[ad_1]

Gross sales forecasting is a vital exercise for high-performing gross sales groups. It helps them create concrete motion plans to shut extra offers in any given quarter.

The issue is there doesn’t appear to be a complete lot of consensus on how to really do a gross sales forecast.

Groups of all sizes use a bunch of various strategies, making it troublesome for these of us seeking to put collectively our first gross sales forecast to know what steps to take.

On this article, we’re going to have a look at six totally different gross sales forecast examples utilizing totally different forecasting methodologies so you possibly can perceive and resolve which calculation makes probably the most sense in your group.

What’s gross sales forecasting?

Earlier than we get into the examples, let’s all get on the identical web page:

What’s gross sales forecasting anyway?

Gross sales forecasting is the method of trying ahead and projecting what your gross sales income will appear like within the coming monetary interval (often month-to-month or quarterly).

Whereas some monetary forecasts may take a look at a yr and even two sooner or later, gross sales forecasts are far more tangible and shouldn’t look any additional than three months forward.

There are a selection of various methods to forecast gross sales (we’re going to have a look at six of them shortly), however most of them take a look at a mixture of historic knowledge (earlier gross sales), present data (pipeline opinions and salesperson judgment), and forward-looking estimates (corresponding to new merchandise which might be about to hit the market).

Typically talking, gross sales leaders are liable for gross sales forecasting duties, although they typically contain their gross sales staff on this course of, notably in the event that they’re utilizing a pipeline-based methodology.

Gross sales leaders then ahead their gross sales forecasts up the chain to senior management and finance leaders to make essential selections that inform modifications to the gross sales technique, investments, and resourcing decisions.

What’s essential when making a gross sales forecast?

Gross sales forecasting must be largely data-driven.

Sure, it’s okay to rely just a little by yourself instinct and the judgment of your gross sales reps (they’ll must inform you how seemingly it’s {that a} sure deal will shut, as an example), however laborious knowledge must be your basis.

So, you’re going to want:

- A clear and up-to-date gross sales pipeline. Push your reps to maintain it up to date with deal possibilities loaded in and all lead playing cards within the appropriate pipeline levels.

- An understanding of earlier efficiency. Pull your numbers from the previous few quarters and analyze progress tendencies which may be relevant to your forecast.

- Lead scoring/rankings. In case your gross sales staff makes use of a lead scoring or rating system, this knowledge could show useful in formulating a forecast.

- Trade/aggressive evaluation. Will probably be essential to know of any main modifications in your business. For instance, a brand new market entrant could disrupt gross sales, as may a legislative change related to your vertical.

Collect the above data, then dive into your gross sales forecast, utilizing the under examples as a reference.

6 gross sales forecast examples

Able to create your personal gross sales forecast however unsure the place to begin?

Discover six totally different gross sales forecast examples under, every utilizing a special methodology for projecting gross sales income.

Be aware the variations, and select the gross sales forecasting methodology that most accurately fits your group.

1. Historic knowledge forecast

A historic knowledge gross sales forecast is precisely because it sounds.

You’re going to have a look at historic gross sales information (i.e., gross sales volumes and income figures for earlier quarters) and use them to estimate future gross sales.

A wiser historic knowledge forecast would take into consideration progress tendencies. Be aware that within the above instance, gross sales income is rising at $20k per quarter. So, we might assume that if our quarter 4 gross sales income was $290k, quarter one of many following yr must be $310k.

Historic forecasting is nice as a result of it’s simple, however that’s about it.

As your stockbroker will inform you (in the event that they’re trustworthy): ”previous efficiency is just not indicative of future outcomes.”

That’s the main disadvantage of relying solely on historic knowledge for gross sales forecasts; you’re not considering what’s taking place proper now (in your pipeline and out there).

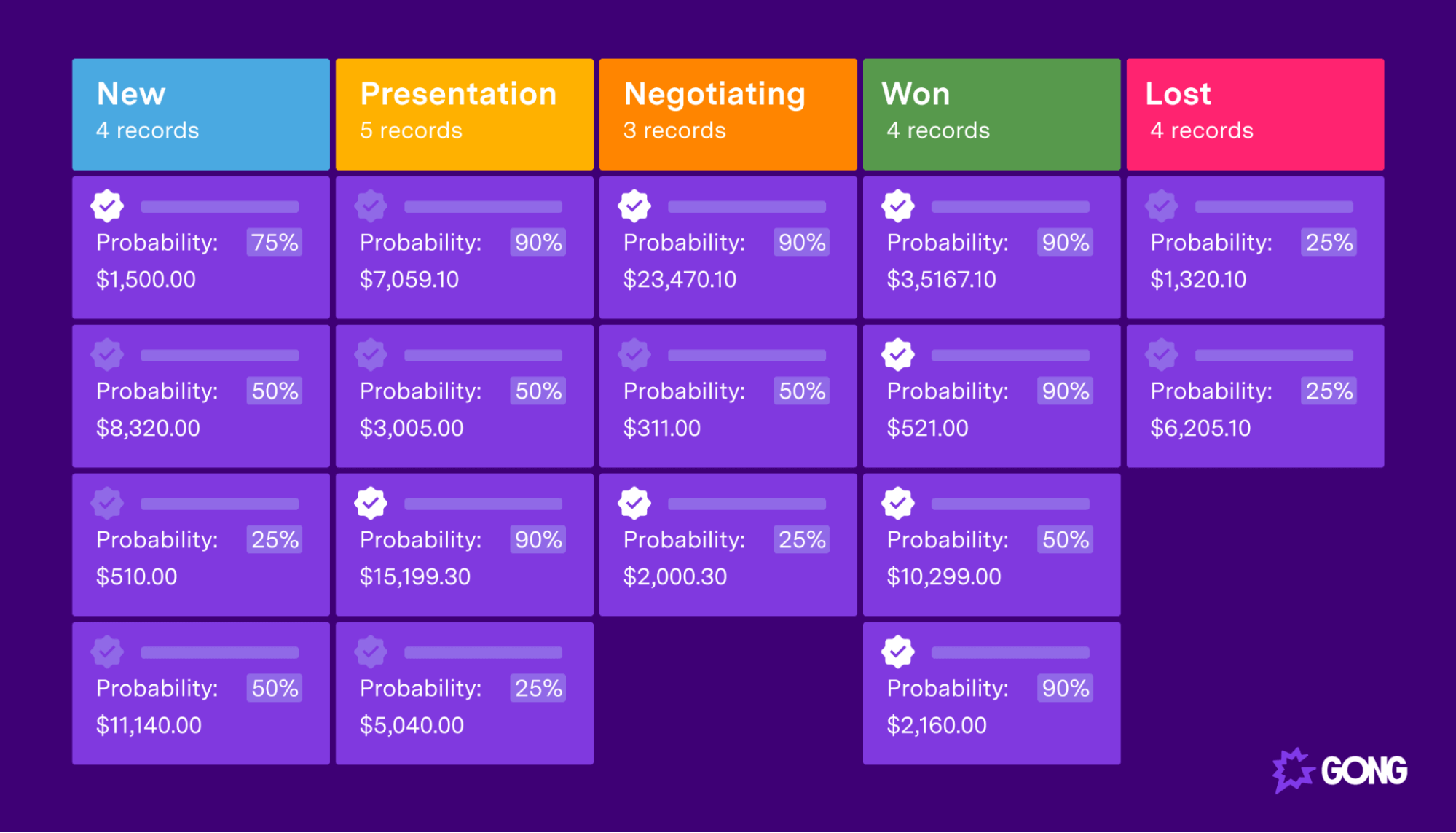

2. Alternative stage likelihood forecast

This sort of gross sales forecast appears on the offers you’ve gotten in your gross sales pipeline proper now and builds a projection primarily based on:

- The likelihood of closing at every stage of the gross sales course of

- The anticipated income from every deal

Such a forecast clearly relies on you having that knowledge accessible, that means your gross sales reps must be proactive with including deal quantities to every card, and it’s good to have deal stage possibilities loaded in primarily based on historic efficiency.

Let’s say you’ve gotten the next deal stage possibilities:

- Prospecting – 10%

- Qualification – 25%

- Proposal – 40%

- Negotiation – 60%

- Closing – 90%

First, analyze every gross sales alternative and add up the anticipated future income from every deal. Let’s say yours appears like this:

- Prospecting – $2.5m

- Qualification – $1.2m

- Proposal – $800k

- Negotiation – $700k

- Closing – $450k

For this gross sales forecasting mannequin, you’ll merely a number of the income projections for every deal stage by the common sale likelihood at every stage, for instance:

- Prospecting – $2.5m x 10% = $250k

- Qualification – $1.2m x 25% = $300k

- Proposal – $800k x 40% = $320k

- Negotiation – $700k x 60% = $420k

- Closing – $450k x 90% = $405k

Your gross sales forecast, on this case, is the whole throughout all deal levels (on this case, $1.695m).

Deal stage likelihood is without doubt one of the extra correct gross sales forecasting strategies, plus it’s fairly simple to drag collectively (at the least in case you use a income intelligence platform).

It does have a few drawbacks, nevertheless.

First neglects to incorporate the age of every deal. A 3-month-old deal sitting in Qualification doesn’t have the identical probability of closing as a 3-day-old deal, proper?

Secondly, the chance stage likelihood forecast assumes that conversion charges stay fixed from one interval to the subsequent. We all know this isn’t all the time the case, and thus can result in large gaps within the accuracy of your forecasts.

Trying on the above instance, if we had been to lose 10% conversion price within the Closing stage, the forecast can be round $45k off.

3. Gross sales cycle forecast

The gross sales cycle methodology covers what the earlier gross sales forecasting course of missed: the age of every gross sales alternative.

Busy gross sales pipelines typically embody previous offers (though that’s generally a gross sales supervisor no-no), so the gross sales cycle forecasting methodology takes this under consideration.

With this methodology, you examine the age of the deal to the common gross sales cycle size. You’ll must provide you with a weighting system primarily based on deal age.

Let’s say, for instance, that the common time period for a deal to shut at your group is 62 days, and we’re going to weight offers into 5 classes:

- Over 62 days – 10% shut probability

- 45-62 days – 30% shut probability

- 31-44 days – 45% shut probability

- 18-30 days – 35% shut probability

- 0-18 days – 25% shut probability

Then, you’ll multiply every deal’s related shut probability by its anticipated income, add all of it up, and there’s your gross sales forecast.

The gross sales cycle forecasting methodology is much like the deal stage likelihood forecast in that it has a disadvantage. It pays consideration to the age of every alternative however ignores historic likelihood primarily based on the pipeline stage that deal is in.

For extra correct gross sales forecasts, think about using each approaches after which taking a mean determine.

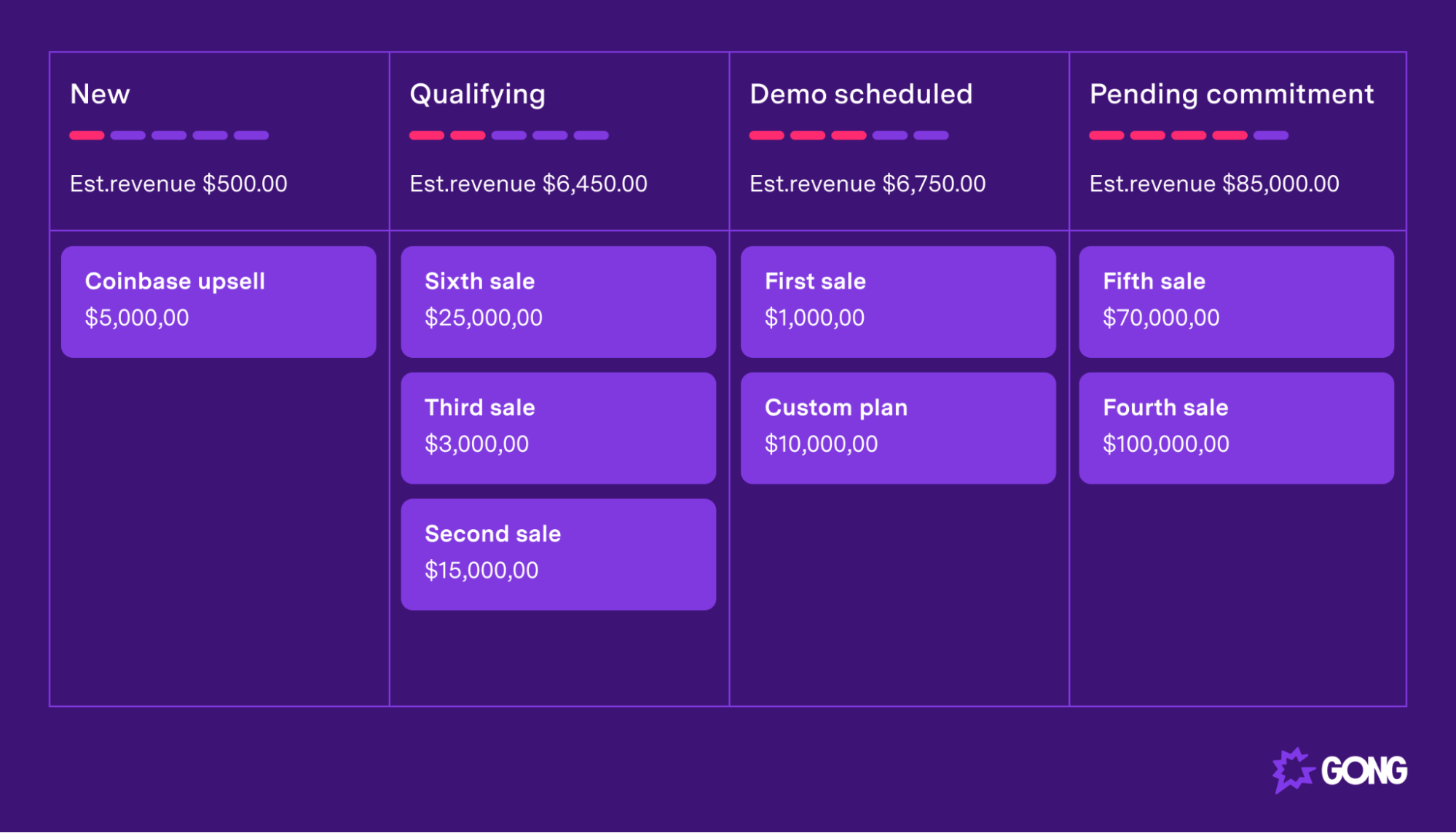

4. Backside-up forecast

The pipeline-based gross sales forecast might be probably the most generally used methodology for creating gross sales projections.

It’s top-of-the-line methods to construct an correct forecast as a result of it’s purely primarily based on the offers your staff has in play proper now.

After all, you’ll must depend on what your reps say concerning the probability of every deal closing, however you belief them, proper?

With this technique, gross sales organizations carry out an intensive pipeline overview, going by every deal on the desk and asking:

- What’s prone to shut (and what isn’t?)?

- Why or why not?

- What’s the greenback worth of every of those gross sales offers?

- What time durations are we ? (i.e., are they going to shut within the upcoming months that we’re presently forecasting for?

Then, you merely add up the whole worth of every of the offers, and there’s your forecast.

If you wish to get just a little extra refined, you possibly can mix different sorts of forecasts, utilizing precise gross sales knowledge from earlier durations and historic deal stage possibilities to complement gross sales rep intuitions.

Or, you possibly can simply leap straight in together with your Backside-Up Gross sales Forecast Template for Excel.

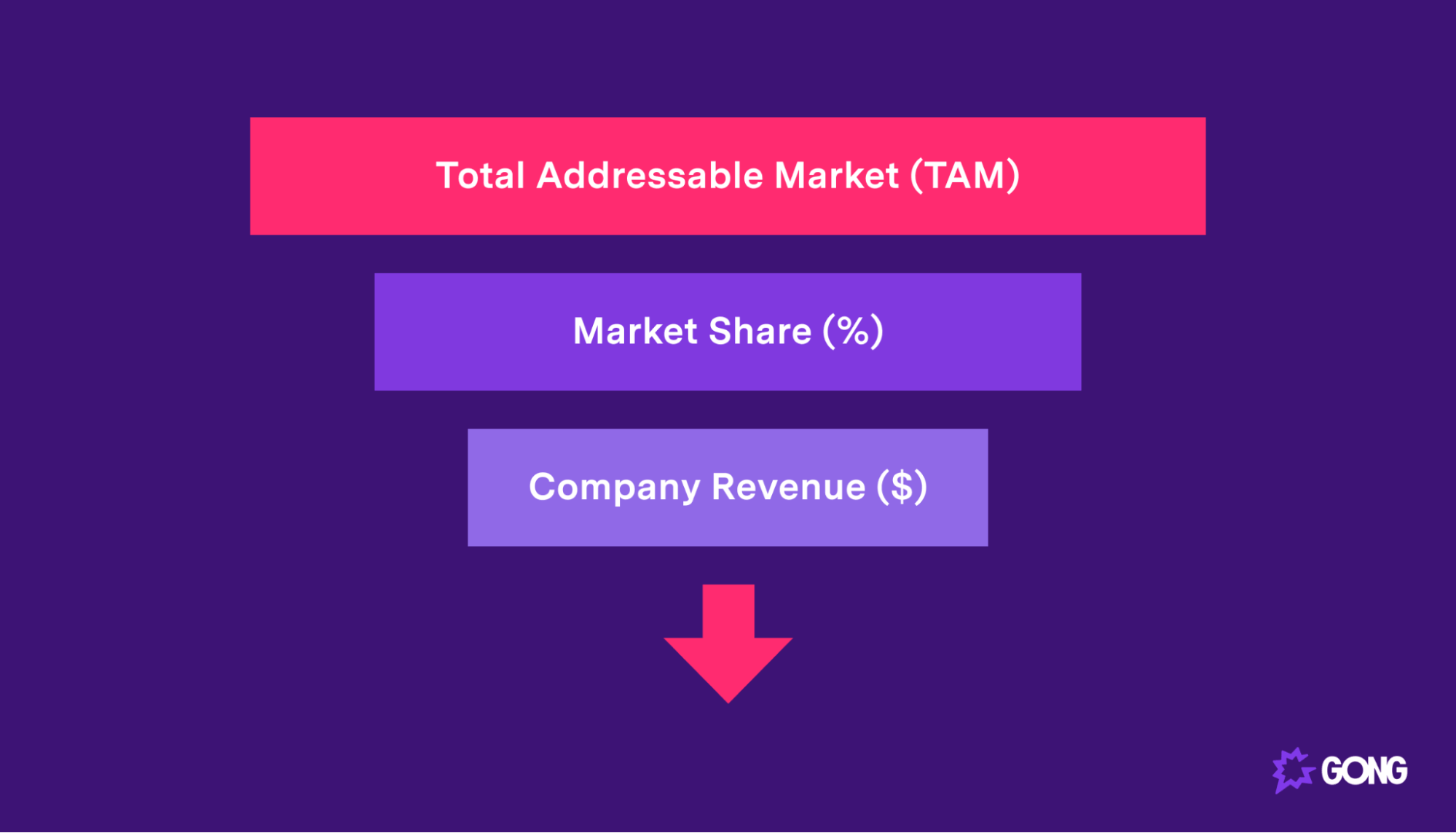

5. High-down gross sales forecast

High-down gross sales forecasts don’t take a look at what you’ve received within the pipeline now. As a substitute, they assess the whole income worth of the goal market (which we name the whole addressable market) and your organization’s capacity to seize that income.

Right here’s the way it works:

First, it’s good to decide what the TAM greenback worth is. Let’s say in your business, it’s $250m.

Then, you take a look at your market share. Perhaps you personal 10% of the market.

From right here, it’s only a little bit of basic math: $250m x 10% = $25m. What’s your annual gross sales forecast?

As you’re in all probability pondering, this isn’t probably the most correct forecasting methodology. It depends on a information of your accessible market, however that doesn’t imply they’re prepared to purchase.

Plus, it doesn’t take into consideration:

- Your gross sales staff’s capacity to shut offers

- Your advertising and marketing staff’s developments for the approaching interval

- Adjustments to the marketing strategy which can affect month-to-month gross sales

The highest-down gross sales forecast is finest utilized by those that are new to the market and who can’t analyze a gross sales pipeline or overview historic gross sales knowledge.

6. Multi-variable forecast

Multi-variable gross sales forecasts are just a little sophisticated, however they’re probably the most correct round.

Extra usually utilized by bigger organizations, multi-variable forecasts mix the approaches we’ve checked out above.

As an illustration, you may begin with a pipeline overview led by your gross sales reps, primarily based on their very own instinct and understanding of what alternatives are prone to flip into gross sales.

Then, you’ll try the historic gross sales pattern. How briskly is gross sales income rising? 3% 1 / 4? How does that align with the pipeline-based forecast?

You might also examine gross sales rep predictions with deal stage possibilities to evaluate accuracy (or perhaps your possibilities want updating).

On the entire, there isn’t a single option to carry out a multi-variable gross sales forecast. Every group makes use of a special components.

We’d suggest experimenting with every of the above strategies and assessing that are probably the most correct in your firm.

Then, you possibly can construct a multi-variable calculation that is sensible.

Conclusion

Gross sales forecasting could be a painful, long-winded course of that takes a big staff of reps, managers, and gross sales leaders days of conferences and dredging by stories.

Discover, although, that we mentioned can.

That’s as a result of in case you’re savvy with a little bit of tech, you will get your gross sales forecasting software program to handle the entire thing for you or at the least provide help to get there a lot sooner.

Able to dive in? Get our free gross sales forecasting template right here and begin making extra correct income projections.

[ad_2]

Source link