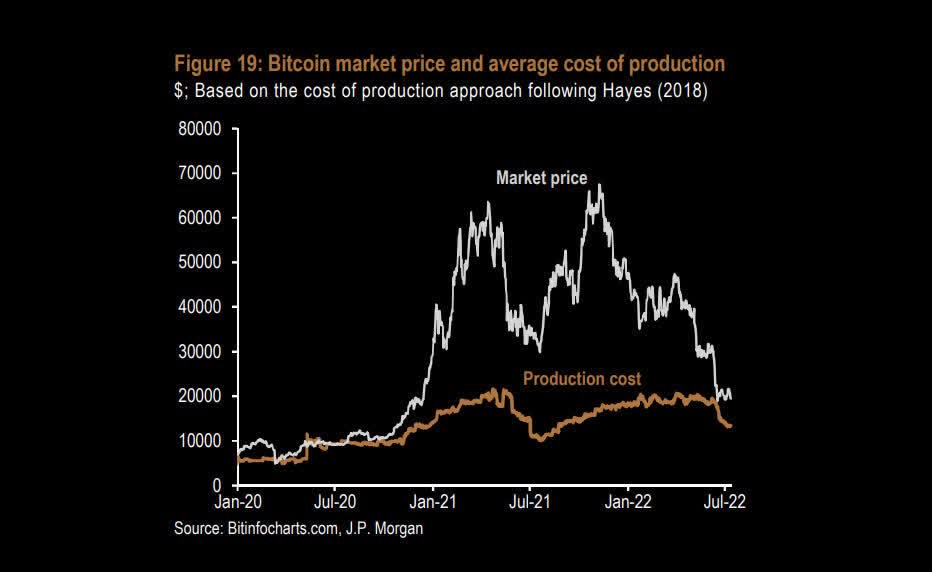

The massive image: Because the crypto crash continues to depart Bitcoin costs depressed in comparison with their place a yr in the past, knock-on results are nonetheless taking part in out in varied areas. A kind of is the manufacturing value, and miners’ efforts to manage it could be a double-edged sword for the crypto market.

JPMorgan Chase & Co. stories that the price of mining Bitcoin has fallen to round $13,000 from $24,000 since early June. Bloomberg notes that the drop is probably going an impact of the crypto winter, however it’s unclear whether or not this might assist or hinder any restoration of the cryptocurrency’s value.

It is simple to pin the decline on a miner exodus after Bitcoin’s value crashed from its excessive final November, which could possibly be decreasing the quantity of electrical energy and processing energy wanted for mining. Summer season heatwaves may also encourage some mining pauses. Nevertheless, JPMorgan strategists led by Nikolaos Panigirtzoglou declare it is really as a result of miners defending profitability by extra environment friendly rigs.

On the one hand, decreasing mining prices to make Bitcoin extra worthwhile may stabilize the market. However, some see that manufacturing value as the ground for Bitcoin’s value throughout downturns. Decreasing that flooring would possibly make it doable for the crypto winter to get even worse.

Bitcoin peaked at virtually $70,000 final November earlier than tanking this spring. The downturn has despatched shockwaves by varied entities like crypto corporations, El Salvador’s authorities, North Korea’s weapons program, and ransomware gangs.