Kunakorn Rassadornyindee

Early this morning, Real Elements Firm (GPC) launched its three-month numbers and as soon as once more outcomes had been extremely good. We propose to inspect our earlier analyses: love at first sight and lengthy solely. Except for our purchase case recap based mostly on i) the getting old automotive inhabitants within the macro areas the place the corporate operates, ii) fewer new automobiles bought (resulting from macroeconomic uncertainty, provide chain disruption and semiconductor scarcity) that result in larger upkeep restore, and iii) stable fundamentals (dividend aristocrat standing and ample liquidity for accretive M&A); at present, we want to add a iv) level: improve automotive complexity.

Right here at Mare Proof Lab’s tower, we’re not tremendous enjoyable of full EVs, however we imagine {that a} hybrid automobile system would be the resolution over the medium-term horizon (earlier than hydrogen might be cost-competitive). This could assist Real Elements gross sales over the long-term horizon.

Half-year Outcomes

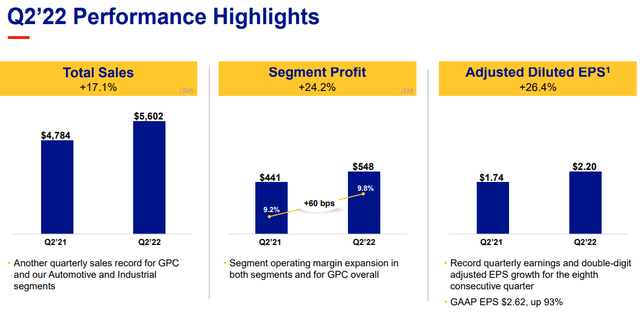

Topline income stood at $5.6 billion in comparison with the $4.8 billion recorded in the identical interval final 12 months. This progress was supported by Kaman Distribution Group integration and was partially offset by the forex impact. Wanting on the section revenue efficiency, the Automotive Elements Group division delivered a plus 10.9%, reaching €323 million. As well as, the Industrial Elements Group section recorded a rise of just about 50% on the working revenue degree, reaching for the primary time a double-digit margin (10.6% to be exact) and in worth absolute a $225 million revenue.

GPC Q2 Monetary Snap (Real Elements Firm Q2 Presentation)

Conclusion and Valuation

Our inside group believes that it is now time to overview upwards our purchase ranking. Real Elements is consistently delivering higher outcomes and is at present offering larger steering for 2022 (already positively reviewed after the Q1 replace). We used to worth the corporate with a “conservative” revenue margin of 8.5%, we at the moment are forecasting a 50 foundation level improve, sustaining our long-term progress price at 2.5% and a WACC of 5.8%. Then, we derive a goal value of $165 per share (in comparison with the earlier one at $155). Except for the valuation, the corporate has a powerful stability sheet with an outstanding FCF technology. We appreciated GPC’s capital self-discipline technique with its M&A optionality (thanks additionally to a fragmented market). Given the previous observe report coupled with its dividend aristocrats standing, we’re all in with GPC.

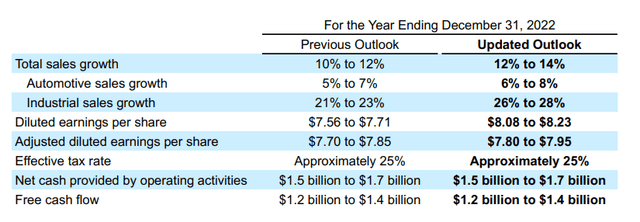

GPC New Outlook (Real Elements Firm Q2 Press Launch)