[ad_1]

by Charles Hugh-Smith

Are 55 and older staff propping up the U.S. financial system? The info is reasonably persuasive that the reply is sure.

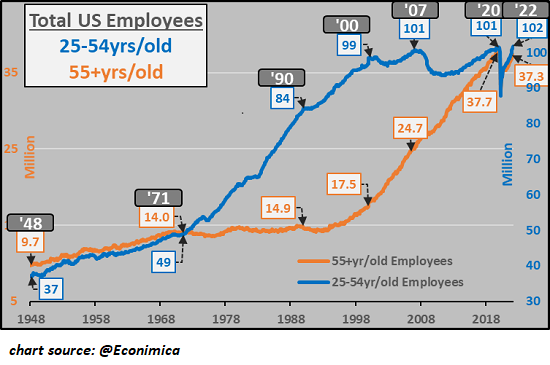

The chart of U.S. employment ages 25 to 54 years of age and 55 and older reveals a startling change.

There are actually 20 million extra 55+ employed than there have been in 2000, an equal of your entire workforce of Spain. This unprecedented demographic / employment transition is price a better look.

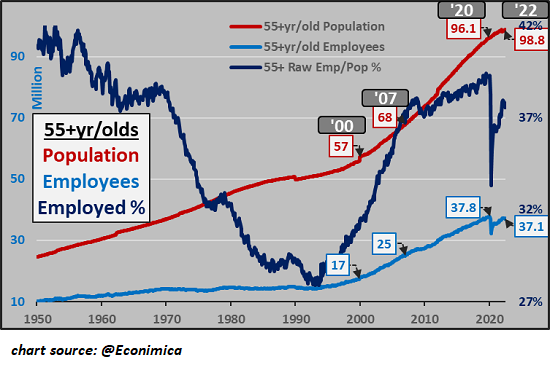

Because the second chart reveals, a few of this improve is because of the rising inhabitants of Individuals over 55 years of age–a rise of 42 million. In 2000, 30% of these 55 and older have been employed. Right this moment, over 37% are employed–a major improve within the share of 55+ people who find themselves working.

A rise of 20 million workers age 55 and older is so massive that it’s troublesome to know. A rise equal to a whole nation’s workforce is one strategy to make sense of it. One other is to take a look at the rise of America’s complete inhabitants from 2000 to 2022, which is about 48 million individuals (282 million in 2000, 330 million right this moment).

The full U.S. inhabitants elevated by 17%. The 55+ inhabitants elevated by 42 million (from 57 million in 2000 to 99 million right this moment), a 74% improve. Whole employment within the 55+ cohort elevated by 113%.

In 2000, solely 17.6% of the 55 and older populace had a job. Now the share is 37.5% A 20% improve within the share of 55+ who’re employed in a 20-year span is unprecedented.

If the share of employed 55+ had stayed the identical, there would solely be 17 million 55+ staff right this moment. As a substitute, there are over 37 million. This raises a query: why are so many older staff persevering with to work longer than they did in 1990 and 2000?

I doubt there’s one trigger or reply. We are able to attribute this dramatic shift to numerous causes: older households that by no means recovered from the monetary harm wrought by the 2008-09 World Monetary Meltdown; older staff (like me) who solely have Social Safety for retirement revenue who can’t get by on simply their SSA verify; those that take pleasure in their work and see no cause to cease; individuals who retired and have become bored out of their minds so that they returned to the workforce; mother and father who preserve working to assist their offspring and/or aged mother and father; individuals who preserve working to take care of healthcare protection till they qualify for Medicare; older entrepreneurs who can dial again their workload however who nonetheless love their work, and so forth.

All of those replicate structural modifications within the U.S. financial system: a gentle decline within the buying energy of wages and monetary safety, systemic publicity to the dangers of economic bubbles bursting, and so on. The underside line is that nest-eggs that have been deemed enough are now not enough, and the one strategy to fill the hole is to maintain incomes cash.

These modifications are mirrored within the decline within the share of employed 55+ individuals from 28% in 1970 to 18% in 1990 and 2000, and the following rise to 37%. In an financial system with an increasing workforce of younger workers and rising productiveness, extra older staff may retire early. That is now not the case.

In lots of circumstances, there isn’t any nest-egg because of chapter through enormous medical payments, the heavy burdens of pupil loans, or the prices of serving to youngsters and grandchildren or very aged mother and father. (Many people aged 65-70 are taking good care of mother and father 90+ years of age and serving to out with lively 3-year olds. Retirement? You’re joking.)

In consequence, bills have risen reasonably than dropped for the 55+ cohort, requiring an revenue to stabilize family funds. (Have you ever checked out childcare (grandchildren) and aged care (mother and father) prices lately?)

One other essential structural change is the demand for staff of any age who’re dependable and in a position to do the work. People who find themselves accustomed to the constructions of labor by advantage of 40 or 50 years of employment are usually dependable staff and thus valued by employers beset by a shortage of dependable, productive workers. (My first formal paycheck was issued by Dole Pineapple in 1970. That’s 52 years of getting accustomed to the calls for of employment. I’m fairly properly damaged in now.)

There are additionally demographic and cultural dynamics in play: the persevering with satisfactions of labor and the lack of objective many really feel in retirement, the decline in age discrimination, longer lifespans, and so on.

Regardless of the causes, 37 million staff 55 and older are incomes cash that’s flowing into the financial system and offering secure productiveness–20 million extra 55+ staff than 20 years in the past. These 20 million jobs generate revenue that isn’t simply funding cruises and RVs. In lots of circumstances, it’s supporting a number of generations on both aspect of the 55+ cohort.

Are 55 and older staff propping up the U.S. financial system? The info is reasonably persuasive that the reply is sure.

Charts courtesy of CH @Econimica)

Latest podcasts/movies:

Save Cash On Meals, Get Free Gold & Silver, Beat Value Inflation (1:08 hrs)

It’s Time To Finish The Fed & Return To A Decentralized Forex (X22 Report, 38 min)

Charles Hugh Smith On Inequalities And The Distortions Brought about By Central Financial institution Insurance policies (FRA Roundtable, 30 min)

Tectonic Shift of Mercantilism Revalued (Gordon Lengthy, Macro-Analytics, 42 min)

My new guide is now out there at a ten% low cost this month: When You Can’t Go On: Burnout, Reckoning and Renewal.

In case you discovered worth on this content material, please be a part of me in in search of options by changing into a $1/month patron of my work through patreon.com.

Assist Help Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

70

[ad_2]

Source link