[ad_1]

Every payday you could have nice intentions. You swear that that is the month the place you aren’t going to spend an excessive amount of cash. You will watch each penny and preserve your spending underneath management. Earlier than you realize it, you’ll be able to’t even afford to purchase groceries. Is there a solution to your drawback? Sure. STOP SPENDING MONEY.

Overspending is an issue which impacts many individuals. Whether or not you might be wealthy or battle to make ends meet, you too may discover that you just spend an excessive amount of. Some causes are monetary, and others are emotional.

The primary manner you will get spending underneath management is to have a look as to why you might be spending an excessive amount of. That is step one. Nobody can reply this query however you.

After years of serving to 1000’s of readers (identical to you), I’ve compiled an inventory of the highest 12 causes that folks overspend. You may end up in a single, two or much more!

HOW DO YOU KNOW IF YOU ARE OVERSPENDING?

YOU’VE MAXED OUT YOUR CREDIT CARDS

When there is no such thing as a room to cost something in your playing cards, you may need an issue. Most often, maxed bank cards indicators you might be residing past your means. If you must proceed to cost since you don’t have cash, then you might be spending an excessive amount of.

YOU CAN’T FIND A HOME FOR YOUR LATEST PURCHASE

Your temptation is likely to be electronics or purses. It doesn’t matter what you like to purchase, you may discover you might be working out of room to retailer issues. When the stuff takes over your own home and is inflicting litter, it’s time to take a protracted onerous take a look at the way you spend cash.

YOUR BUDGET NEVER WORKS

There could also be months if you don’t manage to pay for in your finances to cowl your mortgage or meals. Once you regularly spend cash on the unsuitable issues, your finances is not going to work.

Meaning in case you have simply $50 for leisure, don’t spend $75. That different $25 has to come back from one other finances line.

YOU SPEND MORE THAN YOU EARN

Check out your bank card balances. You is likely to be paying solely the minimal stability as a result of you’ll be able to’t pay it in full. Once you spend greater than you make and proceed so as to add extra debt, check out what you might be shopping for. It is likely to be time to tug again and keep out of the shops.

HOW TO STOP SPENDING SO MUCH MONEY

Now you can see the way you spend your cash, the subsequent step is to make a change. It’s a must to cease throwing it away. Proper now. Listed here are the steps to take to regulate and cease spending cash.

1. MAKE A BUDGET

I do know, I do know. I most likely sound like a damaged file as I preserve mentioning this finances factor. Nonetheless, it’s true. In case you wouldn’t have a finances, you haven’t any concept the place you might be spending your cash.

A finances is required so that you could direct your cash the place to go every time you receives a commission. It additionally helps you understand how a lot you must accessible to spend on groceries, clothes, eating out and even leisure. When you realize you could have a restricted quantity to spend on particular classes, you might be immediately accountable for our spending.

Learn extra: Create a Price range (even in the event you suck at budgeting)

2. PLAN AHEAD

Meal planning is one factor many individuals don’t take into consideration in relation to overspending. In case you don’t plan your meals (and inventory your fridge and pantry accordingly), you usually tend to run out to eat for dinner. Doing this at $25 a pop 2 or 3 occasions every week takes its toll in your finances.

Making a meal plan is not going to solely assist you to management your spending, however you may additionally discover that you just eat (and really feel) significantly better too.

3. USE A SHOPPING LIST

Earlier than you go to the shop, it’s important you make an inventory. Verify your fridge, freezer, and pantry so that you’re not buying gadgets you don’t want – particularly produce.

There may be a lot waste of meals that expires earlier than you’ll be able to devour it. That ends in you shopping for gadgets in order that they will find yourself proper within the trash can. Ensure you plan your procuring journey after which buy simply what you want, in addition to what you’ll be able to eat earlier than you hit the shop the next week.

4. STOP PAYING FOR CONVENIENCE

There’s a fast repair for practically every thing. You’ll find dinners in packing containers, small pre-packaged snacks, and so on. Slightly than buy comfort gadgets, purchase the bigger measurement snacks after which re-package your self into smaller baggies. You’ll not solely get extra out of a field, however you’ll be able to even management how a lot you set into every baggie.

There are different methods we pay for comfort. We pay for somebody to iron our shirts, wash our automobiles and even mow our lawns. By doing these items ourselves, we are able to preserve rather more cash and simply cease overspending.

Learn extra: How You’re Killing Your Grocery Price range

5. STOP USING CREDIT CARDS

We stay in an age the place our cash is all digitally tracked, be it on credit score or debit playing cards. Sure, they’re extra handy, however they make it simple to overspend. Once you use money, it’s unimaginable to overspend. You truthfully can. Not. Do. It.

I hear on a regular basis that folks repay playing cards on the finish of the month and that they don’t overspend, however that’s not the reality for most individuals. You may suppose that it’s simply $10 every week. Nonetheless, that $10 every week is successful of $520 over the course of a 12 months. What might you do with a further $500 in your pocket?

Learn extra: Create a Workable Money Price range System

6. PAY YOUR BILLS ON TIME

All of us have payments. We all know when they’re due. Once you miss the cost due date, you get assessed a late cost. Pay them on time, so that you don’t pay greater than it’s worthwhile to.

Along with late charges, not paying your payments on time can have an opposed impact in your credit score rating.

Study the right way to set up your payments, so that you by no means pay them late once more.

7. DO NOT LIVE ABOVE YOUR MEANS

Few of us wouldn’t love new garments or a brand new automotive. All of us would love to earn more money or get the most well liked new gadget. The factor is, are you able to afford it? Is it a need or is it a necessity?

If you’re utilizing credit score or loans to get gadgets you can not afford, then you might be residing past your means and spending cash you don’t have. Cut back and just be sure you can truthfully afford the home or the automotive and that it doesn’t wreck your finances and price you an excessive amount of.

Learn extra: Defining Your Needs vs. Your Wants

8. DON’T FALL FOR IMPULSE BUYS

Shops are sneaky about making us spend cash. They use indicators, structure, and even scents to lure you into wanting to purchase extra. The factor is, if you buy one thing you didn’t intend to, then you might be already blowing your finances and doubtless overspending.

One other manner that you’re spending an excessive amount of is if you plan dinner however then resolve on the final minute to exit to dinner as an alternative. Why do this when you could have meals ready for you at dwelling (which you’ve already paid for)?

The ultimate cause you could impulse purchase is that of emotion. In case you really feel a rush due to that new merchandise, you could buy out of impulse and emotion as an alternative of want.

Learn extra: Stopping Impulse Procuring

9. FIND ANOTHER BOREDOM FILLER

I bear in mind being in an internet discussion board when my children had been little, and we talked about our day. Lots of the moms went to the shop each. Single. Day. They stated they might not deal with being in the home and simply needed to go someplace. That resulted in them shopping for issues they didn’t want.

If you’re bored, discover a new passion. In case you simply must get out of the home, why not go for a stroll or play a recreation with the youngsters? Discover a technique to redirect your boredom so that you keep out of the shop and cease overspending.

10. USE FINANCIAL GOALS

Once you wouldn’t have monetary targets, you don’t have anything to work in the direction of. You may wish to get out of debt, or it’s your decision that newer car.

Check out what you might be spending every week on non-essential gadgets. What would occur in the event you would put that cash into financial savings or paid off your debt as an alternative? How a lot nearer would you be in the direction of getting that new automotive or being debt free?

Discover a aim you wish to obtain. Discuss to your loved ones and see in case you have one thing you’ll be able to work in the direction of collectively. By setting a aim that everybody desires, you’ll all be extra conscious of your spending and can contribute in the direction of reaching it extra shortly.

11. STOP SPENDING MONEY WHEN YOU TRACK YOUR SHOPPING

I do know many individuals who’ve tried to make use of money, they usually say it doesn’t work as a result of they spend it too shortly. There are others I do know who spend an excessive amount of on plastic every month. The reason being that they don’t seem to be monitoring what they spend, which is a cause why they overspend.

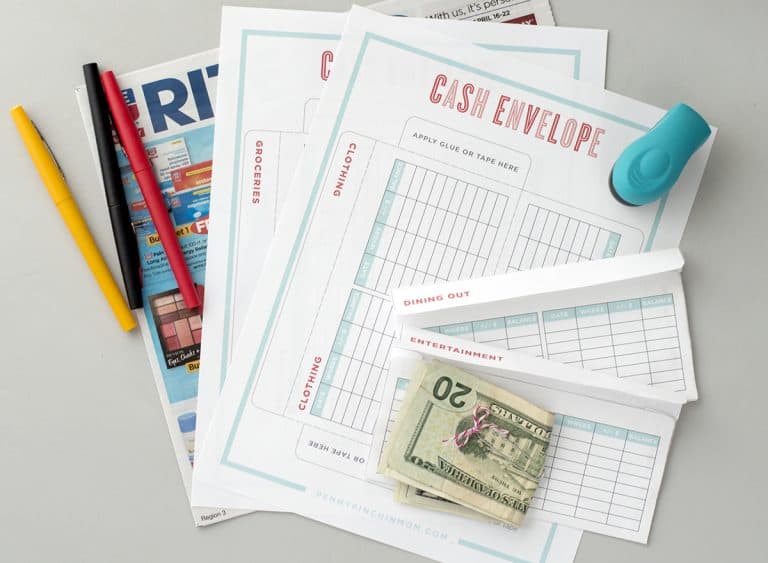

In case you use money, that is the place the envelope system is most useful. You’ll monitor your spending out of every one so you’ll be able to see the place your cash goes. Because the envelope quantity will get smaller and smaller, you suppose twice earlier than you decide up that merchandise — as a result of you could not be capable to afford it.

You are able to do this similar factor in the event you use plastic. There are all types of monitoring apps that will help you monitor what you might be spending on all your varied classes.

Regardless of the way you pay for gadgets, be sure you are at all times monitoring what you spend – you is likely to be shocked to study the place your cash goes.

Learn extra: Creating and Understanding a Spending Plan

12. DON’T FALL FOR THE SALES

Once you stroll into the shop, pay no thoughts to the gross sales. Use your checklist and follow it. Don’t fall for the flamboyant gross sales indicators, smells, and flashing lights to lure you into shopping for one thing you don’t want.

Learn extra: Understanding the Methods Shops Use to Get You to Spend Cash

Earlier than you’ll be able to acquire management of your funds, it’s worthwhile to work out why you might be spending greater than you need to. Easy adjustments to the best way you view cash could make all of the distinction.

[ad_2]

Source link