[ad_1]

The automotive sector is among the worst affected by the mix of excessive inflation and rising rates of interest. Shoppers have change into extra cautious and are prioritizing their purchases with concentrate on non-discretionary objects, in response to the pressure on spending energy. For CarMax, Inc. (NYSE: KMX), 2022 has been a difficult 12 months to this point, marked by lackluster gross sales and falling revenue.

Final week, the Richmond-based used automobile vendor’s inventory dropped to the bottom degree in additional than two years as investor sentiment was damage by its weaker-than-expected second-quarter outcomes and the administration’s cautious steering. The inventory has been on a downward spiral for practically a 12 months now, with the market selloff accelerating the decline.

Valuation

So far as potential patrons are involved, the inventory has change into low-cost and enticing. However the unfavorable pricing surroundings and persevering with stress on gross sales and revenue, that are unlikely to satisfy the market’s estimates within the coming quarters, name for warning. So, it’s value ready till demand circumstances enhance, earlier than investing in KMX.

Learn administration/analysts’ feedback on quarterly experiences

The corporate has efficiently overcome related challenges previously, and the administration is optimistic about its long-term prospects. Going ahead, the main focus can be on offering a greater omnichannel expertise to clients and associates by ramping up each on-line and in-store choices, leveraging the diversified enterprise mannequin.

Ups & Downs

Apparently, there have been many ups and downs in CarMax’s enterprise in recent times –- after experiencing a stoop within the early months of the pandemic, enterprise boomed as individuals developed a penchant for proudly owning used automobiles as an alternative of latest ones. The pattern reversed early this 12 months when the enterprise was hit by macroeconomic challenges.

The weak spot is prone to proceed within the coming months because the Federal Reserve maintains its hawkish coverage and raises rates of interest to tame inflation, thereby denting shopper confidence additional.

Reflecting the deepening inflation stress and rate of interest hikes, CarMax’s unit gross sales are trending beneath the prior-year ranges at the same time as common promoting costs enhance. Weak point in car gross sales is a traditional factor throughout financial downturns and demand ought to bounce again as soon as market circumstances enhance. CarMax’s monetary place is robust sufficient to get better from the non permanent setback.

Key Numbers

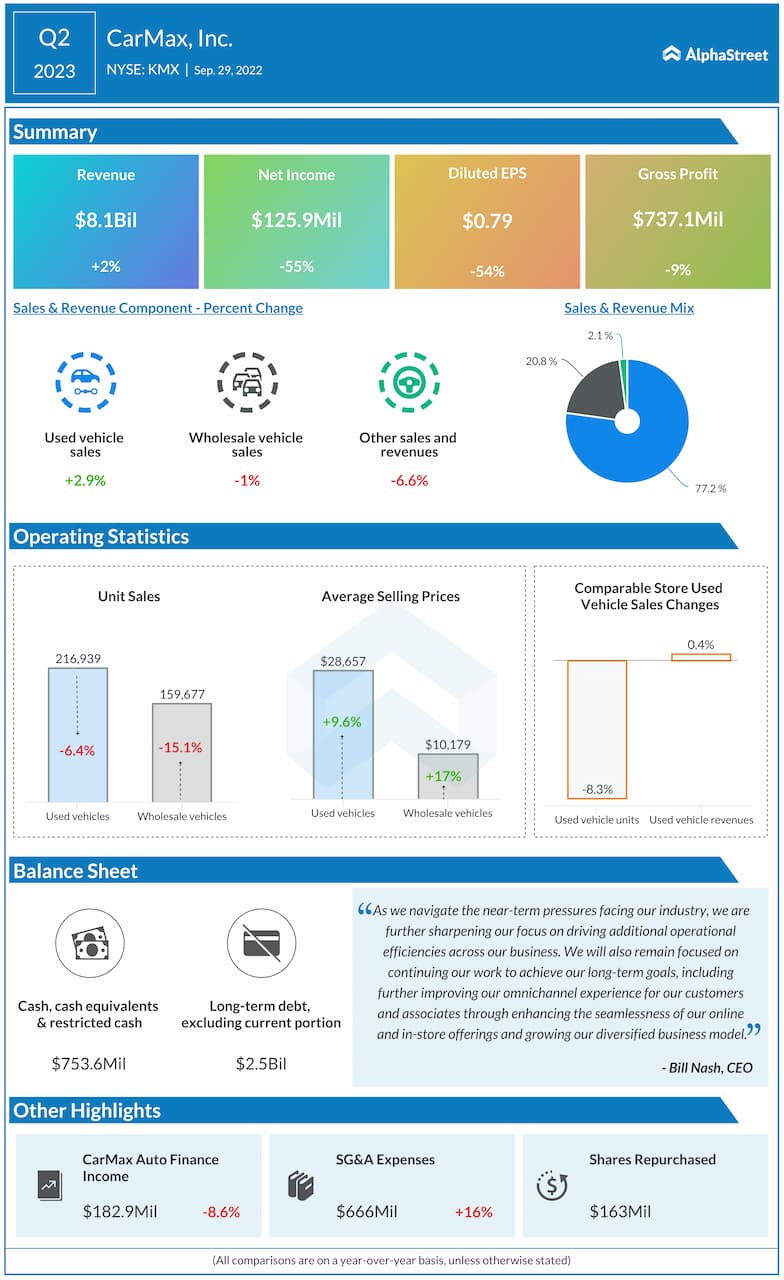

Within the second quarter, greater gross sales within the used automobile section greater than offset declines within the different divisions, leading to a 2% enhance in revenues to $8.1 billion. Comparable-store used car gross sales, on a unit foundation, dropped 8.3%, whereas earnings per share decreased 54% year-over-year to $0.79. Each numbers missed estimates.

From CarMax’s Q2 2023 earnings convention name:

“Our efficiency was impacted by the macro elements that I discussed beforehand. We consider trade gross sales had been additionally impacted by a shift in shopper spending prioritization from massive purchases to smaller discretionary objects. In response to the present surroundings and shopper demand, we now have continued to supply the next mixture of lower-priced automobiles. We started the second quarter with a low single-digit decline in comp gross sales throughout June that mirrored a continuation of softer though bettering gross sales, which we mentioned on our final earnings name.”

Inventory Watch: Why Common Motors is an effective purchase after earnings

Shares of CarMax misplaced about 43% to this point this 12 months. They made a modest restoration from the post-earnings downturn this week and traded greater on Tuesday afternoon.

[ad_2]

Source link