Petmal

FREYR Battery (NYSE:FREY) inventory is buying and selling close to its post-SPAC highs and is seeing good momentum regardless of the numerous correction within the broader markets. The corporate not too long ago obtained a value goal enhance from the prior $18 to $26 by Morgan Stanley (MS) analyst Adam Jones. The analyst additionally hiked his bull case value goal for the corporate to $60 from the prior $34. Adam Jones highlighted on-shoring and the Inflation discount Act which can incentivize EV and battery manufacturing domestically. He additionally cited a current binding off-take settlement as a cause for turning extra optimistic in regards to the inventory.

Late final month, FREYR Battery signed a broad partnership with Japanese electrical motor producer Nidec (OTCPK:NJDCY). In it, FREYR and Nidec have agreed to transform and develop the beforehand introduced 31 GWh conditional offtake settlement between them to a binding gross sales settlement beneath which FREYR will provide 38GWh of cells (with an estimated gross worth of $3 billion +) from 2025 to 2030 with an choice to upsize volumes to 50 GWh in that interval. A binding gross sales settlement is normally useful in securing undertaking financing at favorable phrases. FREYR and Nidec additionally agreed to type a three way partnership to mix FREYR’s clear, next-generation battery cells with modules and packs into built-in downstream ESS options for industrial and utility-grade prospects.

With the transition to Electrical Automobiles choosing up, a number of gamers have emerged within the cell and battery manufacturing house. FREYR battery differentiates itself as being cleaner (much less CO2 emission throughout its manufacturing) and an onshore producer within the U.S. and Europe. Onshore or near-shore manufacturing has gained some traction in recent times given important provide chain points post-Covid which have impacted manufacturing. Having an on-shore or near-shore elements producer lessens the chance of provide chain disruption.

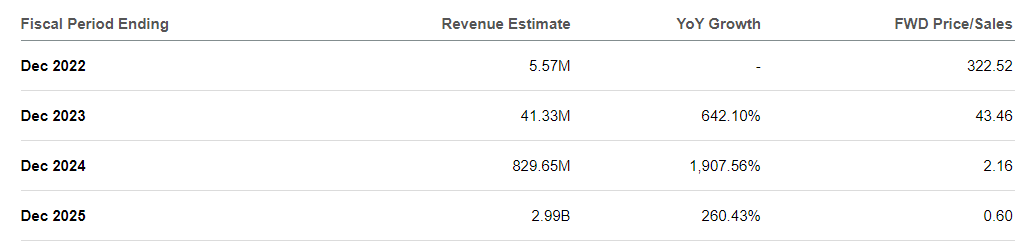

The corporate presently doesn’t have any important revenues (for the present 12 months it’s anticipated to generate simply $5.57 million in revenues in line with consensus estimates) however over the subsequent 3-4 years, as its battery manufacturing amenities go browsing, analysts predict important ramp-up in revenues given its off-take agreements and the sturdy momentum in EV business.

Whereas I don’t have an issue investing within the corporations in pre-revenues or preliminary phases, I search for some form of a moat whether or not it’s expertise, early mover benefit or business construction to present me some form of confidence within the firm’s longer-term prospects. For instance, I lined Li-Cycle (LICY) a couple of days again. It’s also a play on the transition to EVs because it addresses the problem of Li scarcity by recycling Lithium from used batteries. LICI is predicted to see a big ramp-up in revenues over the subsequent couple of years. The one factor which I appreciated about Li-Cycle was its distinctive expertise which will increase the restoration charge of used Lithium and different uncommon metals from used batteries and leaves little wastage.

FREYR, alternatively, doesn’t personal considerably differentiated expertise. It has licensed 24M expertise however there are different rivals and end-customers together with Kyocera, GPSC, ITOCHU, Lucas TVS and Volkswagen (OTCPK:VWAGY) which license and use the identical expertise. So, there may be little expertise moat for the corporate.

There may be additionally no early mover benefit and the business is fragmented with a number of larger producers like CATL, LG Chem, Panasonic, BYD (OTCPK:BYDDY), and Samsung SDI already out there. Even in Europe, there are rivals like Northvolt. Additional, the most important potential consumers are massive car corporations which have larger bargaining energy and plenty of of them are having the choice to fabricate their very own batteries in-house. So, it is a powerful business to be in.

Additionally, whereas there may be lots of buzz round on-shoring or near-shoring elements suppliers, with covid-related disruptions waning and provide chain situations enhancing, I don’t suppose this shall be a high precedence for lengthy. In the long run price economics will prevail and since labor price is less expensive in Asia, producers there may need an edge. Additional, whereas the corporate is doing job by way of decrease CO2 emissions, it isn’t one thing that its rivals can’t obtain.

If we expect a couple of years forward and assume the corporate is ready to execute nicely and attain the goal manufacturing capability, its gross sales will ramp up considerably.

FREY income estimates (Consensus Estimates, In search of Alpha)

Nonetheless, there may be lots of uncertainty between now and some years down the road. There’s a good probability of a number of new initiatives by present rivals and new gamers, particularly given the form of valuations the businesses like FREYR are getting. The expertise may additionally enhance which is a giant danger as the corporate presently licenses expertise and should not be capable to sustain the tempo. Valuation may compress as traders understand it’s a commodity enterprise with the extreme competitors and little moat. Additionally, what the Federal Reserve is doing by way of growing rates of interest and quantitative tightening may need a damaging affect on the valuations of loss-making story shares which have a lot to show by way of execution.

That stated, the momentum can proceed within the close to time period with the sell-side analysts cheerleading the inventory and assigning a a lot larger goal value than the place the inventory presently is buying and selling at. Aside from Morgan Stanley, Goldman Sachs (GS) analysts additionally upgraded the inventory final month as they targeted on advantages from the Inflation Discount Act. Nonetheless, I imagine whereas the inflation discount act may incentivize these producers to arrange their amenities within the U.S., it can not guarantee their long-term profitability and price competitiveness. Therefore, regardless of sturdy near-term momentum, I choose to be on the sidelines and have a impartial ranking on the inventory.