Financial institution OZK

Introduction

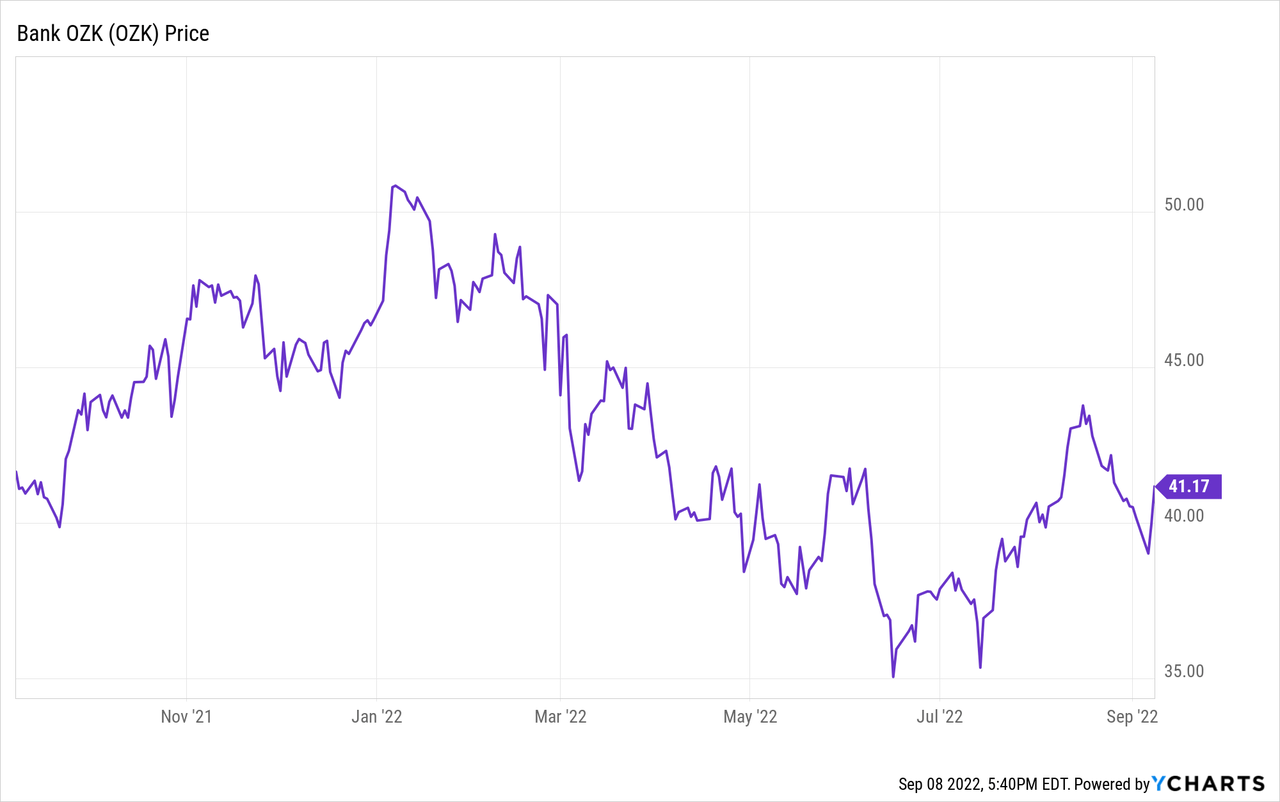

Again in Could, I assumed the popular shares of Financial institution OZK (NASDAQ:OZK) had been too low-cost to disregard as the popular dividend yield had elevated to roughly 6.4%. On the present share value of $17.55 for the popular shares, buying and selling with (NASDAQ:OZKAP) as ticker image, the yield is roughly 6.6%. On this article, I’ll primarily concentrate on the sustainability of the popular dividend yield and I might suggest you to learn a few of my older articles to get a greater understanding of the financial institution’s enterprise mannequin.

The financial institution carried out properly within the second quarter

Though I am primarily within the financial institution’s most well-liked shares as I solely personal these fixed-income securities, it’s clearly vital to inspect how the enterprise is doing as finally, the financial institution wants to have the ability to afford the popular dividends. The rising rates of interest ought to assist the financial institution to broaden its internet curiosity margin, however we additionally should not overlook inflation and an financial slowdown may weigh on the efficiency of the mortgage guide, with extra loans getting into the ‘overdue’ stage.

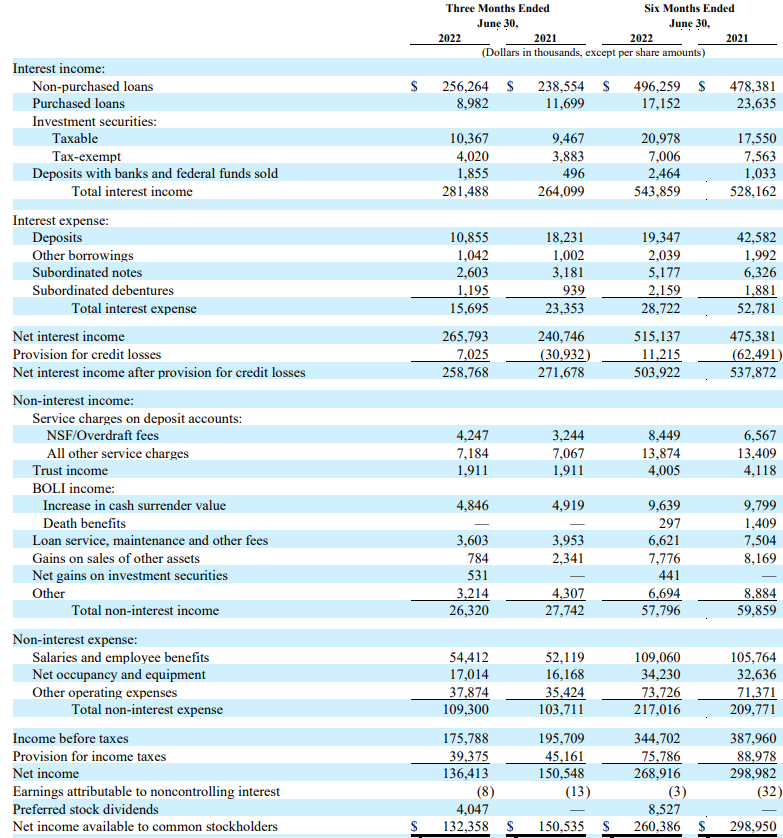

Fortuitously, the financial institution reported a really stable end result within the second quarter as its curiosity revenue elevated to $281.5M whereas the curiosity bills got here in at simply $15.7M. This resulted in a internet curiosity revenue of simply over $265M, which is a rise versus the $250M within the first quarter of this 12 months and the $241M in Q2 final 12 months.

Financial institution OZK Investor Relations

The web curiosity revenue stays essential for Financial institution OZK because the financial institution would not generate a whole lot of income from its non-interest actions. As you’ll be able to see above, Financial institution OZK solely reported $26.3M in non-interest revenue for the quarter whereas the full non-interest bills got here in at $109M for a internet non-interest expense of $83M.

This resulted in a pre-tax and pre-loan loss provision revenue of roughly $183M and because the financial institution recorded simply over $7M in provisions for credit score losses, the reported pre-tax revenue was just below $176M leading to a internet revenue of $136.4M. We nonetheless must deduct the popular inventory dividends which totalled simply over $4M, leading to a internet revenue of $132.4M attributable to the widespread shareholders.

This already is an efficient first step for the popular shares as the popular dividends require lower than 3% of the earnings to be absolutely coated. Or in different phrases, the popular dividend protection degree exceeds 3,000%.

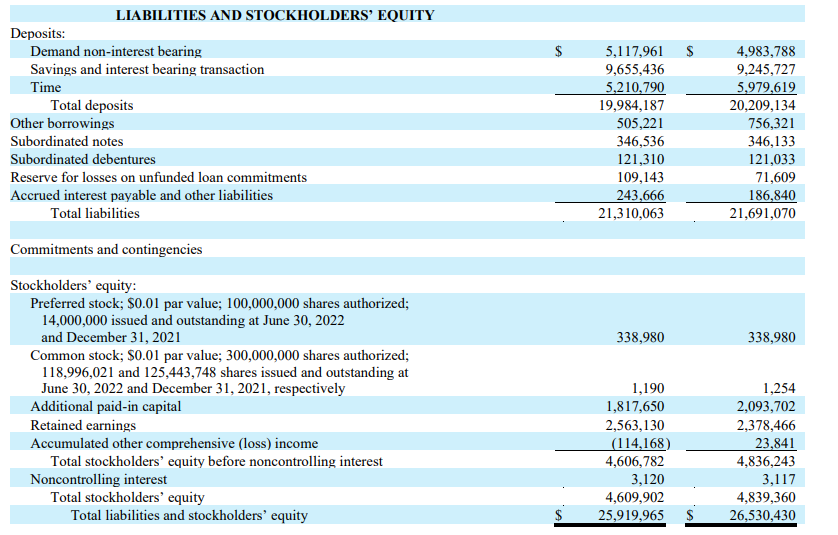

And looking out on the liabilities aspect of the stability sheet, it seems like we should not be too apprehensive concerning the asset protection degree both. The financial institution has 14 million most well-liked shares excellent for a complete of $350M. Which means that of the $4.6B in fairness, roughly $4.25B ranks junior to those most well-liked shares. Or if we have a look at it from the other standpoint, the asset protection degree is in extra of 1,300%.

Financial institution OZK Investor Relations

There’s one caveat although, the stability sheet of Financial institution OZK comprises simply over $666M in goodwill and intangible property, however even if you happen to would exclude these from the equation, the asset protection ratio stays very strong.

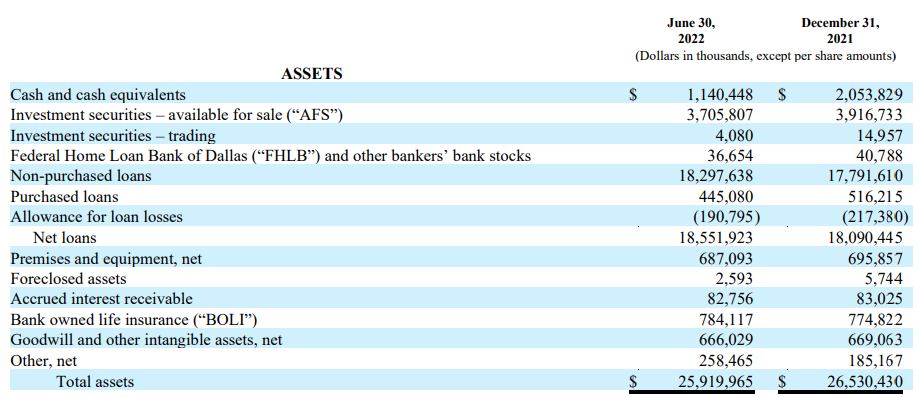

The mortgage guide stays robust

The mixture of a really robust most well-liked dividend protection ratio and a powerful asset protection ratio is sweet information for the popular shares. However the asset protection ratio additionally requires a powerful mortgage guide. If all of a sudden half of the mortgage guide defaults on loans, then even the popular shares will probably be dealing with powerful instances as Financial institution OZK must scramble to guard its fairness cushion.

Fortuitously, Financial institution OZK is operating a stable stability sheet. Of the $26B in property, nearly $5B is held in money and funding securities, so the liquidity degree is fairly good. I am primarily within the $18.55B mortgage guide and notably within the comparatively low quantity of mortgage loss allowances.

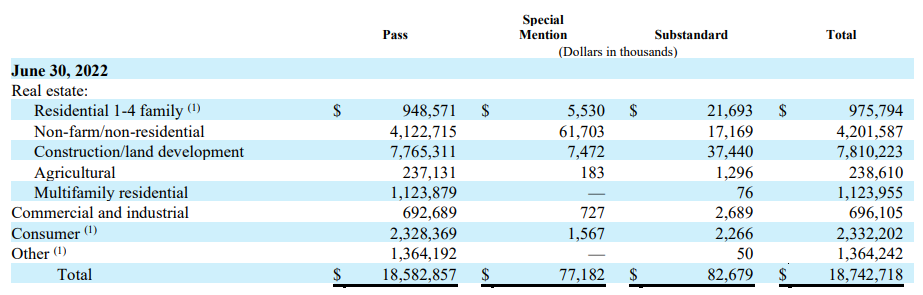

Financial institution OZK Investor Relations

Trying on the breakdown of the mortgage guide, it is clear the non-farm and non-residential in addition to the development and growth loans signify nearly two-thirds of the mortgage guide. Fortuitously, the overwhelming majority of those loans is certified as ‘move’ with just below $160M of the loans categorised as ‘particular point out’ or ‘substandard’.

Financial institution OZK Investor Relations

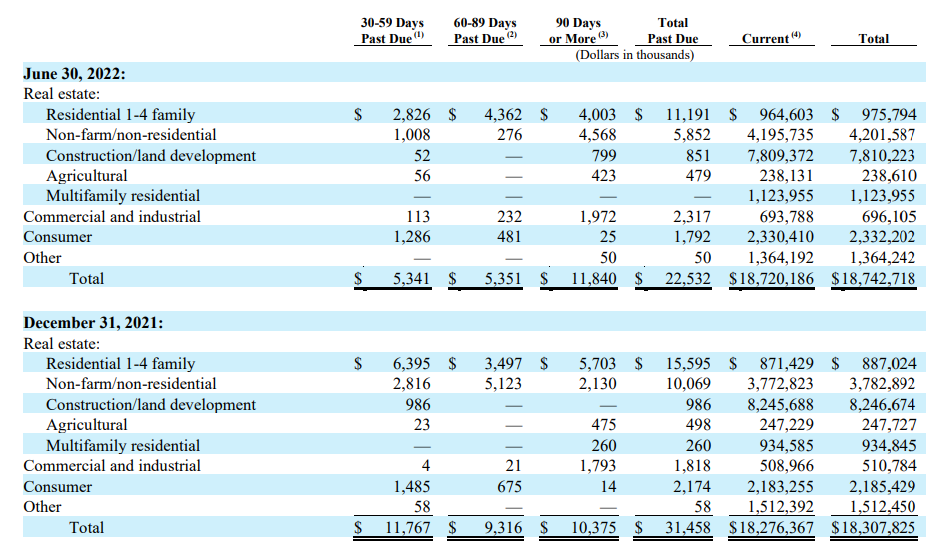

Much more vital than the classification, there’s the low quantity of loans overdue. As you’ll be able to see under, simply over $22.5M of the $18.7B mortgage guide was categorised as overdue, and that is a reasonably robust efficiency and a lower in comparison with nearly $31.5M as of the top of 2021.

Financial institution OZK Investor Relations

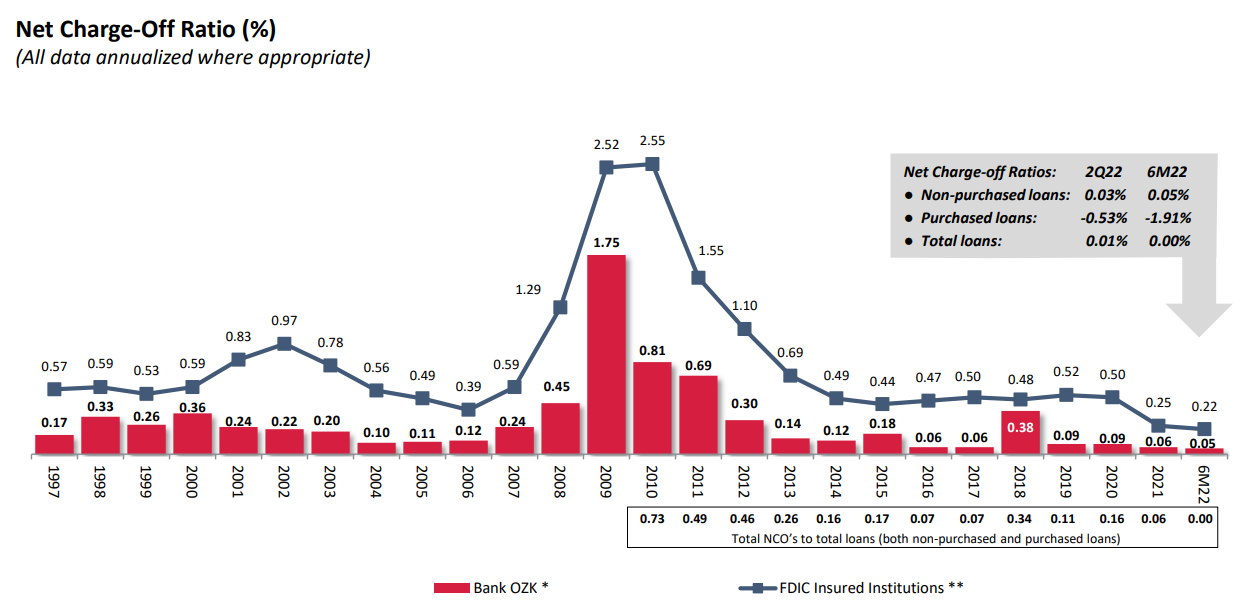

An extra $36M of the loans is presently categorised as ‘non-accrual’ however that is also a lower in comparison with the $44.3M as of the top of final 12 months. And with a mean loan-to-value ratio of 64% within the Actual Property Specialties Group, Financial institution OZK ought to have the ability to keep away from substantial haircuts on its mortgage guide, even on the loans that are actually categorised as non-performing. This implies Financial institution OZK ought to proceed its robust historical past of being one of many banks with the bottom charge-off ratios within the USA.

Financial institution OZK Investor Relations

Funding thesis

The rising internet curiosity margin may enhance the earnings profile of the financial institution, however maybe Financial institution OZK may also have to extend its mortgage loss provisions as I can think about the present inflationary atmosphere places a number of the debtors in a tricky place. From an funding perspective, I proceed to carry the popular shares in Financial institution OZK, and given the robust most well-liked dividend protection ratio and asset protection ratio, I am more than pleased to take care of my place and I would not thoughts including to this place on additional weak point.