (BBN).

Retail Appears to be like Low cost, However Possibly It Ought to Be

I’ll now shift the dialog to some corners of the market that do not spike any curiosity for me. I discussed earlier that the majority corners of the fairness market have been offered aggressively. This makes worth seem nearly the whole lot, however I might avoid what I think about worth traps for the second.

One space that involves thoughts is retail. This can be a sector I’ve some publicity to, sadly, because it rallied within the aftermath of Covid-19 when shoppers have been flush with money, excessive financial savings charges, and proved very resilient. Since then, the story has been categorically detrimental. Actually, retail, as measured by the SPDR S&P Retail ETF (XRT) is down nearly twice what the S&P 500 is in 2022:

Retail vs S&P 500 (Google Finance)

This divergence may counsel a contrarian shopping for alternative. In some methods, I hope it does. Whereas I lowered my place in XRT this 12 months, I’m nonetheless lengthy and that place is in an IRA. So I do not profit from tax-loss harvesting by promoting it, and can merely stay lengthy. However relatively than “double-down” to recoup losses, I’m going to remain affected person earlier than including extra.

The explanations are multi-fold. Retail is getting hammered due to the macro-environment concerning shopper sentiment, inflation, and rates of interest. Do you see these attributes materially altering anytime quickly? I positive do not. Actually, inflation has change into a greater fear for American households as 2022 has gone on, regardless of extra “skilled” predictions that inflation is peaking. Bear in mind, these are the identical people who informed you inflationary can be transitory, so forgive me if I will not take their phrase on it peaking this time round both.

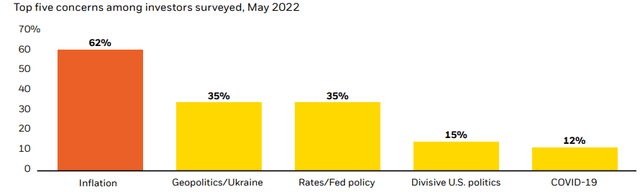

Except for the truth that even when inflation has peaked, that does not imply it’ll reverse course in a significant method. If inflation stays at present ranges, be careful. The truth that shoppers are this apprehensive about it means that spending goes to be subdued in the intervening time. In any case, if you’re apprehensive in regards to the future and inflation, you possibly can start to tighten the belt a bit. With inflation far and away the most important macro-concern amongst U.S. traders, this implies a change in momentum will not be forthcoming:

Investor Issues Ranked (BlackRock)

The takeaway right here is that I do not see a significant catalyst for a retail bump within the short-term. Just like most sectors, there’s in all probability some long-term worth right here. However I’m pretty satisfied I can decide this publicity up at a good higher worth within the months forward. Maybe as we will nearer to the vacation buying season I’ll rethink and attempt to front-run that catalyst. However, for now, I do not see quite a lot of benefit in direction of pumping good cash after unhealthy with all of the headline inflation threat weighting on the minds of American shoppers and traders.

**My private holdings embrace XRT.

Mainland Europe Is One other Keep away from For Me

One other space that has worth on the floor is Europe. Not surprisingly, shares on the mainland have taken an enormous hit in 2022, as they’re confronted with not solely inflation and slowing progress, but in addition battle in Ukraine. This can be a main headwind, inflicting fears of the battle spreading throughout different sovereign borders in addition to power provide worries. The web outcome has been a steep sell-off on this nook of the world, with valuations touching ranges not seen for the reason that onset of Covid-19 over two years in the past:

European Shares P/E (Bloomberg)

It appears very easy and apparent that EU shares ought to be a purchase right here. With nervous traders on the lookout for worth, and Euro equities sitting at traditionally low cost costs, it’s nearly a no brainer, proper?

To me, the reply isn’t any. Something this painfully apparent ought to give traders rapid pause anyway. The market is telling us one thing we have to no less than think about. Is shopping for throughout instances of stress and below-average valuations typically a successful play? Completely. And it very effectively could possibly be right here. However I’m involved equities usually are not as low cost as they seem. Sure, the P/E is low, however the “E” a part of that equation may simply sink additional. If the Russia-Ukraine battle escalates, be careful. If shoppers find yourself being compelled to pay drastically extra to warmth their houses this winter, be careful. If financial exercise slows, be careful. All of those headwinds are very actual.

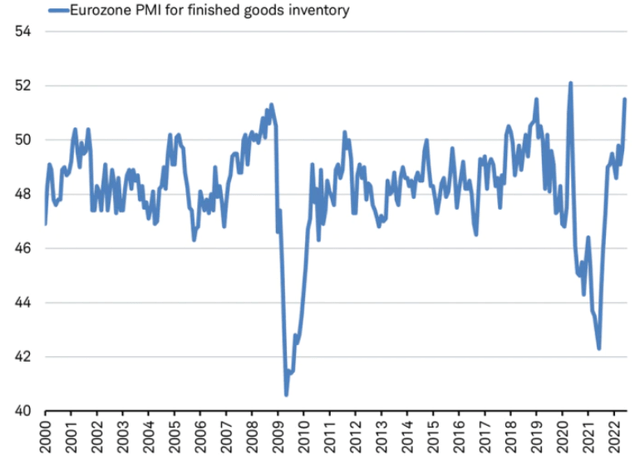

Actually, there are already indicators that the macro-environment within the Euro-zone is weakening. PMI information and stock build-up are regarding for the area’s equities, with completed items close to twenty-year highs:

Stock Construct-up (Euro-zone) (Charles Schwab)

What I need to convey right here is that whereas Europe appears to be like low cost, it appears to be like low cost for a motive. That doesn’t imply we have to panic, however I might be extra discerning right here. The outlook could be very cloudy there – the potential for an escalation in a navy battle is just not one thing we usually need to assess when discussing developed market equities. This can be a massive crimson flag that instances have modified considerably, and traders will in all probability be taking over extra threat than they understand even when valuations are “low cost”. For me, I might proceed to look to developed markets when branching out of the U.S., however in these markets which are extra faraway from japanese Europe and unlikely to be drawn right into a navy battle. Personally, I like Canada, Australia, and Eire for that goal, in that order.

*My private holdings embrace the iShares MSCI Canada ETF (EWC), the iShares MSCI Australia ETF (EWA), and the iShares MSCI Eire Capped ETF (EIRL). I additionally personal the iShares MSCI United Kingdom ETF (EWU), however am much less bullish on that choice presently given the continuing political drama.

Backside-line

In abstract, 2022 has been a 12 months to neglect to this point. We are able to hope that quarters three and 4 convey higher tidings. However hope is just not an funding plan. To arrange for the subsequent few months I might counsel shifting into Power, whose sell-off relies on recession fears primarily. To me, the availability story and the fast decline in costs each help larger costs going ahead. The NASDAQ stays a dangerous index, however I imagine shopping for on down days will show fruitful ultimately. I additionally see worth in municipal bonds and developed market equities which are effectively faraway from the geo-political dangers in mainland Europe.

Against this, I see basic Euro-equities and retail shares as locations to keep away from, regardless of being very attractively priced on the floor. I feel the reductions these arenas provide are justified, and will not be shopping for in till I see one other leg down (which I anticipate). Typically, realizing what to keep away from is simply as vital as realizing what to purchase, and that is that sort of market for my part. Finally, I hope this train provides readers some meals for thought, and can assist for preparation for the second half of the 12 months.