andresr/E+ through Getty Pictures

Funding Thesis

I imagine Kindred (OTC:KNDGF) to be a long-term purchase in case you can settle for the volatility brought on by potential ESG-related short-term headwinds. It is my conviction that essentially the most vital headwinds for the corporate are behind it and that the return to the Dutch market along with simpler comps ought to return the inventory to earlier costs and extra.

Enterprise

Based in 1997 and at present headquartered in Malta, Kindred is the fourth greatest digital leisure group on the earth (by gross winnings revenues). They account for 9 manufacturers beneath poker, on line casino, and sportsbook classes with the most important markets being the UK, Belgium, France, and, hopefully, the Netherlands. To have extra management over their software program choices, they acquired in 2021 B2B Estonian sport creator, Chill out Gaming.

By the top of 2021, Kindred employed 2055 workers in over 13 places of work worldwide. It is primarily listed within the OMX Nasdaq Stockholm with a market cap of ~21Bi SEK.

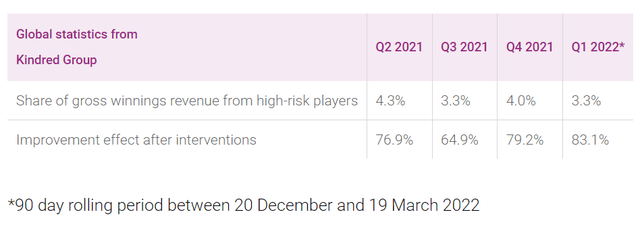

There was a rising effort made, by the corporate, to vary the paradigm of playing to a extra sustainable approach with a transparent goal of reaching 0% income from dangerous playing by 2023. Kindred estimates that 3.3% (Q1’22 knowledge) of their income is derived from these “high-risk gamers” and desires to implement AI know-how to realize their 2023 aim. This push is crucial in a morally and socially acceptable approach, but in addition as a result of it stops the actions of governments tacking it and limiting their actions.

Kindred’s Dangerous Playing Stats (Kindred’s web site)

They’ve been via a current 6 months “cool-off” interval concerning the regulation of the Dutch market which severely impacted the general enterprise. In the meanwhile, the net playing license has been issued to them and they’re over expectation concerning market share restoration.

Macro Setting and Sector

Kindred is recovering from robust comps created by the COVID-19 large on-line shift in playing and we’re beginning to see an general slowdown in economies worldwide resulting from a number of exterior elements just like the battle in Ukraine and inflation. These conditions signify an advanced atmosphere for companies to function in and though I imagine that on-line playing will do okay in a recession, that is nonetheless a cyclical enterprise and it is going to be affected by a downturn.

The playing market, particularly the net one, is predicted to develop CAGR near double-digit within the subsequent years. The growing transition from bodily to on-line playing seen in recent times ought to stay excessive, though at a smaller charge. This development is seen on a much bigger scale within the US market the place Kindred is pursuing an honest market place general, administration hopes to be prime 10 sooner or later. This basic market pattern is offering “tailwinds” to the sector and we see some loss-making US operators already with vital valuations, displaying that buyers acknowledge the brilliant way forward for the trade.

Competitors is fierce and we’re seeing the impacts of it within the US the place no firm is at present capable of be worthwhile, Europe’s markets are extra mature with established gamers working for some years now. I see the primary rivals of Kindred being: Betsson (OTCPK:BTSNF), Entain (OTCPK:GMVHF), Flutter Leisure (OTCPK:PDYPF), Kaizengaming, and DraftKings (DKNG).

Financial Evaluation

In recent times, we now have seen Kindred rising revenues above trade development charges (~13% CAGR since 2017) implying success of their enterprise mannequin and in addition high quality all-around. One of many issues I’ve to provide credit score to Kindred is the sustainable and regular development that they’ve been doing over the previous years, this seems to be the other of what different rivals are doing who pursue development in any respect prices.

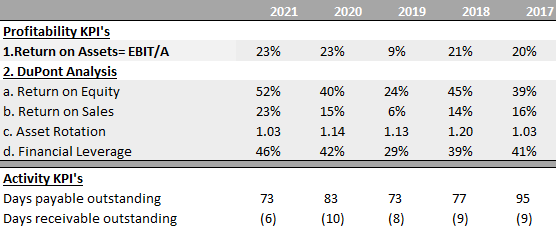

Kindred KPIs (Kindred’s web site)

Having the attention to take COVID-19 growth years with a “grain of salt”, it is a very asset-light mannequin that gives nice returns on virtually each stage. Their capability to supply outcomes with the belongings and capital owned is unbelievable. The web playing trade works with a detrimental working capital mannequin, permitting them to finance the enterprise with deposits from clients and suppliers. In addition they have a low debt stage which as a result of regulatory threat concerned, I are likely to agree that they need to watch out with leverage.

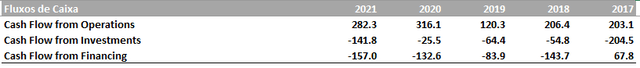

Price highlighting the money technology talents of Kindred, it is a very cash-generative enterprise, with income matching the money from operations, even in durations with main sudden occasions, as we noticed in current instances. Potential dividends and buybacks going ahead needs to be enticing.

Kindred Money Movement Assertion (Kindred’s web site)

Potential Sale or Merger

We now have been seeing some US funds shopping for giant positions in Kindred recently. The primary one is Corvex Administration which has been build up a substantial possession place of greater than 10% and shortly started influencing the board to contemplate a merger or a sale. This state of affairs is feasible if we check out current occasions within the sector and see that there may exist extra outstanding gamers transferring into the house (the case of Disney) or the consolidation of current corporations just like the, now deserted, merger concept between Entain and DraftKings.

Effectively, Kindred has a low debt steadiness sheet, good know-how, and expertise within the trade, strategic established positions worldwide and belongs to a listing of low-multiple (low cost compared to the remaining) playing operators along with Betsson and, earlier than it was purchased by MGM, LeoVegas (OTCQX:LEOVF).

Though an funding should not be primarily based on this risk, I imagine this needs to be considered when assessing the potential upside of Kindred.

Future Outlook and Analysis

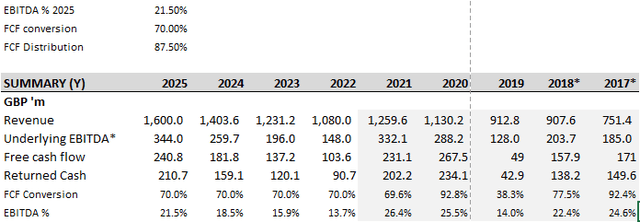

On the current Capital Markets Day in London, administration offered clear pointers going ahead into 2025. The thought is to have 1.6BI GBP in income (natural), an EBITDA margin between 22% and 21%, and a distribution of 75% to 100% FCF (after M&A). The discharge was under my expectations, particularly over the low 2025 EBITDA margin positioned under historic averages. Underlying EBITDA for the file excessive 2021 COVID-19 interval was 332M GBP, fairly near the 2025 aim of 344M GBP. I am hoping that administration illustrated a really conservative view of the long run and that we would see some upside potential going ahead.

Historic and Future Values (Kindred’s web site)

This future projection is contemplating a linear evolution of the EBITDA margin, with the restoration from the Dutch market and in addition the gradual implementation of the Kindred Proprietary Platform to mannequin the trail till 2025.

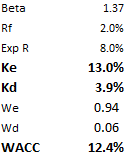

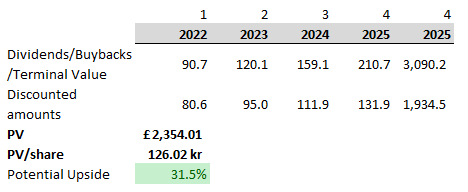

Assumptions for DCF (personal knowledge) DCF Mannequin (Personal and Kindred’s knowledge)

Utilizing simply the money distributed to the shareholders in a 4-year DCF mannequin with a 12.4% WACC, I get to a good worth of roughly 125 SEK. This goal represents a possible upside of greater than 30% from the present worth. Whereas that is simply an approximation goal, it exhibits the potential of the enterprise and the (unfair) beating that it took due to short-term headwinds.

Firm and Sector Dangers

Even believing in a constructive consequence, there are two essential dangers to consider when assessing Kindred with the primary being the regulatory threat limiting their capability to function in a number of markets, an identical state of affairs to what occurred within the Dutch case. This case pertains to the continued regulation taking place throughout Europe, for the time being, we’re seeing examples within the UK (Entain remark) and Norway (current developments). I imagine this to be extra of a sector threat general.

The second threat is concentrated extra within the growth of further competitors wars as we see within the US market since I do not see (but) any clear moat for the businesses. Competitors driving more and more higher bonuses and extra compelling odds will consequently decrease the returns and profitability of working members. I contemplate the brand new Kindred Sportsbook Platform an appropriate concept to mitigate this threat by differentiating their provide.

Conclusion

Kindred operates in a problematic atmosphere pushed by competitors and low ESG scores, which could require an additional margin of security for the entry worth. Nonetheless, I do see worth within the traits of the sector, administration, previous sustainable development, and long-term thesis. I imagine it is now undervalued when wanting on the future outlook, regardless of desirous to see extra of a restoration earlier than committing additional. The potential for additional trade consolidation, within the type of a merger or a sale, may additionally present some capital appreciation upside to the inventory.