[ad_1]

A brand new firm is trying to do for B2B {hardware} gross sales what a rising variety of firms have been doing within the shopper sphere, by making it simpler for companies to pay for tools in instalments by leases and subscriptions.

Whereas firms equivalent to Klarna and Affirm have been pushing fee companies that assist shoppers procure items with out having to pay for all the things up entrance, Berlin-based startup Topi launched out of stealth final December with $4.5 million in funding to do one thing comparable for B2B transactions. On the time, Topi was considerably obscure when it comes to what its precise product could be, however the firm immediately introduced its first product in partnership with German electronics retailer Gravis, and unveiled a recent $45 million in fairness and debt financing.

{Hardware}-as-a-service

At its most simple stage, Topi is promoting a hardware-as-a-service enterprise mannequin, permitting retailers to hire out their tools equivalent to smartphones, printers, PC screens, espresso machines, robotic arms, or no matter industry-specific equipment they specialise in. Whereas it’s true that many retailers supply financing choices already that permit companies to stagger their funds, this isn’t sometimes built-in straight into the checkout course of — and that, successfully, is what Topi is bringing to the desk.

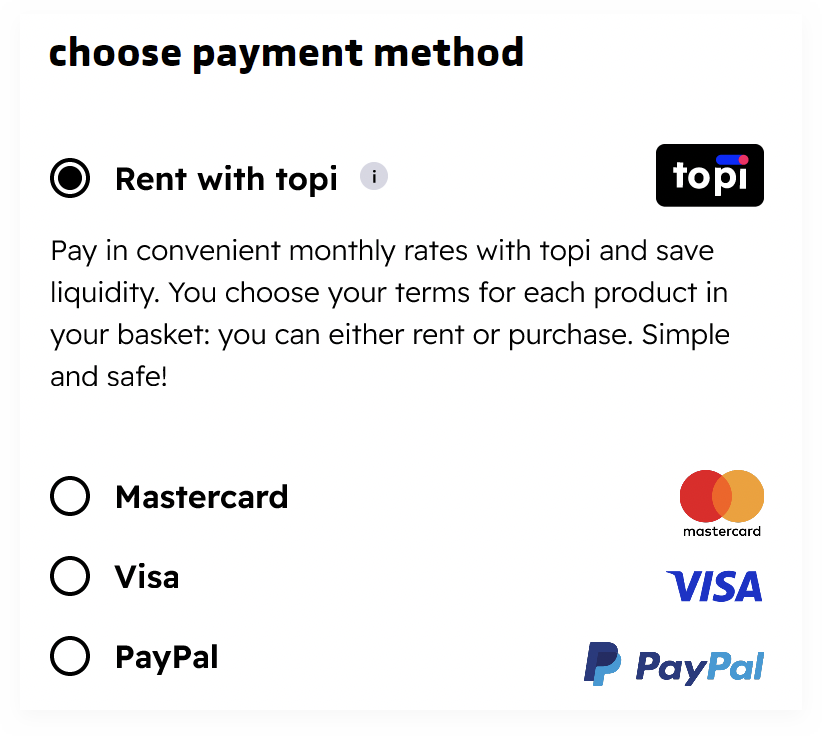

Topi fee strategies

The issue, in the end, is that firms can spend 1000’s of {dollars} up-front on bodily items which are important to their operations, leaving them with restricted capital for different business-critical purchases. On prime of that, merchandise that they purchase is likely to be outdated or out of date in just some years.

In tandem, with companies throughout the economic spectrum tightening their purse strings as a result of financial pressures, retailers will likely be on the lookout for new methods to encourage their prospects to proceed spending cash, even when it means on barely completely different phrases.

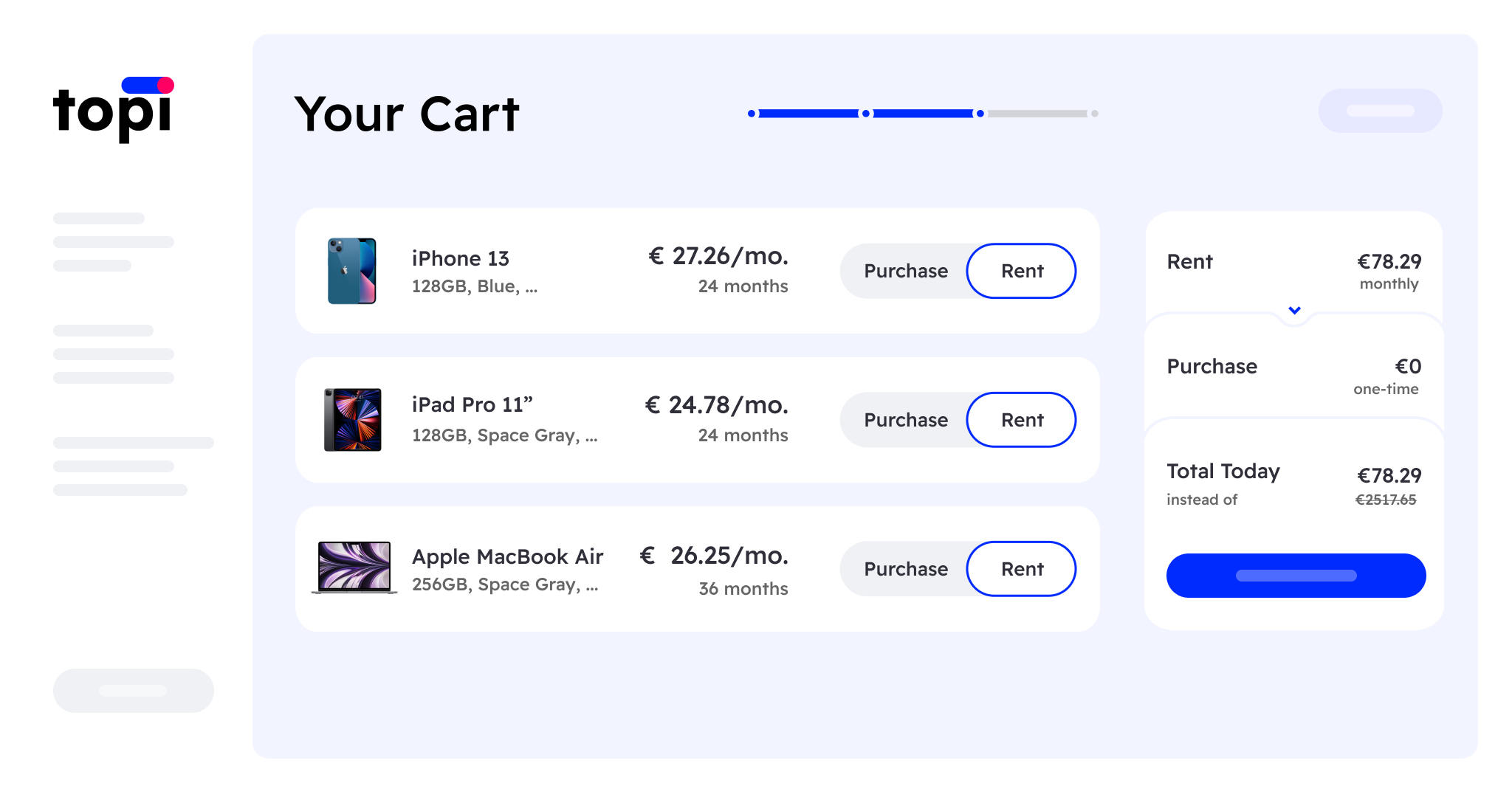

Topi basically brings collectively the assorted elements {that a} vendor would possibly want to supply {hardware} subscriptions, together with insurance coverage, logistics, and refinancing suppliers, in order that retailers can simply construct leases into their present on-line channels utilizing Topi’s APIs. So for instance, an electronics retailer would possibly supply a €1,000 MacBook Air for a month-to-month charge of €26.25 payable over three years with a full guarantee included, after which the client can resolve to improve to the most recent MacBook mannequin, return the system, or pay the rest of the steadiness to personal the laptop computer outright. Sooner or later, Topi may also supply Klarna-style instalment fee choices for patrons who know prematurely that they wish to personal the product on the finish.

It’s price noting that Topi additionally helps up-front purchases, so {that a} buyer can resolve to hire an iPhone on the checkout for a two-year interval, whereas shopping for a laptop computer outright. Topi is pitched as a modular platform, in order that retailers can decide and select which components they need — they’ll choose simply month-to-month billing and credit score checks, to the total shebang together with refinancing companions and insurance coverage.

Moreover, whereas the Topi branding is distinguished at checkout with the inaugural product, the corporate mentioned that it plans to supply a white-labeled model that permits companies to incorporate their very own brand.

Topi: Like a Klarna for B2B transactions

Entry over possession

A fast peek throughout the buyer know-how sphere reveals a gradual transition from possession to entry. That is evidenced in fields equivalent to music, the place subscription streaming companies from the likes of Spotify and Apple Music now outweigh bodily format or obtain gross sales. And the so-called round financial system is driving demand for shopper electronics leases that features smartphones, and even vehicle subscription companies.

There may be proof of this shift elsewhere within the B2B area too, with Munich-based Klarx specializing in development tools leases. So it’s clear there’s a motion away from possession, one thing that Topi cofounder Charlotte Pallua mentioned different retailers should be aware of in the event that they’re to remain forward of the curve.

“If conventional retailers wish to keep aggressive and never lose their prospects to these retailers, they might want to begin providing subscriptions as a fee possibility,” Pallua informed TechCrunch.

Pallua earlier labored as a technique and enterprise improvement supervisor at Apple within the San Francisco Bay Space, the place she led a group tasked with exploring the feasibility of {hardware} subscriptions — Apple has but to launch such a service, however stories proceed to floor that the Cupertino firm remains to be trying to bolster its recurring income by way of such subscriptions. Pallua met her cofounder Estelle Merle whereas at Harvard Enterprise College in Boston, and the duo cemented their friendship out in Silicon Valley the place Merle labored briefly at Tesla throughout her MBA earlier than touchdown at German mobility startup Through.

A 12 months on from its basis, Pallua and Merle at the moment are able to launch their companies in partnership with Gravis, an Apple approved reseller which has 40 bodily retailers in Germany along with its on-line retailer. Gravis was a key accomplice as Topi iterated its product by its pilot part.

“We’re excited that our enterprise prospects can now simply subscribe to their IT tools in real-time on the level of transaction, with out tedious processes and bureaucratic paperwork,” Gravis managing director Jan Sperlich mentioned in an announcement. “In our pilot part, round half of our prospects that rented {hardware} by Topi got here again for added merchandise.”

However arguably extra essential than all of that, Topi isn’t simply targeted on enhancing entry to {hardware} or serving to firms’ cashflows — they see sustainability as a core underlying promoting level behind its product.

“In gentle of local weather change, being sustainable is more and more essential for firms,” Pallua mentioned. “Used gadgets needs to be given a second life or correctly recycled — a drawer stuffed with outdated gadgets ought to not exist.”

Topi’s funding spherical constituted $15 million in fairness and $30 million in debt, with backers together with Index Ventures, Creandum, TriplePoint Capital, and undisclosed angel traders.

[ad_2]

Source link