denizbayram/iStock by way of Getty Photos

Historical past by no means repeats itself. Man at all times does.

Voltaire

Mark Twain is credited with an identical saying, that historical past would not repeat but it surely rhymes. In fact, there’s scant proof that Clemens stated something of the type simply as Voltaire might or might not have penned the quote above. However each males have been a lot wittier than I – than most – so I am going to take them each as being consultant, if not real.

I’ve been knowledgeable investor for now over 30 years and I’ve seen buyers make the identical errors again and again, as if they’re dominated by some mysterious power that forestalls them from studying from their previous. And that could be true. Actuality is, as Einstein might have stated, an phantasm, albeit a really persistent one. What we see as actuality is in fact merely an approximation, a prediction of our brains. We won’t really see the current as a result of there’s a lag between the data being captured by our eyes and processed by our brains. To make our life simpler, our brains basically predict the long run, based mostly on previous expertise, and current us with actuality because it believes it must be based mostly on what it was just a few milliseconds in the past.

In a way then, our brains use our previous experiences to foretell the long run (which we name “the current”). See the place I am going with this now? There’s a multitude of psychological limitations, cognitive biases, that successfully stop us from being good buyers. Right this moment, in an age of prompt data, we’re bombarded by seemingly convincing proof that frequently reinforces our current biases and prevents us from breaking freed from our previous experiences. Buyers at this time are pressured to see all financial slowdowns and all bear markets within the context of 2008 and 2020. And if they are a bit older, possibly 2000-2002.

And so, the bear case at this time just isn’t that we are going to have a light financial slowdown and a mean bear market however that the financial system will implode and shares should fall, as they did in these bear markets, by much more than they have already got. For individuals who low cost 2020 as atypical, a lot the higher since each the 2000-2002 and the 2008 bear markets fell by 50%. Now, that is a bear market.

I’ve stated many instances that it’s not my job to foretell the long run however merely to precisely observe the current. I am human too, so it is not simple however after 4 many years as an investor, I’ve discovered to acknowledge my very own biases and shortcomings – more often than not. I spend numerous time making an attempt to determine the consensus and the way will probably be improper. How do you determine the consensus? That is one other one which is not simple as a result of what you see because the consensus is biased by your sources. That is why I put numerous emphasis on what persons are doing moderately than what they’re saying. I additionally attempt to keep away from sources with an agenda whether or not Zero Hedge or the common Wall Road strategist.

I might say the consensus at this time is undoubtedly unfavourable in regards to the financial system and markets. Sentiment has actually improved from the place it was on the lows however total, I believe most buyers are nonetheless fairly unfavourable in regards to the future. The pessimism is not stunning often because there does appear to be numerous issues about which to fret. Recession appears inevitable as yield curves invert. Inflation is coming down however not quick sufficient and wages aren’t maintaining. Europe is in a pure fuel noose of its personal making. Inventories are rising and actual retail gross sales peaked 16 months in the past in March of 2021. Shopper sentiment is terrible, and the main financial indicators are down for five consecutive months.

It’s important to ask your self although, with all that unhealthy information, why is the S&P 500 up 17% from its lows? How, within the face of all that unhealthy information in regards to the financial system, can anybody have the boldness to purchase shares? The reply is that there are some individuals who can do what Warren Buffett says it is best to do in these conditions (and what he’s really doing by the way in which), particularly purchase when everybody else is fearful. It is arduous to do as a result of the unhealthy information is apparent whereas the excellent news just isn’t.

I may let you know that financial institution stability sheets look nothing like they did in 2008 and an end result that unhealthy is extremely inconceivable. I may let you know that family stability sheets have by no means seemed this good previous to a recession. I may let you know that inflation is fading quickly, that commodity costs – together with agriculture – are again to the place they have been previous to Russia’s invasion of Ukraine. I may let you know that China’s issues aren’t new or unknown to the market. I may let you know that the semiconductor chip scarcity is ending and a glut of chips is creating proper now.

I may additionally let you know that banks are lending, with C&I loans (company) up at an almost 20% annual fee in July. That, regardless of all of the doom and gloom round actual property, actual property loans have been up at a double-digit tempo in July and financial institution holdings of Treasury securities are down each month since March. And that whereas inventories are up, the full enterprise stock/gross sales ratio is decrease at this time than in each month from August of 2014 to March of 2021. I may let you know that core capital items orders are up 24 of the final 26 months and that in rejiggering their provide chains, US corporations will reshore 350,000 jobs this yr.

I may let you know that the inventory market often bottoms with client sentiment and that will have already occurred. I may let you know that the variety of shares within the S&P 500 buying and selling above their 200-day shifting common hit its low of 11.8 in June and that readings underneath 15 are typically fleeting and virtually at all times according to bottoms. I may let you know all these issues and should you assume we’re headed for some 2008-style crack up, you will not care.

Investing just isn’t simple and anybody who tells you in any other case is mendacity. It’s arduous to purchase when each bone in your physique is screaming no. It’s arduous to be grasping when everybody else is fearful. It’s simple to search out the unhealthy information as a result of it’s in your face on a regular basis. Unhealthy information will get clicks and readers. Excellent news is tough to search out and will get ignored when it’s.

I do not know the place the financial system or the markets are headed from right here. However I’m completely sure that regardless of the end result, will probably be completely different than 2000 or 2008 or 2020. As a result of it’s at all times completely different this time however buyers aren’t. They’ll at all times be fearful on the backside and ecstatic on the high. They’ll at all times be dominated by their feelings moderately than logic. And it’ll at all times be tempting to embrace the bosom of the consensus.

In Candide, Voltaire stated that “life is bristling with thorns, and I do know no different treatment than to domesticate one’s personal backyard”. I can consider no higher recommendation for at this time’s investor.

Financial Surroundings

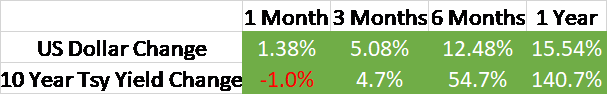

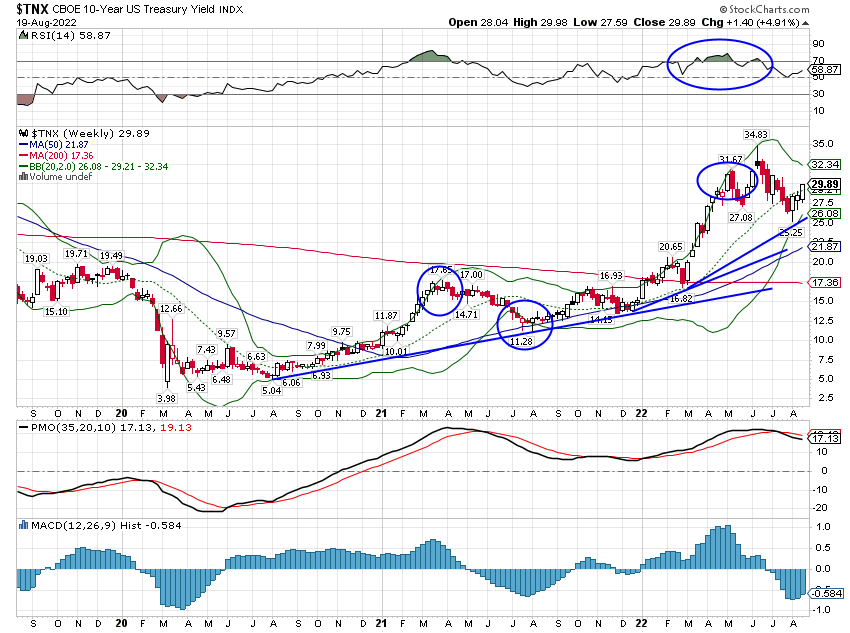

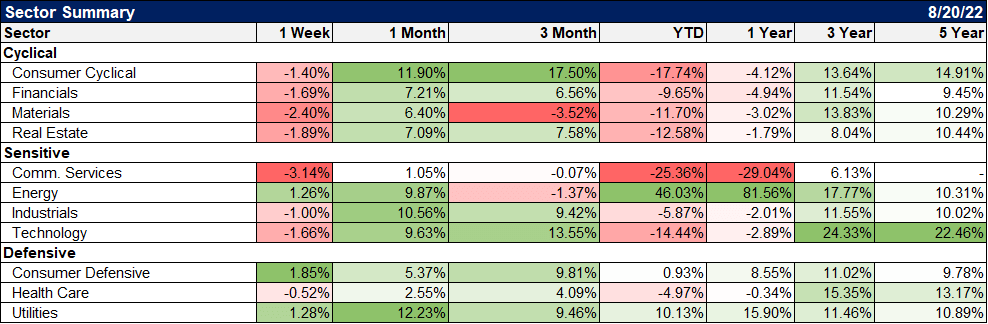

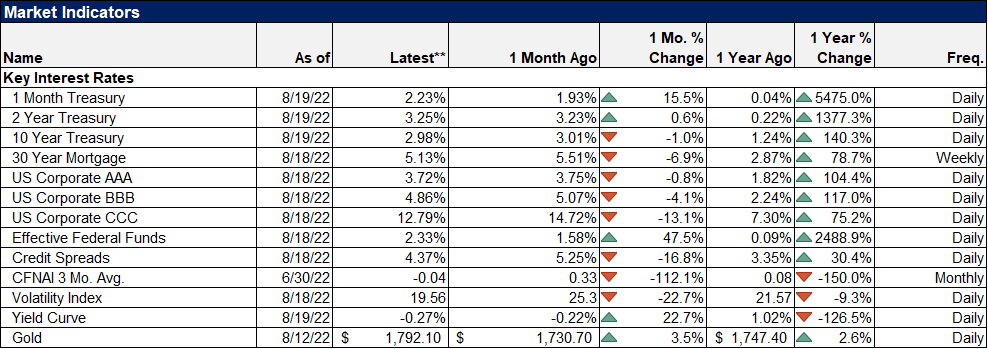

The rising greenback, rising fee surroundings are well-known and entrenched at this level. For these centered on the 10-year Treasury be aware, yields rose final week but it surely is a little more sophisticated than that. The ten-year Treasury yield rose 14 foundation factors, the 3-month T-Invoice yield rose by 8 foundation factors, the distinction between the 2 widening ever so barely. The two-year Treasury be aware yield, in distinction, was unchanged and so the ten/2 curve everybody obsesses about additionally steepened a bit. In truth, the 2-year yield is basically unchanged since its early June peak and the 10-year yield isn’t any larger at this time than it was in mid-April. And but, we nonetheless name this a rising fee surroundings. Why? Perspective. You do not have to be a Licensed Market Technician to see that the 10-year fee is in an uptrend. And the motion of the 10-year yield is extra vital than the 2-year as a result of the latter is simply too influenced by expectations for Fed coverage.

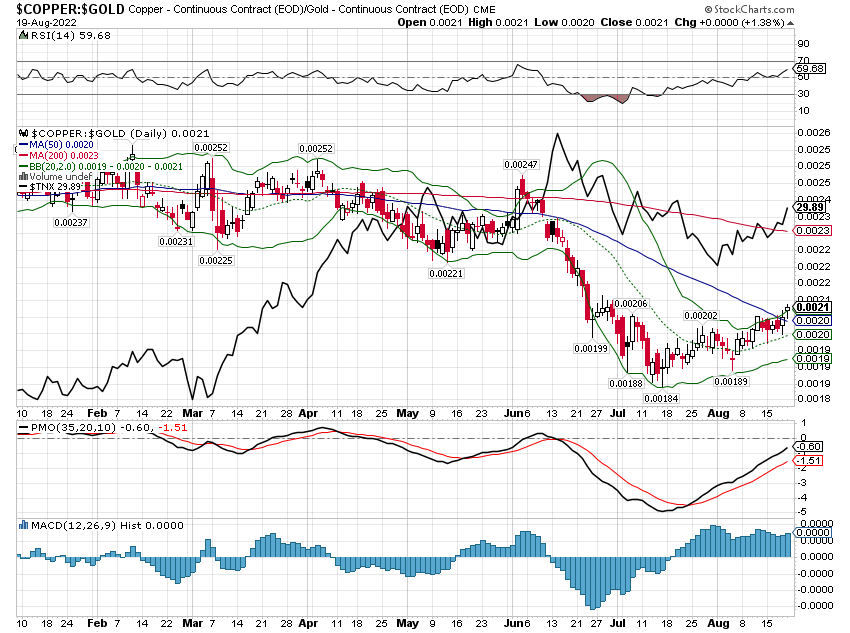

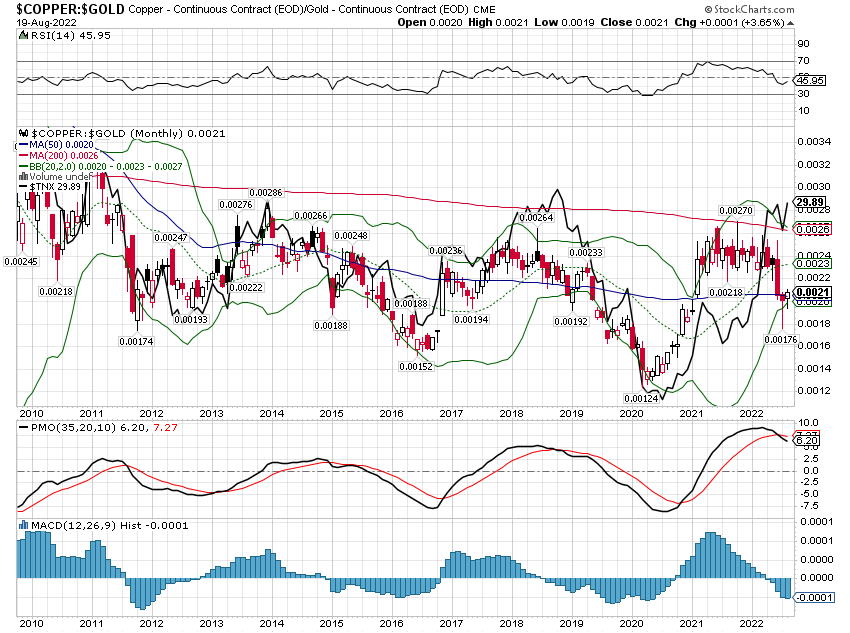

The uptrend in charges is vital as a result of it belies the fundamental bearish argument that we’re in, or on the verge of, recession. It is a piece that does not match the narrative puzzle. The rise in charges final week was additionally confirmed by the copper/gold ratio.

By the way in which, when this ratio was falling in June and early July, the bears have been out in power, telling anybody who would hear that this was only one extra indication that we have been in recession. Once more, perspective, get some. This ratio is an efficient test on charges as a result of it’s extremely correlated with the 10-year yield. It isn’t, by itself, helpful as a recession indicator. We have entered recession with it falling and with it rising simply as we have entered recession with charges falling and charges rising.

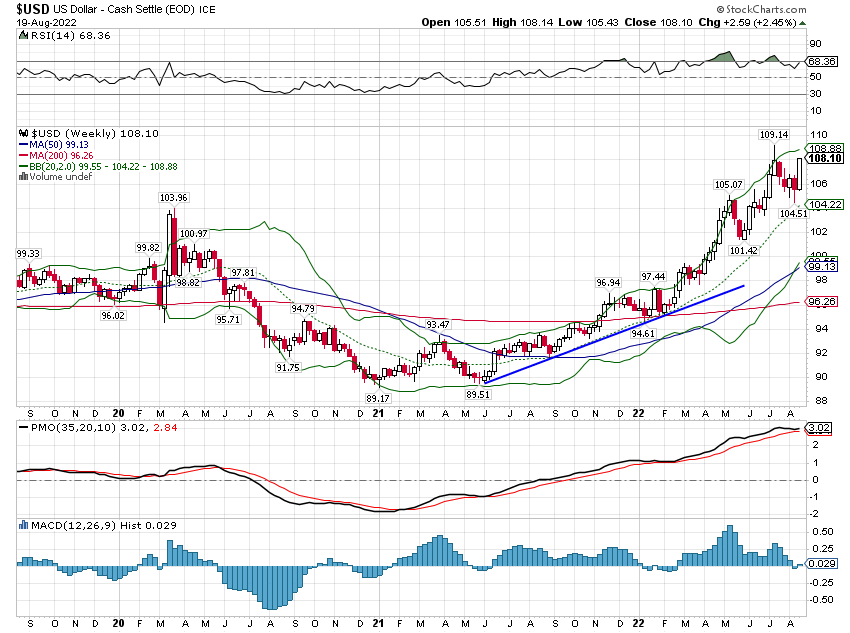

The greenback can be in an apparent uptrend, and regardless of all people and his brother being lengthy already, I stated final week that it could most likely persist. And it did have an excellent week, and the uptrend is apparent and persevering with. There can be a reversal in some unspecified time in the future but it surely’s most likely going to take some excellent news out of Europe, which implies excellent news out of Ukraine. It isn’t arduous to think about should you attempt.

There isn’t any scarcity of people that will let you know how unfavourable this rising greenback is as a result of the world is awash in dollar-denominated money owed that develop into tougher to pay when the greenback rises. On this view of the world, there’s a scarcity of {dollars} – to which I say, poppycock. There’s actually a scarcity of {dollars} in locations the place a greenback mortgage at this time is a Swiss financial institution deposit tomorrow. Thus, you’ll be able to’t get {dollars} in locations like Nigeria and Pakistan. For good cause, I’d add. As for the remainder of the rising world, I am fairly certain their bankers know the best way to hedge forex threat.

A rising greenback can trigger stress in different elements of the world and that can blow again on the US. However can just isn’t will, and proper now I see greenback energy as a boon, not a bane.

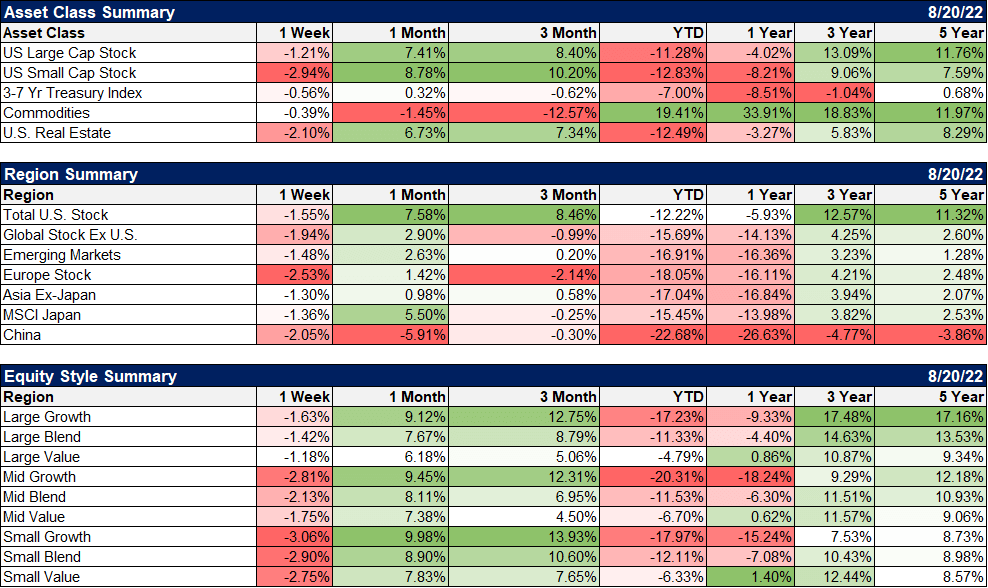

Markets

Shares, bonds, actual property, and commodities have been all decrease final week though I might be hard-pressed to supply a concrete cause for the promoting. Most shares are in a short-term uptrend that began in mid-July and most indexes have reached their 200-day shifting averages, a extensively accepted dividing line between up and down pattern. Exceptions to which are uncommon however the dividend indexes, a few of which have made new all-time highs early final week, actually qualify. If I have been within the advertising and marketing division, I might take this chance to remind you that we’ve a big allocation to dividend ETFs.

The promoting final week on the 200-day shifting common isn’t a surprise within the least since it’s a logical place to promote in case you are in a downtrend. In case you are in a downtrend outlined by being underneath the 200-day shifting common and also you anticipate the downtrend to proceed, then promoting at that degree is actually the very best you are able to do so. And it appears there are nonetheless lots of people who anticipate the downtrend to proceed, together with all these futures market merchants who’re nonetheless sitting on file quick positions.

Worth outperformed final week however the distinction was insignificant.

Merchants largely favored defensive names final week with utilities posting a achieve regardless of rising charges (they are typically fee delicate). Power made a rally try and ended the week larger however I might nonetheless maintain my powder dry. Crude oil traded with an 85 deal with final week and remains to be in a downtrend that began, not coincidentally, when charges hit their excessive and shares hit their low (mid-June). I believe you wish to keep affected person and never take any large positions till the pattern turns again up.

Credit score spreads widened barely final week however are nonetheless effectively beneath ranges we affiliate with credit score market stress.

In his Philosophical Dictionary, Voltaire stated that “frequent sense could be very uncommon”. That’s actually true in monetary markets, the one market the place individuals await costs to go up earlier than shopping for. The outlook on the lows is at all times unfavourable or perceived that means or we would not be on the lows. However there are occasions when actuality is kind of completely different than notion, when the consensus has develop into complacent and lazy. Typically the excellent news is on the market for all to see but it surely nonetheless will get ignored.

As I’ve stated loads these days, I am not advocating an all-in wager on shares right here. There are nonetheless some issues we’ve to get previous. And the rally off the lows has improved sentiment to some extent the place a correction of this rally appears seemingly. However everybody at this time is aware of the bearish case, and getting cash from issues that everybody is aware of is uncommon on Wall Road. I am going to finish with another quote:

It ain’t what you do not know that will get you into hassle. It is what you realize for certain that simply ain’t so.

Mark Twain or somebody nobody remembers who gave the impression of Mark Twain

Joe Calhoun

Unique Publish

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.